2. Alloy vs Middesk

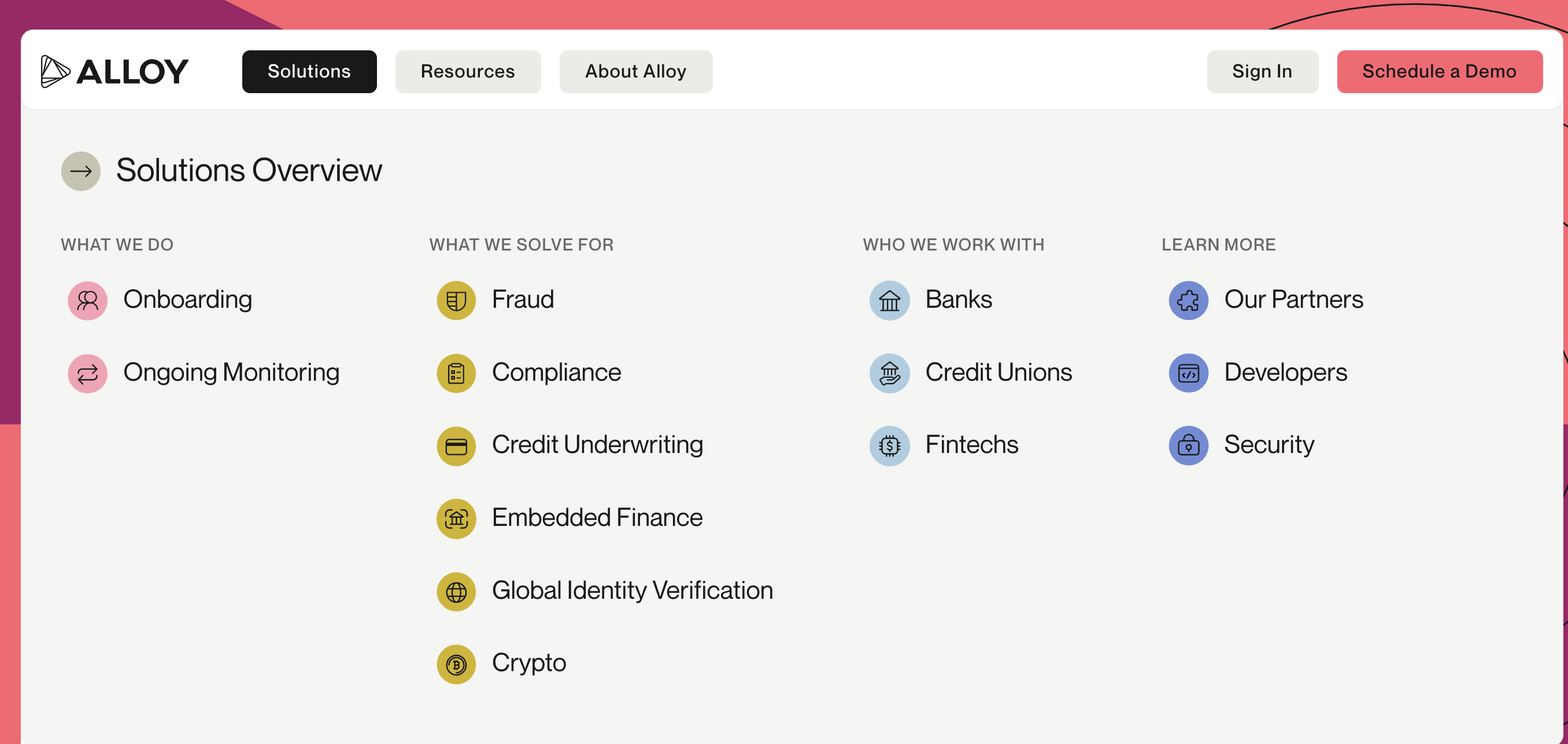

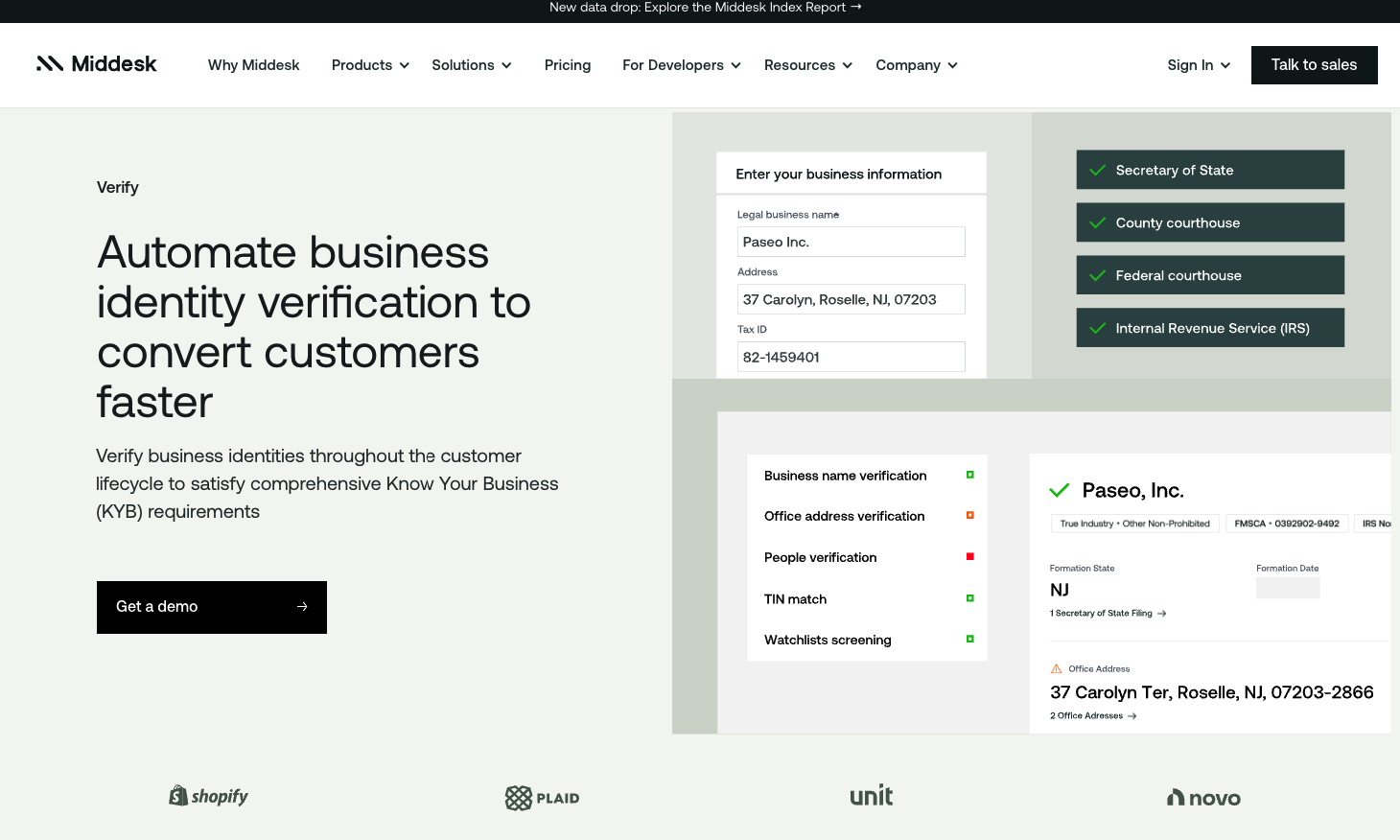

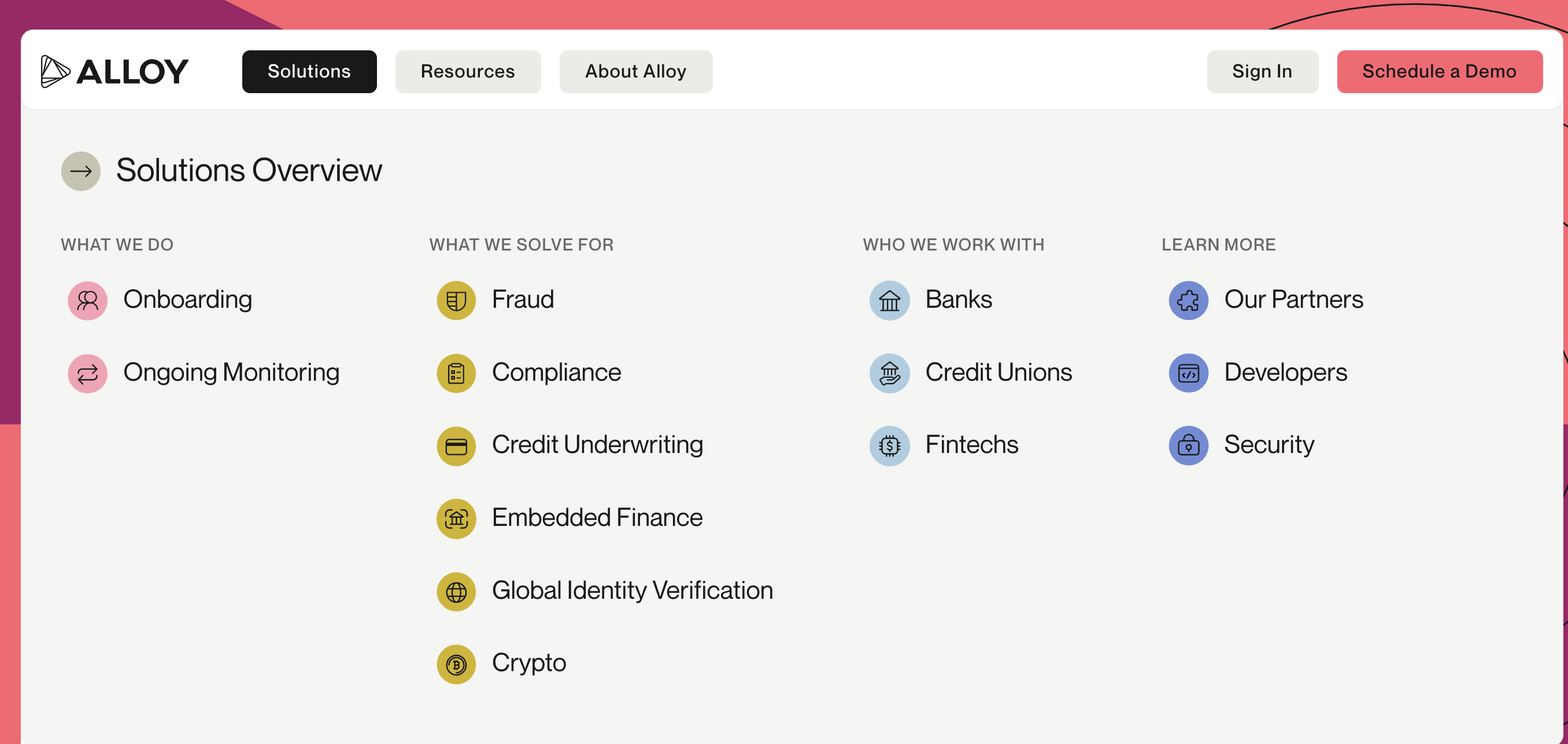

Alloy is a leading identity decisioning platform that helps financial institutions and fintech companies automate onboarding, compliance, and ongoing customer monitoring. While Middesk focuses primarily on U.S. business identity verification, Alloy operates as a broader risk and identity orchestration layer—bringing together data sources, rules, and workflows to streamline KYC, KYB, and fraud prevention in one unified platform.

Alloy is not a direct data provider like Middesk or Global Database. Instead, it acts as a decisioning engine that connects to multiple third-party data partners—including business verification, sanctions, fraud, and document verification vendors—to automate risk decisions at scale.

Core Strengths

1. End-to-End Onboarding Orchestration

Alloy allows companies to automate the entire KYB/KYC flow, including:

Workflow configuration

Risk scoring

Data orchestration

Case management

Decisioning rules

Ongoing monitoring

For companies looking to centralise onboarding logic, Alloy provides capabilities that go far beyond Middesk’s data-focused model.

2. Integrates With Dozens of Data Providers

Alloy’s power lies in its marketplace of third-party integrations, enabling companies to plug in:

KYB / business identity data

UBO data

Fraud prevention signals

Sanctions & PEP lists

Document verification partners

Credit data and behavioral analytics

This makes Alloy a strategic choice for companies that need flexibility in how they build their KYB stack.

3. Strong Focus on Financial Services

Alloy is widely used by:

Its infrastructure is specifically designed to support regulated industries with strict onboarding and compliance workflows.

4. Advanced Rules Engine

Compliance and risk teams can build custom rules without engineering involvement, including:

This level of configurability is something Middesk does not aim to provide.

5. Ongoing Monitoring Across Data Sources

Alloy supports continuous monitoring for:

Business profile changes

Risk updates

Sanctions hits

Document expiry

Fraud indicators

This is essential for institutions under ongoing AML obligations.

Who Alloy Is Best For

Alloy is ideal for organizations that need:

Workflow automation across KYB, KYC, and fraud

Decisioning logic tied to multiple sources

Operational efficiency for compliance teams

A single platform to orchestrate onboarding

Flexible integration with many data vendors (including Middesk)

Many companies even integrate both Alloy and Middesk, using Alloy as the orchestration layer.

