Zavia.ai: AI-Powered UBO Intelligence and Sanctions Screening Engine

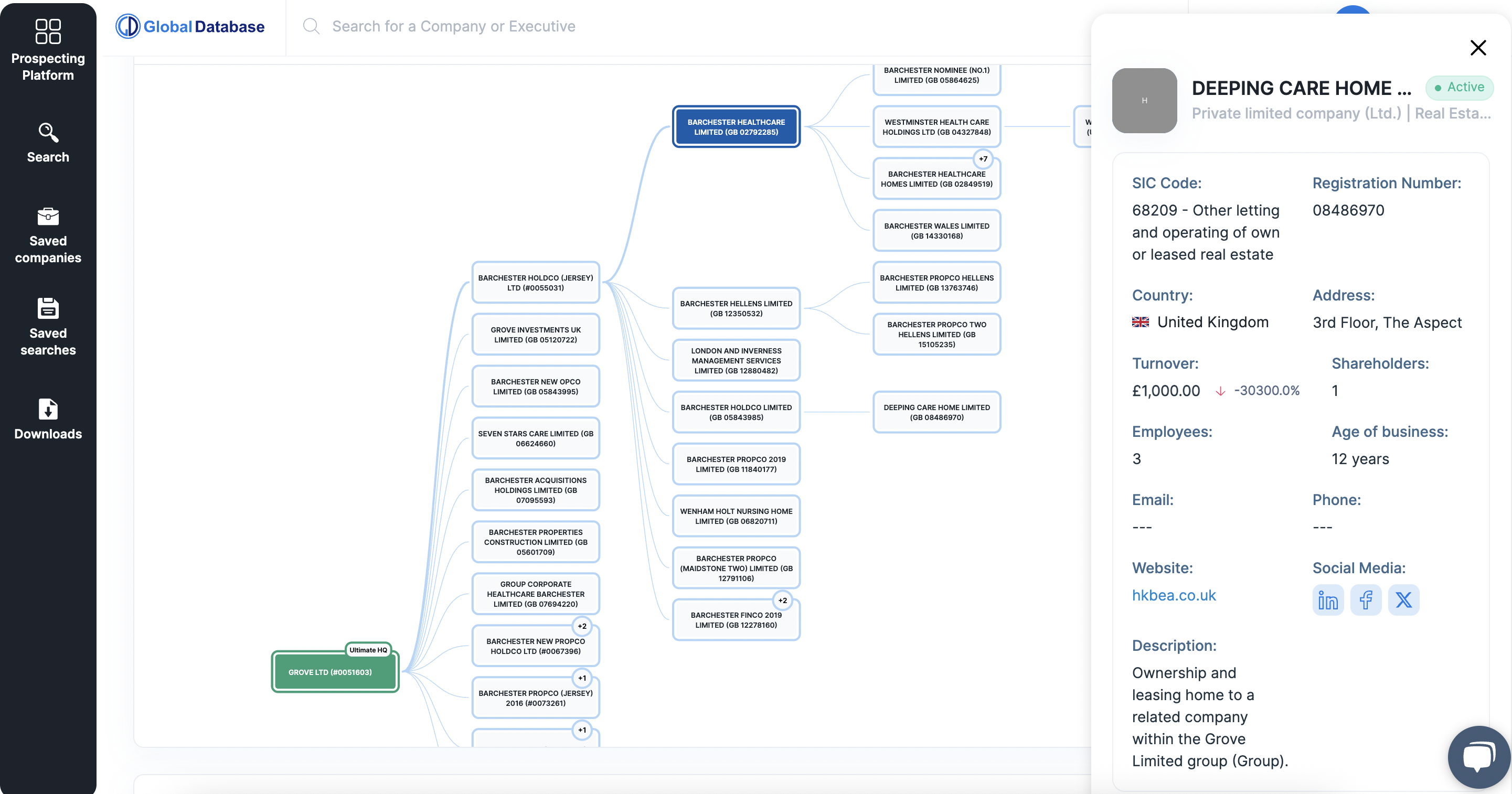

Zavia.ai is an advanced UBO discovery platform built to help compliance teams, investigative units, and financial institutions map hidden ownership structures and uncover risk in real time. Positioned as a modern alternative to Sayari, Zavia leverages proprietary AI models on top of verified registry data to automate UBO identification across borders.

Why Choose Zavia.ai Over Sayari?

AI-driven UBO mapping — Zavia uses machine learning and graph algorithms to trace complex shareholding layers, nominee structures, and offshore linkages.

Registry-sourced accuracy — All company and shareholder data is pulled directly from official government registries in 100+ countries.

Sanctions & PEP flagging — Automatically detects high-risk entities and individuals involved in sanctioned networks or PEP databases.

Built-in compliance framework — Designed for AML, FATF, and KYC/KYB workflows with audit-ready evidence trails.

Multi-channel access — Data available via web platform, API, CRM integrations (Salesforce, HubSpot), or bulk delivery.

