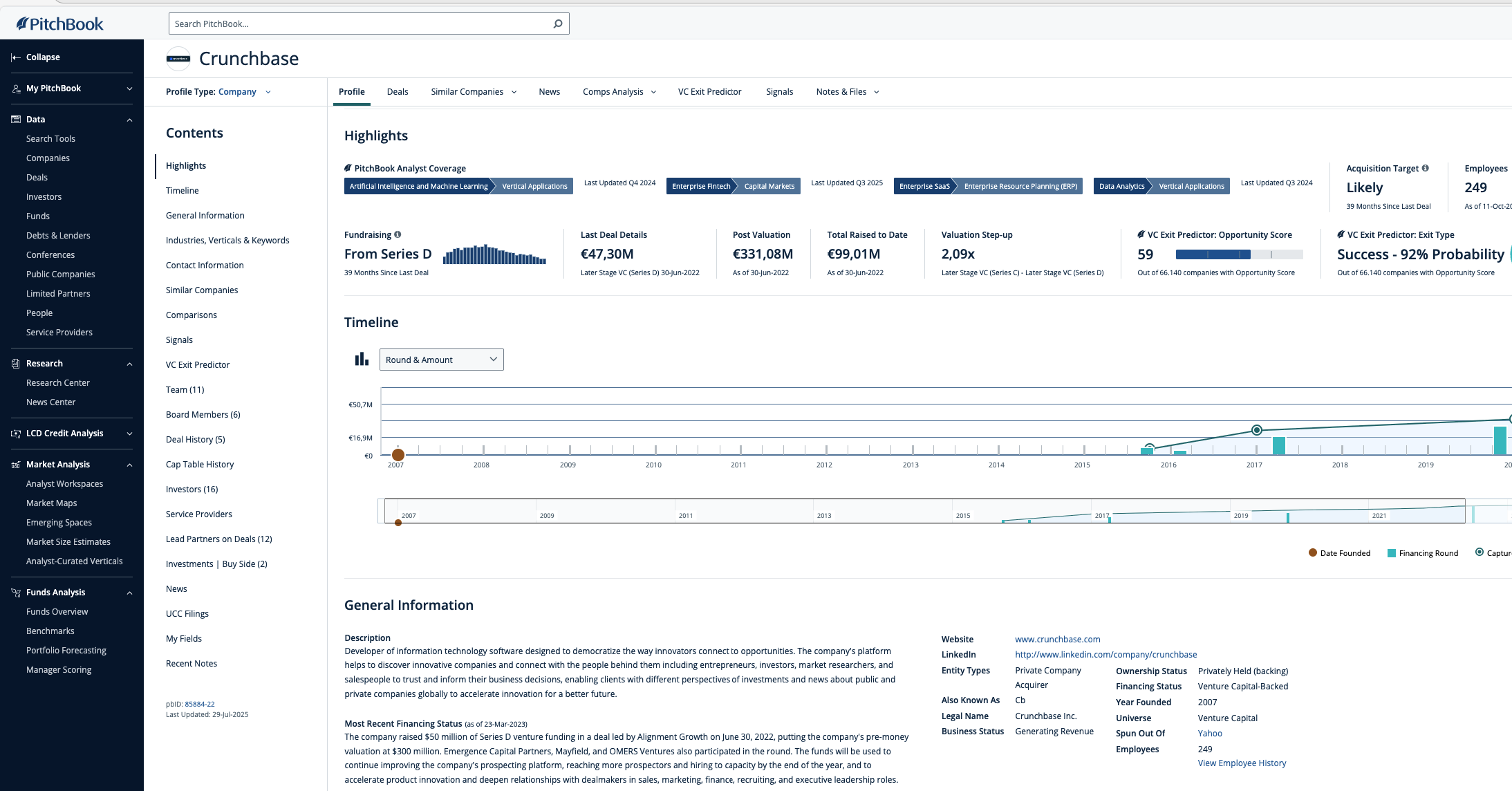

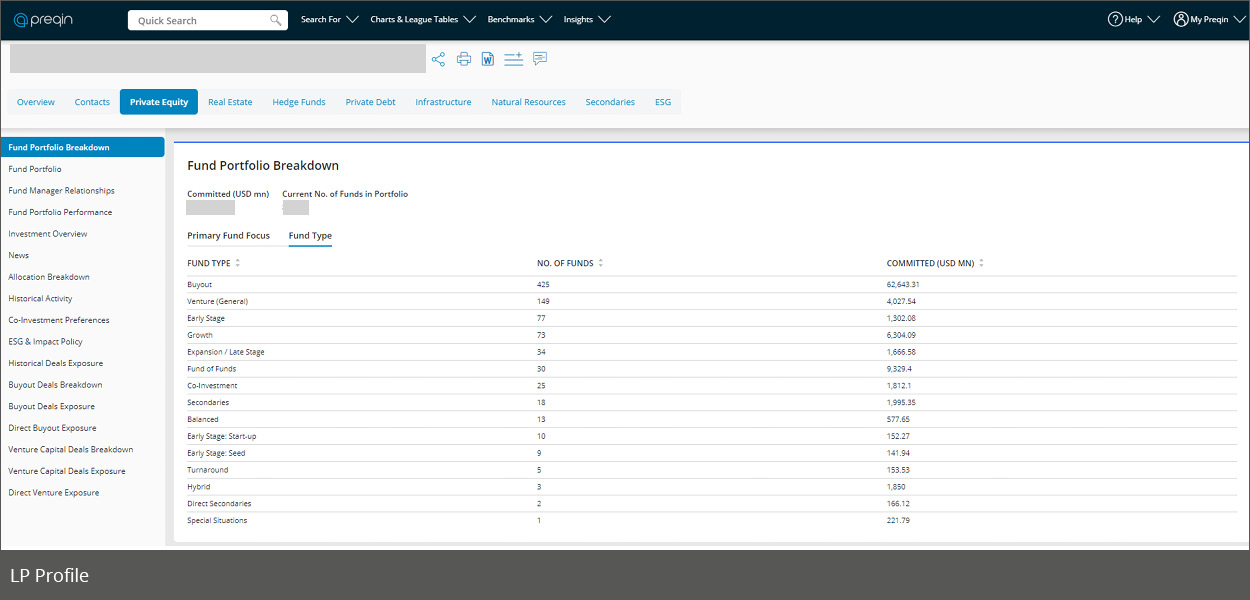

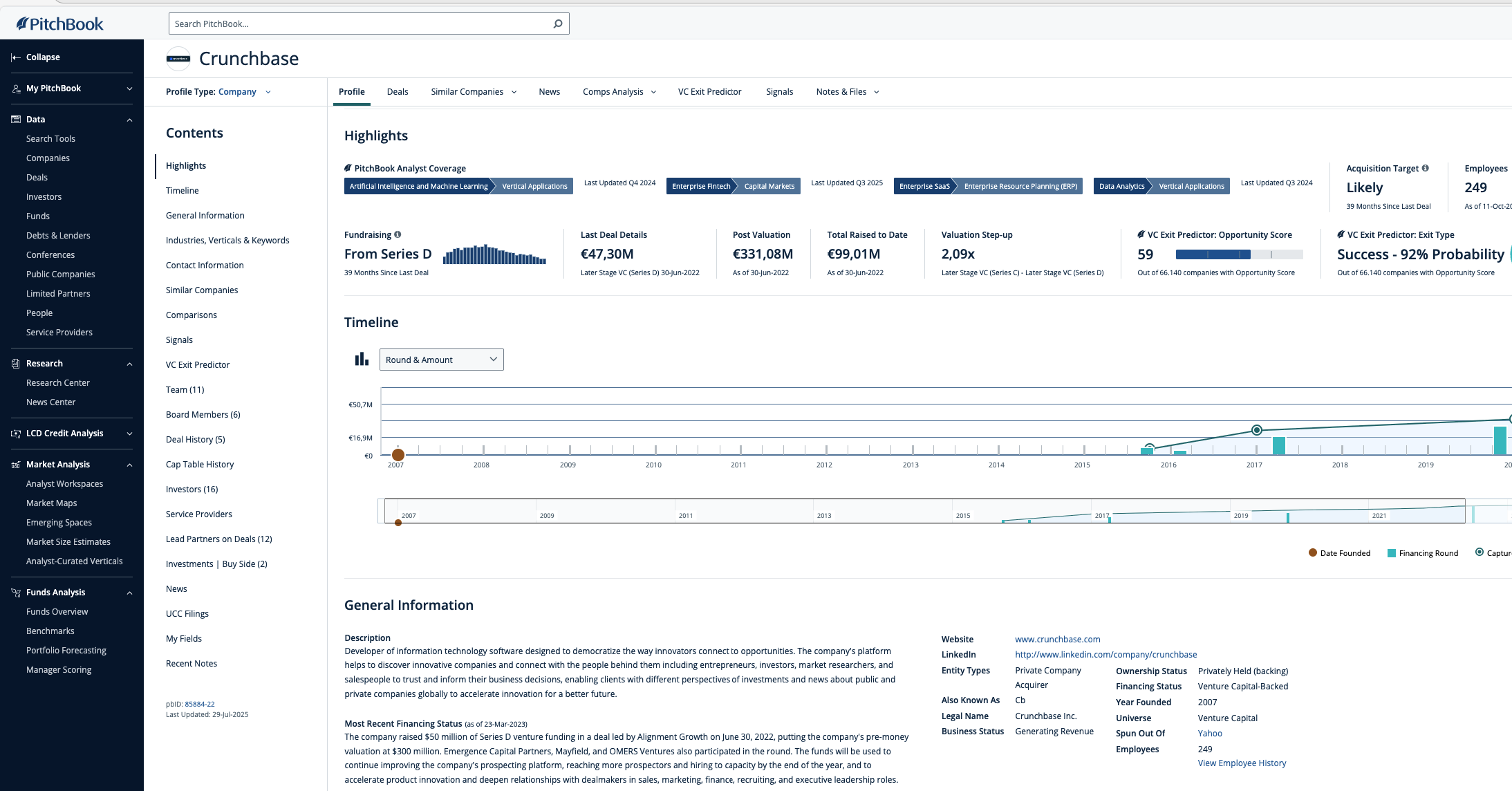

2. PitchBook

Best for: Venture capital, private equity, and M&A intelligence

PitchBook is one of the most respected platforms for tracking venture capital, private equity, and M&A activity worldwide. It delivers extensive insights into company valuations, investor portfolios, and transaction details, making it a preferred tool for institutional investors, analysts, and corporate finance teams.

However, while PitchBook offers exceptional deal-level transparency, its database includes roughly 8 million companies, focusing primarily on funded or investment-related entities. This means it does not provide visibility into the hundreds of millions of smaller or non-funded companies that operate outside the venture ecosystem. Additionally, financial data is generally available only for companies that have raised funding, limiting its use for full-market visibility.

Key Features

- Comprehensive Deal Tracking — Covers funding rounds, acquisitions, IPOs, and valuations across global private markets.

- Fund Performance Analytics — Includes data on venture capital and private equity fund performance, LP commitments, and portfolio returns.

- Valuation & Multiple Analysis — Historical data on revenue, EBITDA, and valuation metrics for funded companies.

- Investor Networks — Maps relationships among investors, founders, and portfolio companies for deeper market insight.

- Market Benchmarking — Allows sector, stage, and geography-based comparisons to identify investment trends and competitive dynamics.

Why It’s a Strong Alternative to Crunchbase

PitchBook offers a financially validated, investor-focused alternative to Crunchbase, ideal for professionals who need accurate funding histories, valuation data, and deal-level intelligence.

While Crunchbase provides broad startup coverage, PitchBook goes much deeper into the financial and transactional details of funded companies, offering far more rigorous data on investors and capital movement. That said, its focus on venture and private equity markets means it does not capture the full spectrum of active registered businesses—especially private companies with no fundraising history.