How Alloy Compares to Middesk

Feature | Alloy | Middesk |

|---|

Geographic focus | Global (via data partners) | U.S.-only |

Type of product | Decisioning + workflow platform | KYB data provider |

KYB data | ✔ (via integrations) | ✔ U.S. only |

EIN verification | Via partners | ✔ |

Registry data | Via partners | ✔ U.S. |

UBO / ownership | Via partners | Limited |

Workflow automation | ✔ advanced | ✖ |

Monitoring | ✔ multi-source | Limited |

Best for | Banks & fintechs needing orchestration | U.S. business identity checks |

Summary

Alloy is not a direct KYB data competitor to Middesk, but rather a higher-level orchestration platform that integrates KYB, KYC, AML, and fraud signals into a unified decisioning engine. Organizations select Alloy when they need end-to-end onboarding automation, multi-source risk analysis, or a scalable compliance infrastructure that can incorporate multiple data providers—including Middesk itself.

3. Zephira.ai vs Middesk

Zephira.ai is an API-first platform built for developers who need real-time, registry-sourced company data across more than 150 countries. Unlike traditional KYB providers focused on a single market, Zephira.ai delivers normalized, structured legal entity data through a unified API, enabling global onboarding, supplier verification, and compliance workflows at scale.

Its emphasis on direct registry connectivity and consistent schema mapping positions it as a strong alternative to Middesk, especially for companies expanding beyond U.S.-only coverage.

Core Strengths

1. API Access to Verified Registry Data Worldwide

Zephira.ai provides standardized corporate data collected directly from official government registries and statutory filings, including:

Legal entity names

Registration numbers

Business status

Incorporation dates

Registered addresses

Local tax identifiers

Business types

This ensures consistently verifiable information for compliance and onboarding workflows.

2. Lightweight, High-Volume KYB Checks

Zephira.ai offers an efficient Light KYB Check, returning essential fields such as:

Ideal for marketplaces, financial platforms, and SaaS providers performing large-scale entity checks.

3. Deep Corporate and Financial Data

Beyond basic KYB, the platform provides enriched data such as:

Industry classifications (NAICS, SIC, NACE, local codes)

Estimated company size indicators

Director and officer information

Full financial statements where published

Group structure context (where available)

This level of depth goes significantly further than Middesk’s domestic data scope.

