Zephira.ai

Zephira.ai is an API-first company data platform designed specifically for developers, fintechs, and RegTechs. Its core proposition is simple: real-time access to registry-sourced data across 100+ countries, with flexible pricing that makes it accessible from startups to enterprises.

Key Features

- API-first design: Data is delivered through lightweight, developer-friendly APIs.

- Registry-sourced: All data comes directly from government registries, ensuring authenticity.

- Coverage: 100+ countries globally vs North Data’s 21 European countries.

- Data types: Company identifiers, KYB profiles, UBO ownership, tax IDs, legal structures, and financial metrics.

- Real-time delivery: Updated daily, available instantly.

Pricing

Zephira.ai offers tiered monthly plans based on usage volume:

- Starter ($99/month) – 100 full company profiles, 30 API calls per minute.

- Pro ($299/month) – 600 full company profiles, 100 API calls per minute.

- Business ($1,000/month) – 3,000 full company profiles, 300 API calls per minute.

- Enterprise (custom pricing) – unlimited API calls, up to 6,000 API calls per minute.

Each API call includes company registry information, full financials, directors & shareholders, firmographic data, and digital insights — going far beyond North Data’s raw filings.

Strengths vs North Data

- Coverage: Global vs Europe-only.

- Delivery: Real-time API vs quarterly static updates.

- Financials & UBOs: Digitized financials, ownership, and shareholders vs limited PDFs.

- Pricing model: Transparent tiered subscriptions with enterprise scalability vs fixed, non-reseller model.

Limitations

- No sales prospecting layer: Unlike Global Database, Zephira.ai doesn’t include contact emails/phone numbers.

- Developer-focused: Best for technical teams; less suited for non-technical end users.

Verdict: Zephira.ai is one of the strongest North Data alternatives for fintechs, RegTechs, and developers seeking scalable, real-time registry data with flexible pricing.

Would you like me to now move on with Section 5: Creditreform, or should I pause and build the Feature Comparison Matrix so you get a clear side-by-side of North Data vs Global Database vs Zephira.ai vs others?