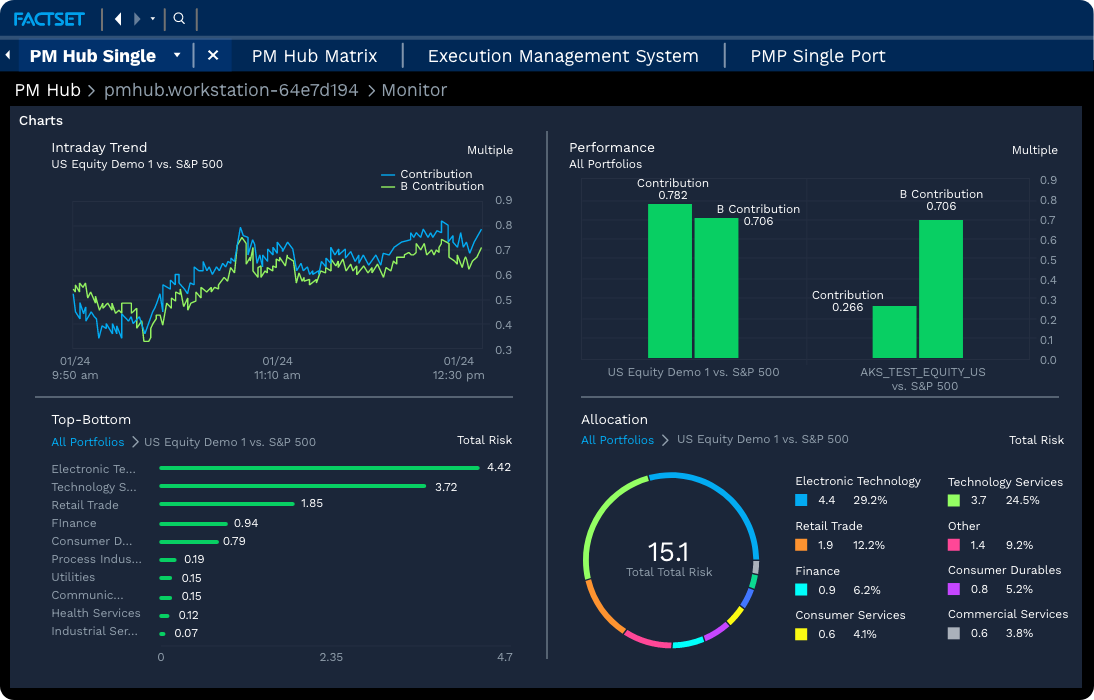

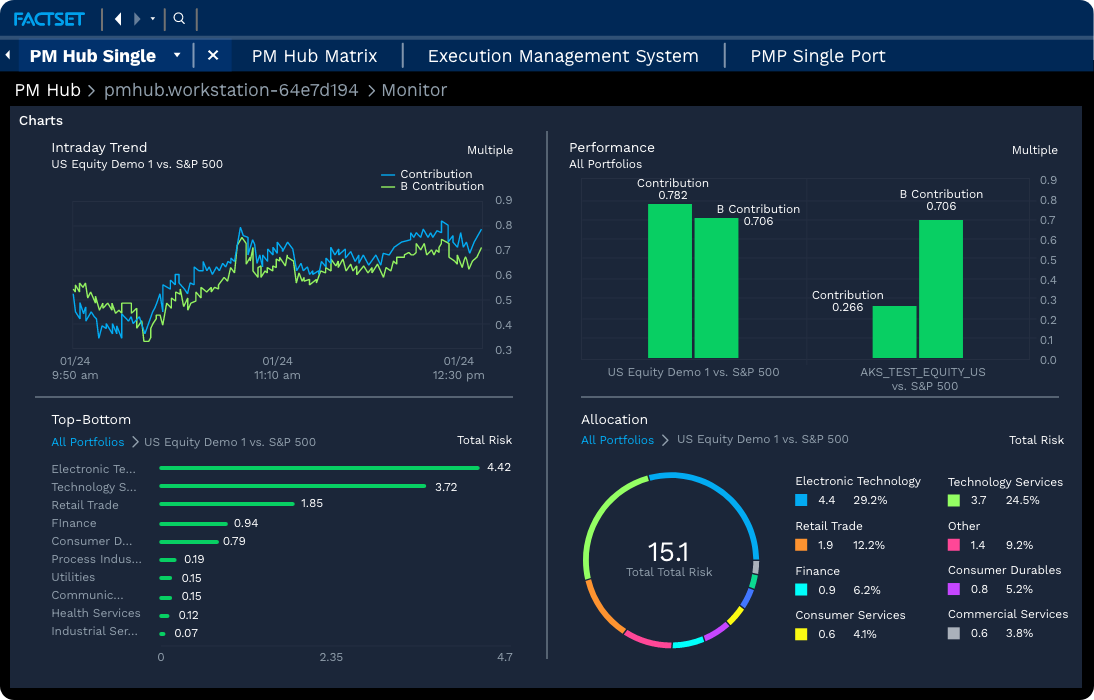

3. FactSet

Best for: Public market data, financial analytics, and institutional investment research

FactSet is a global leader in financial data and analytics, widely used by banks, asset managers, and institutional investors to evaluate markets, portfolios, and listed companies. The platform provides a powerful combination of real-time market data, research tools, and financial modeling capabilities, integrating seamlessly into workflows for analysts and portfolio managers.

Unlike Crunchbase, which focuses on startups and funding activity, FactSet specializes in public companies—offering deep insights into financial statements, stock performance, earnings forecasts, and industry benchmarking. However, it has limited visibility into private or early-stage companies, making it less suitable for users seeking startup or small business data.

Key Features

- Comprehensive Public Company Coverage — Financials, ratios, and earnings data for millions of listed companies worldwide.

- Market & Portfolio Analytics — Real-time equity, fixed-income, and derivatives data with advanced charting and modeling tools.

- Research Integration — Combines data with in-house and third-party research reports for institutional-grade analysis.

- Screening & Valuation Tools — Build and test custom investment strategies using financial and performance indicators.

- Workflow Integration — Deep integration with Excel, Power BI, and proprietary portfolio management systems.

Why It’s a Strong Alternative to Crunchbase

FactSet serves a very different audience than Crunchbase — one that needs audited financial data and market intelligence rather than startup deal tracking. For investors and institutions focused on listed companies, portfolio analysis, or financial modeling, FactSet provides unmatched data accuracy and analytical depth.