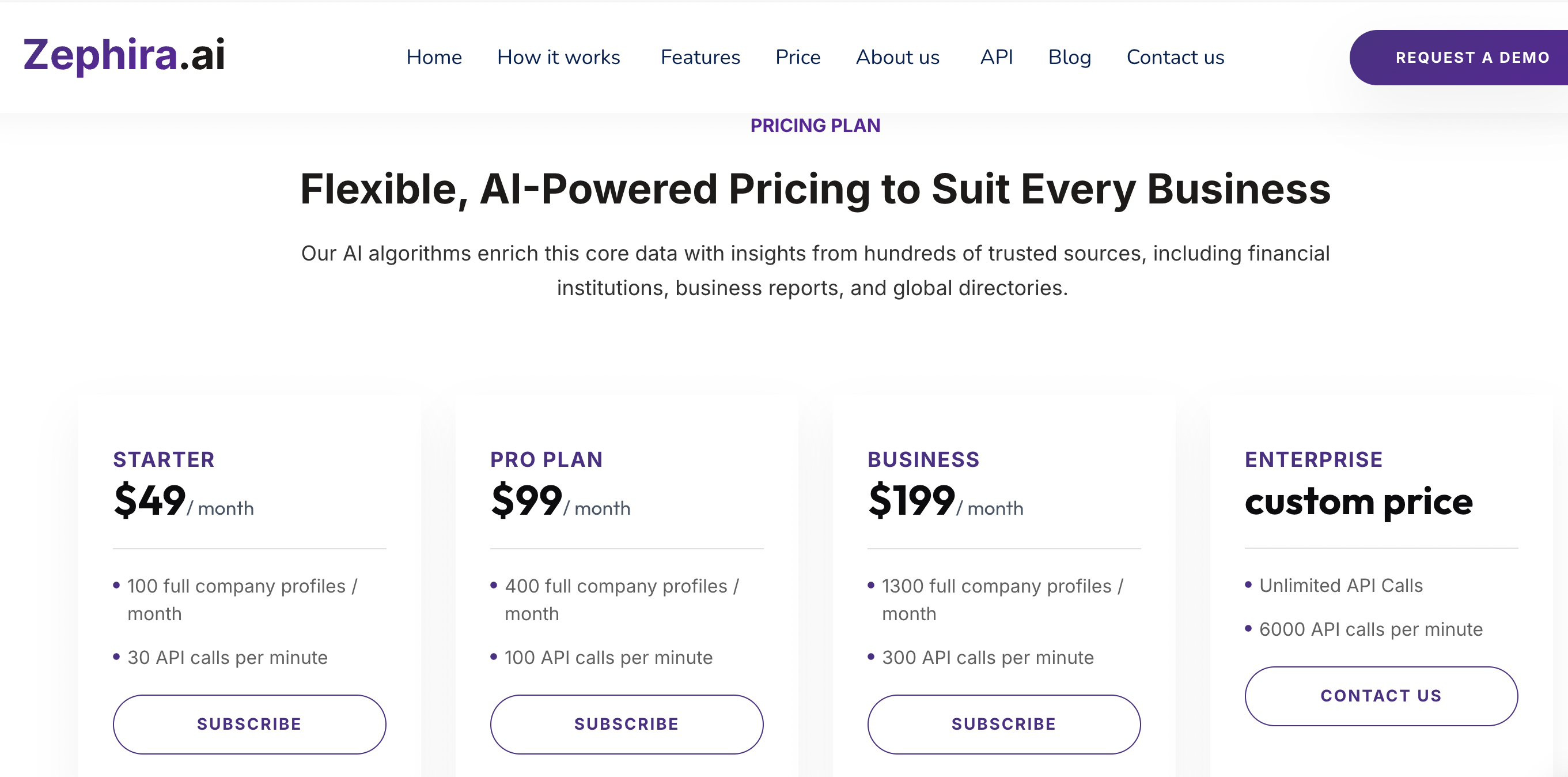

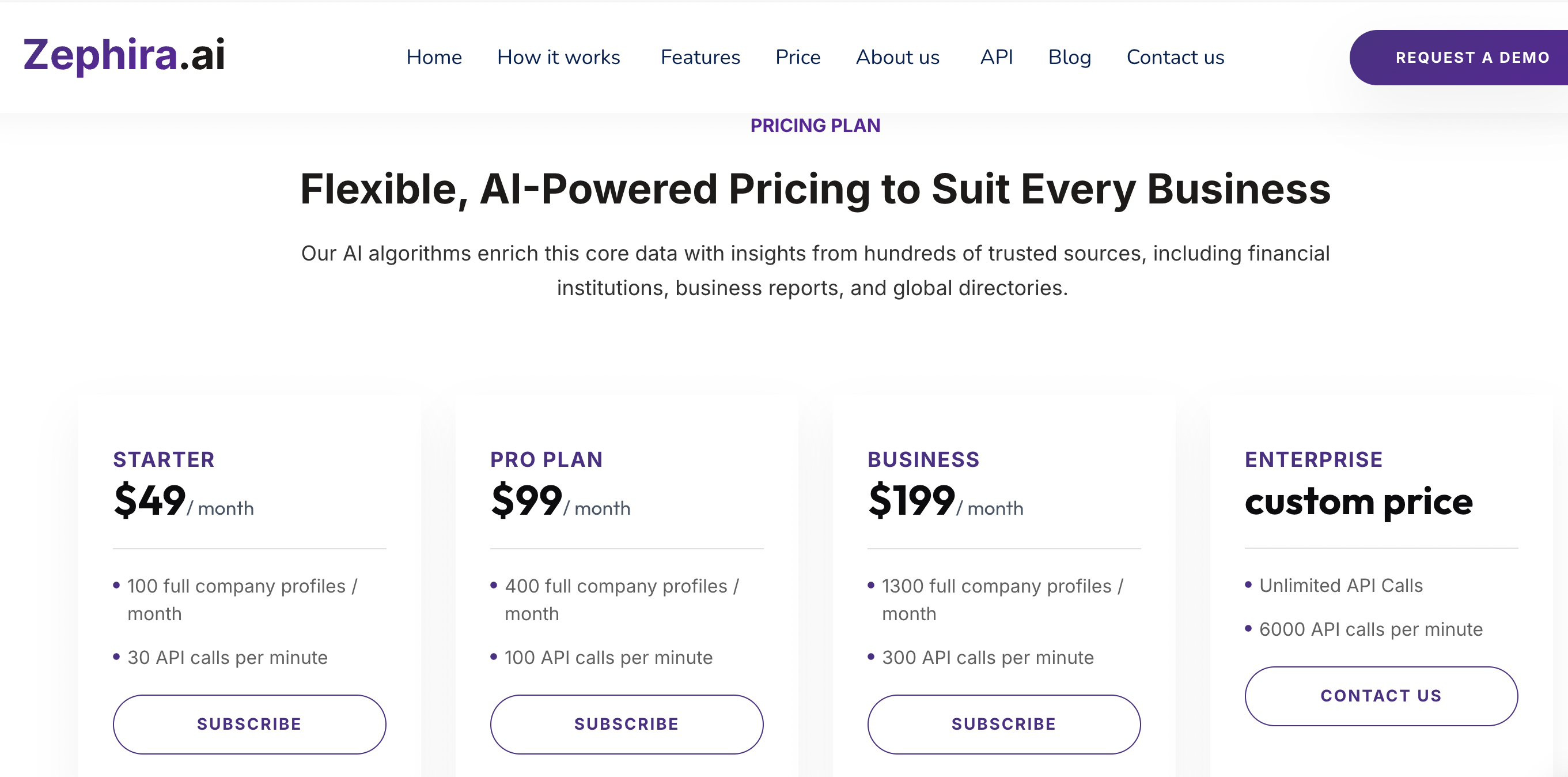

4. Transparent Per-Request Pricing

Zephira.ai uses a clear, consumption-based pricing model with no seat limits or long-term commitments.

This is beneficial for:

Developers integrating global KYB

Platforms handling unpredictable volumes

Cost-sensitive high-throughput operations

The model is typically more flexible than Middesk’s structure for scaling international workloads.

5. Consistent, Audit-Ready Corporate Data

All information originates from official registries, statutory documents, and government-published sources, ensuring:

Full auditability

Compliance alignment

Local legal accuracy

This gives compliance teams confidence when validating entities across multiple jurisdictions.

Who Zephira.ai Is Best For

Zephira.ai is particularly valuable for:

Fintechs and payment companies expanding internationally

Marketplaces onboarding global sellers

Platforms verifying suppliers across multiple regions

Developers requiring a unified, API-first approach to KYB

Companies needing real-time, registry-based corporate intelligence

Its architecture is designed for organizations that want scalable global coverage without complex integrations.

How Zephira.ai Compares to Middesk

Feature | Zephira.ai | Middesk |

|---|

Geographic coverage | 150+ countries | U.S.-only |

EIN verification | ✔ | ✔ |

Global registry access | ✔ | ✖ |

UBO / ownership | ✔ (where legally available) | Limited |

Financial data | ✔ | ✖ |

Industry codes | ✔ global | ✔ U.S.-only |

Pricing flexibility | High (per-call) | Moderate |

Best for | Global platforms & developer-first products | U.S.-focused KYB |

Summary

Zephira.ai is a powerful alternative to Middesk for teams requiring global KYB, developer-friendly APIs, real-time registry data, and flexible consumption-based pricing. Its depth of coverage and structured data delivery make it especially well suited for fintechs, marketplaces, and international platforms moving beyond U.S.-only operations.

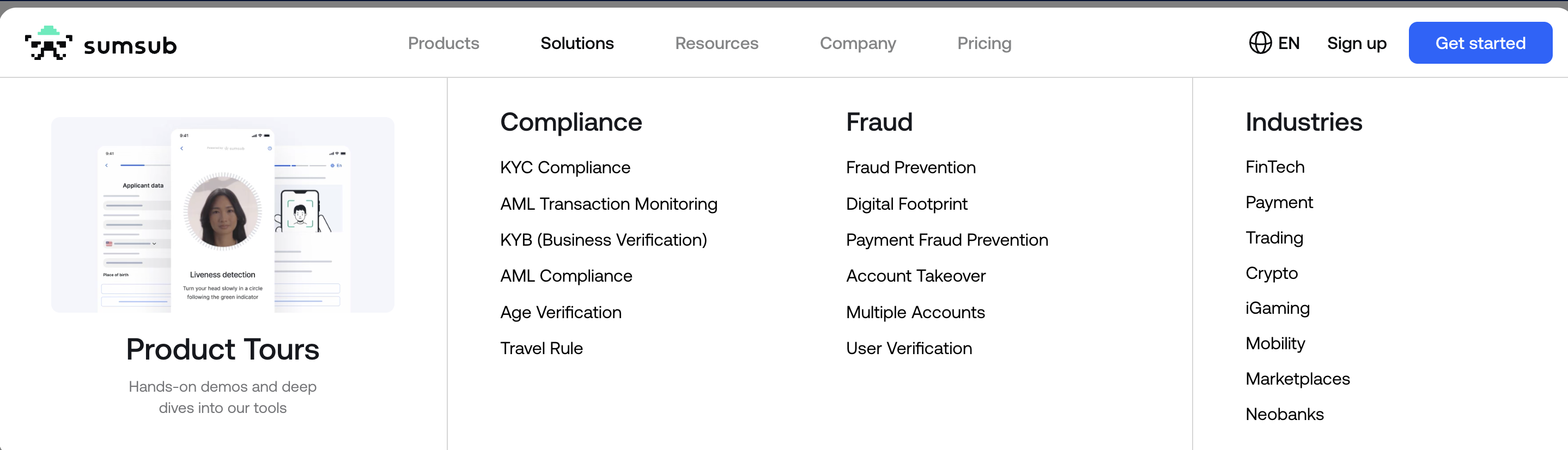

4. Sumsub vs Middesk

Sumsub is a global verification and compliance platform offering KYC, KYB, AML screening, and fraud prevention for regulated industries. Unlike Middesk—whose primary focus is U.S. business identity—Sumsub delivers business verification workflows across more than 220 countries and territories, making it a strong choice for organizations that need unified identity checks for both individuals and companies worldwide.

Its strength lies in combining identity verification, document checks, liveness, KYB, sanctions screening, and ongoing monitoring under a single, configurable platform. This makes Sumsub a comprehensive alternative for companies seeking more than basic business identity data.

