Introduction: FiDA and the Future of Financial Data in Europe

The European Union is preparing to finalize its landmark Financial Data Access (FiDA) regulation, a framework set to reshape how financial information is shared across the bloc. At its core, FiDA is designed to give consumers and small businesses greater control over their financial data — from payments and loans to insurance and investments — and to enable regulated third parties to develop new digital financial services.

But FiDA’s impact goes beyond empowering consumers. By moving to exclude Big Tech firms such as Apple, Meta, Google, and Amazon from this ecosystem, EU policymakers are signaling a commitment to digital sovereignty, ensuring that financial data remains within a framework governed by European institutions and rules.

While FiDA focuses on personal and SME financial data, its principles — trust, compliance, and transparency — resonate across the broader financial ecosystem. This is where registry-sourced data comes into play. Just as FiDA ensures individuals can safely share their financial information, first-party company data sourced from official registries provides the corporate transparency banks and fintechs need for compliance, onboarding, and risk management.

Together, FiDA and registry data are shaping a more secure, innovative, and sovereign digital finance environment for Europe.

FiDA’s Latest Update: Excluding Big Tech from Europe’s Data Market

As negotiations around the Financial Data Access (FiDA) regulation reach their final stages, one decision is becoming clear: Big Tech companies will be excluded from direct participation in Europe’s financial data-sharing framework.

Why Big Tech Is Being Blocked

EU policymakers, led by Germany and supported by the European Parliament and Commission, argue that granting companies like Apple, Google, Meta, and Amazon access to consumer financial data could undermine Europe’s digital sovereignty. Their concern is that digital “gatekeepers” would leverage sensitive financial information at scale, potentially:

- Disintermediating banks and insurers from their customers

- Consolidating even more market power in already dominant global platforms

- Reducing competition and consumer choice in Europe’s financial services

As one EU diplomat put it, this is one of the rare cases where Big Tech is “actually losing the lobbying fight” in Brussels.

The Banking Industry’s Influence

Banks and insurers strongly supported this stance, warning that allowing Big Tech into FiDA would turn financial institutions into data sources for global platforms while stripping them of their customer relationships. Their lobbying efforts successfully framed the debate around the risk of creating new digital monopolies in finance — echoing concerns already seen in online advertising and app ecosystems.

By backing the exclusion of Big Tech, the EU is prioritizing a financial ecosystem where European banks, fintechs, and regulated third-party providers can innovate without the shadow of global platforms dominating consumer data access.

What FiDA Actually Covers: Consumer and SME Financial Data

The Financial Data Access (FiDA) regulation is not about company registries or balance sheets. Its focus is squarely on consumer and SME financial information held by banks, insurers, and investment firms — with the goal of giving customers more control over who can use their data.

Data Types Included in FiDA

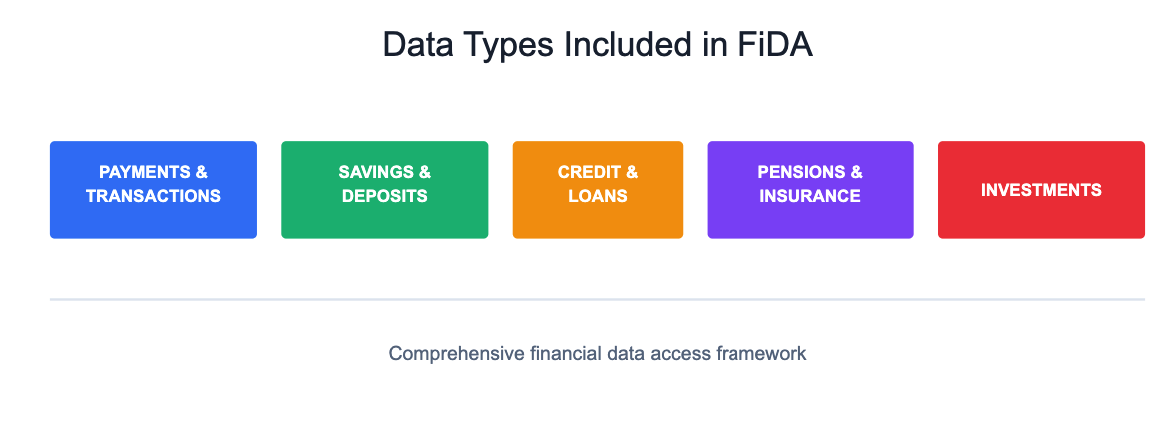

FiDA expands on the open banking rules introduced under PSD2. Instead of only covering payment accounts, the regulation extends data-sharing rights across the wider financial sector, including:

- Payments & transactions – account balances, payment history

- Savings & deposits – interest-bearing accounts, term deposits

- Credit & loans – consumer loans, mortgages, SME financing

- Pensions & insurance – contracts, contributions, claims

- Investments – securities accounts, portfolio holdings

With consent, consumers and SMEs can allow licensed third-party providers — such as fintech apps — to access this data and deliver services like personalized budgeting, product comparisons, or financial advice.

What FiDA Does Not Include

FiDA does not require access to corporate registry filings, financial statements, or ownership structures. That remains a separate but complementary domain, where registry-sourced data providers support due diligence, KYB, and compliance checks.

By keeping its scope limited to consumer and SME financial data, FiDA aims to unlock innovation in digital finance while safeguarding Europe’s principle of digital sovereignty — ensuring financial data serves consumers and local ecosystems, not global tech giants.