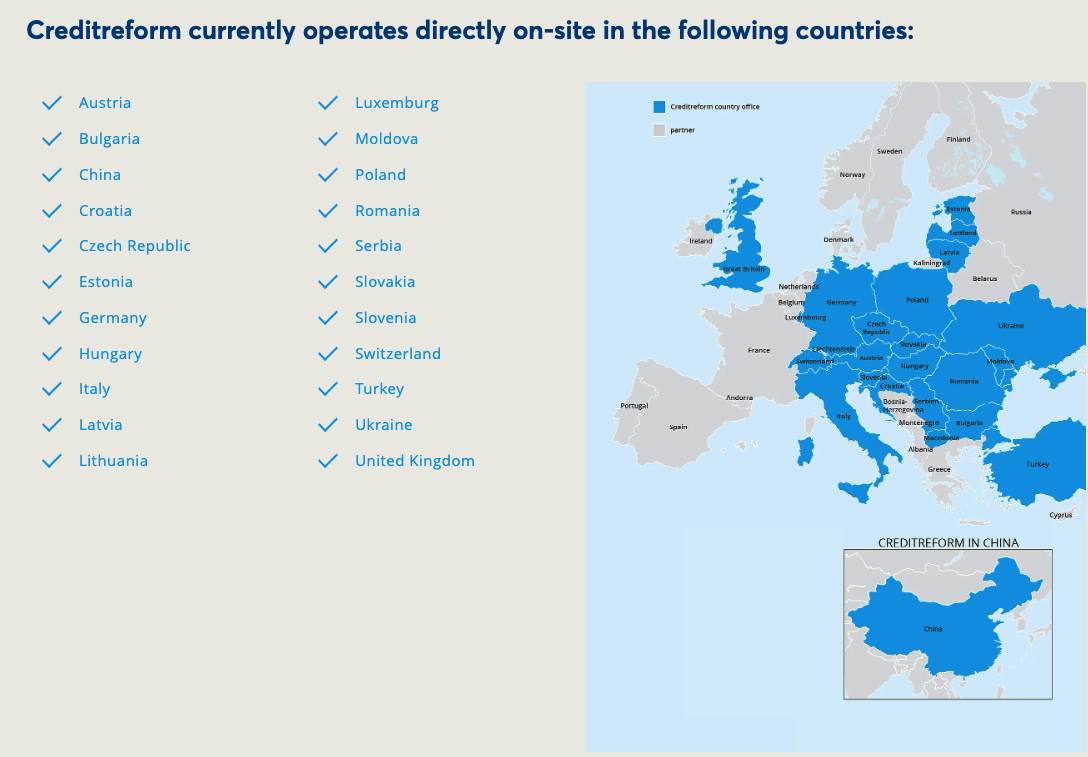

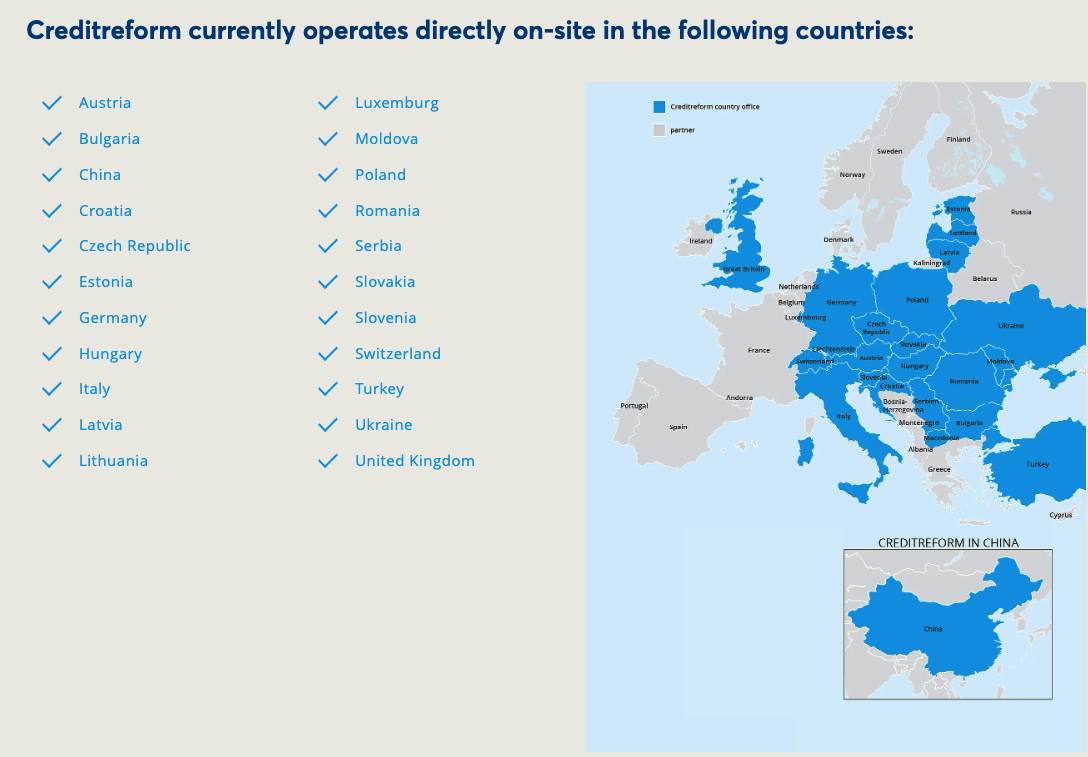

Creditreform

Creditreform is one of Germany’s oldest and most established providers of business information and credit risk management services. Unlike North Data, which delivers raw registry filings, Creditreform combines registry data with credit reports, risk scoring, and debt collection services. It is widely used by banks, insurers, and exporters to evaluate business solvency.

Key Features

- Credit reports: Detailed insights into company solvency, payment history, and risk classification.

- Debt collection: Integrated collections and receivables management services.

- Registry integration: Uses official filings but layers them with proprietary scoring models.

- Local expertise: Particularly strong in Germany and German-speaking markets.

- International network: Member of a global alliance of credit agencies, expanding reach beyond Germany.

Strengths vs North Data

- Financial depth: Provides credit scores and payment history, which North Data lacks.

- Practical risk use cases: Goes beyond transparency into actionable credit and risk decisions.

- Update frequency: Continuously updated credit information vs North Data’s quarterly cycle.

- Service scope: Includes debt collection — a feature not offered by registry-only providers.

Limitations

- Geographic bias: Strongest in Germany; less comprehensive in other markets.

- Not built for enrichment or sales: Unlike Global Database or Zephira.ai, it doesn’t provide firmographic data, contacts, or API-first developer access.

- Pricing: Credit reports are typically priced per request and can be more expensive than raw data access.

Verdict: Creditreform is a strong alternative to North Data for organizations that need credit risk assessment and debt collection in Germany or across Europe. It fills North Data’s gap in financial scoring but does not address broader use cases like sales prospecting or global coverage.

SCHUFA

SCHUFA (Schutzgemeinschaft für allgemeine Kreditsicherung) is Germany’s leading credit bureau, best known for its consumer credit scoring, but it also maintains extensive data on businesses. While North Data provides raw registry records, SCHUFA focuses on creditworthiness, financial reliability, and risk scoring, making it a trusted source for banks, leasing companies, and insurers.

Key Features

- Credit scoring: Widely used in Germany for both individuals and companies.

- Risk management: Helps lenders, landlords, and businesses evaluate counterparties.

- Large database: Covers millions of individuals and companies within Germany.

- Registry integration: Combines registry data with financial behavior and payment history.

- Established trust: Considered the default authority for credit checks in Germany.

Strengths vs North Data

- Financial insights: Provides credit scores and payment data, unlike North Data’s raw filings.

- Actionable risk tools: Used directly in lending and leasing decisions, beyond transparency.

- Continuous updates: Credit data updated more frequently than North Data’s quarterly refresh.

- Market dominance: Nearly universal adoption in Germany gives SCHUFA strong local credibility.

Limitations

- Geographic scope: Almost entirely focused on Germany, with little international coverage.

- Limited enrichment: Does not provide broader firmographic data, ownership structures, or sales prospecting features.

- Privacy controversies: Its strong focus on individuals has led to criticism regarding data protection and transparency.

- Not built for integration: Less developer- or API-friendly compared to Zephira.ai or Global Database.

Verdict: SCHUFA is a strong North Data alternative for organizations needing credit risk evaluation in Germany. However, for broader use cases like international KYB, enrichment, or global sales intelligence, its utility is limited compared to competitors.

