2. Dun & Bradstreet

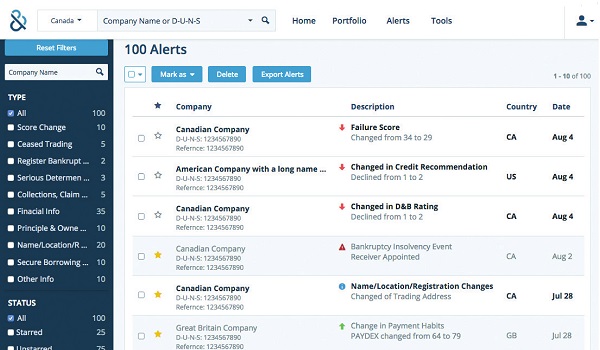

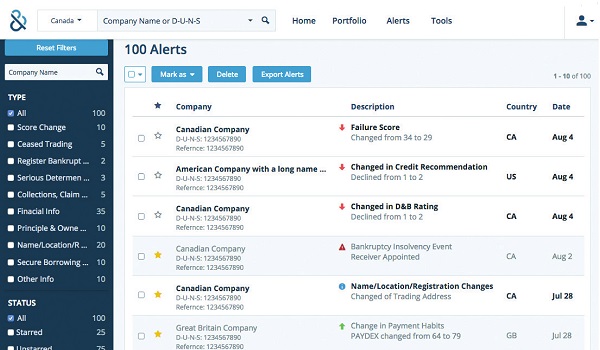

D&B provides global company intelligence powered by its proprietary D-U-N-S® Number system. It’s known for credit risk scoring, supplier verification, and compliance data.

Key Features:

- D-U-N-S® Number-based identification

- Risk and credit scoring

- Financial statements and trade payment data

- Third-party risk monitoring tools

- Integrations with major CRMs and ERPs

Pricing:

Custom pricing based on company size and usage. Entry-level tools start at $1,500/year, with higher tiers for full API and enterprise capabilities.

3. Zavia.ai

Zavia.ai focuses on AI-powered UBO discovery. It unravels complex ownership chains by combining registry data and smart graph analysis.

Key Features:

- Real-time UBO discovery

- Visual ownership mapping

- Global registry integration

- AML/KYC dashboard for compliance teams

- Batch screening and audit trail

Pricing:

Starts at $299/month for small compliance teams. Enterprise APIs are priced based on jurisdictional scope and data volume.

