The End of Plausible Deniability

UBO Verification (Ultimate Beneficial Owner Verification) is the mandatory process of identifying the natural persons who ultimately own or exercise effective control over a legal entity. While traditional compliance focused on simple shareholding thresholds (usually 25%), the 2026 regulatory standard has shifted toward identifying "effective control"—stripping away layers of shell companies, trusts, and nominees to reveal the human decision-makers behind the corporate veil.

In the high-stakes arena of global commerce, this is no longer just a "tick-box" exercise. In 2026, the era of "plausible deniability" has ended. The regulatory landscape has shifted tectonically with the full maturity of the US Corporate Transparency Act (CTA) and the EU’s interconnected transparency registers, giving regulators the digital infrastructure to see through opaque structures faster than legacy systems can document them.

For enterprise leaders, the question is no longer just "Who owns this company?" It is far more complex: "Can we prove effective control in real-time before a regulator or a sanctioned entity taints our supply chain?"

This guide strips away the legacy jargon to provide a irst-principles approach to identifying beneficial owners, equipping you to navigate a market where transparency is the only currency that matters.

The Billion-Dollar Blind Spot in Your Supply Chain

Every year, Global 2000 companies spend billions on ESG initiatives, sustainability reports, and ethical sourcing certifications. They audit factories, track carbon footprints, and sign rigorous Codes of Conduct with their Tier 1 suppliers.

Yet, despite this massive investment, many of these organizations are sitting on a billion-dollar blind spot: they know what their suppliers do, but they don't know who owns them.

In the modern supply chain, Hidden Ultimate Beneficial Owners (UBOs) represent the single largest unmanaged risk. While a supplier might look pristine on paper—with a clean credit score and a valid sustainability certificate—its ownership structure could be funneling profits to sanctioned individuals, political regimes involved in human rights abuses, or conglomerates with a history of environmental negligence. This is the "Greenwashing by Structure" trap. You aren't funding unethical practices directly; you are funding the owners of unethical practices.

The Disconnect: Vetting the Entity vs. Vetting the Owner

Most procurement teams rely on standard due diligence processes that stop at the legal entity level. They check if "Supplier X Ltd" has lawsuits or bad credit. But "Supplier X Ltd" is often just a localized shell or a subsidiary.

If you do not trace the ownership chain to the natural person at the top (the UBO), you are making risk decisions based on incomplete data. A clean subsidiary can be 100% owned by a parent company heavily involved in forced labor or money laundering. Without UBO discovery, your ESG compliance is effectively blind to this relationship.

Table: The Visibility Gap in Traditional Supply Chain Risk Management

Risk Factor | Standard Supplier Vetting (Status Quo) | UBO-Centric Due Diligence (The New Standard) |

|---|---|---|

Scope of Check | Reviews the specific legal entity signing the contract. | Reviews the entire corporate family tree, up to the UBO. |

Data Source | Static databases, credit reports, and self-assessments. | Live registry data and real-time ownership mapping. |

Blind Spot | Cannot see if the supplier is a shell for a sanctioned owner. | Identifies the natural person profiting from the contract. |

ESG Impact | Verifies if the factory is compliant. | Verifies if the capital flows support unethical actors. |

Conflict of Interest | Relies on the supplier to disclose conflicts. | Algorithmic detection of links between suppliers and internal employees. |

Regulatory Risk | Vulnerable to "Shadow Sanctions" (50% Rule). | Full visibility into indirect ownership and sanctions exposure. |

Why This Matters Now

This is no longer just a moral dilemma; it is a financial one. When a hidden UBO is exposed by investigative journalists or regulators, the blowback on the enterprise buyer is immediate. Stock prices drop, consumer trust evaporates, and regulators—armed with new laws like the EU CSDDD—launch investigations.

In an era of radical transparency, ignorance of ownership is no longer a defense. It is a liability.

The New Regulatory Reality: CSDDD and Beyond

For decades, supply chain due diligence was a "soft" requirement—driven by voluntary codes of conduct, consumer pressure, and the occasional PR crisis. In 2025, that era is officially over.

Governments across Europe and globally have moved from encouraging transparency to mandating it under threat of massive financial penalties. The shift is fundamental: you are no longer just responsible for your own operations; you are legally liable for the bad actors hiding in your supply chain.

