Only 2–3% of companies worldwide ever raise institutional funding. That means PitchBook—while powerful for tracking VC, PE, and M&A activity—leaves out 97% of the global business landscape. For teams in corporate strategy, investment research, market intelligence, and partnership development, this blind spot can mean missed opportunities.

Many professionals are now turning to platforms that offer a broader, registry-sourced, and more reliable view of private and public companies—including verified financials, ownership structures, and early growth signals, regardless of funding history.

In this guide, we explore the top PitchBook alternatives for 2025—ranked by coverage, accuracy, and use case.

1. Global Database – Full Visibility Into Every Registered Company, Not Just the Funded Few

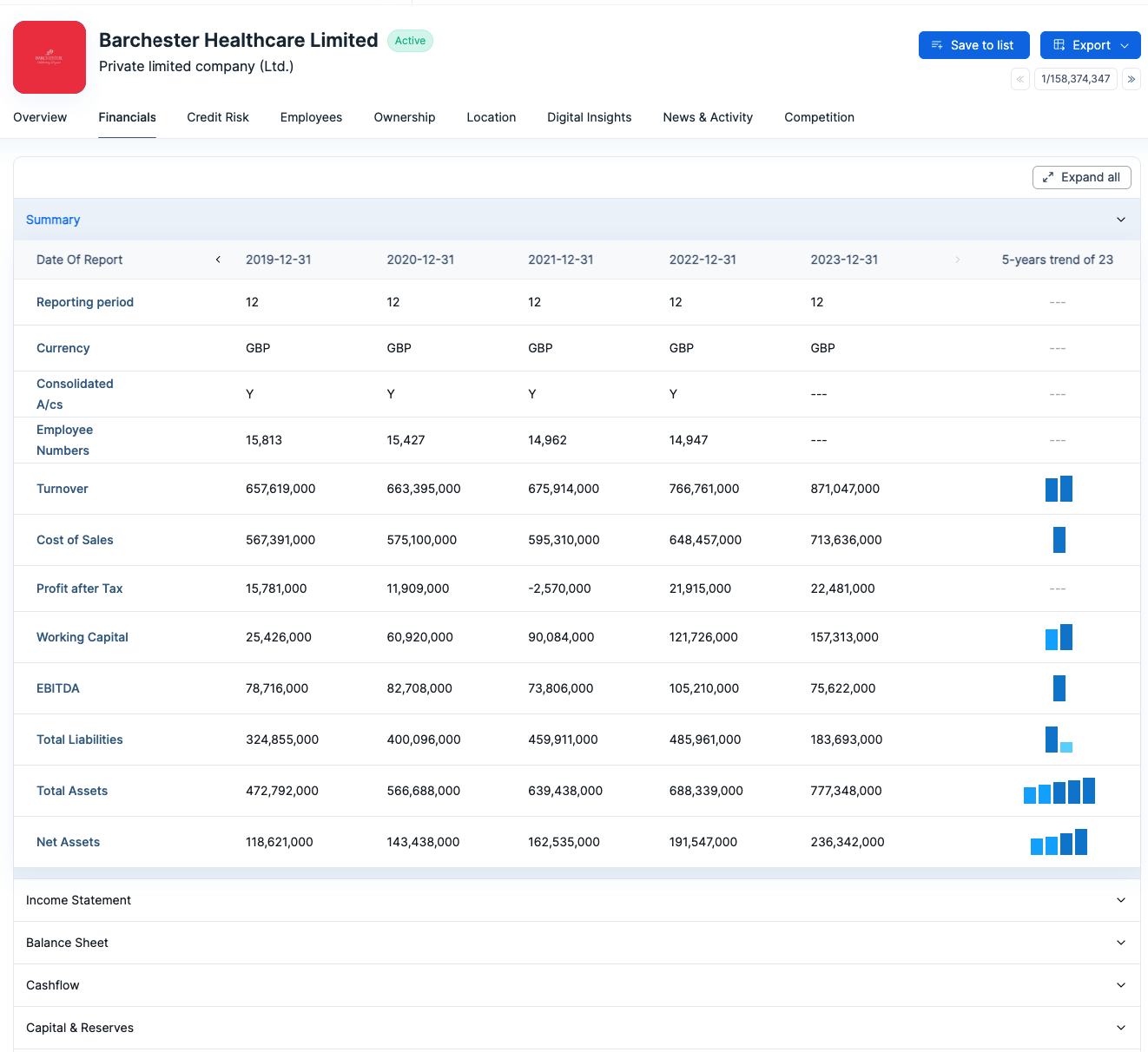

Global Database is a top-tier alternative to PitchBook for those who need comprehensive, real-time company intelligence—not just data on venture-backed firms. While PitchBook centers around companies that have raised capital, Global Database covers every legally registered business, including those incorporated as recently as yesterday.