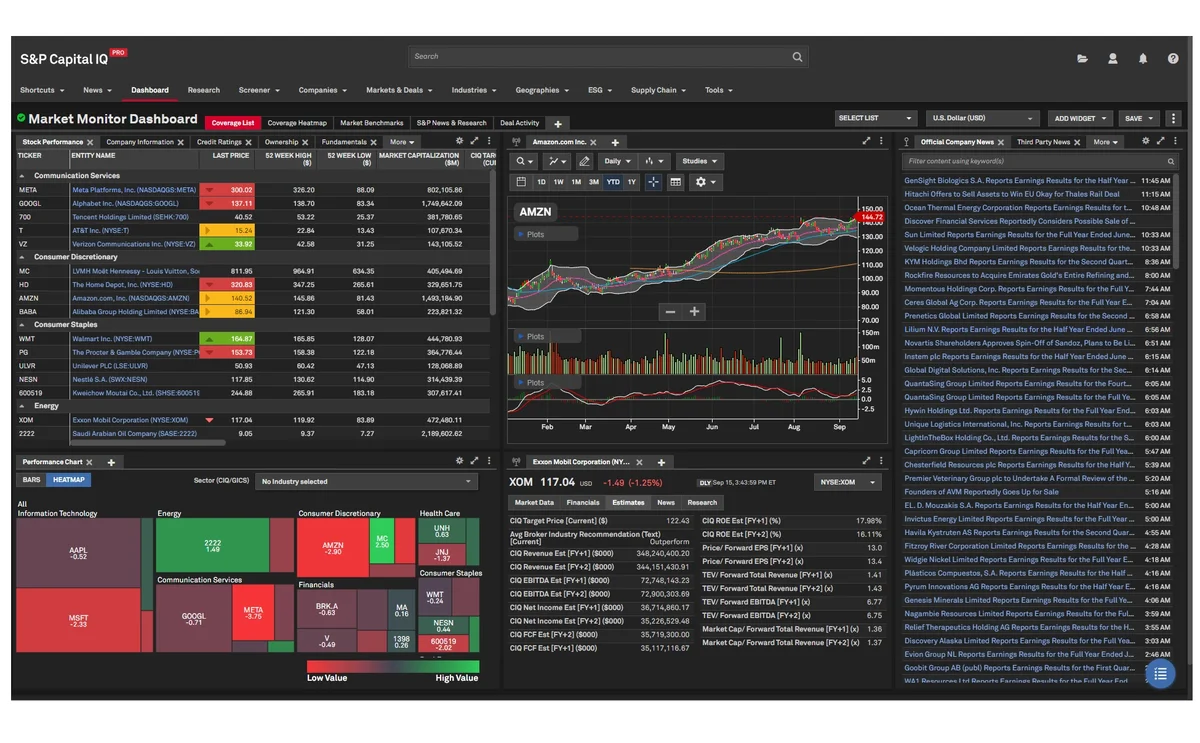

4. Capital IQ (S&P Global)

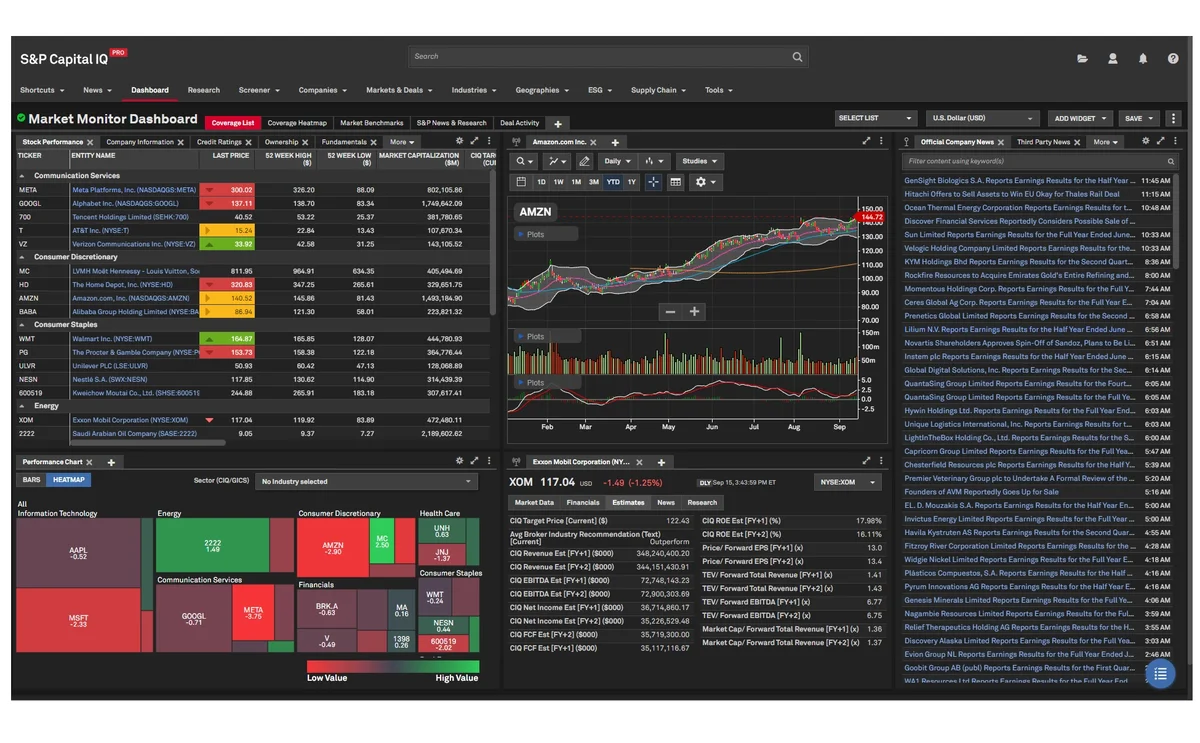

Capital IQ is a favorite among investment analysts, offering clean access to public and private company financials, deals, and valuation tools.