OpenCorporates

OpenCorporates is the world’s largest open database of companies, with records on more than 200 million entities sourced from official registries worldwide. Its mission is transparency: to make corporate data universally accessible for researchers, journalists, regulators, and compliance professionals. While North Data focuses narrowly on 21 European countries, OpenCorporates offers global breadth — but with major trade-offs in depth, enrichment, and dataset reliability.

Key Features

- Global coverage: 200M+ companies across 140+ jurisdictions.

- Open data model: Much of the dataset is licensed for public or non-commercial use.

- Registry-first: Direct sourcing from government registries.

- Transparency focus: Popular with investigative journalists, NGOs, and regulators.

- API access: Supports programmatic integration with usage tiers.

Strengths vs North Data

- Geography: Global reach vs North Data’s 21 European countries.

- Accessibility: Open data approach makes it more transparent and easier to access for non-commercial users.

- Updates: Some registries updated more frequently than North Data’s quarterly cycle.

- Public trust: Recognized worldwide for transparency and anti-corruption work.

Limitations

- Offline data: Almost half of the dataset is no longer active or regularly maintained, reducing its practical usefulness.

- Data depth: Primarily registry records; lacks financials, firmographics, contact details, or UBO ownership structures.

- Commercial use: Licensing restrictions for businesses, despite the “open” model.

- Consistency: Data quality and completeness vary significantly by jurisdiction.

- Not built for business needs: Lacks enrichment for sales, marketing, or risk analysis.

Verdict: OpenCorporates is a valuable alternative to North Data for transparency and research use cases, but its large proportion of offline data and lack of enrichment make it less reliable for commercial applications. Companies that require live, enriched, and actionable datasets will find more practical value in providers like Global Database, Monetaiq.com, or Bureau van Dijk.