Use Cases:

- Investigative journalism & forensic audits

- Financial crime and sanctions risk assessment

- Enhanced due diligence (EDD) for high-risk entities

- Multinational supplier verification

- Regulatory reporting and ongoing monitoring

Designed for Global Compliance and Transparency

Where Sayari is often used for investigative reporting or intelligence use cases, Zavia.ai is purpose-built for operational compliance teams who need automation, real-time coverage, and consistent global data standards. Its AI engine not only accelerates UBO discovery, but also highlights gaps or inconsistencies in disclosed information.

Who Uses Zavia?

Zavia is used by:

- AML and compliance teams at financial institutions

- Risk advisory firms

- Government agencies and regulators

- Procurement and ESG audit departments

- Screening platforms integrating with its API

Zavia.ai can be white-labeled or embedded into existing compliance workflows, providing flexible access to critical ownership intelligence.

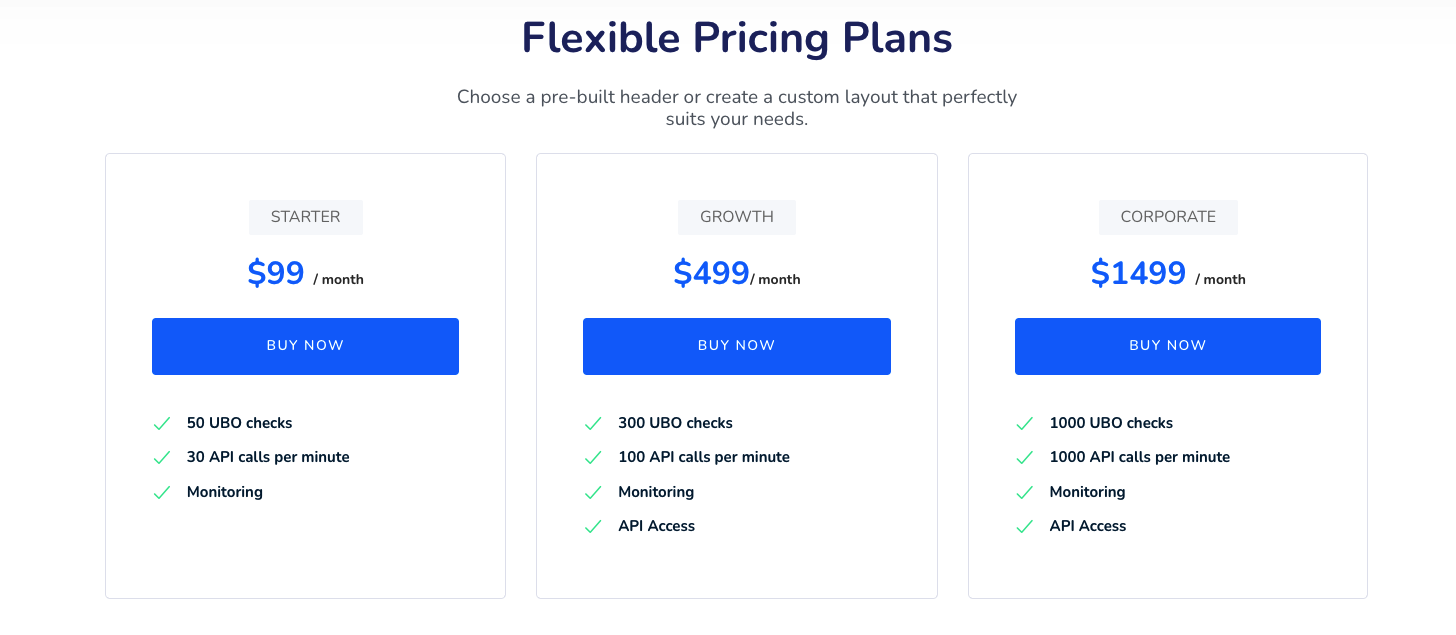

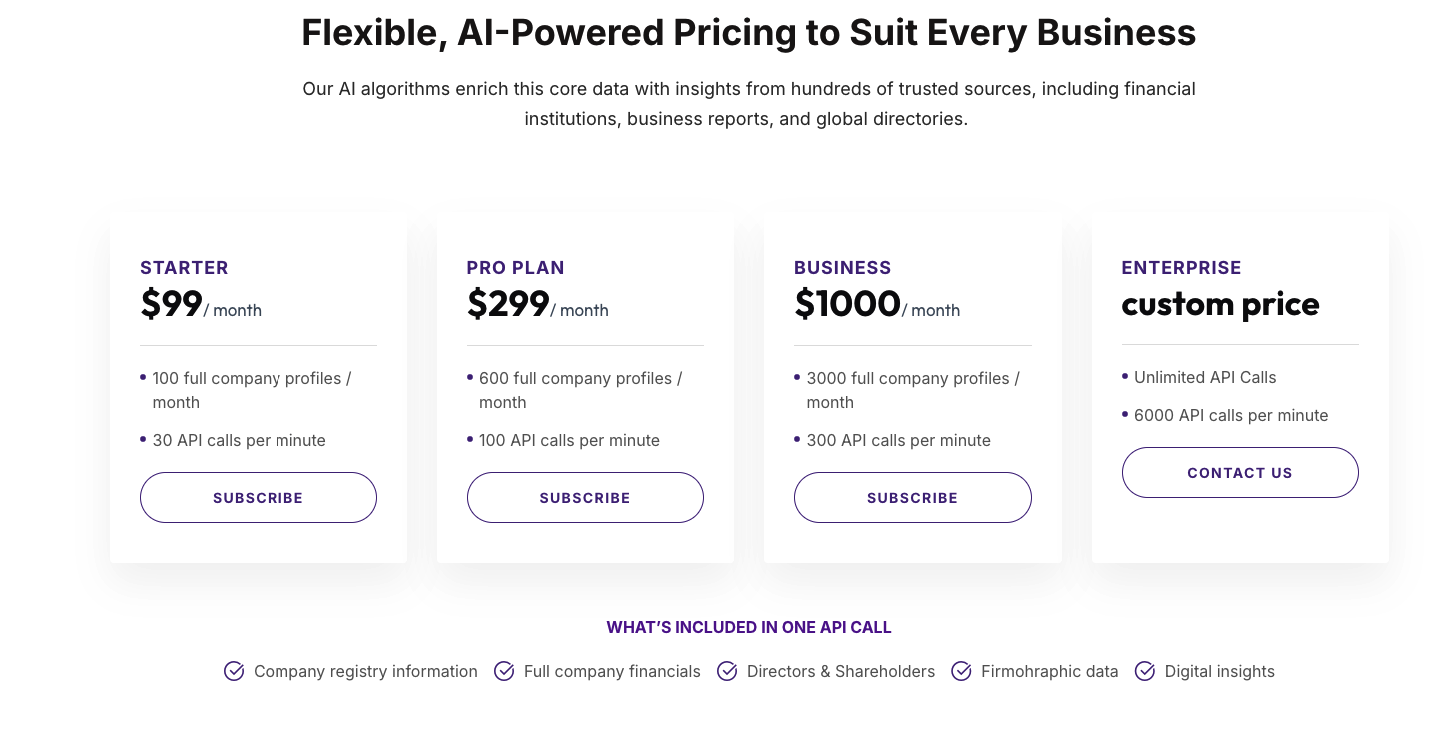

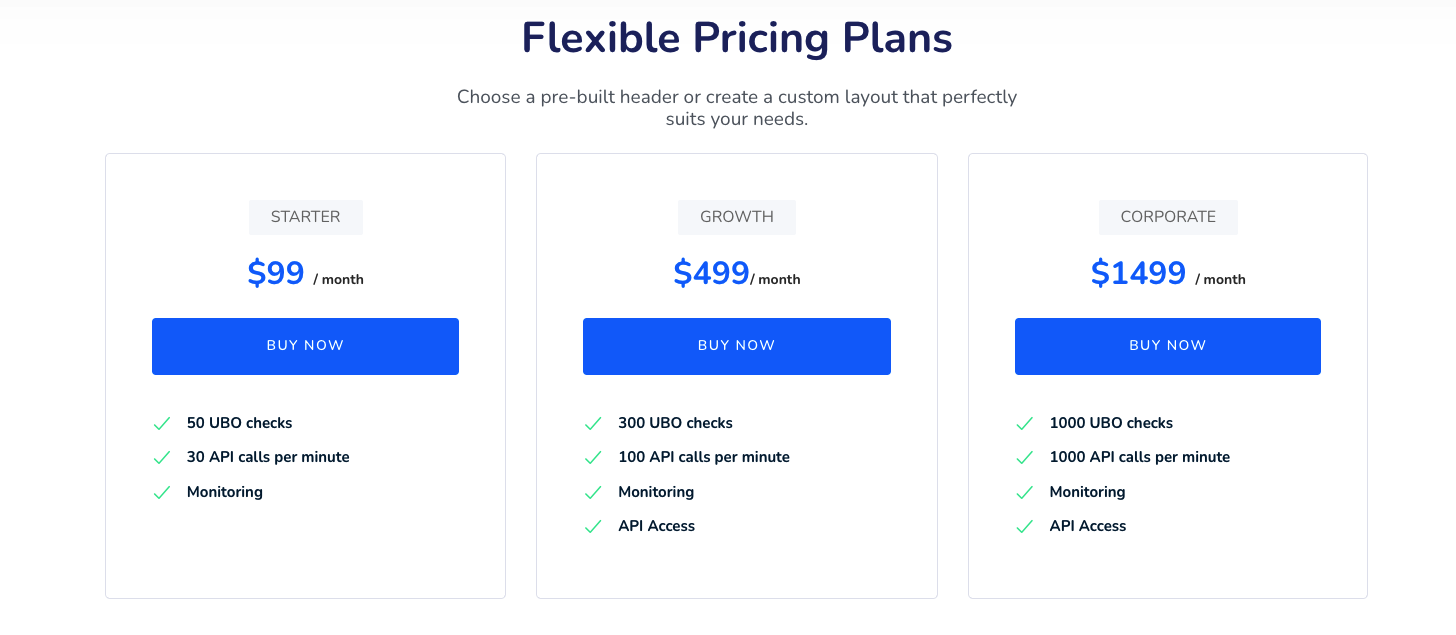

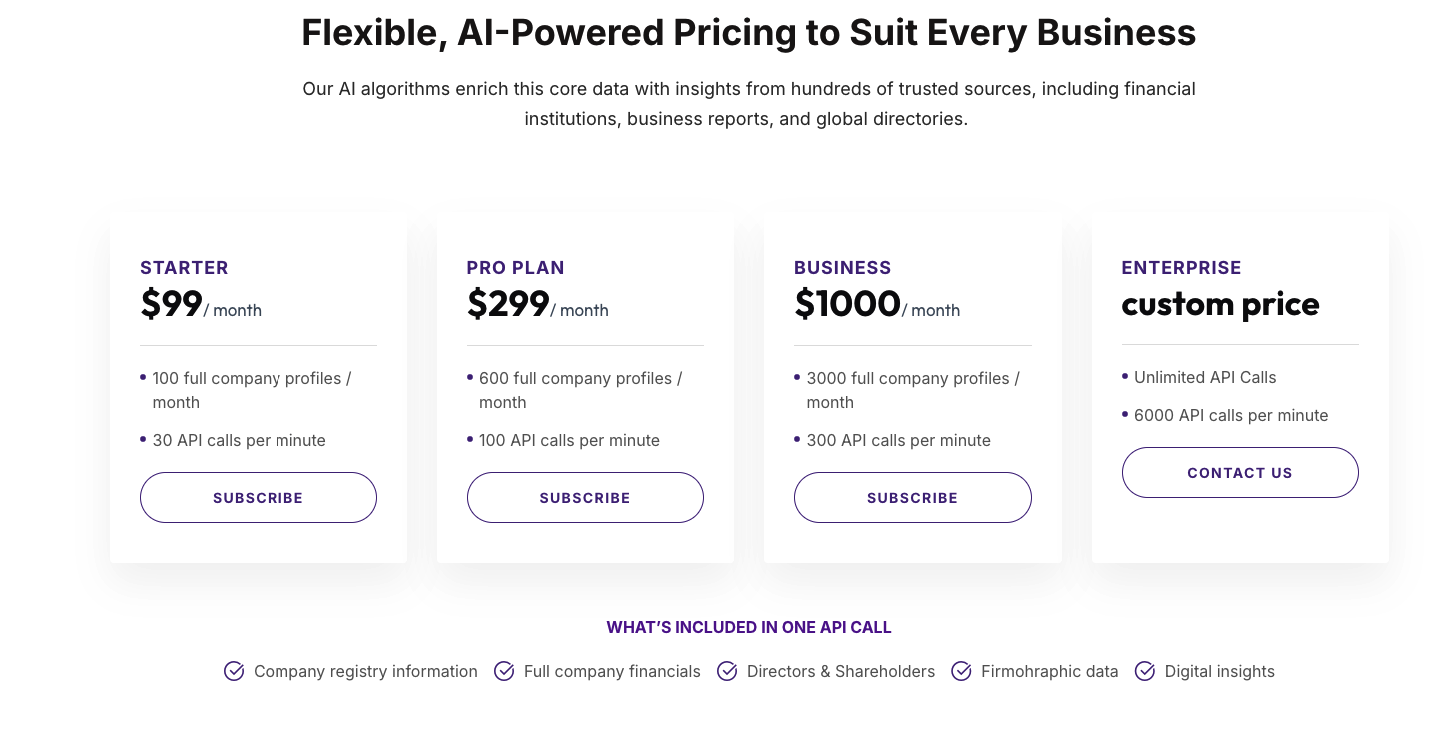

Zavia.ai Pricing

Zavia offers simple, usage-based pricing, starting from $99 per month, with no long term commitments . You gain access to real-time, registry-sourced company data across 100+ countries.

Looking for a Modern Alternative to Sayari?

If you're seeking a platform that combines:

- Verified registry data

- Automated UBO resolution

- Sanctions, PEP, and risk screening

- Seamless integration with your compliance stack

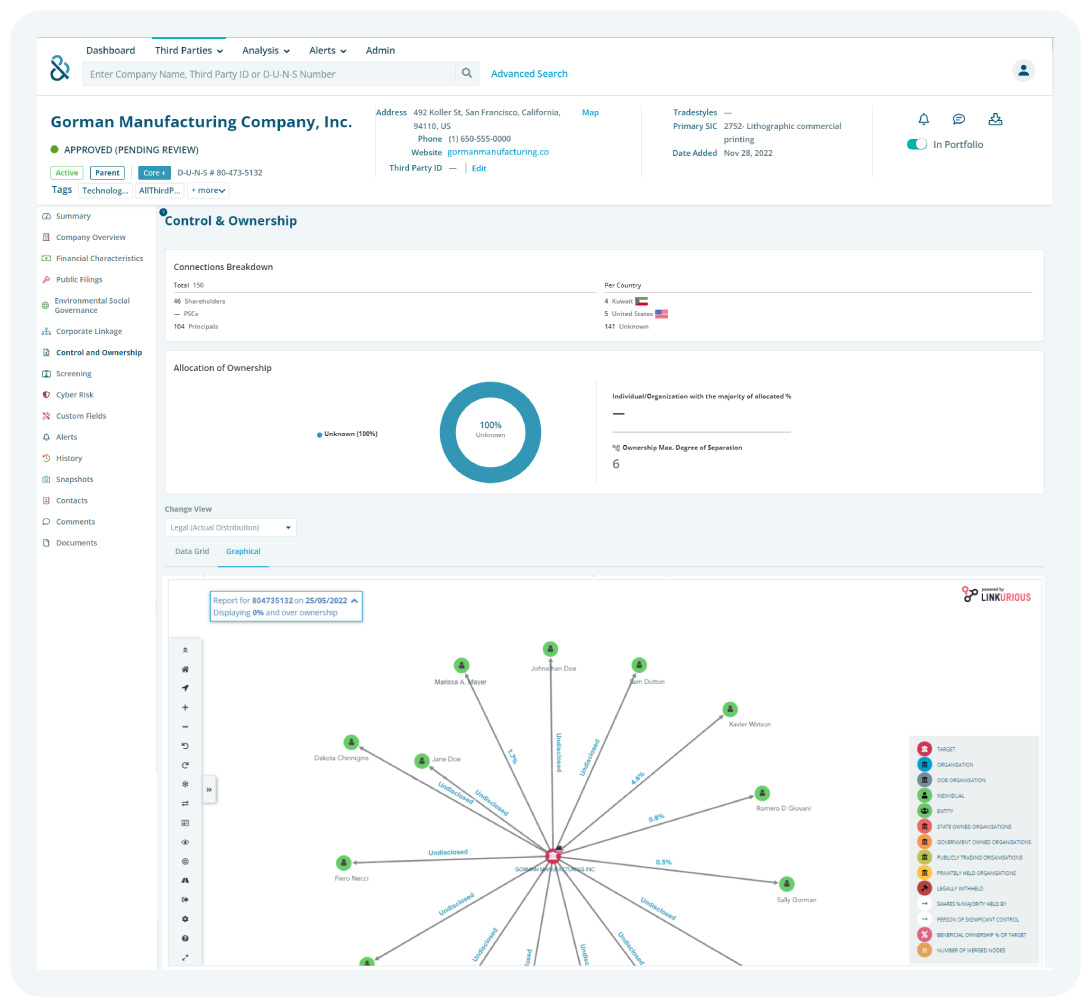

Dun & Bradstreet (DNB): Global Corporate Linkage and Risk Intelligence

Dun & Bradstreet (DNB) is one of the most established names in business intelligence, offering extensive global company coverage through its proprietary D-U-N-S® Number system. While Sayari focuses on registry-level data and ownership mapping in complex jurisdictions, DNB excels in providing high-level corporate hierarchies, risk ratings, and credit information across millions of entities worldwide

Why Consider DNB Instead of Sayari?

Global corporate hierarchies — DNB provides ownership linkages across 500M+ entities, helping organizations identify parent companies, subsidiaries, and affiliated firms.

Proprietary risk scores — Gain access to commercial credit scores, failure risk indicators, and ESG risk insights.

KYC & AML support — UBO data is available through DNB’s compliance solutions, especially for multinational onboarding.

Platform integrations — DNB integrates into major CRMs, ERP systems, and third-party onboarding tools.

Enterprise-ready — Scalable for large financial institutions, government contracts, and multinational corporations.

Use Cases:

- Multinational due diligence and risk profiling

- Credit checks and financial health assessments

- Supplier and third-party risk management

- Corporate hierarchy mapping at scale

- FATCA, AML, and CDD compliance

Strengths and Limitations

DNB’s scale is unmatched in the commercial data world. However, it often relies on aggregated and partner-sourced data rather than direct registry filings. In contrast to Sayari’s source transparency, DNB offers structured, high-level views that are ideal for credit, procurement, and policy-driven onboarding—but less granular for investigative deep dives.

Additionally, resale and derivative product rights are often restricted , which can limit flexibility for platforms and service providers.

Who Uses DNB?

- Large banks and insurers

- Government procurement and trade agencies

- Fortune 500 enterprises

- Risk and compliance software vendors

- Global credit insurers

Dun & Bradstreet (DNB) Pricing

Dun & Bradstreet charges from $30 USD per company report .

More detailed reports can cost $50 to $200+ , depending on the country and data depth.

For API access, CRM integrations, or enterprise use, pricing typically starts from $25,000 per year and can go much higher based on volume and licensing terms.

DNB vs Sayari: Which Is Right for You?

Choose DNB if you need:

- Deep global linkage coverage

- Creditworthiness and risk indicators

- Enterprise-ready integrations

- Structured, summarized data at scale

If you prioritize registry-sourced data transparency, ownership visualization, or open licensing , you may prefer Global Database, Zavia.ai, or Zephira.ai.