With over 300 million companies tracked globally, and data sourced directly from 100+ government registries, Global Database offers unmatched transparency into both public and private companies. Its in-house use of AI and OCR to digitize financial filings ensures standardized, searchable access to financials, ownership structures, and group linkages across jurisdictions.

Why Global Database stands out:

Covers all registered businesses, not just funded startups

Real-time access to newly incorporated companies

Financials (P&L, balance sheet, cash flow) across 20+ years

Shareholder data, UBOs, and full corporate hierarchies

Available via API, bulk export, or user platform

Why choose it over PitchBook:

If your work depends on getting the full picture—not just tracking investment rounds—Global Database offers broader, fresher, and more actionable insights. It’s built for teams who care about the real business landscape, not just what’s been funded.

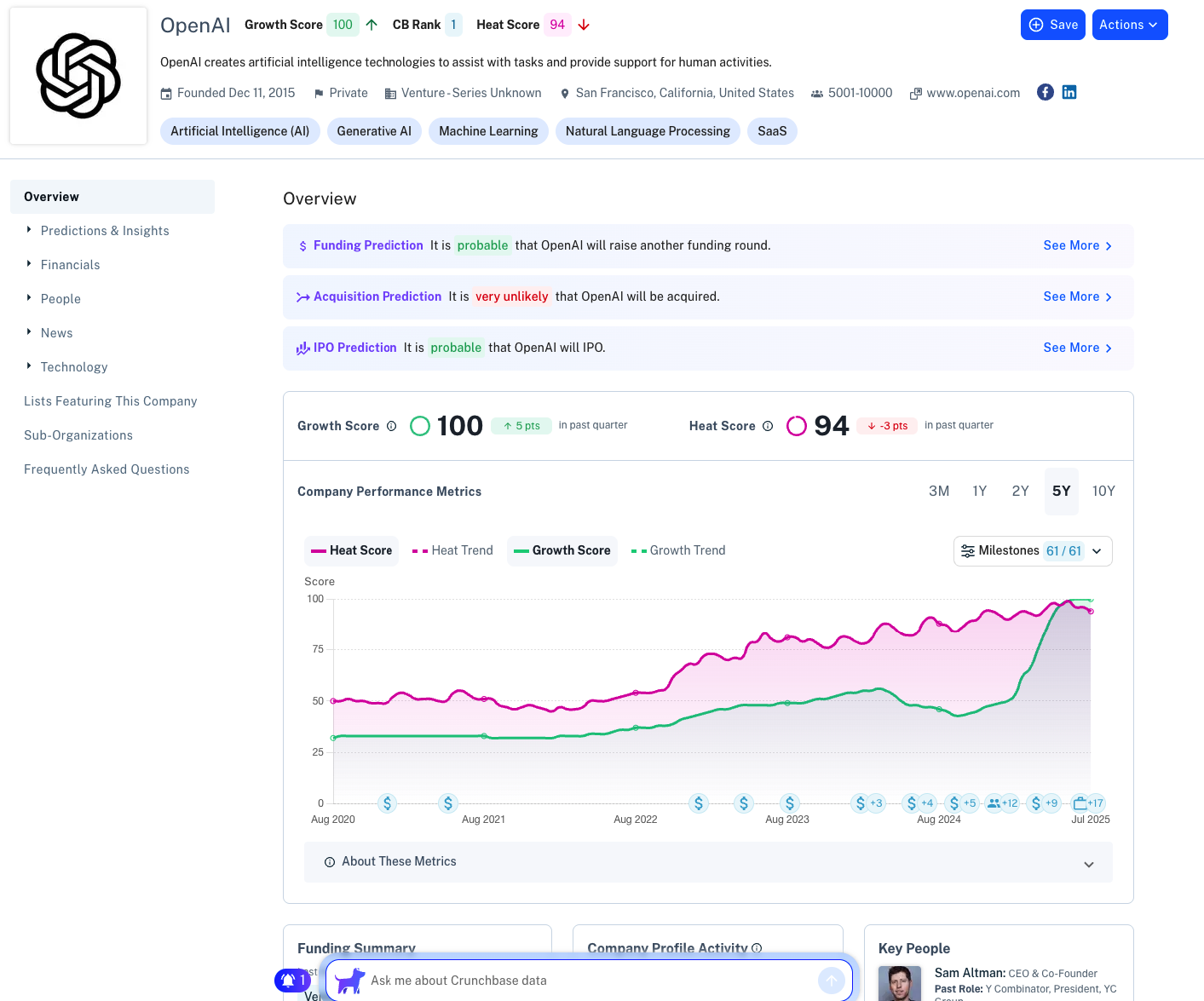

2. Crunchbase – Startup and Investor Intelligence with a Self-Reported Twist

Crunchbase is widely used for tracking startups, funding rounds, and investors. It’s accessible, with a freemium model and broad adoption among startup teams and sales reps.

But its Achilles’ heel is that it relies heavily on self-reported and community-submitted data. Accuracy and completeness—particularly for financials, employee counts, and ownership—are often unreliable compared to registry-sourced data.

Key strengths

Fast access to startup profiles and funding rounds

Strong filters for sector, stage, location

Freemium model with API for enrichment

Why choose Crunchbase over PitchBook

For surface-level startup research, Crunchbase is cheaper and easier. But for due diligence or financial analysis, it falls short.

3. Dealroom – Europe-Centric Startup and Scaleup Data with Ecosystem Insights

Dealroom is a strong PitchBook alternative, particularly for those focused on startups, scaleups, and innovation ecosystems in Europe and beyond. While it shares similarities with Crunchbase in covering funding rounds, valuations, and investor networks, Dealroom differentiates itself with curated insights, ecosystem mapping, and a growing emphasis on impact-driven and deep tech companies.