Core Strengths

1. Global KYB Coverage

Sumsub supports business verification across a broad range of jurisdictions, allowing companies to:

Validate legal entities internationally

Collect and analyse corporate documents

Confirm registration details

Identify shareholders and controlling parties (where available)

For companies with global onboarding needs, this scope goes far beyond Middesk’s U.S.-only focus.

2. Combined KYC + KYB + AML Platform

Sumsub unifies multiple compliance functions, including:

Individual identity verification

Business verification

Document verification

Sanctions, PEP, and watchlist screening

Transaction monitoring workflows

This enables risk and compliance teams to work from a single platform rather than integrating multiple vendors.

3. Configurable Compliance Workflows

The platform provides customizable workflows for:

Business onboarding

Partner and merchant verification

Vendor and supplier screening

High-risk KYB flows

Corporate document collection

These workflows help automate complex multi-step processes that Middesk does not directly support.

4. Deep Fraud Prevention Capabilities

Sumsub includes advanced fraud detection signals, such as:

Forged document detection

Liveness and biometric checks

Behavioral risk indicators

Device and IP intelligence

This positions Sumsub as more than a data source — it is a full risk analytics system.

5. UBO and Shareholder Identification

Sumsub assists companies in identifying beneficial owners through:

Shareholding data (where legally accessible)

Corporate document extraction

Multi-layer ownership charts

Although not as registry-centric as some specialized UBO platforms, it provides more ownership visibility than Middesk.

Who Sumsub Is Best For

Sumsub is ideal for organizations that require:

A unified platform for KYC + KYB + AML

Global business verification across many jurisdictions

Fraud prevention integrated into onboarding

Document verification and liveness checks

Regulated, high-risk use cases (fintech, crypto, payments, mobility, marketplaces)

It is especially useful for companies looking to consolidate multiple vendors into a single compliance stack.

How Sumsub Compares to Middesk

Feature | Sumsub | Middesk |

|---|

Geographic coverage | Global (220+ countries) | U.S.-only |

KYB | ✔ global | ✔ U.S. |

KYC | ✔ | ✖ |

AML screening | ✔ | Limited |

Fraud prevention | ✔ advanced | ✖ |

Workflow automation | ✔ robust | Limited |

Document verification | ✔ | ✖ |

UBO tools | ✔ multi-layer support | Limited |

Best for | Global KYC/KYB & AML in one platform | U.S. business identity checks |

Summary

Sumsub is a strong Middesk alternative for companies needing global coverage, integrated KYC and KYB, and a complete fraud and compliance workflow. While Middesk excels at U.S. business identity verification, Sumsub offers a broader, more comprehensive compliance infrastructure suitable for multinational onboarding and regulatory environments.

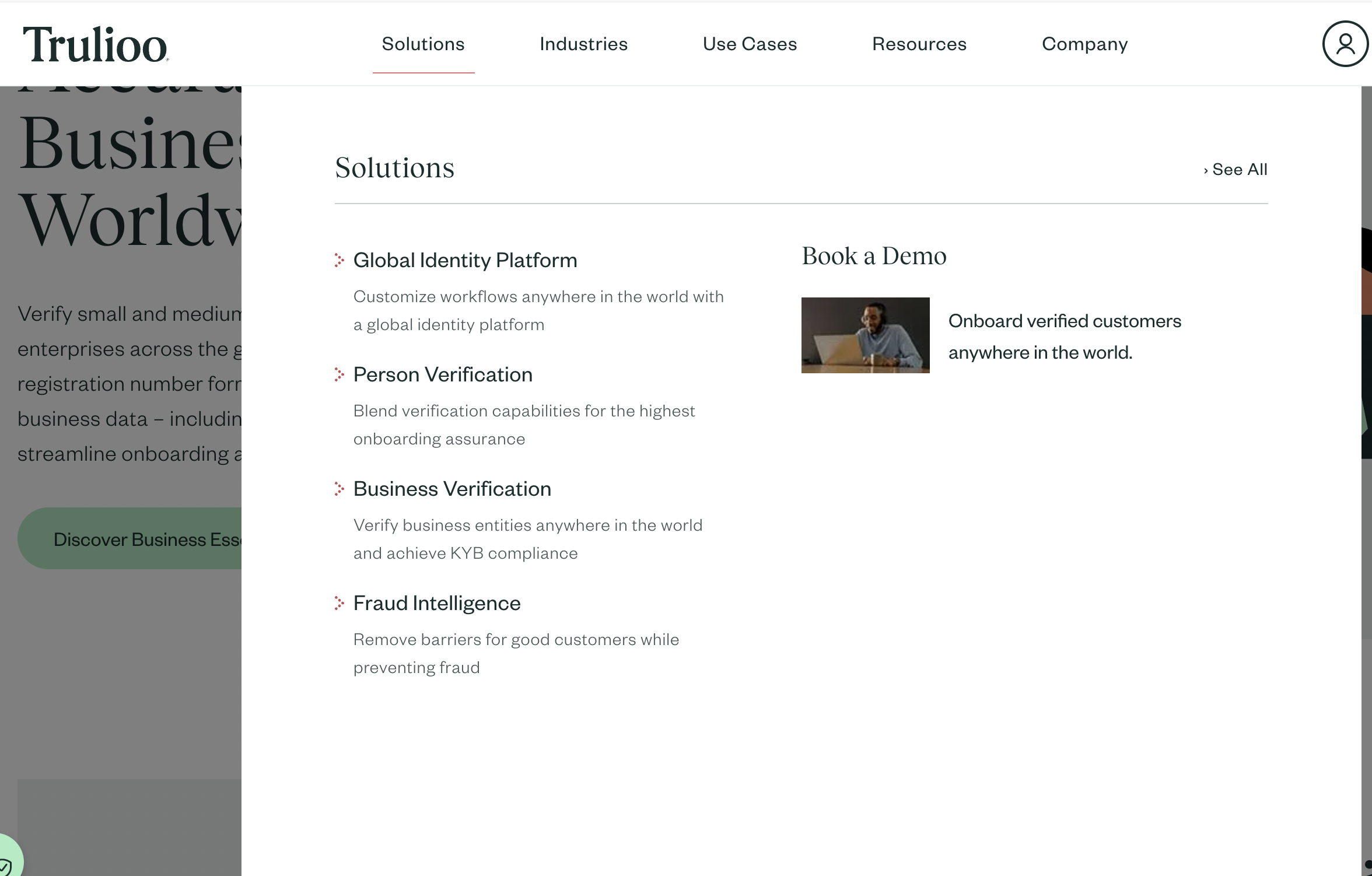

5. Trulioo vs Middesk

Trulioo is one of the most established global identity verification providers, offering KYB, KYC, AML screening, document verification, and workflow orchestration through a unified platform. While Middesk is primarily focused on validating U.S. businesses through Secretary of State and IRS data, Trulioo covers more than 195 countries, making it a strong choice for organizations that require international onboarding.

Trulioo’s value lies in its broad data network—combining registry data, government sources, watchlists, and commercial datasets—alongside a flexible verification platform designed for enterprises, fintechs, and cross-border marketplaces.

Core Strengths

1. Global KYB Coverage Across 195+ Countries

Trulioo’s KYB product includes access to:

This makes it a powerful alternative to Middesk for companies verifying businesses outside the United States.

2. Unified Platform for KYB, KYC, and AML

Trulioo consolidates multiple compliance services, including:

Business verification

Individual identity verification

Document verification and eID checks

Watchlist, PEP, and sanctions screening

Ongoing monitoring

Adverse media checks

Companies often choose Trulioo to simplify vendor management by combining these capabilities into a single platform.

3. Extensive Data Network

Trulioo aggregates data from a wide range of authoritative and commercial sources, enabling:

Cross-border entity validation

Multi-layer ownership checks

Regulatory compliance for financial institutions

Enhanced due diligence for high-risk industries

This broad data foundation goes beyond Middesk’s U.S.-centric approach.

4. Beneficial Ownership Identification

Trulioo provides insights into corporate ownership and control, including:

Shareholder information (where legally accessible)

Top-level UBO visibility

Multi-country ownership checks

Document-based ownership verification

While not equivalent to specialized global UBO platforms, Trulioo offers stronger international ownership capabilities than Middesk.

5. Enterprise-Grade Features and Workflow Automation

Trulioo supports:

Custom onboarding workflows

Flexible API and SDK integrations

Case management

Continuous monitoring and alerts

High-volume verification pipelines

These features make it suitable for large organizations with complex compliance requirements.

Who Trulioo Is Best For

Trulioo is best suited for:

Global fintech and payment companies

Marketplaces onboarding sellers from multiple countries

Banks and financial services requiring AML checks

Platforms needing combined KYC + KYB in a single solution

Organizations expanding beyond the U.S. and requiring international registry access

Its scale and compliance depth make it a strong match for enterprises handling millions of verifications.

How Trulioo Compares to Middesk

Feature | Trulioo | Middesk |

|---|

Geographic coverage | Global (195+ countries) | U.S.-only |

KYB | ✔ global | ✔ U.S. |

KYC | ✔ | ✖ |

AML screening | ✔ comprehensive | Limited |

Ownership checks | ✔ multi-country | Limited |

Document verification | ✔ | ✖ |

Workflow automation | ✔ enterprise-grade | Limited |

Best for | Global onboarding & compliance | U.S. business identity checks |

Summary

Trulioo is a strong alternative to Middesk for companies needing global business verification, KYC/KYB unification, and enterprise-grade compliance tooling. Its broad international coverage and deep AML capabilities make it ideal for organizations operating across multiple jurisdictions or requiring more comprehensive compliance processes than Middesk typically provides.