The "Big Two" You Cannot Ignore

While the UK Modern Slavery Act and the US Uyghur Forced Labor Prevention Act (UFLPA) set the stage, two European frameworks have radically escalated the stakes for global enterprises.

The EU Corporate Sustainability Due Diligence Directive (CSDDD)

This is the "GDPR of Supply Chains." It requires large companies to identify and mitigate negative human rights and environmental impacts not just in their own operations, but across their entire chain of activities.

The Stick: Penalties can reach up to 5% of net worldwide turnover. For a Fortune 500 company, this is not a parking ticket; it is a material financial event.

The Kicker: It introduces civil liability. Victims of human rights abuses in your supply chain can sue your company in European courts for damages if you failed to conduct adequate due diligence.

The German Supply Chain Act (LkSG)

Already fully operational for companies with 1,000+ employees, the LkSG is the blueprint for the new enforcement environment.

The Trap: While it primarily targets "direct" suppliers, it triggers an immediate obligation for indirect suppliers (Tier 2 and beyond) the moment you have "substantiated knowledge" of a violation.

The Reality: In a digital world, "substantiated knowledge" is easy to prove. If an NGO publishes a report linking your Tier 2 supplier’s Ultimate Beneficial Owner to a militia or a sanctioned entity, you are on the hook. You cannot claim ignorance when the data was available.

The "Passive Compliance" Trap

Most enterprise compliance programs were built for a different era. They rely on passive verification:

Send a supplier a Code of Conduct.

Ask them to self-certify compliance.

Check their name against a static watchlist.

This approach is now dangerous.

Under CSDDD and LkSG, regulators expect active discovery. They demand that you map your value chain and understand who controls the nodes within it.

Challenger Insight: If your due diligence process relies on your supplier telling you the truth, you are already non-compliant. A factory engaging in forced labor will not disclose it in a questionnaire. A shell company laundering money will not list its UBO on its website.

The only defense against these regulations is independent, registry-sourced verification of ownership. You need to know who the UBO is before the regulator does.

Table: The Financial Risk of Non-Compliance

Regulation | Jurisdiction | Target Companies | Max Penalty |

|---|---|---|---|

CSDDD | EU (Global Reach) | 1,000+ Employees | 5% of Global Turnover + Civil Liability |

LkSG | Germany | 1,000+ Employees | 2% of Global Turnover + Tender Exclusion |

UFLPA | USA | All Importers | Cargo Seizure (Guilty until proven innocent) |

Sapin II | France | 500+ Employees | €1 Million + Personal Liability for Directors |

Anatomy of "Greenwashing by Structure"

In the past, greenwashing was simple: a company would exaggerate its recycling efforts or buy cheap carbon offsets to look good. Today, sophisticated bad actors use a far more dangerous tactic: Greenwashing by Structure.

This occurs when a supplier creates a pristine "clean skin" legal entity to front for a parent company or Ultimate Beneficial Owner (UBO) involved in severe ESG violations. The supplier’s operations look compliant—they might even pass a physical factory audit—but the profits flow directly to individuals or regimes that violate the very ethical standards your company claims to uphold.

The "Russian Doll" Corporate Defense

Bad actors know exactly how standard procurement teams operate. They know you will check the immediate supplier, so they build a "Russian Doll" structure to hide the rot.

The Outer Layer (Your Supplier): A newly registered limited liability company in a reputable jurisdiction (e.g., the UK or Netherlands). It has a clean credit history, valid ISO certifications, and a diverse board of directors.

The Middle Layer (The Obfuscation): This company is owned 100% by a Holding Company registered in a jurisdiction with low transparency (e.g., Delaware, BVI, or a rigid trust structure).

The Core (The Toxic UBO): The Holding Company is ultimately controlled by an individual sanctioned for human rights abuses, or a conglomerate known for illegal deforestation.

If your due diligence stops at Layer 1, you approve the vendor. You inadvertently fund the bad actor, and when the press uncovers the link, your brand takes the hit.

Case Study: The "Eco-Friendly" Component Manufacturer

Note: This is a representative scenario based on common market patterns.

The Scenario: A European automotive giant contracted a "Green Energy" supplier for battery components. The supplier had perfect ESG scores and a modern, safe factory in Southeast Asia.

The Hidden Reality: Deep UBO discovery revealed that the supplier was a wholly-owned subsidiary of a mining consortium. While the factory was clean, the parent company was under investigation for using forced labor in the extraction of the raw materials used in those very batteries.