The platform is used by governments, VCs, corporates, and accelerators to monitor innovation hubs and emerging trends across tech sectors. While its data is a mix of automated collection, partnerships, and user submissions, Dealroom offers structured deal flow tracking, company signals, and visibility into fast-growing private companies—even those outside of mainstream VC attention.

Key strengths of Dealroom:

Strong coverage of European tech companies, scaleups, and innovation clusters

Ecosystem mapping tools for regions, cities, and verticals

Profiles include funding history, team size, valuation estimates, and market focus

Useful for policy makers, VCs, accelerators, and corporate innovation teams

API access and export capabilities for data-driven research

Who it’s for:

Ideal for government agencies, early-stage investors, ecosystem builders, and corporate strategy teams tracking innovation trends and high-growth companies, particularly in Europe.

Why choose Dealroom over PitchBook:

While PitchBook is more finance-heavy and U.S.-focused, Dealroom offers better ecosystem visibility, especially for European tech markets. It's a compelling choice for those seeking broader context, early signals, and scaleup intelligence beyond just funded deal data.

4. Monetaiq – Deep Financials and Digital Signals for Smarter Company Profiling

Monetaiq is a PitchBook alternative built for professionals who need structured financial data and performance signals on both public and private companies—regardless of funding activity. Unlike PitchBook, which focuses on deal flow and investor relationships, Monetaiq provides access to 20+ years of standardized financial statements, credit indicators, and even digital performance metrics like website traffic, engagement rates, and market signals.

The platform is especially useful for market analysts, corporate development teams, and strategy professionals looking to benchmark companies, assess growth potential, or evaluate competitors with more than just investment history.

Key strengths of Monetaiq:

Financials: balance sheet, profit & loss, cash flow, and key ratios

Historical data covering 20+ years, including for private firms

Credit scores, credit limits, and payment behavior insights

Website traffic, audience geography, and engagement trends

API access and export-ready formats for integration and modeling

Who it’s for:

Ideal for financial analysts, strategic research teams, and investment professionals who need more than just who funded what—they want to know how companies are actually performing over time.