Moody’s Bureau van Dijk (Orbis): Deep Company Hierarchies and Standardized Financials

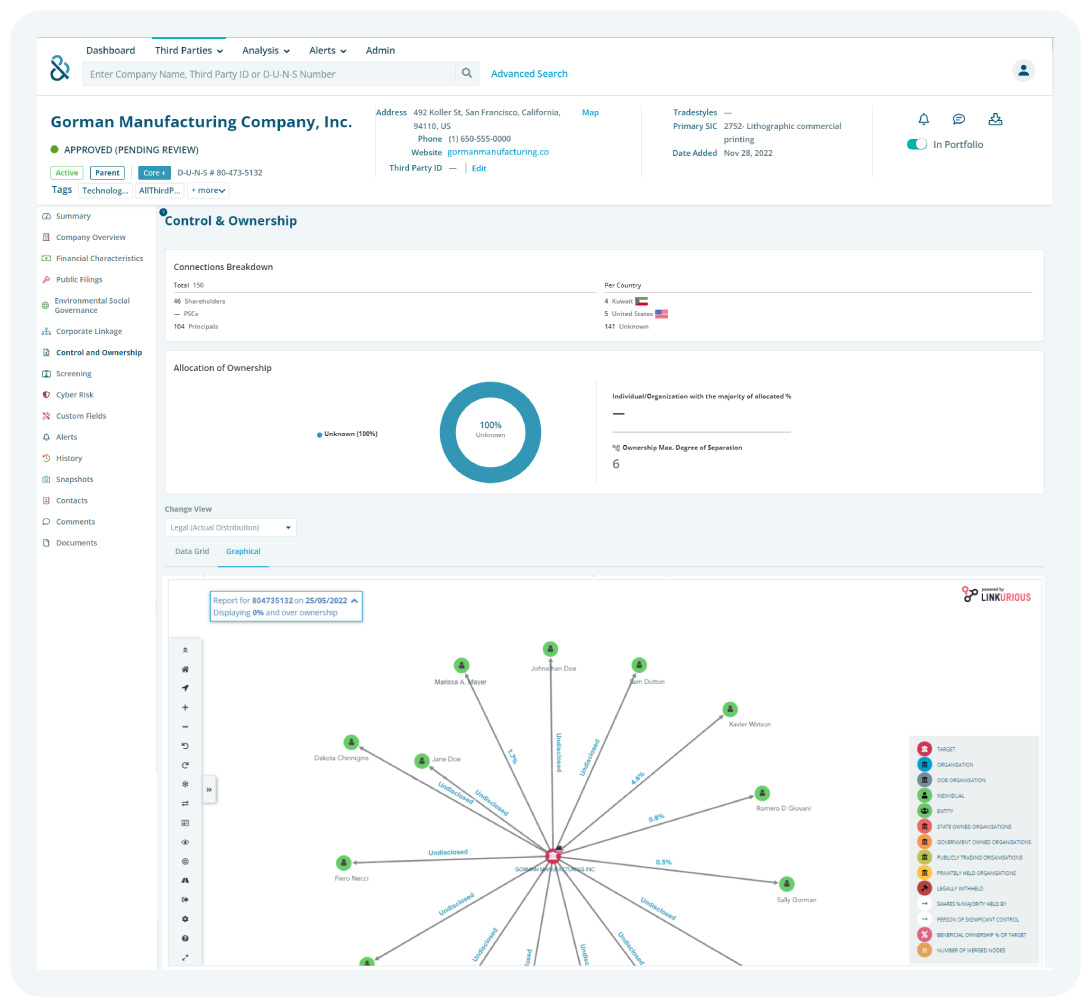

Moody’s Bureau van Dijk (BvD) is a globally recognized corporate intelligence provider known for its flagship platform, Orbis, which aggregates ownership, financial, and compliance data on over 450 million companies. Often used by banks, regulators, and auditors, BvD delivers highly structured information ideal for risk modeling, regulatory reporting, and UBO analysis—making it one of Sayari’s closest traditional competitors.

Why Choose Bureau van Dijk Over Sayari?

Comprehensive global coverage — Data on companies in 200+ jurisdictions, including public and private firms, with deep ownership trees and ultimate beneficial owner identification.

Standardized financials — Aggregates and normalizes financials across countries and accounting standards for easy comparison and modeling.

Compliance tools — Integrated with sanctions lists, PEP databases, and compliance modules tailored for FATF and AML frameworks.

Complex ownership tracing — Visual tools and reports to map indirect and circular ownership, nominee structures, and ultimate controllers.

Rich historical archives — Access to 20+ years of archived corporate data, ownership changes, and financial performance.

Use Cases:

- AML and compliance screening

- Financial due diligence and credit assessment

- M&A research and deal sourcing

- UBO and control structure audits

- Tax transparency and regulatory reporting

Strengths and Considerations

While Sayari is registry-first , BvD relies on a combination of partner data feeds, registry filings, corporate disclosures, and manual research. The data is highly curated and standardized , but users don’t always get full transparency into the original source documents.

Additionally, licensing is restrictive —many users face limitations on data reuse, redistribution, and derivative product creation. This makes BvD less flexible for platforms and integrators compared to alternatives like Global Database or Zephira.ai.

Who Uses Bureau van Dijk?

