2. Bureau van Dijk (A Moody’s Analytics Company)

Overview:

Part of Moody’s Analytics, Bureau van Dijk specializes in private company data and ownership intelligence . Its flagship product, Orbis, combines millions of data points from global sources and is known for its depth and reliability.

What makes it different:

- Detailed corporate hierarchies and UBO (Ultimate Beneficial Owner) info

- Extensive financials, even for private firms

- Compliance tools, including anti-money laundering and transfer pricing solutions

- Excellent coverage across Europe and emerging markets

Ideal for: Financial analysts, compliance teams, and multinational corporations that need reliable corporate intelligence.

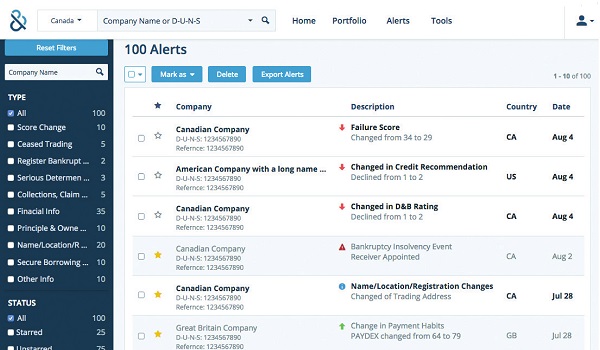

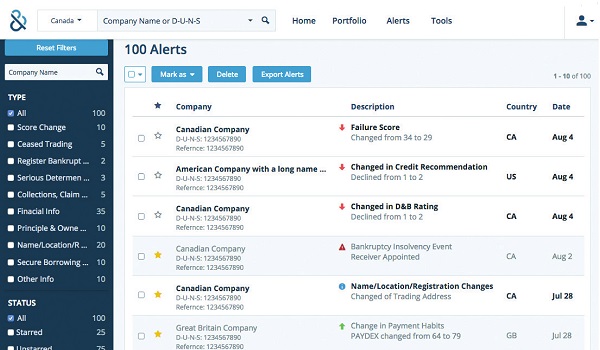

3. Dun & Bradstreet (D&B)

Trusted worldwide:

Dun & Bradstreet is one of the most recognized names in business intelligence, with data on over 500 million businesses globally. The company’s proprietary D-U-N-S Number system is widely used for verifying and monitoring organizations.

Key strengths:

- Comprehensive credit scores and risk indicators

- Global data coverage with local detail

- Supplier risk and financial health analysis

- Integration into CRMs and ERPs

Best for: Companies operating globally who need trusted, scalable data for prospecting, onboarding, or risk mitigation.

4. Coface

Dual expertise in credit insurance & information services:

Coface is a global credit insurer and business information provider. It delivers a mix of credit insurance, financial reports , and risk data tailored for exporters and financial institutions.

Highlights:

- Country and sector risk analysis

- Real-time credit assessments

- Strong European and emerging market presence

- Customized risk scoring models

Ideal for: Risk managers and exporters looking to evaluate clients and suppliers before extending credit.

5. Creditsafe Italia

A direct competitor to Cerved in Italy:

Creditsafe is one of Europe’s fastest-growing providers of credit data. Its Italian platform provides user-friendly access to real-time insights on over 365 million companies globally .

What it offers:

- Straightforward credit reports and financial summaries

- Compliance and anti-fraud data

- Integrations with CRMs and financial systems

- Transparent pricing and intuitive interface

Perfect for: Italian SMEs and corporations needing real-time financial intelligence in a familiar local context.

6. Zavia.ai

Startup-focused, AI-driven platform:

Zavia.ai is designed for the modern tech ecosystem , aggregating data from open sources and applying machine learning to highlight market signals, risks, and opportunities.

Features include:

- Focus on startups and fast-growing companies

- AI-powered company scoring and analysis

- Market trend and investment insights

- Tailored for VC, tech, and innovation sectors

Best for: Investors, VCs, and innovation teams tracking early-stage companies.

7. Zephira.ai

Developer-first data access:

Zephira is a flexible platform that offers on-demand access to company registry data via APIs. It’s built for teams that want to embed real-time company data into apps, CRMs, or compliance tools.

What makes it unique:

- Usage-based pricing (no upfront licensing)

- Global registry and UBO data

- Easy integration into existing systems

- Fast setup for tech teams and developers

Ideal for: SaaS providers, regtech startups, and internal teams building data-driven workflows.

8. ReportAziende

Italian-focused business intelligence:

ReportAziende offers company profiles, financial statements, and legal data directly sourced from Italian public registries.

Strengths:

- Quick access to data on Italian firms

- Ownership structure and shareholder insights

- Pay-per-report or subscription options

Great for: Local businesses and legal professionals looking for cost-effective and verified company info.

9. InfoCamere

Official business registry data:

InfoCamere is the IT backbone of the Italian Chambers of Commerce, managing the national company register.

Features:

- Access to official, up-to-date registry data

- Financial, legal, and tax information

- Trusted by lawyers, accountants, and compliance professionals

Best for: Verified data on Italian companies directly from the source.

10. CRIF

Credit bureau with a European edge:

CRIF offers a broad suite of services including credit scoring, business information, and decisioning tools . It is a leading player in Italy and has strong presence across Europe and Asia.

Highlights:

- Business credit ratings and scoring

- Integrated credit management solutions

- Consumer and commercial data

- Custom analytics and risk modeling

Perfect for: Banks, fintechs, and companies needing sophisticated risk analysis.

FAQ – Choosing the Right Cerved Alternative

Q1: Which Cerved competitor is best for global B2B prospecting?

A: Global Database and Dun & Bradstreet offer the most extensive global coverage, especially for sales and marketing use cases.

Q2: What if I need official Italian registry data?

A: InfoCamere is the official source, while ReportAziende and Creditsafe Italia offer simplified access with value-added features.

Q3: Are there flexible, developer-friendly options?

A: Yes. Zephira.ai offers usage-based API access with easy integration for dev teams.

Q4: What’s best for analyzing startup ecosystems or VC targets?

A: Zavia.ai focuses on startups, venture-backed companies, and trend analysis using open data and AI.

Q5: Is there a free alternative to Cerved?

A: Most platforms are commercial, but Zavia.ai and ReportAziende offer freemium models or pay-per-report access, which can be more budget-friendly.