Why choose Monetaiq over PitchBook:

PitchBook tracks capital movement; Monetaiq tracks business fundamentals. If your goal is to analyze real financial health, not just valuation trends, Monetaiq delivers the data you need to make informed decisions—backed by facts, not just funding events.

5. FactSet – Institutional-Grade Financial Data with Broad Market Coverage

FactSet is a premium alternative to PitchBook for professionals who need deep financial data, market analytics, and equity research tools—especially across public companies, large private firms, and global markets. While FactSet isn’t focused on venture capital or early-stage deal flow like PitchBook, it provides institutional-grade data used by investment banks, asset managers, and corporate finance teams.

With detailed financial statements, valuation models, ownership data, and M&A analytics, FactSet is built for decision-makers who prioritize data accuracy, modeling flexibility, and historical depth over startup tracking or funding news.

Key strengths of FactSet:

Full financials for public and large private companies worldwide

Analyst estimates, forecasting tools, and valuation models

Ownership breakdowns, insider activity, and shareholder movements

M&A tracking, corporate actions, and global market intelligence

Integrates with Excel, APIs, and proprietary modeling environments

Who it’s for:

Best suited for institutional investors, M&A advisors, and equity research analysts who need high-integrity data to build models, perform valuations, and support investment decisions.

Why choose FactSet over PitchBook:

While PitchBook focuses on startup funding and private market visibility, FactSet excels at delivering structured, historical, and predictive financial intelligence for sophisticated modeling and public market analysis. It’s a go-to for those seeking depth over breadth and is often part of the core toolset in capital markets environments.

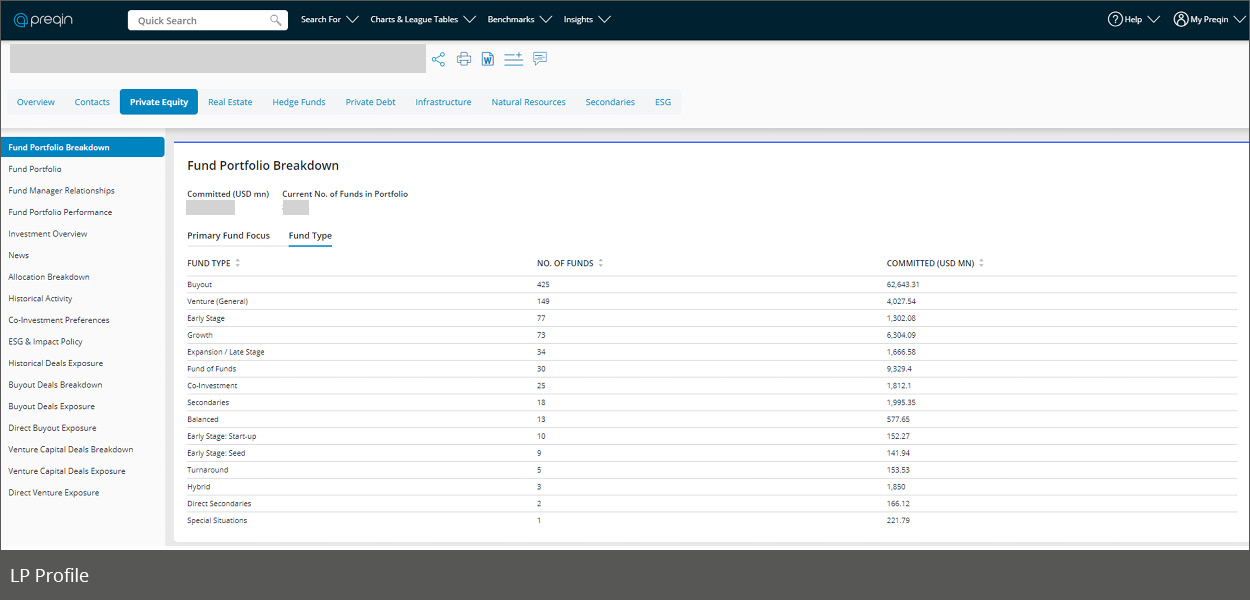

6. Preqin – Alternative Asset Intelligence with a Focus on Private Capital Markets

Preqin is a direct competitor to PitchBook, specializing in alternative assets including private equity, venture capital, real estate, infrastructure, private debt, and hedge funds. It offers detailed coverage of fund managers, LPs, fundraising activity, and portfolio companies, making it one of the most widely used platforms in the institutional investment space.