Monetaiq.com

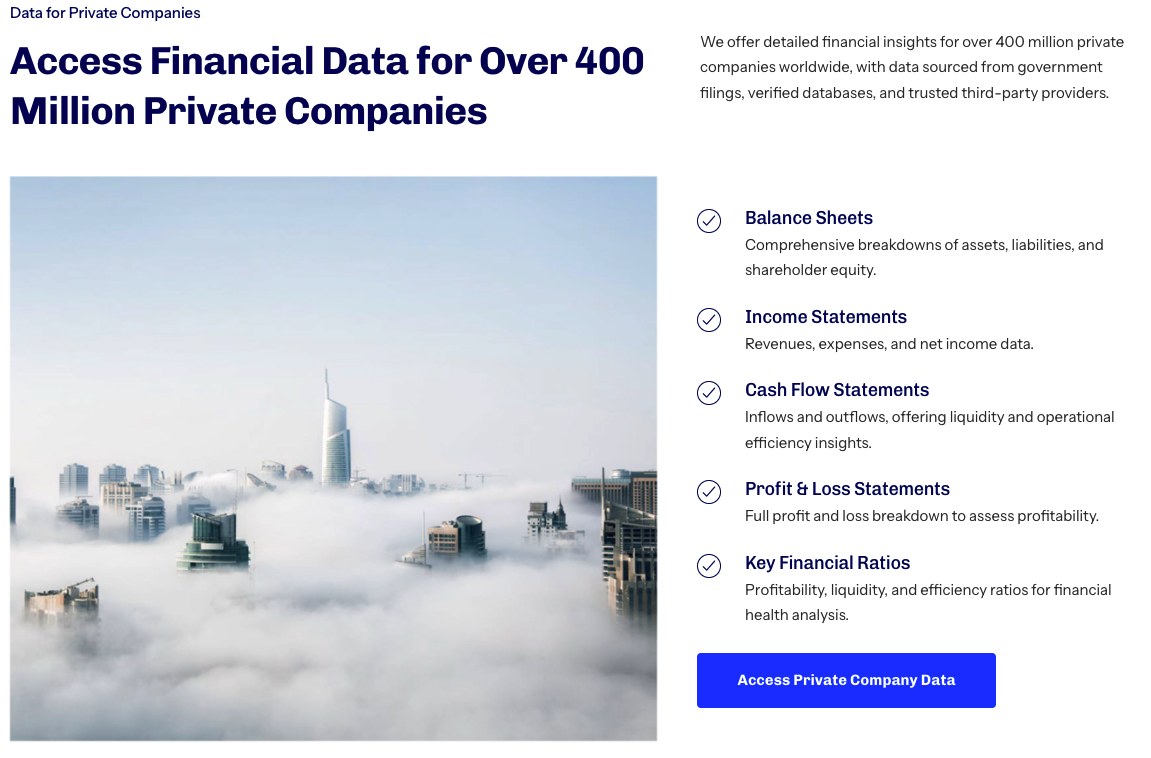

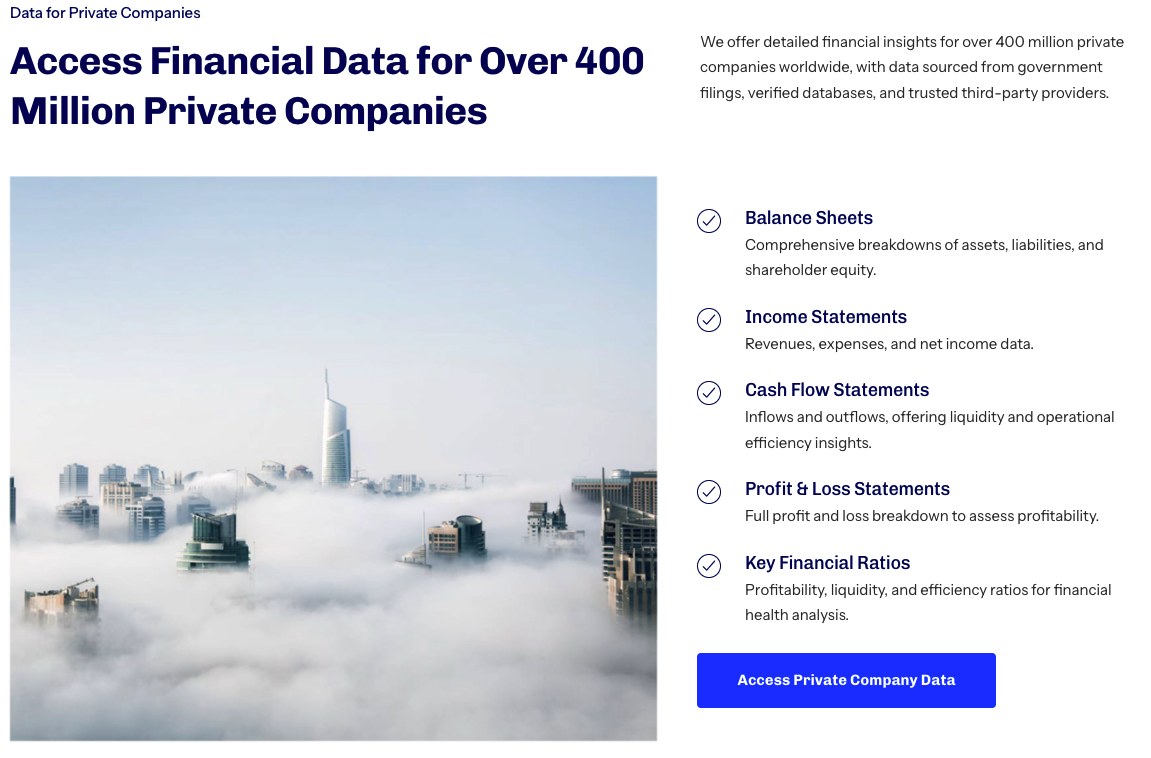

Monetaiq.com is a financial intelligence platform powered by official registry data. While North Data provides raw filings with limited financial availability, Monetaiq.com specializes in deep financial insights, making it particularly valuable for investors, analysts, and risk managers.

Key Features

- Financial data focus: Access to 20+ years of historical company financials across multiple markets.

- Credit scores & limits: Proprietary scoring models that assess company creditworthiness.

- Registry-sourced foundation: Data originates from official filings but is digitized and standardized for analysis.

- Digital insights: Includes website traffic, engagement metrics, and technology usage — areas where North Data offers nothing.

- Delivery options: Available via API, bulk data feeds, or web platform.

Strengths vs North Data

- Financial depth: Digitized and historical financial statements vs limited PDFs.

- Analytics: Credit scoring, ratios, and trend analysis vs raw filing access.

- Digital layer: Adds website traffic and tech stack data, which North Data does not provide.

- Update frequency: Daily refreshes vs quarterly updates.

- Use case breadth: Suitable for investment research, procurement, and risk monitoring.

Limitations

- Specialized scope: Strong on financials and digital insights, but less focused on sales prospecting or contact data.

- Cost: Advanced financial datasets may be more expensive than registry-only providers.

- Regional gaps: While global in intent, coverage strength can vary depending on the country.

Verdict: Monetaiq.com is a strong alternative to North Data for financial analysts, investors, and risk professionals. It directly addresses North Data’s biggest weakness — the absence of digitized financials — while adding a modern layer of digital intelligence. For organizations that need pure financial depth, Monetaiq.com is far more useful than North Data’s basic registry snapshots.