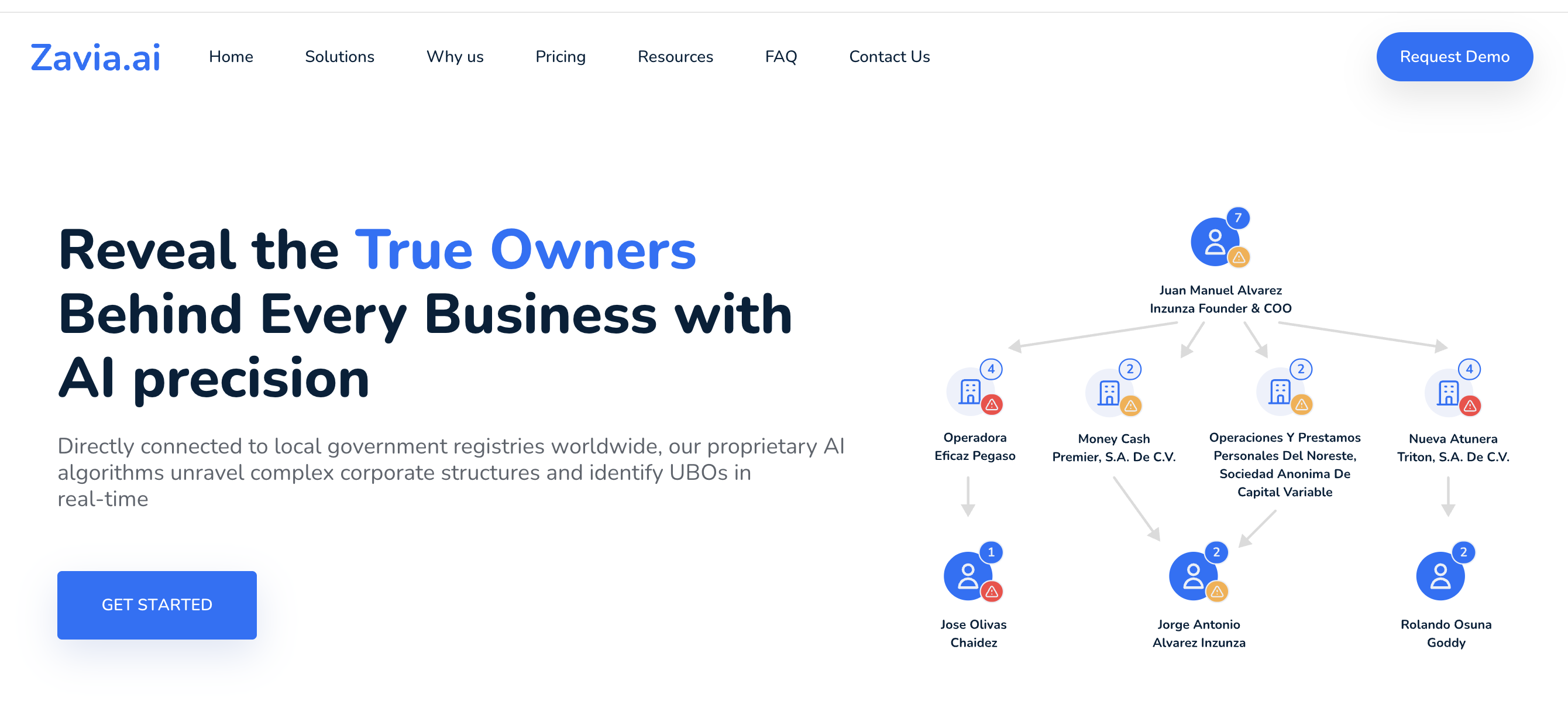

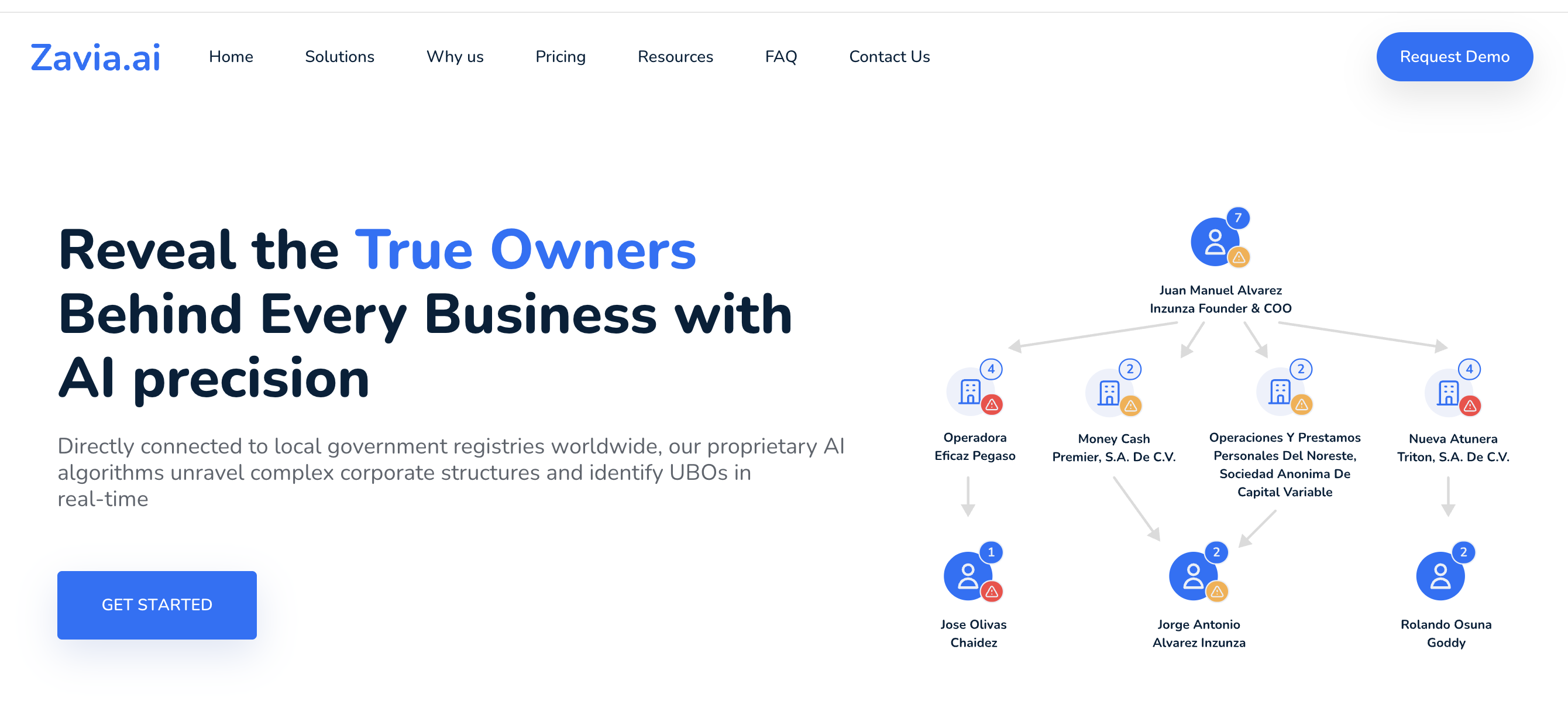

6. Zavia.ai vs Middesk

Zavia.ai is an advanced UBO and corporate ownership intelligence platform designed to help organizations uncover, verify, and monitor complex business structures across the globe. While Middesk focuses on validating U.S. businesses, Zavia.ai specializes in identifying ultimate beneficial owners (UBOs), parent–subsidiary relationships, and multi-layered corporate hierarchies using data sourced from official government registries.

Zavia.ai is an advanced UBO and corporate ownership intelligence platform designed to help organizations uncover, verify, and monitor complex business structures across the globe. While Middesk focuses on validating U.S. businesses, Zavia.ai specializes in identifying ultimate beneficial owners (UBOs), parent–subsidiary relationships, and multi-layered corporate hierarchies using data sourced from official government registries.

Powered by a proprietary engine that standardizes and reconstructs ownership chains from thousands of registry records, Zavia.ai enables risk, compliance, and investigative teams to map corporate structures with a level of depth that goes far beyond standard KYB checks.

Core Strengths

1. Advanced Global UBO and Ownership Mapping

Zavia.ai excels at reconstructing multi-layer ownership, including:

Shareholders and controlling interests

Intermediate parent companies

Cross-border corporate linkages

Multi-jurisdiction structure charts

Ownership percentages where available

This is a major differentiator from Middesk, which provides only U.S. officer data and does not support multi-country ownership mapping.

2. First-Party Registry-Sourced Ownership Data

The platform collects and processes ownership information directly from:

This provides audit-ready ownership insights suitable for AML, KYB, and compliance processes.

3. AML & Risk Use Cases

Zavia.ai is built for scenarios where ownership and control are key risk factors:

High-risk customer onboarding

Enhanced due diligence (EDD)

Sanctions exposure analysis

Identification of politically exposed persons (PEPs) linked through ownership

Assessing indirect beneficial control

This allows compliance teams to identify hidden risks Middesk cannot uncover.

