Overview

Trustpair is a leading platform helping global enterprises prevent B2B payment fraud and strengthen third-party risk management.

Their solution automates supplier verification before each payment — ensuring that every beneficiary is a real, registered, and compliant company.

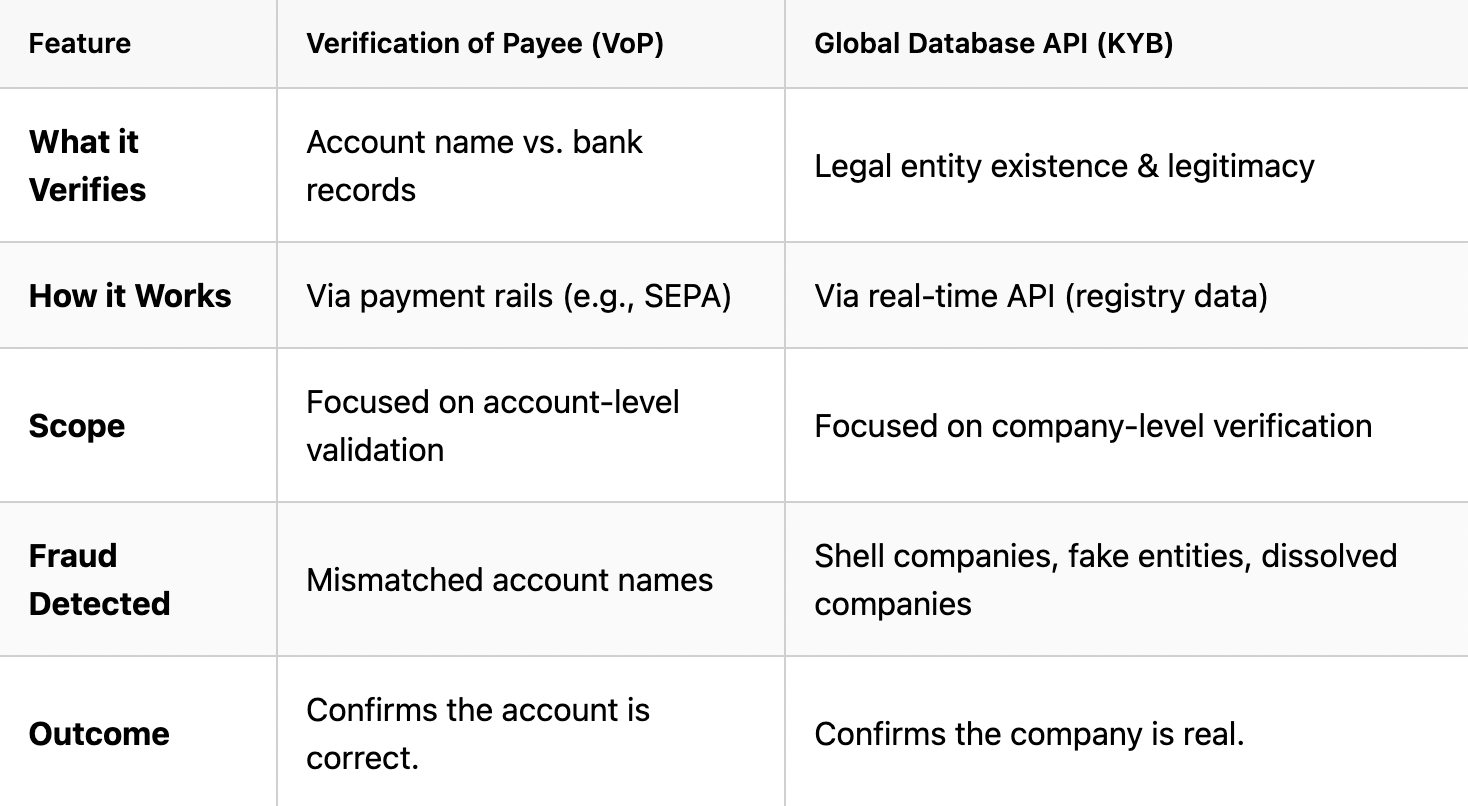

To deliver this, Trustpair integrated the Global Database API, creating a seamless layer of registry-verified supplier intelligence that complements Verification of Payee (VoP) systems.

The Challenge

Payment fraud and supplier impersonation are among the biggest risks in corporate finance.

While Verification of Payee (VoP) confirms whether a bank account name matches the beneficiary’s name, it doesn’t verify if the beneficiary company actually exists — a critical gap in cross-border payments.

Fraudsters exploit this gap by:

- Creating fake or deregistered entities with matching account names,

- Impersonating legitimate suppliers with small name variations,

- Using recently registered or dormant companies to receive fraudulent transfers.

These schemes result in millions in losses and reputational damage for large enterprises each year.

Trustpair’s customers — including major corporations across Europe and North America — needed a way to validate supplier identity at the entity level before releasing payments.

The Solution

To close this risk gap, Trustpair integrated Global Database’s real-time registry verification API.

Using the Light KYB and Company Registry Data API, Trustpair automatically:

- Verifies supplier identity against 150+ official government registries.

- Matches key identifiers such as legal name, registration number, VAT, and EIN.

- Checks company status (active, dissolved, inactive, under liquidation).

- Surfaces ownership data, directors, and UBOs for deeper due diligence.

- Confirms the founding date — for example, if a company was founded only a month ago, this may raise a red flag for potential fraud or shell activity.

This registry-level validation complements VoP by ensuring the entity behind the account is legitimate before bank-level confirmation occurs.

Problems Trustpair Solves with Global Database

- Supplier impersonation — Prevent payments to fraudulent or fake suppliers.

- Dormant or dissolved companies — Detect entities no longer active.

- Shell or recently registered companies — Flag new or suspicious incorporations.

- Cross-border validation gaps — Verify entities in countries where VoP does not apply.

- Manual verification burden — Replace time-consuming checks with automated workflows.

Together, these improvements strengthen payment integrity, reduce operational risk, and give enterprises greater confidence in their supplier base.

Why Trustpair Chose Global Database

- Direct connections to 300+ official registries

- Standardized legal identifiers across countries (VAT, EIN, Tax ID)

- Registry-verified financials and ownership data

- Real-time performance via REST API and webhook alerts

Together, they form a complete payment integrity stack — ensuring both the bank account and the entity are legitimate before funds move.

Looking Ahead

Trustpair plans to enhance due diligence even further by integrating additional Global Database APIs to:

- Identify the parent company and global group structure,

- Access full company financials to assess stability and creditworthiness,

- Retrieve verified Ultimate Beneficial Owner (UBO) data,

- Monitor company status changes to detect future risks automatically.

These enhancements will enable continuous supplier due diligence, ensuring that risk monitoring doesn’t stop after onboarding — it evolves with the business relationship.

In Summary

By integrating Global Database’s registry-verified intelligence, Trustpair eliminated a critical blind spot in payment verification — ensuring that every supplier is not only the right payee but a real, legally active company.

This collaboration sets a new benchmark for cross-border payment security, third-party risk management, and data-driven fraud prevention.