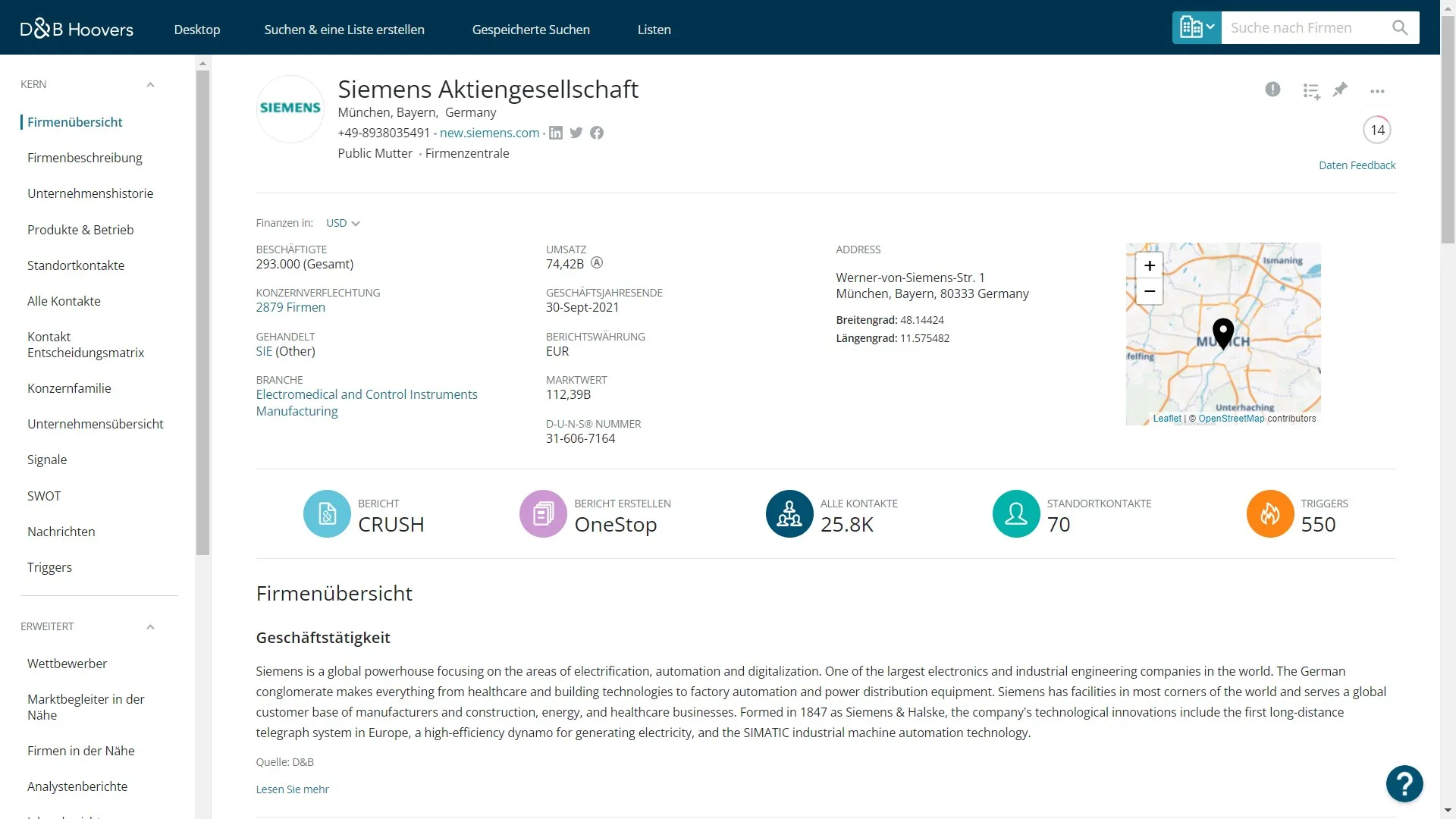

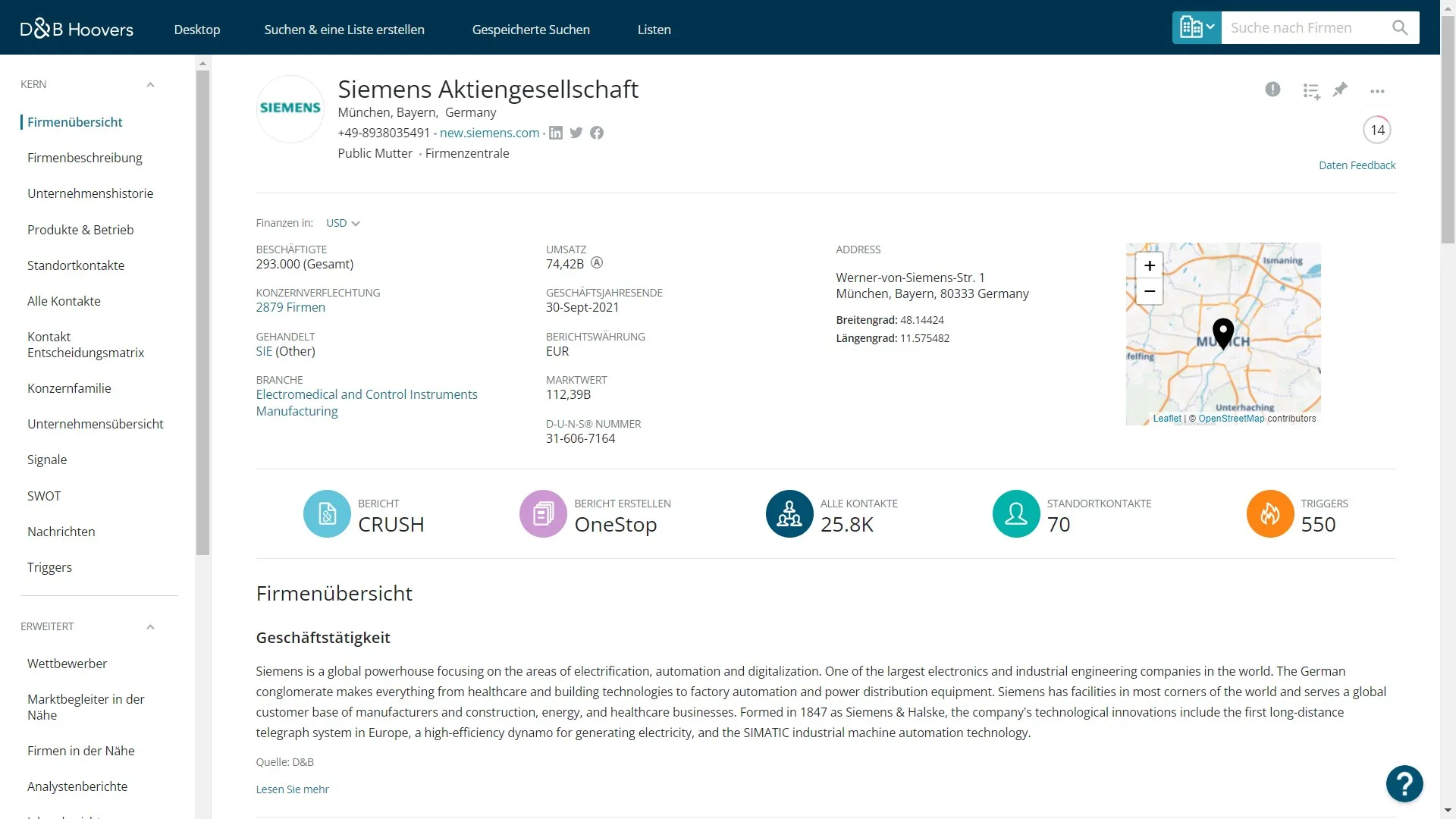

Dun & Bradstreet (D&B)

Dun & Bradstreet (D&B) is one of the largest and most recognized business intelligence providers in the world. Unlike North Data’s narrow focus on raw European registry filings, D&B delivers global, enriched company profiles combined with its proprietary D-U-N-S® Number, which acts as a universal identifier for companies.

Key Features

- Global coverage: Over 500M business records across 200+ countries.

- D-U-N-S® Number: Widely adopted unique identifier for company verification and supply chain risk.

- Data enrichment: Includes firmographics, financials, corporate hierarchies, and beneficial ownership.

- Risk & compliance tools: Solutions for AML, KYC, fraud detection, and third-party risk monitoring.

- Sales & marketing enablement: Used for account-based marketing, prospecting, and CRM enrichment.

- Delivery options: Web platform, API, bulk data feeds, and integrations with major CRMs and ERP systems.

Strengths vs North Data

- Coverage: Global (200+ countries, 500M+ companies) vs Europe-only (21 countries, 78M companies).

- Identifiers: D-U-N-S® Number recognized by regulators and enterprises worldwide.

- Data depth: Enriched profiles with hierarchies, UBOs, and financials vs raw filings only.

- Update frequency: Continuous vs quarterly.

- Breadth of use cases: Covers compliance, risk, supply chain, sales, and marketing.

Limitations

- Cost: Pricing can be high, especially for smaller businesses.

- Transparency: Data sourcing methods are less transparent than registry-focused providers like North Data or OpenCorporates.

- Reseller restrictions: Licensing terms are strict, with limited rights for derivative products.

- Complexity: Broad solutions can be overwhelming for users who only need basic registry data.

Verdict: D&B is a powerful alternative to North Data for enterprises that need global coverage, compliance tools, and sales enablement. However, its cost and restrictive licensing may make it less appealing for smaller firms or partners looking for flexible data resale.

Bureau van Dijk (Moody’s Analytics)

Bureau van Dijk (BvD), a Moody’s Analytics company, is best known for its flagship platform Orbis, which aggregates data on more than 450 million companies worldwide. Where North Data focuses on raw filings from 21 European registries, BvD emphasizes depth, financial detail, and corporate ownership structures, making it a cornerstone for compliance, financial analysis, and M&A research.