However, its coverage is heavily skewed toward public companies. Private company information, when available, is often limited to basic identifiers and sparse financial data. As such, FactSet is best suited for users operating in the public markets and institutional finance space, rather than those looking for comprehensive private company visibility.

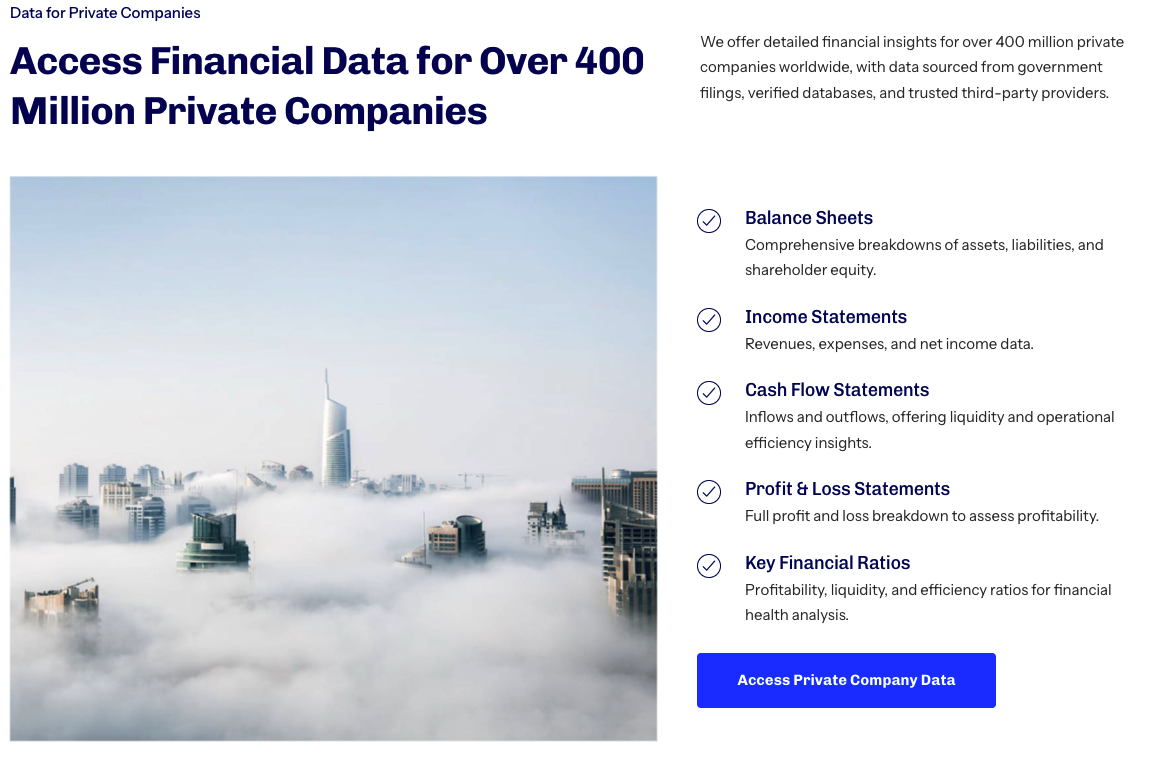

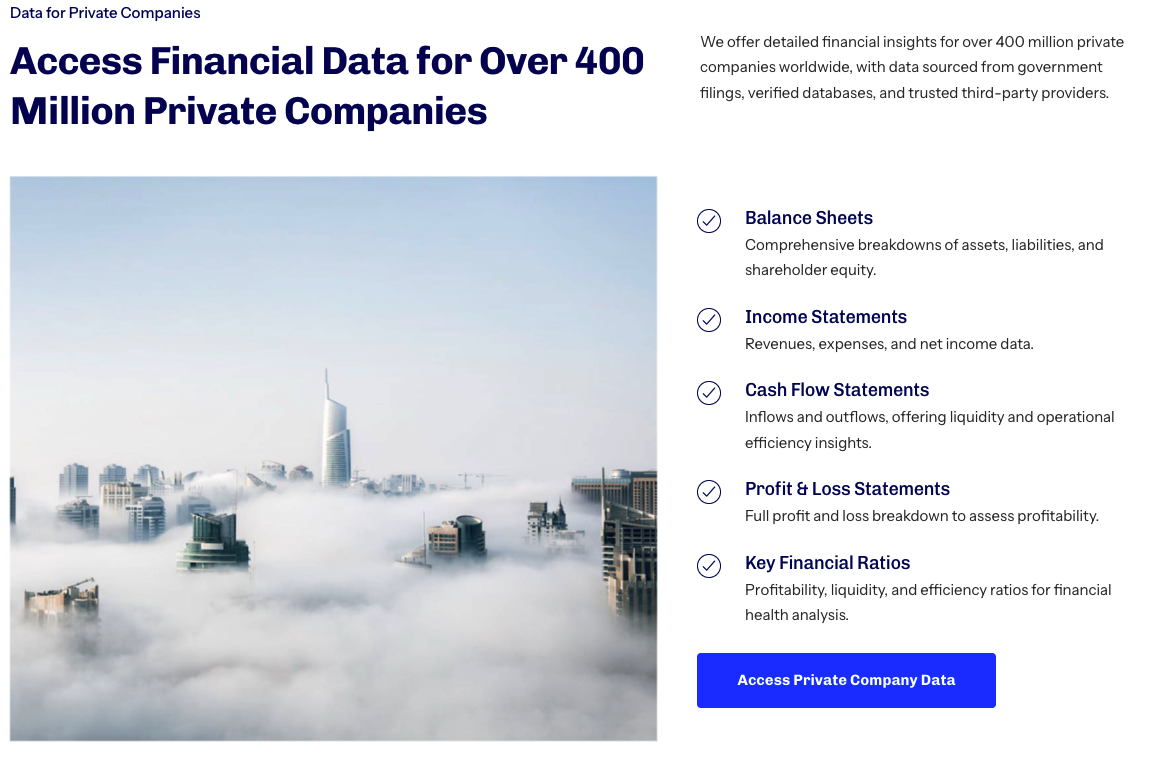

4. Monetaiq.com

Best for: Financial intelligence powered by registry data and historical performance analysis

Monetaiq.com is a next-generation financial data platform built on registry-sourced and verified company information. Unlike Crunchbase, which focuses mainly on startup activity and funding events, Monetaiq.com provides in-depth financial transparency across both private and public companies, helping users understand long-term business performance rather than short-term funding news.

What sets Monetaiq.com apart is its focus on official financial statements, digitized and standardized using AI and OCR technology. The platform offers over 20 years of historical balance sheets, profit and loss statements, and cash flow data, giving professionals a detailed view of each company’s financial trajectory.

Key Features

- Registry-Sourced Financials — All data originates from official government and registry filings, ensuring complete accuracy.

- 20+ Years of Historical Data — Detailed financial records allow long-term trend analysis for private and public companies.

- Standardized Financial Metrics — Revenue, EBITDA, margins, ratios, and growth indicators are harmonized for cross-country comparison.

- Digital Insights — Includes website analytics, estimated traffic, and engagement data to gauge a company’s online visibility and growth.

- Valuation and Risk Indicators — Derived from financial ratios and performance metrics, helping analysts assess company stability.

Why It’s a Strong Alternative to Crunchbase

Monetaiq.com bridges a major gap left by Crunchbase and traditional financial platforms. While Crunchbase shows who raised capital, Monetaiq.com shows how companies actually perform financially — regardless of whether they’ve received funding.

By sourcing directly from official filings, it ensures that data is audited, standardized, and compliant, covering both established enterprises and newly registered firms. Its blend of financial depth and digital engagement metrics provides a more holistic view of company health and market presence, something few other platforms deliver.