Key Features:

- In-depth financial data and ratios

- M&A, equity, and debt transaction tracking

- Private company insights

- Excel plug-in for modeling

- Alerts, benchmarking, and screening tools

Pricing:

Typically starts at $13,000/user/year. Discounts are available for academic institutions and bulk licenses

5. FactSet

FactSet is known for its powerful analytics, financial modeling, and portfolio tools used by hedge funds and asset managers globally.

Key Features:

- Integrated public/private market data

- ESG ratings and governance insights

- Quant modeling and portfolio analytics

- M&A and research integration

- Custom dashboards and data feeds

Pricing:

Starts at $12,000/year/user with add-ons for ESG, quant tools, or private market modules.

6. MonetaIQ

MonetaIQ specializes in digital company insights, including traffic data, audience geography, and tech stack information.

Key Features:

- Web traffic volume and growth trends

- Source and engagement analytics

- Technology stack and cloud infrastructure data

- Digital benchmarking reports

- Ideal for SaaS, VC, and marketing intelligence

Pricing:

Starts at $199/month. API access and custom dashboards available on request.

7. Thomson Reuters Eikon (Refinitiv)

Eikon delivers real-time financial markets data, fundamentals, and macroeconomic indicators.

Key Features:

- Equity, commodities, FX, and bond data

- Global macroeconomic dashboard

- Analyst estimates and consensus forecasts

- Screening and charting tools

- Plug-ins for Excel and terminals

Pricing:

Starts at $3,600/year, with enterprise and trading packages reaching $20,000+/year depending on access level.

8. Bloomberg Terminal

Bloomberg Terminal is the flagship product for finance professionals who need fast, comprehensive coverage of global markets.

Key Features:

- Real-time financial data and alerts

- Global newsfeeds and trading capabilities

- Company profiles, filings, and analyst research

- Chat, messaging, and market updates

- Access to Bloomberg’s proprietary datasets

Pricing:

Starts at $24,000/year per user, with volume discounts for multi-terminal deployments.

9. Mergent

Mergent is ideal for historical financial research and public company analysis, with deep archives and regulatory data.

Key Features:

- Historical financials back 30+ years

- SEC filings, annual reports, dividend data

- Corporate actions and company history

- Academic and research-friendly interface

- Downloadable reports and spreadsheets

Pricing:

Starts at $1,200/year. Institutional pricing available for universities and libraries.

10. Crunchbase

Crunchbase provides real-time insights into private companies, startups, and funding activity across the globe.

Key Features:

- Funding rounds, acquisitions, and exits

- Founders, executive teams, and investors

- Industry and market segmentation

- Search filters by stage, valuation, or sector

- Chrome extension and CRM integrations

Pricing:

Free plan available. Pro starts at $49/month, while enterprise and API tiers vary based on usage.