Key Features

- Orbis platform: Comprehensive global database with advanced search and analytics tools.

- Coverage: 450M+ companies across nearly every jurisdiction.

- Financial depth: Standardized and digitized financial statements, often with 10–20 years of history.

- Ownership structures: Detailed parent-subsidiary linkages, shareholder breakdowns, and UBO mapping.

- Risk & compliance tools: Screening for AML, sanctions, and politically exposed persons (PEPs).

- Integrations: API access and compatibility with financial institutions’ compliance workflows.

Strengths vs North Data

- Coverage: Truly global vs Europe-only.

- Financial data: Extensive digitized statements vs limited PDFs.

- Ownership depth: Advanced group structures and UBOs vs none.

- Update frequency: Continuous updates vs quarterly refresh.

- Use cases: Compliance, M&A, investment analysis, and credit risk vs mostly research/legal filings.

Limitations

- Cost: Premium pricing, often prohibitive for SMEs.

- Licensing: Strict restrictions on resale and derivative product creation.

- Complexity: Designed for large enterprises; can be overwhelming for smaller users needing simple registry checks.

- Transparency: Aggregates data from multiple sources, not always clear where each dataset originates.

Verdict: Bureau van Dijk is one of the most powerful alternatives to North Data, excelling in financial detail, ownership mapping, and compliance support. However, its high cost and restrictive licensing make it best suited for large enterprises, banks, and consultancies, not for smaller firms or those seeking open, flexible access.

Coface

Coface is best known as one of the world’s largest trade credit insurers, but it also provides business information services. Unlike North Data, which is limited to raw registry filings, Coface combines financial data, credit risk assessments, and insurance-backed insights to help exporters, banks, and multinational corporations manage counterparty risk.

Key Features

- Trade credit insurance: Coverage against customer defaults, backed by in-house risk intelligence.

- Business information reports: Company credit profiles, payment histories, and financial stability assessments.

- Global network: Presence in 100+ countries with access to millions of corporate profiles.