- Global banks and investment firms

- Big Four and audit firms

- Regulators and tax authorities

- Compliance and onboarding software vendors

- Corporate intelligence teams

Moody’s Bureau van Dijk (Orbis) Pricing

Pricing for Orbis starts from $20,000 USD per year .

Larger packages with full global access or more data features can cost $100,000+ per year .

It’s mainly used by banks, auditors, and large enterprises that need detailed company ownership and financial data.

Orbis vs Sayari: Which One Is Right for You?

Choose Moody’s BvD if you need:

- Consistently structured and comparable financials

- Re-built visualizations of complex ownership

- Longitudinal data for trend analysis and modeling

- Enterprise-level compliance integrations

If you prioritize source-level transparency, flexible licensing, and automation-ready delivery , solutions like Global Database or Zavia.ai may offer more agility.

Zephira.ai: Real-Time Company Registry Data for Developers and Platforms

Zephira.ai is a modern, API-first data platform that delivers real-time access to company registry data across 100+ countries. Designed specifically for developers, fintechs, onboarding solutions, and compliance platforms, Zephira provides granular, structured data directly from government sources—without the licensing restrictions or delays found in legacy providers like Sayari.

Why Choose Zephira.ai Over Sayari?

Real-time API access — Instantly retrieve company records, including legal name, registration number, VAT, tax ID, and company status.

Ownership & UBO data — Access shareholder information and map parent-subsidiary relationships with clear, normalized structures.

Developer-focused — Easy-to-use endpoints, no minimum contract, and transparent pay-per-call pricing.

Modular pricing — Pay only for the data you use (e.g., $0.20 per UBO lookup), ideal for startups or scaling platforms.

Flexible licensing — Unlike Sayari, Zephira allows full use of data in commercial products, apps, and workflows.

Use Cases:

- KYB and onboarding automation for fintechs

- API-powered UBO lookup for compliance tools

- Embedding company verification into web or mobile apps

- CRM and customer database enrichment

- Supporting regulated use cases in payments, lending, and insurtech

Built for Scale and Simplicity

Where Sayari is geared toward analysts, investigators, and risk researchers, Zephira.ai is built for product and engineering teams that need to integrate verified registry data into digital workflows, instantly. No manual exports. No vendor lock-in. Just clean, normalized data on demand.

You can filter by:

- Company name or registration number

- Jurisdiction

- VAT or Tax ID

- Ownership thresholds (e.g., show only shareholders >25%)

Who Uses Zephira?

- Regtech startups building KYB/KYC flows

- B2B SaaS platforms needing company verification

- Procurement and ERP platforms integrating compliance

- Risk scoring and fraud prevention tools

- Marketplaces verifying sellers and vendors

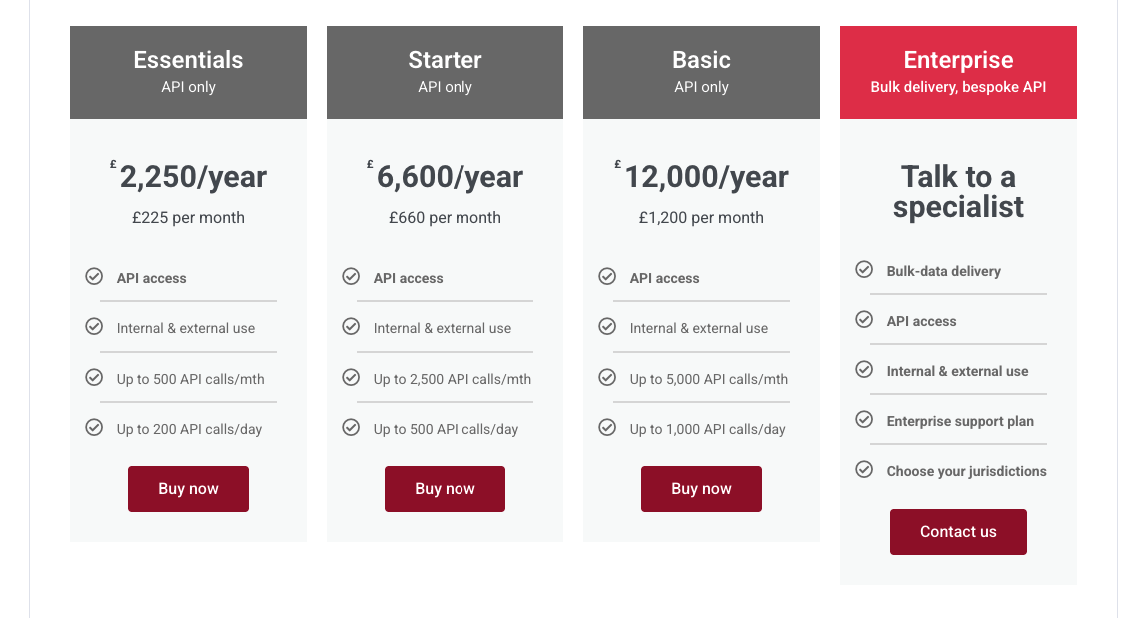

Pricing:

Zephira.ai vs Sayari: Which Is Best for You?