The Consequence: The automaker faced a PR disaster and a stock dip when an NGO mapped the ownership chain publicly. They were technically sourcing "clean" parts, but they were financially fueling a "dirty" empire.

The Tier 2 & 3 Blind Spot

The risk doesn't end with the companies you pay directly. The EU CSDDD and German LkSG extend liability to your indirect supply chain (Tier 2 and beyond) if you have "substantiated knowledge" of a risk.

In 2025, ignorance is difficult to prove. If a Tier 1 supplier subcontracts to a Tier 2 entity owned by a sanctioned UBO, and that data is available in a public registry or a tool like Global Database, regulators may argue you should have known. The complexity of the structure is no longer a valid excuse for missing the risk.

Table: The Facade vs. The Reality

How structural obfuscation tricks standard compliance checks.

The Facade (What You See) | The Reality (What UBO Discovery Reveals) | The Risk |

|---|---|---|

Clean Legal Name | Toxic Parent Company | Funding a parent co. with a history of bribery or pollution. |

"Local" Business | Offshore Control | The entity is a shell; 100% of revenue moves to a tax haven. |

Nominee Directors | Shadow UBO | The "owner" on paper is a lawyer; the real controller is a PEP. |

New Incorporation | Phoenix Company | The entity was created to replace a sanctioned company that dissolved. |

ESG Certified | Dirty Capital | Operational compliance masks financial support for unethical actors. |

Why Legacy Due Diligence Fails (The Static Data Trap)

For decades, the standard for vendor vetting has been the "Credit Report Model." Procurement teams purchase a static report from a legacy provider, check the financial health score, archive the PDF, and move on.

In 2025, this model is fundamentally broken.

The pace of global risk has accelerated. Sanctions are applied overnight. Shell companies are formed and dissolved in days. Corporate structures change weekly. Yet, most enterprises are still protecting their supply chains with data that is months—sometimes years—out of date.

This is the Static Data Trap, and it is the primary reason why sophisticated companies still get caught in compliance scandals. compliance scandals.

The "Database" Delusion

Most legacy intelligence providers operate on a "Database Model." They aggregate data, clean it, and store it on their own servers. When you search for a company, you aren't seeing the current reality; you are seeing a cached snapshot of what that company looked like the last time the provider updated that specific record.

In fast-moving markets or opaque jurisdictions, that record could be 6 to 12 months old.

The Risk: If a supplier’s ownership changes today—perhaps selling a controlling stake to a sanctioned entity—a static database might not reflect that change for weeks. During that "blind" window, you are processing invoices and exposing your organization to strict liability under the CSDDD.

The Reality: "Fresh" data in 2025 means Live Registry Access. It means querying the official government source at the moment of the search, not querying a cached copy from last quarter.

The "Credit Score" Fallacy

Legacy due diligence is heavily biased toward financial risk. A high credit score (e.g., a D&B rating) is often used as a proxy for "safe to do business with."

This is a dangerous conflation.

Financial Health $\neq$ Ethical Health. A company can have excellent cash flow, strong credit, and prompt payment history while simultaneously being owned by a money launderer or employing forced labor.

The Blind Spot: Credit reports tell you if a supplier can deliver. They do not tell you if they should be part of your supply chain. Relying on a credit score for ESG compliance is like judging a book’s content by the quality of its paper.

The Self-Reporting Loophole

A surprising amount of "verified" data in legacy databases is actually self-reported. Companies are asked to update their own profiles to improve their credit scores or visibility.

The Conflict: Bad actors lie. A front company for a sanctioned regime will not voluntarily list its true Beneficial Owner in a self-assessment questionnaire or a directory profile.

The Fix: You cannot ask the fox to guard the henhouse. True compliance requires independent, third-party validation directly from official government registries, bypassing the supplier’s self-interest entirely.

Table: Static Databases vs. Live Intelligence

Why the tools of yesterday cannot solve the problems of tomorrow.

Feature | Legacy "Database" Providers | Modern Live Intelligence (Global Database) |

|---|---|---|

Data Source | Cached/Stored Data (Updates periodically) | Live Registry Connection (Real-time pull) |

Refresh Rate | Monthly, Quarterly, or Annual | Instant (At the moment of query) |

Ownership Depth | Often limited to direct shareholders | Multi-tier UBO Mapping (Parent/Grandparent) |

Verification | often Self-reported or Crowd-sourced | Official Government Documents |

Monitoring | Periodic "Push" alerts (often delayed) | Continuous Monitoring via API |

Blind Spot | Misses changes made between updates | Zero Latency between change and detection |

The Solution: Integrating UBO Discovery into Procurement

If static databases are the problem, then Live Registry Intelligence is the only viable solution. But buying better data isn't enough; you must fundamentally change how that data is consumed within your procurement workflow.