4. Automated Global Corporate Structure Diagrams

Zavia.ai automatically generates:

Complete parent–subsidiary diagrams

Ownership percentage maps

Multi-layer legal entity structures

Step-by-step transparency trails

This visualization capability is essential for regulated industries needing a clear audit trail.

5. API Access for Automated KYB/UBO Checks

The Zavia.ai API enables:

This makes it suitable for fintechs, RegTechs, and enterprise compliance systems.

Who Zavia.ai Is Best For

Zavia.ai is ideal for organizations that require:

Deep global ownership intelligence, not just surface-level KYB

Enhanced due diligence on high-risk entities

Cross-border UBO mapping for compliance and investigations

Parent and subsidiary identification at multiple levels

Regulatory-grade audit trails for AML frameworks

It is widely applicable in banking, payments, corporate intelligence, insurance, procurement, and investigative research.

How Zavia.ai Compares to Middesk

Feature | Zavia.ai | Middesk |

|---|

Geographic coverage | Global | U.S.-only |

Ownership depth | ✔ full multi-layer UBO | ✖ limited |

Parent–subsidiary mapping | ✔ automatic | ✖ |

AML support | ✔ strong | Limited |

Registry sourcing | ✔ multi-country | U.S. only |

Workflow automation | ✔ via API | Limited |

Best for | Deep UBO & risk analysis | Basic U.S. business identity checks |

Summary

Zavia.ai is a strong alternative to Middesk for organizations needing global ownership transparency, multi-layer UBO mapping, and complex corporate structure analysis for compliance or investigative purposes. While Middesk excels in verifying U.S. legal entities, Zavia.ai delivers the depth of ownership intelligence required for modern AML, EDD, and risk workflows across multiple jurisdictions.

7. ComplyAdvantage vs Middesk

ComplyAdvantage is a global AML and risk intelligence platform that provides sanctions screening, PEP monitoring, adverse media insights, and KYB/KYC verification. While Middesk focuses primarily on validating U.S. business registrations, ComplyAdvantage is designed for organizations that need to identify, assess, and monitor financial crime risk across multiple jurisdictions. Its data, analytics, and automation capabilities make it a strong fit for regulated industries.

ComplyAdvantage is a global AML and risk intelligence platform that provides sanctions screening, PEP monitoring, adverse media insights, and KYB/KYC verification. While Middesk focuses primarily on validating U.S. business registrations, ComplyAdvantage is designed for organizations that need to identify, assess, and monitor financial crime risk across multiple jurisdictions. Its data, analytics, and automation capabilities make it a strong fit for regulated industries.

Core Strengths

1. Extensive AML and Risk Intelligence

ComplyAdvantage maintains a large, continuously updated risk database including:

Global sanctions lists

Politically Exposed Persons (PEPs)

Adverse media monitoring

Law enforcement and regulatory actions

High-risk jurisdictions and state-owned entities

This enables a level of risk assessment that goes far beyond Middesk’s scope.

2. KYB with Integrated Risk Screening

The platform verifies businesses while simultaneously evaluating risk indicators, including:

Registration and incorporation details

Business status

Key officers and related individuals

Ownership links (where available)

Screening against AML datasets

This combined verification-and-risk approach is valuable for companies with compliance obligations.

3. Real-Time Monitoring and Alerts

ComplyAdvantage offers continuous monitoring across:

This is essential for financial institutions required to maintain ongoing AML vigilance.

4. Compliance Workflow Automation

The platform provides tools to streamline compliance operations:

These features make it easier for organizations to manage large-scale AML and KYB processes.

5. Broad Integrations and API Flexibility

ComplyAdvantage integrates with:

This allows companies to embed AML and KYB screening directly into onboarding or transaction flows.

Who ComplyAdvantage Is Best For

ComplyAdvantage is ideal for organizations that require:

Combined KYB + AML screening

Global risk insights

Continuous monitoring

Automated compliance workflows

Support for high-risk or regulated sectors

It is widely used in banking, fintech, payments, digital assets, and insurance.

How ComplyAdvantage Compares to Middesk

Feature | ComplyAdvantage | Middesk |

|---|

Geographic coverage | Global | U.S.-only |

KYB | ✔ with risk scoring | ✔ U.S. only |

AML screening | ✔ comprehensive | Limited |

Sanctions & PEP monitoring | ✔ | ✖ |

Adverse media | ✔ | ✖ |

Continuous monitoring | ✔ | Limited |

Workflow automation | ✔ | Minimal |

Best for | AML-driven compliance | Basic U.S. business identity checks |

Summary

ComplyAdvantage is a strong alternative to Middesk for companies that need global business verification combined with financial crime risk intelligence. Its breadth of AML data, monitoring capabilities, and workflow automation make it particularly well-suited for regulated industries that must assess and manage risk at every stage of the customer or merchant lifecycle.

8. Persona vs Middesk

Persona is a flexible identity verification and compliance platform that supports both KYC and KYB through highly configurable workflows. While Middesk focuses on validating U.S.-registered businesses using government data, Persona positions itself as an orchestration layer that combines business verification, individual verification, document checks, and risk screening into a single environment.

Persona is a flexible identity verification and compliance platform that supports both KYC and KYB through highly configurable workflows. While Middesk focuses on validating U.S.-registered businesses using government data, Persona positions itself as an orchestration layer that combines business verification, individual verification, document checks, and risk screening into a single environment.

Its modular design, strong developer experience, and customizable flows make Persona a strong alternative for companies that require tailored onboarding journeys rather than a fixed KYB process.

Core Strengths

1. Highly Customizable KYB Workflows

Persona enables companies to build KYB processes that match their exact requirements, including:

Business verification

Document collection and validation

Beneficial owner identification

Officer and shareholder checks

Risk scoring and custom review rules

This configurability goes far beyond Middesk’s standardized U.S.-only KYB response.

2. Unified KYC + KYB Platform

Persona supports both individual and business verification, allowing companies to:

Verify UBOs and directors

Combine KYC and KYB in one flow

Screen both entities and individuals

Collect identity, business, and compliance documents

This eliminates the need to integrate separate solutions for KYC and KYB.

3. Document and Data Verification Capabilities

The platform includes:

These capabilities allow teams to onboard businesses that require document-based validation—not just registry-based checks.

4. Strong Developer Experience

Persona is known for:

Clean APIs

Detailed documentation

Flexible SDKs

Modular components

Customizable UI flows

Engineering teams often choose Persona when they need to embed identity workflows directly into their onboarding experience.

5. Risk Signals and Ongoing Monitoring

Persona provides ongoing monitoring for:

This gives compliance teams visibility into evolving risk factors.

Who Persona Is Best For

Persona is ideal for companies that need:

Customizable onboarding flows for both businesses and individuals

Integrated KYC + KYB in a single system

Document-based verification in addition to registry checks

Flexible workflows tailored to risk levels or industry needs

Infrastructure suited for fintechs, marketplaces, SaaS platforms, and Web3

It is often chosen by companies that want full control over the user experience and decisioning logic.

How Persona Compares to Middesk

Feature | Persona | Middesk |

|---|

Geographic coverage | Global (via data partners + documents) | U.S.-only |

KYB | ✔ configurable | ✔ U.S. only |

KYC | ✔ | ✖ |

Document verification | ✔ strong | ✖ |

Workflow automation | ✔ advanced | Limited |

UBO verification | ✔ configurable | Limited |

Monitoring | ✔ | Limited |

Best for | Custom onboarding & combined KYC/KYB | U.S. business identity checks |

Summary

Persona is a strong alternative to Middesk for organizations that require highly customizable KYB workflows, global verification capabilities, and combined KYC/KYB orchestration. Its flexibility and breadth of verification methods make it ideal for platforms that need to tailor onboarding journeys to different customer types, risk profiles, or regulatory environments.

9. Ondato vs Middesk

Ondato is a verification and compliance platform offering a wide suite of KYC, KYB, document verification, and AML screening solutions. While Middesk focuses specifically on U.S. business identity data, Ondato delivers European-centric and global verification capabilities, making it a strong choice for businesses that onboard entities across multiple jurisdictions.

Ondato is a verification and compliance platform offering a wide suite of KYC, KYB, document verification, and AML screening solutions. While Middesk focuses specifically on U.S. business identity data, Ondato delivers European-centric and global verification capabilities, making it a strong choice for businesses that onboard entities across multiple jurisdictions.

Ondato combines business verification, identity checks, document processing, and workflow automation into a single platform—making it suitable for fintechs, banks, and digital platforms that require structured and compliant onboarding processes.

Core Strengths

1. Strong KYB Coverage Across Europe and Key Markets Globally

Ondato provides business verification using:

This makes it a powerful alternative for companies operating in or expanding to Europe, where regulatory requirements are stricter and more fragmented than in the U.S.

2. Combined KYC + KYB Platform

Ondato supports both individual and business verification, allowing organizations to:

Verify businesses and their representatives

Perform UBO and shareholder checks (where data is accessible)

Combine director and owner verification into a single flow

Meet EU and international AML requirements

This unified approach helps reduce vendor complexity.

3. Document and Identity Verification Tools

Ondato includes a full suite of identity and document verification capabilities:

These tools are valuable for onboarding entities that require manual documents (e.g., high-risk or newly formed companies).