Choose Zephira if you need:

- Direct registry data via API

- Full developer control and flexible pricing

- Commercial usage rights for embedding and resale

- Fast setup without enterprise onboarding friction

For investigative research, source documents, or risk visualization, Sayari may still be suitable. But for fast, modern integrations— Zephira.ai is built to power the next generation of KYB and compliance tools.

OpenCorporates: Open Access to Global Company Registries

OpenCorporates is the world’s largest open database of companies, offering access to over 200 million entities across 140+ jurisdictions. Unlike Sayari, which focuses on investigative intelligence and deep ownership mapping, OpenCorporates champions transparency and accessibility , providing free or low-cost access to structured company data sourced directly from public registries.

Why Consider OpenCorporates as a Sayari Alternative?

Open-source ethos — Data is sourced directly from official company registries and made publicly accessible wherever legally allowed.

Entity-level transparency — Access to legal identifiers, registration dates, current status, and officer information.

Developer-friendly — RESTful API allows integration into open data tools, research platforms, or internal systems.

Legal traceability — Each record is accompanied by source links and legal attribution, useful for audit or compliance trails.

Global reach — Particularly strong in the UK, EU, and North America, with growing coverage in LATAM and APAC.

Use Cases:

- Transparency-driven investigative journalism

- Open data compliance initiatives

- Initial onboarding or KYB validation

- Beneficial ownership research in select jurisdictions

- Sanity checks on existing data providers

Strengths and Limitations

OpenCorporates stands out for its openness and source integrity , making it a go-to resource for researchers, NGOs, and transparency advocates. However, it does not offer:

- UBO mapping tools

- Risk scoring or financials

- Sanctions/PEP screening

- Data enrichment or AI-layered insights

As a result, it’s often used as a complementary resource , rather than a standalone platform for commercial or regulatory-grade compliance workflows. Companies seeking automation, enrichment, or analytics often pair OpenCorporates with platforms like Global Database or Zephira.ai .

Pricing:

Who Uses OpenCorporates?

- Investigative journalists and NGOs

- Anti-corruption and transparency bodies

- Regtech developers

- Risk and research teams validating public records

- Legal and compliance departments performing manual checks

OpenCorporates vs Sayari: Which Should You Use?

Choose OpenCorporates if you need:

- Free or low-cost access to basic registry data

- Legal transparency and source verification

- Lightweight API access for early-stage validation

For enhanced UBO discovery, ownership risk analytics, and sanctions checks, consider purpose-built tools like Zavia.ai , Global Database , or Sayari .

AsiaVerify: Instant KYB, UBO & Business Verification Across APAC

AsiaVerify is a regional powerhouse for compliance and business verification in the Asia-Pacific region. With direct connections to government registries in countries such as China, Singapore, Vietnam, Indonesia, and more, AsiaVerify specializes in real-time KYB, UBO discovery, and AML checks across APAC markets —where Sayari’s coverage is often limited or less localized.

Why Choose AsiaVerify Over Sayari?

Real-time registry connections — Access legally verified business data, including company status, directors, shareholders, and legal representatives across Asia.

Multi-language support — Automatically translates local-language filings and registry data into English, helping international compliance teams verify APAC entities with confidence.

UBO mapping for APAC — Trace beneficial ownership across cross-border structures, often buried in local documentation.

Regulatory alignment — Designed to support AML, FATF, and KYC/KYB regulations with audit trails and exportable reports.

Easy integration — Available via API, web interface, and partner platforms.

Use Cases:

- Cross-border vendor verification in China, Southeast Asia, and India

- Onboarding of regional partners or subsidiaries

- AML screening for high-risk Asian jurisdictions

- Enhanced due diligence for multinational procurement

- Investor background checks and ESG verification

Strengths and Considerations

AsiaVerify offers unmatched depth and speed in APAC compliance , giving users access to authoritative data in real time. It simplifies what is traditionally a fragmented and opaque process by pulling directly from government registries and translating local filings—something Sayari does not consistently offer in this region.

However, AsiaVerify is APAC-specific and may need to be used alongside global platforms like Global Database or Zephira.ai to cover non-Asian jurisdictions.

Who Uses AsiaVerify?

- Global compliance teams onboarding APAC partners

- Payment processors and fintechs operating in Asia

- Trade compliance platforms expanding in Southeast Asia

- International law firms and investigative units

- Regional procurement and supplier onboarding departments

AsiaVerify Pricing

AsiaVerify does not list public pricing, but based on typical use cases:

- Entry-level plans often start from $300–$500 USD per month

- Pricing depends on country coverage, data volume, and API usage

AsiaVerify vs Sayari: Which Is Right for You?

Choose AsiaVerify if you:

- Need deep verification coverage in China, Vietnam, Singapore, or other APAC markets

- Are struggling with non-English registry documents

- Want real-time access to local government data

- Require localized risk assessment for compliance or procurement

For broader international risk mapping, ownership analysis beyond Asia, or cross-jurisdictional intelligence, consider combining AsiaVerify with platforms like Global Database or Zavia.ai.