Modern compliance isn't a "check-the-box" activity at the start of a relationship. It is an always-on intelligence layer that protects your supply chain from day one to day zero. Here is the three-step framework for integrating UBO discovery into a modern enterprise.

Step 1: Verify the "Natural Person," Not Just the Company

Stop validating "Supplier X Ltd." Start validating the human beings behind it.

When you onboard a new vendor, your system should automatically trigger a real-time KYB (Know Your Business) check that bypasses self-reported data.

The Action: Connect your ERP or onboarding platform (e.g., SAP Ariba, Coupa) directly to a live UBO API.

The Output: Instead of a "Pass/Fail" on the company name, you receive a list of Ultimate Beneficial Owners (UBOs)—the individuals who own >25% or exercise control.

The Filter: These names are immediately screened against global sanctions lists (OFAC, EU, UN), PEP (Politically Exposed Persons) databases, and adverse media.

Challenger Insight:

If your current provider gives you a "green light" on a company but doesn't tell you the name of the person who owns it, they aren't managing your risk—they are hiding it.

Step 2: Map the "Family Tree" (Visualizing the Web)

Risk rarely lives in a straight line. It lives in the messy, tangled web of holding companies and sister entities.

Advanced UBO discovery tools don't just give you a list of names; they generate a Corporate Family Tree. This visual map reveals the hidden connections that standard reports miss.

Parent/Child Relationships: Is your supplier owned by a holding company in a high-risk jurisdiction (e.g., Cayman Islands)?

Sister Entities: Does the owner of your supplier also own a company that was recently banned for environmental crimes?

Circular Ownership: Is the company structure designed to hide the true owner (e.g., Company A owns Company B, which owns Company A)?

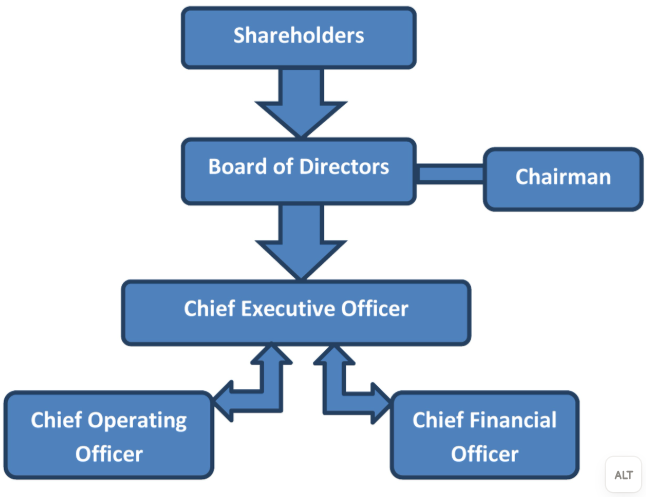

Above: A simplified visualization of a multi-tiered ownership structure, showing how a "clean" local entity can be linked to a sanctioned UBO through multiple layers of shell companies.

Step 3: From "Snapshot" to "Movie" (Continuous Monitoring)

The biggest lie in compliance is that "safe today means safe tomorrow."

Ownership changes. A benign supplier can be acquired by a sanctioned oligarch next week. A clean UBO can be elected to public office and become a PEP overnight.

The Old Way: Re-screening suppliers once a year (or never).

The New Way: Perpetual Monitoring.

By "subscribing" your approved vendor list to a live monitoring API, you receive alerts the moment a material change occurs.

Alert: "Supplier X has a new 40% shareholder."

Alert: "The UBO of Supplier Y has appeared on a new sanctions list."

This turns compliance from a recurring administrative burden into an automated early-warning system.

Workflow: The Modern "UBO-First" Onboarding Process

The following table contrasts the typical, flawed workflow with the secure, data-driven approach.