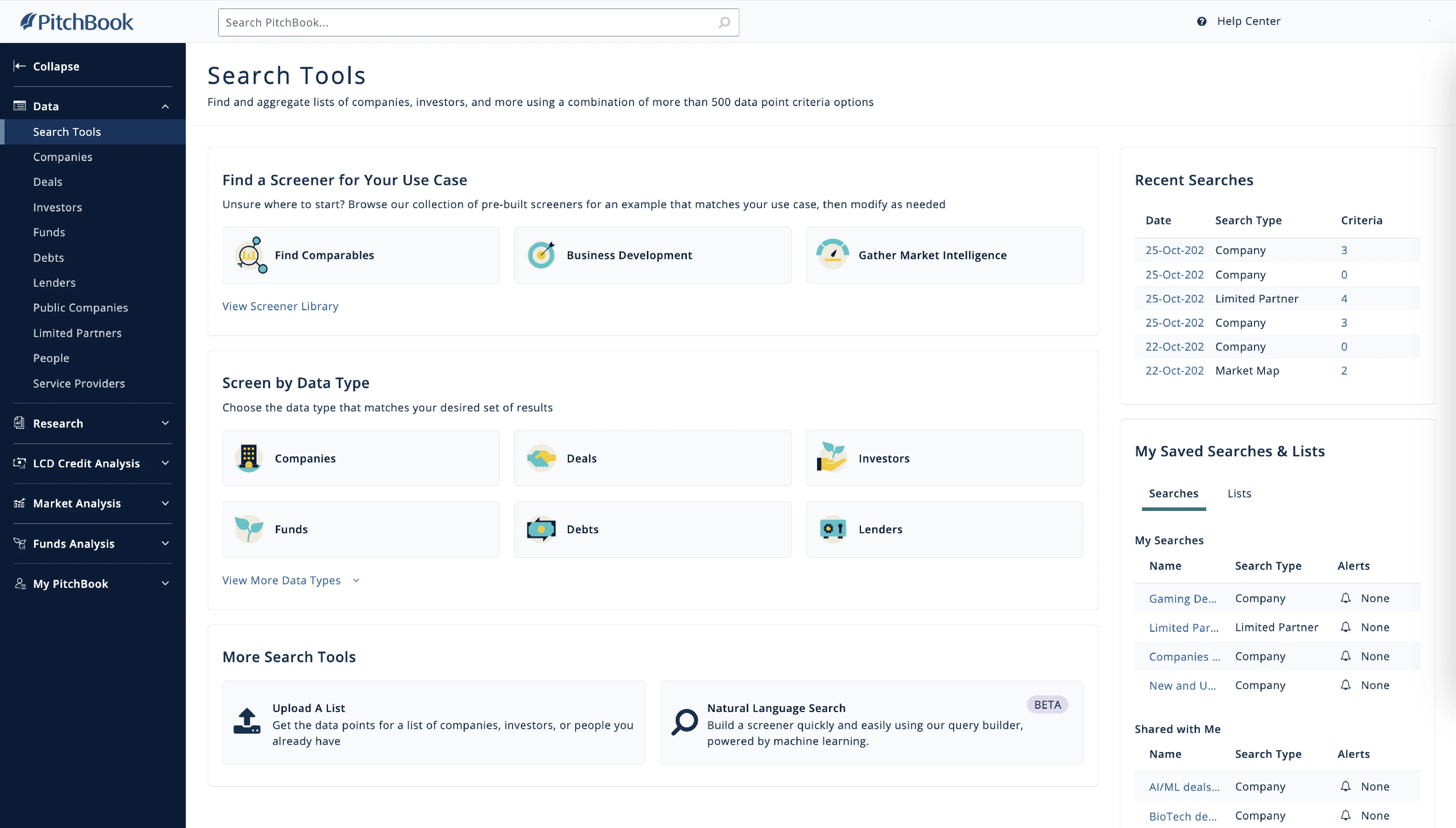

11. PitchBook

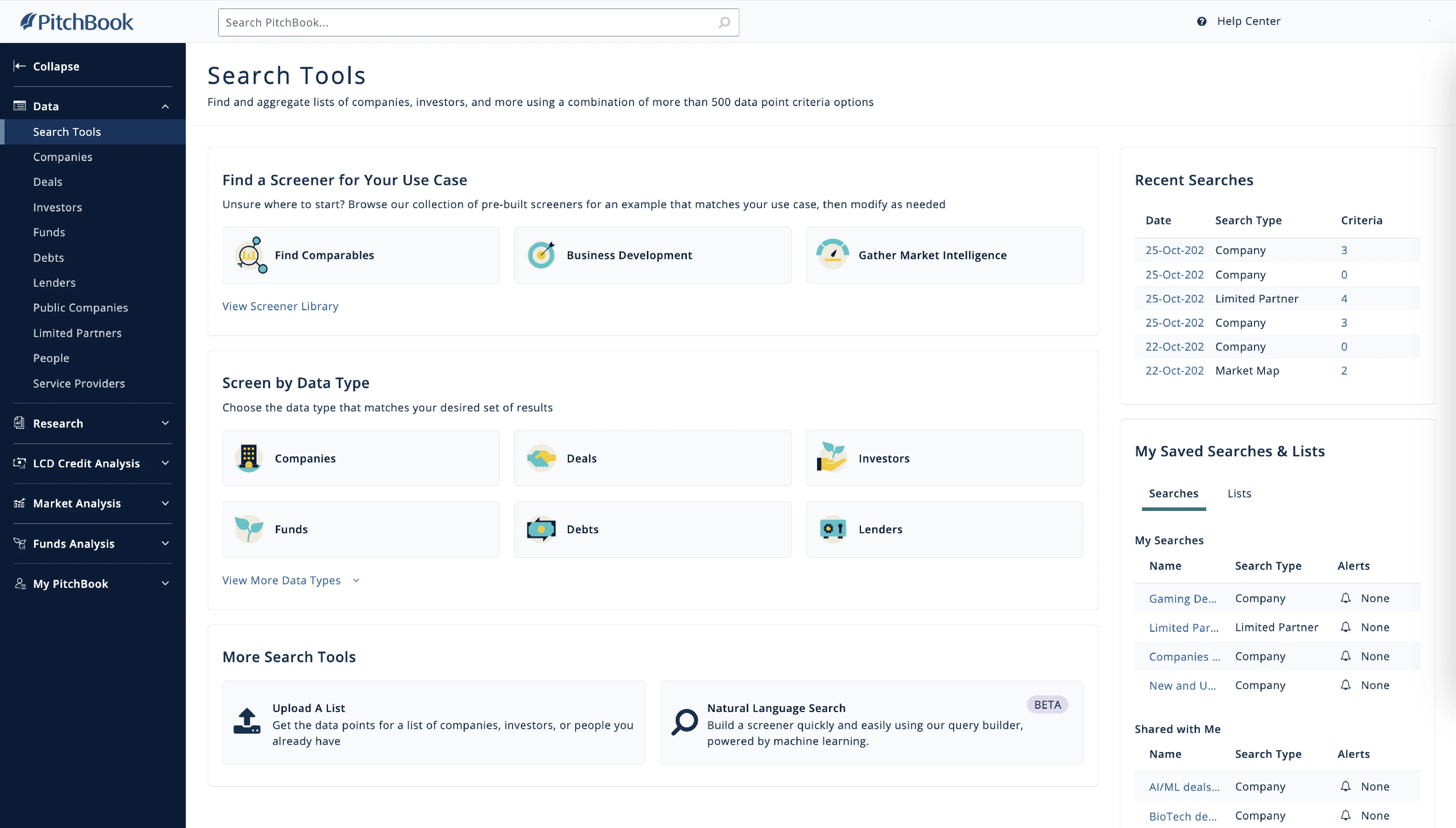

PitchBook focuses on private market data, covering VC, PE, and M&A across multiple sectors and geographies.

Key Features:

- Company valuations, deal flow, and investor portfolios

- Detailed fund performance and LP data

- Cap tables and exit strategies

- Graph-based visualization tools

- Excel integration and analyst research

Pricing:

Starts around $20,000/year per user, depending on modules and data needs.

12. Zephira

Zephira is a lightweight, API-first data provider that allows direct embedding of business data into apps and internal platforms.

Key Features:

- Real-time access to official company registries

- Global financial and ownership data

- Developer-friendly RESTful API

- Pay-as-you-go billing

- Ideal for fintechs and compliance platforms

Pricing:

Pay-per-call starting from $0.02/request. Custom monthly plans available for high-volume users.

FAQ: Bureau van Dijk (Orbis) Alternatives

Why look for an Orbis alternative?

Orbis is powerful but often seen as expensive, inflexible, and lacking modern delivery formats like API-first architecture. Alternatives provide greater speed, customization, and lower cost.

Which is the most cost-effective Orbis competitor?

Global Database, Zephira, and Crunchbase offer affordable entry points, with flexible pricing models for smaller teams and startups.

Best for startup tracking and VC intelligence?

Crunchbase and PitchBook offer in-depth data on early-stage companies, funding rounds, and investor relationships.

What’s best for compliance and UBO discovery?

Zavia.ai and Global Database specialize in UBO identification and real-time registry sourcing, making them strong choices for KYB/AML programs.

Which tools integrate best with internal apps or platforms?

Zephira and Global Database both offer modern REST APIs, ideal for embedding business data into your own systems with minimal overhead.