4. AML Screening and Monitoring

Ondato provides:

Sanctions and PEP screening

Adverse media checks

Continuous monitoring for compliance changes

Risk scoring and automated alerts

This level of integrated risk analysis surpasses Middesk’s capabilities.

5. Off-the-Shelf and Customizable Workflows

The platform allows companies to tailor onboarding flows with:

This is important for regulated businesses that need configurable compliance logic.

Who Ondato Is Best For

Ondato is well suited for:

Fintechs and banks in Europe

Platforms onboarding international businesses

Companies requiring both KYC and KYB in one system

Organizations needing strong document verification

Regulated industries with strict AML obligations

Its breadth makes it a practical all-in-one solution for multi-market compliance.

How Ondato Compares to Middesk

Feature | Ondato | Middesk |

|---|

Geographic coverage | Global, strong in EU | U.S.-only |

KYB | ✔ multi-country | ✔ U.S. only |

KYC | ✔ | ✖ |

Document verification | ✔ robust | ✖ |

AML screening | ✔ | Limited |

Workflow automation | ✔ | Minimal |

UBO checks | ✔ where legally available | Limited |

Best for | EU/global onboarding & AML | U.S. business identity checks |

Summary

Ondato is a strong Middesk alternative for organizations that require European KYB coverage, document verification, and unified KYC/KYB/AML workflows. Its multi-country capabilities, combined with identity verification and compliance automation, make it especially valuable for businesses operating across borders or in tightly regulated industries.

10. iDenfy vs Middesk

iDenfy is an identity verification and fraud prevention platform offering both KYC and KYB solutions with a strong focus on automation, affordability, and risk management. While Middesk specializes in U.S. business identity verification based on government records, iDenfy provides global verification coverage, combining business registry data, document-based checks, sanctions screening, and ongoing monitoring.

iDenfy is an identity verification and fraud prevention platform offering both KYC and KYB solutions with a strong focus on automation, affordability, and risk management. While Middesk specializes in U.S. business identity verification based on government records, iDenfy provides global verification coverage, combining business registry data, document-based checks, sanctions screening, and ongoing monitoring.

Its competitive pricing and broad verification capabilities make iDenfy a popular choice for digital platforms, fintechs, and marketplaces requiring scalable KYB without heavy operational overhead.

Core Strengths

1. Global KYB Coverage

iDenfy supports KYB checks in multiple jurisdictions by combining:

Local business registry data

Corporate filings and public records

Document-based business validation

Ownership and management information (where available)

This gives it significantly broader international reach than Middesk’s U.S.-only approach.

2. Unified KYC + KYB + AML Screening

iDenfy offers fully integrated compliance capabilities, including:

Individual identity verification

Business identity checks

Sanctions and PEP screening

Adverse media monitoring

Ongoing watchlist updates

This unified approach reduces the need for multiple vendors.

3. Strong Document Verification Capabilities

The platform includes advanced document verification features such as:

OCR extraction

AI-based document analysis

Fraud detection signals

Manual review tools for compliance teams

Liveness and biometric verification for KYC

These capabilities support businesses that rely heavily on documentation rather than registry-only verification.

4. Automated Compliance Workflows

iDenfy enables companies to:

Build automated onboarding flows

Apply risk rules to approvals

Generate review tasks for compliance teams

Maintain audit-ready logs

Reduce manual KYB workloads

This helps organizations scale verification without expanding operations teams.

5. Cost-Effective Pricing Structure

iDenfy is known for offering:

Flexible consumption-based pricing

Competitive rates compared to larger identity vendors

No expensive commitment tiers

This makes it attractive for startups and digital platforms performing high volumes of checks.

Who iDenfy Is Best For

iDenfy is well suited for companies that need:

Global KYB and KYC in one platform

Cost-effective onboarding at scale

Automated document-based verification

Built-in AML screening and monitoring

Flexible integration for fintechs, SaaS, eCommerce, and marketplaces

Its balance of functionality and affordability makes it a practical choice for growth-oriented businesses.

How iDenfy Compares to Middesk

Feature | iDenfy | Middesk |

|---|

Geographic coverage | Global | U.S.-only |

KYB | ✔ multi-country | ✔ U.S. only |

KYC | ✔ | ✖ |

Document verification | ✔ strong | ✖ |

AML capabilities | ✔ | Limited |

Workflow automation | ✔ | Minimal |

Pricing | Competitive, usage-based | Moderate |

Best for | Global, cost-efficient verification | U.S. business identity checks |

Summary

iDenfy is a strong alternative to Middesk for organizations seeking affordable global KYB, combined with KYC, AML screening, and automated workflow capabilities. Its breadth of verification methods, global coverage, and flexible pricing make it especially suitable for digital platforms onboarding both individuals and businesses across multiple regions.

Comparison Table Of Middesk VS Other Vendors

Provider | Geographic Coverage | KYB Depth | UBO / Ownership | Financial Data | KYC Support | AML / Screening | Workflow Automation | Ideal For |

|---|

Middesk | U.S.-only | Basic U.S. KYB | Limited | ✖ | ✖ | Limited | Minimal | U.S. entity checks |

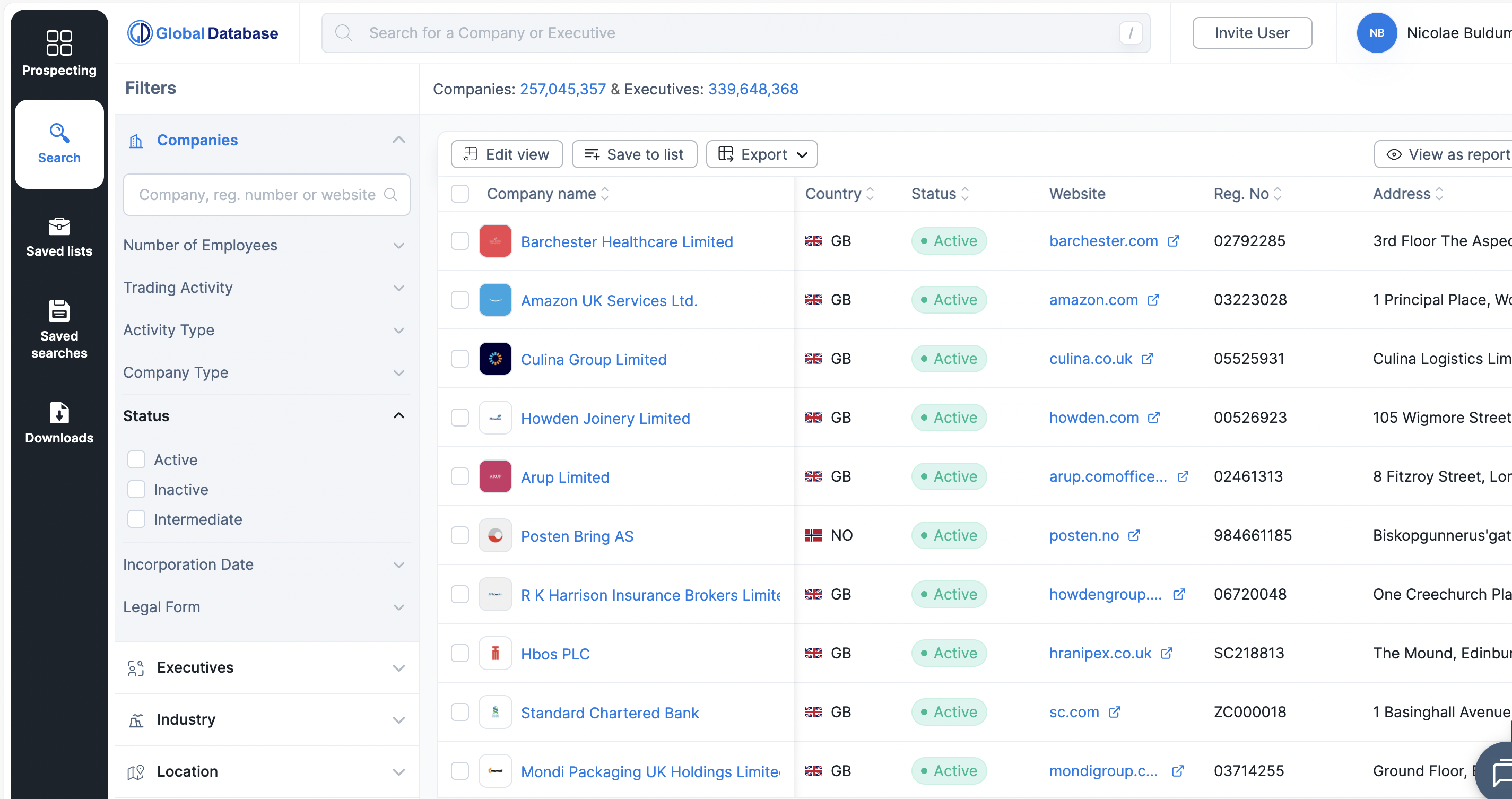

Global Database | 195 countries | Deep registry KYB | ✔ Multi-layer (where available) | ✔ Full financials (20+ years) | ✖ | ✔ AML (sanctions, PEP, watchlists) | ✔ via API | Global onboarding, enrichment, AML & compliance |

Alloy | Global (via partners) | Depends on partners | Depends on partners | ✖ | ✔ | ✔ | ✔ Advanced | Workflow orchestration & decisioning |