Stage | Typical Flawed Workflow | Modern "UBO-First" Workflow |

|---|---|---|

1. Application | Supplier fills out a PDF form. | API pulls live registry data using the Tax ID. |

2. Validation | Procurement checks credit score & self-certifications. | System maps the ownership tree to identify the UBO. |

3. Screening | Screen the company name against blacklists. | Screen the UBO's name against Sanctions & PEP lists. |

4. Approval | Vendor is approved for 1-3 years. | Vendor is approved and enrolled in continuous monitoring. |

5. Trigger Event | Scandal breaks in the news; team scrambles. | System alerts team of ownership change before the scandal. |

The Business Case: From Cost Center to Competitive Advantage

For too long, supply chain compliance has been viewed by the C-Suite as a "grudge purchase"—a cost center necessary to keep regulators at bay, but one that adds zero value to the bottom line.

This view is obsolete. In the current market, radical transparency is a competitive advantage.

Leading enterprises are flipping the script. They aren't just using UBO discovery to avoid fines; they are using it to build a "Clean Chain" brand that commands a premium from customers, investors, and partners.

Here is how investing in deep ownership intelligence pays dividends beyond compliance.

1. The ROI of Reputation (Brand Equity Protection)

It takes decades to build a brand and 24 hours to destroy it.

When a major fashion retailer is linked to forced labor, or a tech giant is found sourcing from a conflict zone, the damage isn't just a regulatory fine—it’s a consumer boycott and a stock market correction.

The Value: UBO discovery is your insurance policy against the headline risk. By proactively identifying and removing toxic actors, you protect the intangible asset—trust—that drives your revenue.

The Metric: The cost of a comprehensive UBO tool is often less than the legal fees for one single day of crisis management following a scandal.

2. Access to Capital and Lower Insurance Premiums

Institutional investors (BlackRock, Vanguard) and insurers are increasingly pricing ESG risk into their models.

For Capital: Companies with transparent, audited supply chains are viewed as lower-risk borrowers. This can translate to better credit ratings and lower costs of capital.

For Insurance: Cyber and liability insurers are demanding proof of vendor due diligence. Demonstrating a robust, API-driven UBO vetting process can be leverage in negotiating lower premiums.

3. Operational Resilience (Predicting Disruption)

Supply chain disruption often stems from financial or legal trouble at the ownership level.

The Scenario: If your key supplier is owned by an oligarch who is about to be sanctioned, that supplier’s assets could be frozen overnight.

The Advantage: If you monitor UBOs, you get the signal before the freeze happens. You can diversify your sourcing while your competitors are left scrambling for parts when the supplier goes dark. Intelligence buys you time.

4. Winning the "Ethical Consumer" Wallet

B2B and B2C buyers are voting with their wallets.

The Shift: Procurement teams at your potential clients are under the same CSDDD pressure you are. When you bid for a contract, being able to say, "We have 100% visibility into the beneficial ownership of our entire supply chain," is a powerful differentiator against competitors who can only offer vague assurances.

Challenger Insight:

"Compliance is a cost. Trust is a revenue driver. UBO discovery bridges the gap between the two."

Table: The ROI of Radical Transparency

Area of Impact | Old View (Cost Center) | New View (Value Driver) |

|---|---|---|

Brand | "Avoid negative press." | "Market our 'Clean Chain' as a premium feature." |

Finance | "Paying for data." | "Lowering cost of capital & insurance premiums." |

Operations | "Checking boxes." | "Early warning system for supplier insolvency." |

Sales | "Internal hurdle." | "Key differentiator in RFPs and tenders." |

Conclusion: The Era of Radical Transparency

We have entered a new era of global business. The days of "plausible deniability"—where you could simply claim you didn't know who owned your suppliers—are gone.

The convergence of aggressive regulations like the CSDDD, the rise of complex evasion tactics like "Greenwashing by Structure," and the unforgiving speed of reputational damage has changed the game. For the modern enterprise, opacity is no longer a risk; it is a guarantee of failure.

The choice facing C-suite leaders and procurement heads is stark:

Stick to the Status Quo: Continue relying on static databases, annual PDFs, and "good faith" questionnaires, hoping that the regulators (or the press) don't look too closely.

Embrace Radical Transparency: Build a compliance infrastructure that is as dynamic as the market itself—powered by live registry data, real-time API connections, and deep, multi-tier UBO mapping.

The companies that choose the second path will do more than just avoid fines. They will secure lower costs of capital, win the trust of ethical consumers, and build supply chains that are resilient to the shocks of a volatile world.

The question is not "Can you afford to invest in UBO discovery?"