- Registry and beyond: Uses registry filings but layers them with credit insurance data, proprietary scoring, and risk monitoring.

- Risk monitoring: Ongoing tracking of counterparties with early warning indicators.

Strengths vs North Data

- Risk orientation: Actionable credit scoring and insurance coverage vs passive access to filings.

- Global footprint: Data and risk services spanning 100+ countries vs 21 in Europe.

- Financial insights: Standardized reports with solvency and payment history vs limited financial PDFs.

- Continuous updates: Near real-time risk monitoring vs quarterly updates.

- Practical value: Used directly to secure financing and trade insurance.

Limitations

- Niche focus: Strong in credit risk and trade, but not designed for sales prospecting, enrichment, or marketing use cases.

- Cost structure: Reports and insurance-backed services can be more expensive than registry-only providers.

- Transparency: Data sources and scoring methodologies are proprietary, less open than registry-focused providers like North Data or OpenCorporates.

- Licensing: Not positioned as a reseller-friendly data provider.

Verdict: Coface is a strong North Data alternative for exporters, banks, and corporates that prioritize credit risk management and trade insurance. It transforms raw company data into actionable risk insights, filling a gap North Data does not address — but is less useful for organizations seeking enrichment or prospecting capabilities.

Unternehmensregister.de

Unternehmensregister.de is the official German Federal Gazette and Company Register portal. It consolidates legally mandated company disclosures in Germany, offering a single access point for official filings, financial statements, and corporate information.

Key Features

- Official government source: Operated under the mandate of the German Ministry of Justice.

- Comprehensive registry integration: Connects to the Handelsregister (Commercial Register), Genossenschaftsregister (Cooperative Register), and Partnerschaftsregister (Partnership Register).

- Legal disclosures: Publishes annual financial statements, management reports, audit opinions, and other mandatory filings for German companies.

- Document retrieval: Direct access to original filings in PDF or scanned form.

- Search functionality: Basic search by company name, registration number, or location.

Strengths vs CompaniesHouse.de and North Data

- Primary source authority: Unlike aggregators (e.g., North Data, CompaniesHouse.de), it is the official publication platform for German company disclosures.

- Full compliance coverage: Includes all filings required by German law, ensuring no risk of missing mandated documents.

- Free basic access: Many filings can be accessed without charge, making it highly accessible for the public.

Limitations

- Usability: The interface is dated and less user-friendly compared to third-party aggregators.

- Search constraints: Search and filtering options are limited, making bulk research challenging.

- Raw data only: Provides filings as unprocessed documents (mostly PDFs), with no enrichment such as revenue/employee estimates, industry tags, or digital insights.

- No API or integrations: Designed for manual legal/compliance use rather than automated data consumption.

- German language only: Content and interface are primarily in German, which can be a barrier for international users.

Verdict: Unternehmensregister.de is the most authoritative and legally binding source of German company information, essential for compliance officers, auditors, and legal professionals who need official, unaltered filings. However, its lack of enrichment, modern search features, and automation support makes it less practical for business intelligence, sales, or global data enrichment compared to providers like North Data or Global Database.