Compared to PitchBook, Preqin offers stronger global fund intelligence, deeper insights into limited partner activity, and rich analytics around fund performance, dry powder, and deal flow trends. While it may not offer company-level financials or ownership structures outside of its private capital lens, it’s a strong choice for firms operating in the fundraising, fund-of-funds, or LP targeting arenas.

Key strengths of Preqin:

In-depth data on fund managers, investors, and portfolio companies

Global fundraising intelligence and LP activity tracking

Benchmarking tools for fund performance and market sizing

Real assets and infrastructure coverage beyond just VC/PE

Excel plugin and API options for deeper integration

Who it’s for:

Best for institutional investors, fund managers, placement agents, and consultants operating in the alternative asset space and looking to monitor fund activity, target LPs, or benchmark performance.

Why choose Preqin over PitchBook:

While both platforms track private capital markets, Preqin offers broader coverage across asset classes, especially for real estate, infrastructure, and private debt—areas where PitchBook is less established. For firms managing or analyzing capital across multiple asset types, Preqin delivers the depth and specialization required.

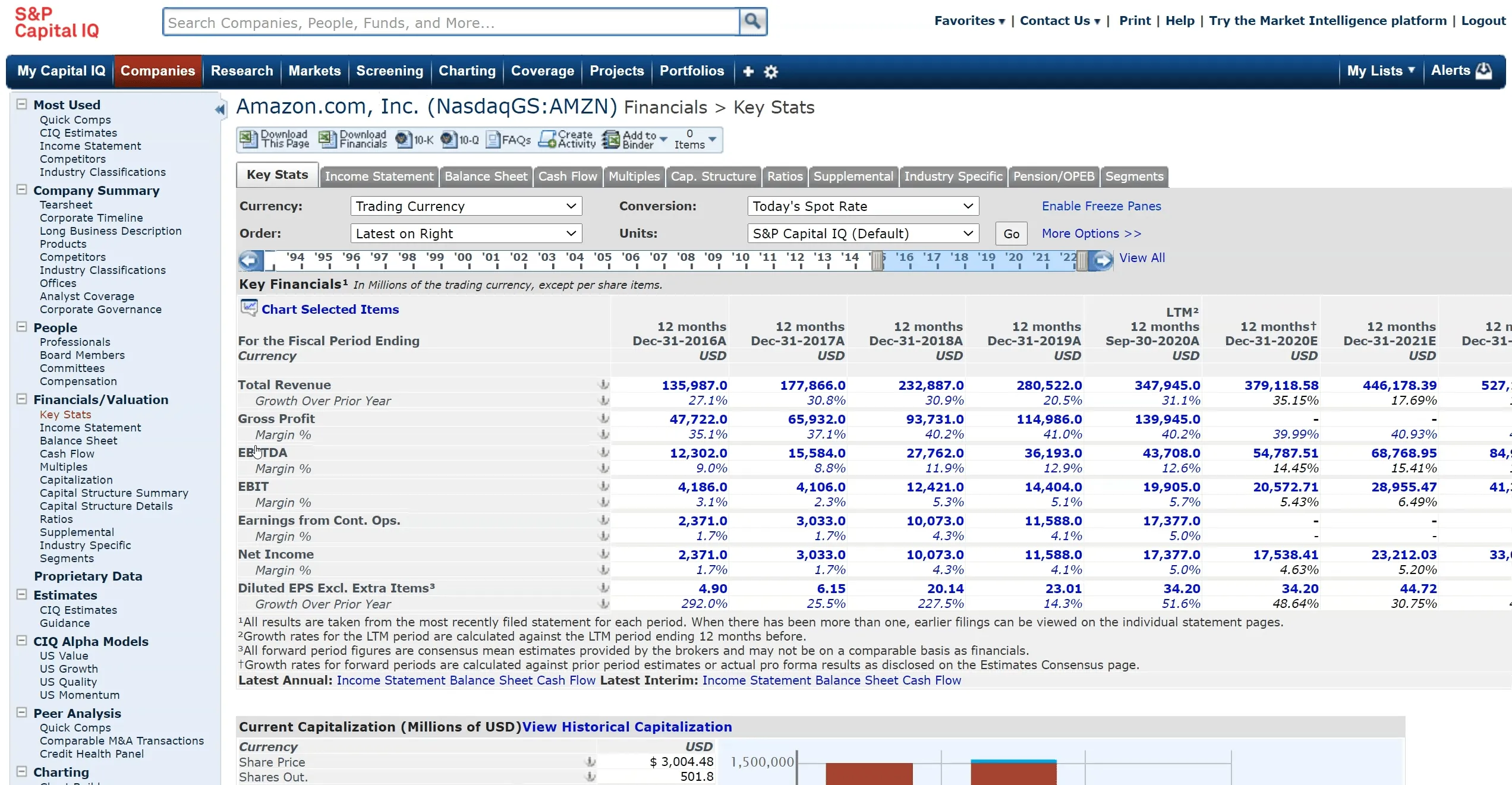

7. Capital IQ – High-Fidelity Financials and Valuations for Public and Private Markets

S&P Capital IQ is a premium platform that delivers in-depth financial data, valuations, and market intelligence across global public and private companies. While PitchBook is known for its focus on VC/PE deal flow and startup ecosystems, Capital IQ excels in financial modeling, equity research, and M&A support, making it a top choice for investment banks, corporate finance teams, and asset managers.

Capital IQ combines standardized financials, analyst estimates, company filings, ownership data, and transaction comps—all in a format optimized for financial analysis. Its powerful Excel plugin and screening tools make it an essential tool for professionals building complex models or conducting valuation work.

Key strengths of Capital IQ:

Deep financial statements with historical and forecasted data

Analyst estimates, earnings revisions, and consensus modeling

Ownership structures, insider transactions, and shareholder data

Global M&A deal tracking and comparable company analysis

Seamless Excel integration and advanced screening capabilities