The question is "Can you afford the price of not knowing?"

Key Takeaways for Enterprise Leaders

Regulation is Global: From the EU to the US, laws now demand you know the person, not just the entity.Static Data is Dangerous: If your compliance data is 30 days old, you are exposed. Real-time registry access is the new baseline.Depth Matters: You are responsible for your Tier 2 and Tier 3 suppliers. You must map the "Family Tree."Compliance is Value: Transparent supply chains attract better investors and protect brand equity.

Ready to Uncover the Invisible Risks in Your Supply Chain?

Don’t let hidden UBOs jeopardize your ESG goals or your regulatory standing.

Global Database provides the live, registry-sourced intelligence you need to map ownership structures, verify UBOs in real-time, and monitor your supply chain 24/7.

See what legacy providers are missing.

Automate your KYB and UBO checks via API.

Protect your brand with data you can trust.

Frequently Asked Questions: UBOs, ESG, and Supply Chain Risk

What is the difference between a Shareholder and an Ultimate Beneficial Owner (UBO)?

A shareholder is a legal entity or person listed on company papers, often just a "nominee" or another company. An Ultimate Beneficial Owner (UBO) is the natural person who actually owns or controls the business (typically >25% ownership).

The Risk: You might contract with a clean-looking shareholder (e.g., a UK Ltd company) while the UBO is a sanctioned individual hiding behind it. Global Database specializes in cutting through these layers to identify the real human owner.

How does the EU CSDDD affect my supply chain due diligence?

The Corporate Sustainability Due Diligence Directive (CSDDD) makes large companies legally liable for human rights and environmental violations in their entire chain of activities—not just direct suppliers. This means you must proactively identify risks in Tier 2 and Tier 3 suppliers. If a subcontractor is owned by a bad actor and you didn't check, you can face fines of up to 5% of global turnover.

Why are static credit reports insufficient for ESG compliance?

Static credit reports focus on financial health (can they pay?), not ethical health (should you pay them?). Furthermore, they are often updated only periodically (monthly/annually). In 2025, sanctions and ownership changes happen daily. Relying on a 3-month-old report leaves you exposed to "Greenwashing by Structure." You need live registry data to be safe.

What is "Greenwashing by Structure"?

This is a deceptive practice where a toxic parent company or sanctioned UBO creates a clean, compliant subsidiary ("shell") to win contracts. The subsidiary passes standard audits, but the profits flow to the unethical owner. Only deep UBO discovery—mapping the full corporate family tree—can detect this.

Can I use Global Database to automate UBO verification?

Yes. Global Database offers a real-time API that integrates directly into your ERP or onboarding software (like SAP, Salesforce, or Coupa). It automatically pulls live registry data, maps the ownership structure, and screens UBOs against sanctions lists the moment a new supplier is added, removing manual work and human error.

How far down the supply chain do I need to map ownership?

Under strict regulations like the German LkSG and EU CSDDD, you are expected to take action if you have "substantiated knowledge" of a risk, regardless of the tier. However, best practice for Enterprise Risk Management is to map ownership for all Tier 1 suppliers and key Tier 2 suppliers in high-risk jurisdictions.

Does Global Database cover offshore jurisdictions like the BVI or Cayman Islands?

Yes. Unlike many providers that only scrape open web data, Global Database connects to official registries in 195+ countries, including complex and opaque jurisdictions. This allows you to trace ownership chains across borders, even when they attempt to hide in tax havens.

What is the "25% Rule" in UBO discovery?

In most AML/KYB regulations, a UBO is defined as anyone owning 25% or more of shares or voting rights. However, risk-averse enterprises often lower this threshold to 10% for high-risk industries. Global Database allows you to customize these thresholds and identify individuals who exercise "control via other means," even if they own less than 25%.

How does "Continuous Monitoring" differ from annual re-screening?

Annual re-screening is a snapshot; it leaves you blind for 364 days a year. Continuous Monitoring is a movie. Global Database’s system "watches" your approved entities 24/7. If a supplier changes ownership, or if their UBO is added to a sanctions list tomorrow, you receive an alert instantly—allowing you to react before the press does.

Why is "Live Registry Access" better than a traditional database?

Traditional databases store cached data that sits on a server and ages. "Live Registry Access"—the technology used by Global Database—queries the government source in real-time when you make a request. This ensures you are making decisions based on the current legal reality, not a version of the truth from six months ago.