The Strategic Rationale Behind FiDA

The EU’s Financial Data Access (FiDA) regulation is not just about opening up financial information — it’s about reshaping Europe’s digital finance ecosystem around three priorities: consumer empowerment, innovation, and digital sovereignty.

Putting Consumers in Control

FiDA shifts the balance of power away from banks and insurers by giving individuals and SMEs the right to control their own financial data. Customers, not institutions, decide who can access their payment, savings, credit, or insurance information.

Unlocking Fintech Innovation

By standardizing access across the financial sector, FiDA creates opportunities for fintechs to deliver:

- Smarter financial management apps

- Innovative lending and credit scoring tools

- Cross-bank dashboards and comparison services

This levels the playing field and helps smaller providers compete with incumbents.

Safeguarding Digital Sovereignty

The EU’s choice to exclude Big Tech underscores its commitment to digital sovereignty. Regulators want to avoid repeating the scenario where global platforms dominate markets — as seen in e-commerce and advertising. With FiDA, financial data remains under the control of regulated, EU-governed players, strengthening Europe’s independence in digital finance.

Transatlantic Tensions and the Big Tech Debate

The EU’s plan to block Big Tech from accessing financial data under FiDA is creating friction with Washington. US leaders and lobbying groups argue the move unfairly targets American companies and could reignite transatlantic trade disputes.

Washington’s Response

US president Donald Trump has openly criticized the EU’s stance, warning that countries “discriminating” against American tech firms may face retaliatory tariffs. With a recent EU–US trade deal still fresh, FiDA’s exclusion of Apple, Google, Meta, and Amazon risks straining relations at a sensitive moment.

Big Tech’s Counterarguments

Lobbying groups representing the major platforms insist the EU’s approach hurts consumers as much as companies. Their case rests on two main arguments:

- Reduced consumer choice – Shutting out Big Tech could limit access to innovative, user-friendly digital finance services.

- Entrenching incumbents – Banks, they argue, are the real gatekeepers of financial data, and FiDA risks reinforcing their dominance rather than breaking it.

For now, however, EU policymakers remain firm: protecting digital sovereignty and fostering local innovation outweighs the risk of transatlantic backlash.

Where Registry Data Fits: Complementing FiDA with Corporate Transparency

The Financial Data Access (FiDA) regulation is focused on giving consumers and SMEs control over their financial data — from payments and loans to insurance and investments. What FiDA does not address, however, is the equally important question of verifying businesses that participate in financial transactions.

FiDA’s Limits

FiDA enables individuals to share their financial history with licensed third parties, but it does not include:

- Company registration details

- Ownership or shareholder information

- Ultimate Beneficial Owners (UBOs)

- Corporate filings or statutory accounts

For banks, insurers, and fintechs, this information remains critical for AML, KYC, and KYB compliance.

Why Registry Data Matters

This gap is where registry-sourced data plays a vital role. Accessing verified information directly from official government registries allows institutions to:

- Confirm that a business exists and is legally active

- Identify ownership and control structures

- Evaluate filing history and financial performance

- Strengthen compliance and reduce onboarding risk

Two Complementary Layers of Trust

FiDA and registry data serve different but complementary purposes:

- FiDA → empowers consumers and SMEs to share financial data securely

- Registry data → ensures that companies in the ecosystem are transparent, verifiable, and compliant

Together, they support a more secure, innovative, and sovereign financial landscape in Europe.

Global Database’s Role in the Post-FiDA Era

FiDA will reshape how consumers and SMEs share their financial data, but it leaves a gap when it comes to verifying the business counterparties behind financial transactions. That’s where Global Database comes in.

By sourcing information directly from more than 150 official registries worldwide, Global Database provides verified insights into:

- Company registrations and legal status

- Ownership structures and UBOs

- Filing history and financial performance

- VAT and tax identifiers

This data is essential for banks, insurers, and fintechs conducting KYB, AML, and risk assessments — areas that FiDA does not cover.

In practice, FiDA and registry-sourced data serve different purposes, but together they strengthen Europe’s financial ecosystem:

- FiDA empowers consumers and SMEs with control over their personal financial data.

- Registry data gives institutions the corporate transparency they need to ensure compliance and trust.

Global Database delivers that second pillar, helping financial institutions operate with confidence in an increasingly regulated environment.

Conclusion: Building Trust in Europe’s Digital Finance Future

The Financial Data Access (FiDA) regulation is set to reshape how financial data flows across Europe. By empowering consumers and SMEs to share their data and by limiting the influence of Big Tech, the EU is pushing for a digital finance ecosystem built on competition, security, and sovereignty.

Still, consumer data sharing is only part of the picture. For banks, insurers, and fintechs, trust also depends on knowing exactly who they are doing business with. Verified information on company registrations, ownership structures, and financial records remains essential for compliance, risk management, and responsible innovation.

That is where registry-sourced data adds value. While FiDA opens the door to consumer-driven services, registry data ensures that institutions have the corporate transparency needed to keep the system safe.

Together, FiDA and registry data represent two complementary layers of trust:

- FiDA empowers individuals and SMEs with control over their financial data.

- Registry data gives institutions the confidence to operate securely and compliantly.

This dual approach will shape Europe’s digital finance future — one that is more open, more innovative, and grounded in transparency.