Zephira.ai | 150+ countries | Registry-sourced KYB | ✔ (where available) | ✔ Structured financial data | ✖ | Limited | ✔ API-first | Developer-first global KYB |

Sumsub | 220+ countries | Global KYB + documents | ✔ | ✖ | ✔ | ✔ | ✔ Configurable | Unified KYC/KYB + AML |

Trulioo | 195+ countries | Global KYB | ✔ Top-level | ✖ | ✔ | ✔ Strong | ✔ Enterprise | Large-scale global onboarding |

Zavia.ai | Global | Deep UBO mapping | ✔ Multi-layer | ✔ Financial indicators | ✖ | ✔ Risk-focused | ✔ API | Ownership mapping & AML |

ComplyAdvantage | Global | KYB + risk scoring | Partial | ✖ | ✔ | ✔ Comprehensive | ✔ Strong | AML-driven KYB & monitoring |

Persona | Global (data + docs) | Configurable KYB | ✔ Configurable | ✖ | ✔ | ✔ | ✔ Highly customizable | Tailored KYC/KYB onboarding |

Ondato | Global (strong EU) | KYB + documents | ✔ (where available) | ✖ | ✔ | ✔ | ✔ | EU/global onboarding & AML |

iDenfy | Global | KYB + documents | ✔ (limited) | ✖ | ✔ | ✔ | ✔ Automated | Cost-efficient KYC/KYB |

Best Choice by Use Case

Different organizations look for different capabilities when evaluating alternatives to Middesk. Below is a neutral, criteria-driven assessment of which vendors align best with specific operational, regulatory, and technical requirements.

5.1 When Global Registry-Sourced KYB Is Required

Most Suitable: Global Database, Zephira.ai

Companies needing direct registry-sourced KYB across many jurisdictions—rather than document uploads or partner-aggregated data—tend to prefer:

Global Database: 195-country coverage, structured registry data, multi-layer ownership (where available), full financial statements, and integrated AML.

Zephira.ai: API-first KYB with normalized registry data and consistent schema across 150+ countries.

Suitable for: Global onboarding, due diligence automation, enterprise enrichment, API-driven workflows.

5.2 When Ownership Transparency and Multi-Layer UBO Mapping Is the Priority

Most Suitable: Zavia.ai

Organizations analyzing complex corporate structures—especially across multiple jurisdictions—benefit most from:

Zavia.ai: Deep ownership reconstruction, multi-jurisdiction shareholder mapping, indirect control detection, and registry-sourced transparency trails.

Suitable for: AML teams, financial institutions, investigative units, enhanced due diligence.

5.3 When Integrated KYC + KYB + AML Is Needed in a Single Platform

Most Suitable: Sumsub, Trulioo, Ondato

Platforms that require both individual and business verification, plus sanctions screening and monitoring, typically adopt:

Sumsub: Strong workflow flexibility and global KYC/KYB coverage.

Trulioo: Enterprise-grade infrastructure and global verification pipelines.

Ondato: Particularly strong in Europe, with document and identity verification included.

Suitable for: Fintech onboarding, marketplaces, payment providers, mobility platforms.

5.4 When AML Risk Scoring and Financial Crime Detection Are Central

Most Suitable: ComplyAdvantage

For organizations where the primary requirement is sanctions, PEPs, adverse media, and risk classification, rather than just KYB:

ComplyAdvantage: Comprehensive AML coverage, real-time updates, global risk datasets, and integrated KYB scoring.

Suitable for: Banks, crypto firms, lenders, and regulated industries with high AML exposure.

Frequently Asked Questions (FAQ) about Middesk

What is KYB and why is it important?

KYB (Know Your Business) is the process of verifying a company’s legal identity, ownership structure, registration status, and potential risk exposure. It is required for financial institutions, payment companies, marketplaces, and organizations that must prevent fraud, money laundering, or onboarding high-risk entities.

How is KYB different from KYC?

KYC verifies individuals (identity, documents, biometrics), whereas KYB verifies legal entities (company registration, directors, shareholders, UBOs). Many platforms combine both processes when onboarding businesses and their beneficial owners.

Why do companies look for alternatives to Middesk?

Middesk provides strong U.S. business identity verification, but organizations often need:

Multi-country KYB coverage

UBO or ownership intelligence

Financial statements

AML, sanctions, and PEP screening

Combined KYC + KYB workflows

Customizable onboarding journeys

Alternative vendors provide broader functionality depending on the use case.

Which Middesk alternatives offer global KYB coverage?

Several vendors offer multi-country KYB, including Global Database, Zephira.ai, Trulioo, Sumsub, Ondato, iDenfy, and ComplyAdvantage. Coverage varies by jurisdiction and verification method (registry data vs. documents).

Which vendors provide real financial data for KYB?

Only three vendors in this article provide actual financial statements or structured financial metrics:

Global Database

Zephira.ai

Zavia.ai

Other platforms may offer financial risk indicators but not detailed financial reports.

Does every KYB provider offer UBO information?

No. Only some solutions support UBO or ownership insight.

Deepest ownership mapping is provided by:

Zavia.ai (multi-layer global UBO)

Global Database (where legally available)

Zephira.ai (registry ownership data)

Others offer limited or document-based ownership checks.

Which platforms combine KYB, KYC, and AML in one workflow?

If an organization needs a single platform for individual, business, and sanctions verification, the most complete solutions are:

Do all KYB providers offer real-time registry data?

No. Some vendors rely on documents, data aggregators, or manual review processes.

Platforms offering direct registry-sourced data include:

Global Database

Zephira.ai

Zavia.ai

These provide higher accuracy and audit-ready information.

Which solution is most suitable for onboarding sellers or suppliers globally?

Companies onboarding international merchants or vendors typically prefer:

Global Database (registry + AML + financial data)

Sumsub or Trulioo (KYC + KYB + AML)

Zephira.ai (API-first global KYB)

Choice depends on whether the priority is compliance, automation, or developer experience.

How should organizations choose the right KYB provider?

Selection depends on several factors:

Geographic coverage needs

Depth of KYB data required (registry, documents, ownership)

Regulatory obligations (AML, monitoring, sanctions)

Integration model (API-only vs. platform)

Need for financial data

Budget and scalability requirements

Companies should evaluate vendors based on their primary use case—global coverage, UBO mapping, KYC integration, risk scoring, or workflow automation.

Zavia.ai is an advanced UBO and corporate ownership intelligence platform designed to help organizations uncover, verify, and monitor complex business structures across the globe. While Middesk focuses on validating U.S. businesses, Zavia.ai specializes in identifying ultimate beneficial owners (UBOs), parent–subsidiary relationships, and multi-layered corporate hierarchies using data sourced from official government registries.

Zavia.ai is an advanced UBO and corporate ownership intelligence platform designed to help organizations uncover, verify, and monitor complex business structures across the globe. While Middesk focuses on validating U.S. businesses, Zavia.ai specializes in identifying ultimate beneficial owners (UBOs), parent–subsidiary relationships, and multi-layered corporate hierarchies using data sourced from official government registries. ComplyAdvantage is a global AML and risk intelligence platform that provides sanctions screening, PEP monitoring, adverse media insights, and KYB/KYC verification. While Middesk focuses primarily on validating U.S. business registrations, ComplyAdvantage is designed for organizations that need to identify, assess, and monitor financial crime risk across multiple jurisdictions. Its data, analytics, and automation capabilities make it a strong fit for regulated industries.

ComplyAdvantage is a global AML and risk intelligence platform that provides sanctions screening, PEP monitoring, adverse media insights, and KYB/KYC verification. While Middesk focuses primarily on validating U.S. business registrations, ComplyAdvantage is designed for organizations that need to identify, assess, and monitor financial crime risk across multiple jurisdictions. Its data, analytics, and automation capabilities make it a strong fit for regulated industries. Persona is a flexible identity verification and compliance platform that supports both KYC and KYB through highly configurable workflows. While Middesk focuses on validating U.S.-registered businesses using government data, Persona positions itself as an orchestration layer that combines business verification, individual verification, document checks, and risk screening into a single environment.

Persona is a flexible identity verification and compliance platform that supports both KYC and KYB through highly configurable workflows. While Middesk focuses on validating U.S.-registered businesses using government data, Persona positions itself as an orchestration layer that combines business verification, individual verification, document checks, and risk screening into a single environment. Ondato is a verification and compliance platform offering a wide suite of KYC, KYB, document verification, and AML screening solutions. While Middesk focuses specifically on U.S. business identity data, Ondato delivers European-centric and global verification capabilities, making it a strong choice for businesses that onboard entities across multiple jurisdictions.

Ondato is a verification and compliance platform offering a wide suite of KYC, KYB, document verification, and AML screening solutions. While Middesk focuses specifically on U.S. business identity data, Ondato delivers European-centric and global verification capabilities, making it a strong choice for businesses that onboard entities across multiple jurisdictions. iDenfy is an identity verification and fraud prevention platform offering both KYC and KYB solutions with a strong focus on automation, affordability, and risk management. While Middesk specializes in U.S. business identity verification based on government records, iDenfy provides global verification coverage, combining business registry data, document-based checks, sanctions screening, and ongoing monitoring.

iDenfy is an identity verification and fraud prevention platform offering both KYC and KYB solutions with a strong focus on automation, affordability, and risk management. While Middesk specializes in U.S. business identity verification based on government records, iDenfy provides global verification coverage, combining business registry data, document-based checks, sanctions screening, and ongoing monitoring.