Use Cases & Best Fit Scenarios

1. Compliance & KYB (Know Your Business)

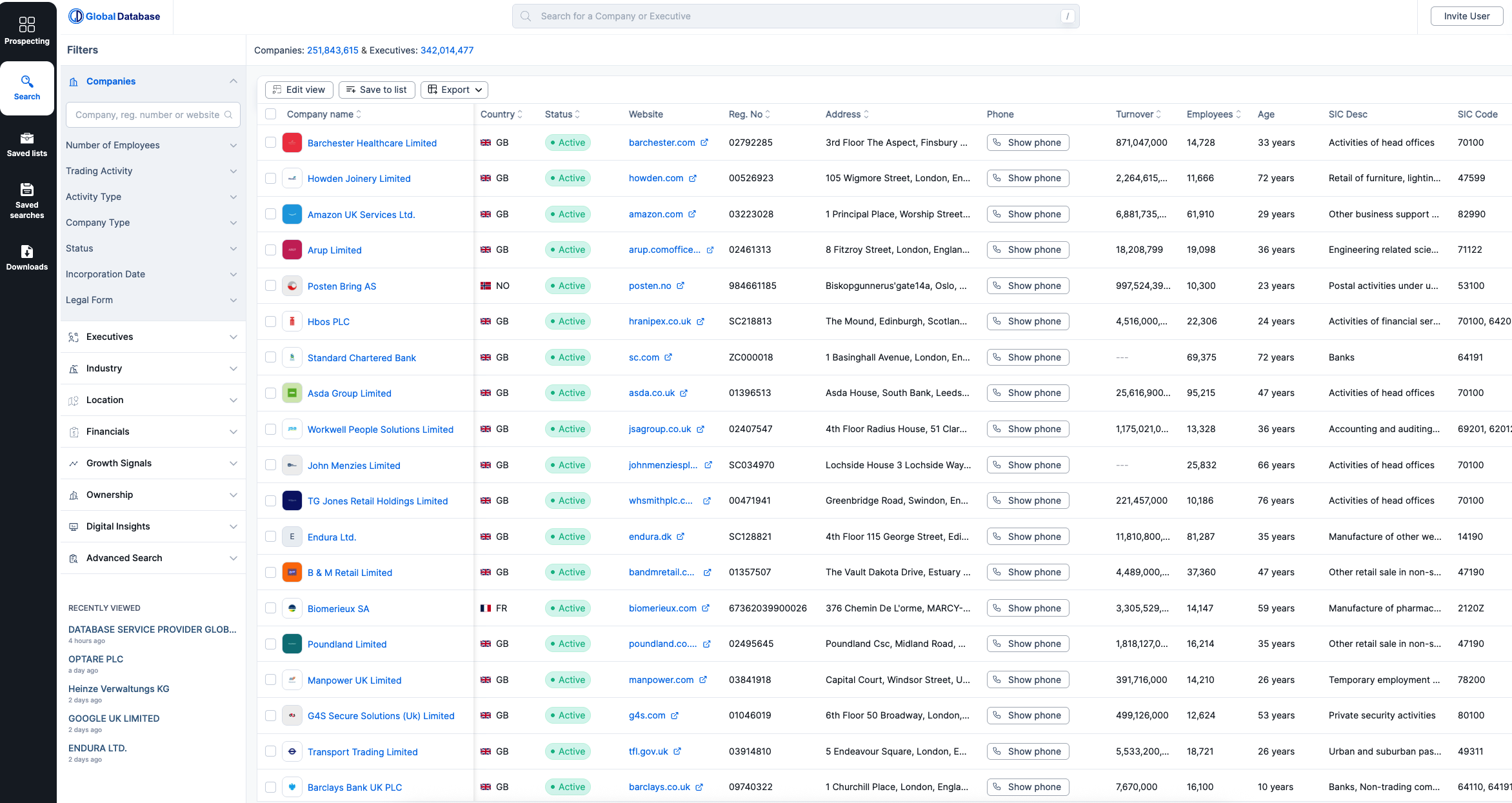

- Best Alternatives: Global Database, Zephira.ai, Bureau van Dijk (Moody’s)

- Why: These providers combine registry-sourced authenticity with ownership structures, UBO mapping, and AML/PEP screening. They also refresh data daily, unlike North Data’s quarterly updates.

- When to avoid North Data: If you need real-time KYB checks across multiple countries, North Data’s European-only and raw data approach is insufficient.

2. Credit Risk & Financial Reliability

- Best Alternatives: Creditreform, SCHUFA, Coface, Dun & Bradstreet

- Why: These companies specialize in credit scoring, payment histories, and trade risk insurance. They provide actionable insights rather than just filings.

- When to avoid North Data: If you need credit scoring or default risk predictions, as North Data doesn’t digitize financials or provide solvency analysis.

3. Financial & Investment Analysis

- Best Alternatives: Monetaiq.com, Bureau van Dijk, Global Database

- Why: These platforms digitize and standardize financial statements, offer historical trend data, and enrich with ratios and credit models.

- When to avoid North Data: If you need structured financial data for valuation, risk modeling, or procurement analysis, as PDFs alone create bottlenecks.

4. Sales Prospecting & Marketing Enrichment

- Best Alternatives: Global Database, Dun & Bradstreet

- Why: They enrich registry data with firmographics, contact information, and CRM integrations, enabling sales teams to target accounts and decision-makers.

- When to avoid North Data: If your goal is lead generation, CRM enrichment, or account-based marketing, since North Data has no contact or firmographic data.

5. Transparency & Research

- Best Alternatives: OpenCorporates, CompaniesHouse.de

- Why: They provide raw or open access to registry data, often with fewer barriers for researchers, NGOs, or journalists.

- When North Data works: For legal filings in Europe where raw registry documents are enough.

- When to avoid North Data: If you need global transparency (OpenCorporates) or deep access to one jurisdiction like Germany (CompaniesHouse.de).

Bottom line:

- Use North Data only if you want unaltered registry filings in Europe.

- For business growth, compliance, or risk use cases, competitors like Global Database, Zephira.ai, Creditreform, Monetaiq.com, and Bureau van Dijk are stronger choices.

Conclusion

North Data plays an important role in the European business data ecosystem by providing direct, registry-verified filings. For legal research, journalism, or transparency projects focused on Europe, its unaltered and trustworthy raw data is useful. However, its limited coverage (21 countries), lack of enrichment, quarterly updates, and absence of financial digitization or reseller rights mean it cannot meet the demands of most modern business use cases.

The competitive landscape shows clear alternatives:

- Global Database and Zephira.ai deliver global registry coverage, daily updates, UBO mapping, and enriched intelligence, making them ideal for compliance, KYB, and sales enrichment.

- Creditreform, SCHUFA, and Coface excel in credit scoring, trade risk, and financial reliability, areas where North Data offers nothing beyond filings.

- Monetaiq.com and Bureau van Dijk (Moody’s) provide deep financial data and analytics, critical for investment and procurement teams.

- Dun & Bradstreet stands out as a broad, enterprise-grade provider for global sales and compliance workflows.

- OpenCorporates and CompaniesHouse.de remain valuable for transparency and single-country registry access, though they share North Data’s limitations of raw, unenriched data.

Takeaway:

If your organization needs basic registry transparency in Europe, North Data still has value. But if you require global coverage, enriched datasets, financial depth, or actionable insights, one of the ten alternatives is almost certainly a better fit. The right choice depends on whether your priority is compliance, credit risk, financial analysis, sales prospecting, or transparency.