Who it’s for:

Designed for equity analysts, investment bankers, private equity professionals, and FP&A teams who need accurate, structured data to drive financial models and investment decisions.

Why choose Capital IQ over PitchBook:

While PitchBook focuses on the lifecycle of private company funding, Capital IQ delivers the financial depth and analytical tools needed for valuation, strategy, and capital markets execution. For professionals who prioritize model-ready data and cross-market comparables, Capital IQ is a best-in-class solution.

8. Zephira.ai – API-First Registry Data for Developers

Zephira.ai is a modern, developer-focused alternative to PitchBook. Built API-first, it provides real-time access to company registry data from 100+ countries, including:

Legal entities, KYB checks, and tax IDs

Ultimate Beneficial Owners (UBOs)

Financial metrics and filings

Group structures and parent-subsidiary relationships

Unlike PitchBook, which emphasizes deal tracking and investor relationships, Zephira.ai is designed for seamless integration into applications, CRMs, onboarding flows, and fintech products. Its transparent pay-as-you-go pricing makes it flexible for both startups and enterprises.

Key strengths

API-native, designed for developers

Real-time access to registry-sourced data

Ideal for KYB, compliance, and onboarding automation

Pay-per-call pricing (no opaque enterprise contracts)

Why choose Zephira.ai over PitchBook

If you need a lightweight, developer-friendly way to embed company intelligence directly into your product, Zephira.ai offers speed, scale, and reliability without the legacy overhead of traditional platforms.

Conclusion

While PitchBook remains a staple in VC and PE circles, its narrow focus on funded companies means it isn’t the right tool for everyone.

For registry-sourced, global company coverage: Global Database

For startup scouting: Crunchbase or Dealroom

For deep financial analysis: Monetaiq, FactSet, Capital IQ

For alternative assets: Preqin

Ultimately, the best alternative depends on whether you need to track who got funded—or understand the real financial health and ownership of the companies shaping global markets.

Of all the options, only Global Database gives you a registry-verified, global view of every company—funded or not. For strategy teams, risk managers, and investors who can’t afford blind spots, that makes it the most complete alternative to PitchBook in 2025.