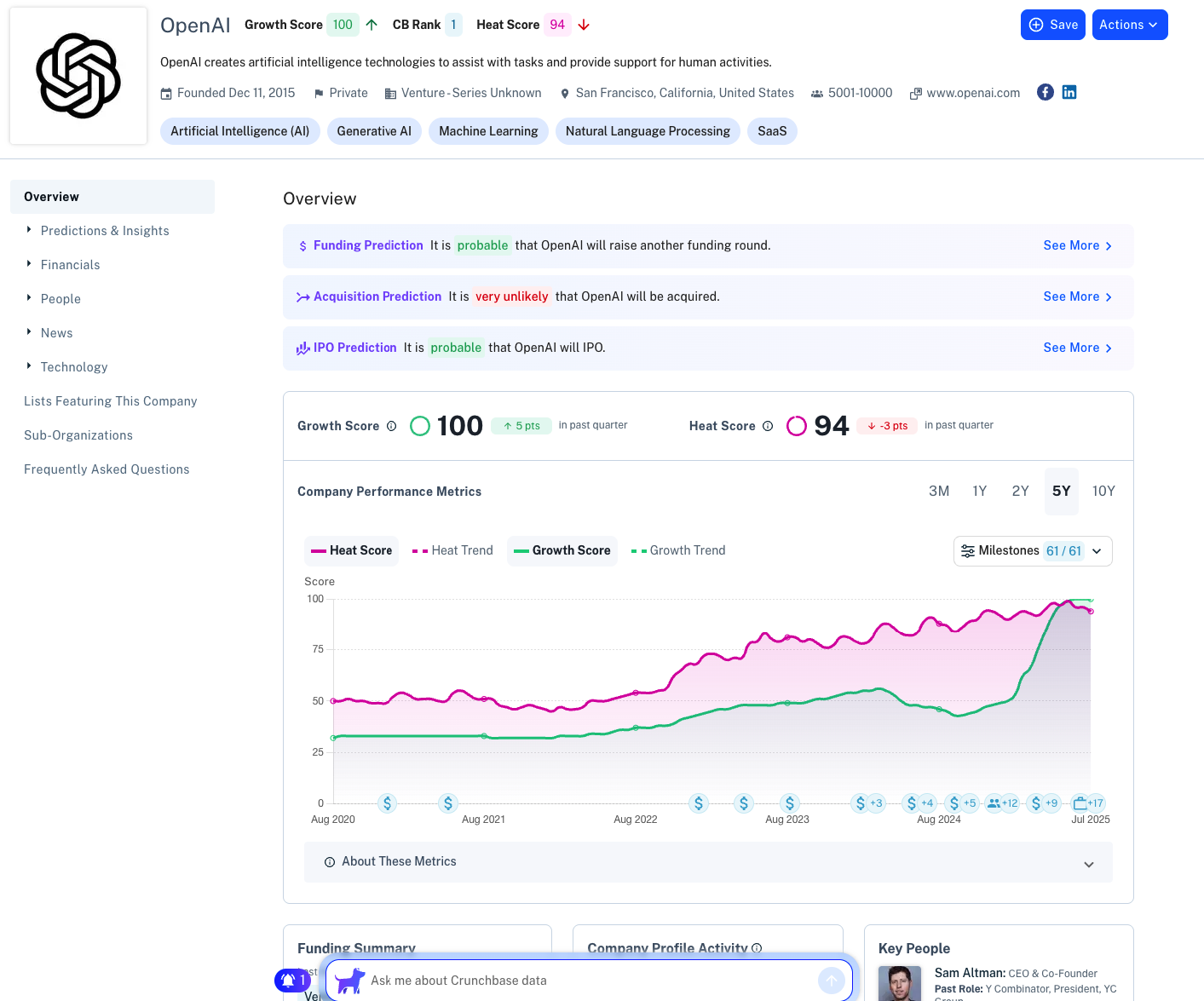

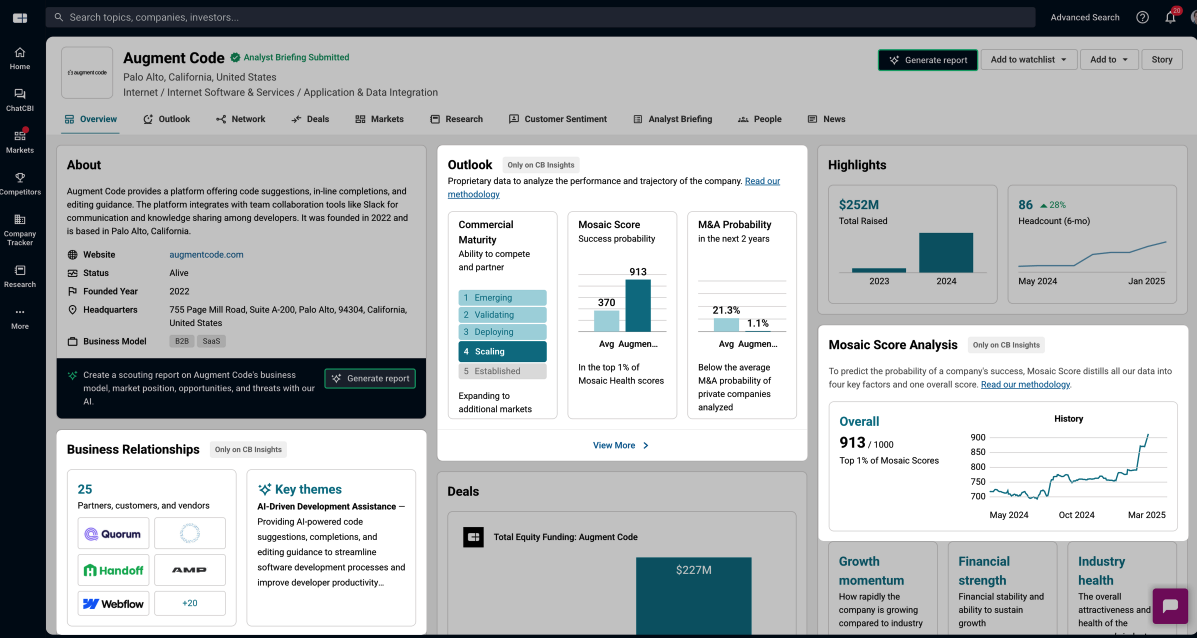

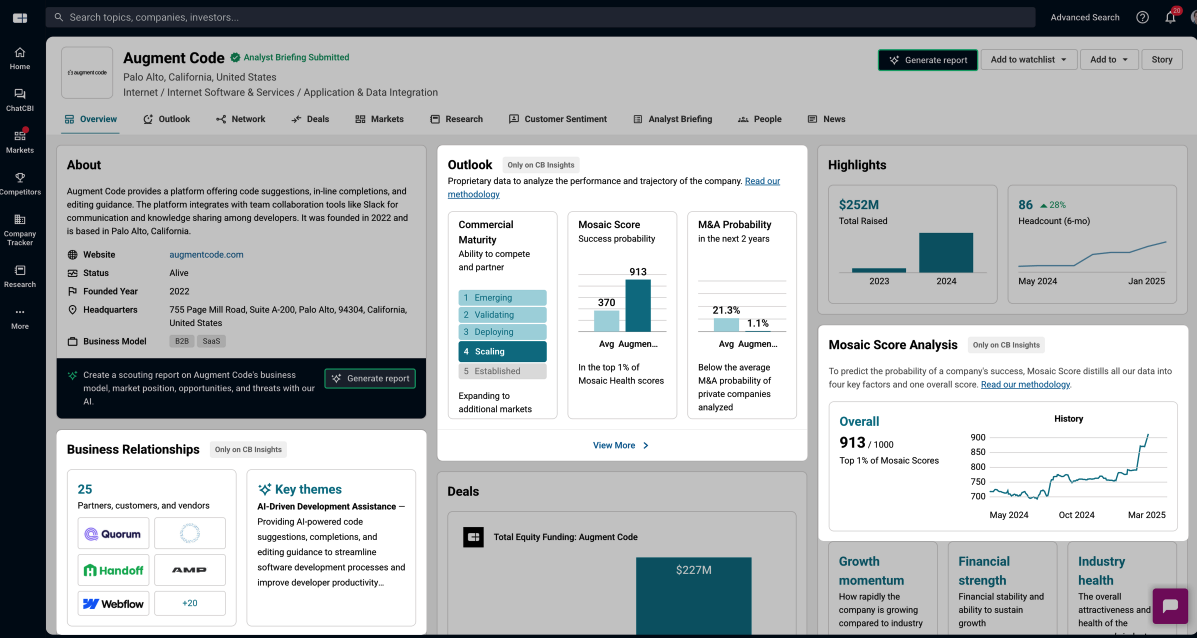

5. CB Insights

Best for: Innovation mapping, startup intelligence, and market trend forecasting

CB Insights is a market intelligence platform that specializes in tracking emerging technologies, venture capital activity, and private company performance. It uses a combination of machine learning and data science to analyze millions of data points from patents, investments, partnerships, and news sources, helping users identify industry shifts before they happen.

While Crunchbase provides visibility into who raised funding, CB Insights goes further by analyzing why and how those investments signal broader market trends. Its research-driven platform is widely used by corporate strategy teams, investors, and analysts to uncover innovation clusters and disruptive startups.

Key Features

- Innovation and Trend Analysis — Identifies emerging technologies, sectors, and business models gaining traction globally.

- Startup and Investor Tracking — Covers private company funding rounds, valuations, and competitive landscapes.

- Patent, Partnership, and M&A Data — Offers insight into strategic movements and market positioning.

- Market Maps and Benchmarking Tools — Visualize competitive ecosystems and evaluate companies by category and size.

- Predictive Intelligence — Uses AI to forecast industry changes, investment momentum, and potential acquisition targets.

Why It’s a Strong Alternative to Crunchbase

CB Insights focuses on analyzing innovation, not just listing it.

While Crunchbase offers a broad but largely user-driven database of startups, CB Insights provides a data science–based understanding of emerging markets and technological disruption. Its strength lies in connecting investment activity with macro trends — giving users strategic foresight rather than just transactional visibility.

That said, CB Insights is less focused on smaller or newly registered companies without measurable innovation activity. For users seeking comprehensive business registry coverage or full-company visibility, platforms like Global Database or Monetaiq.com complement CB Insights’ analytical depth.

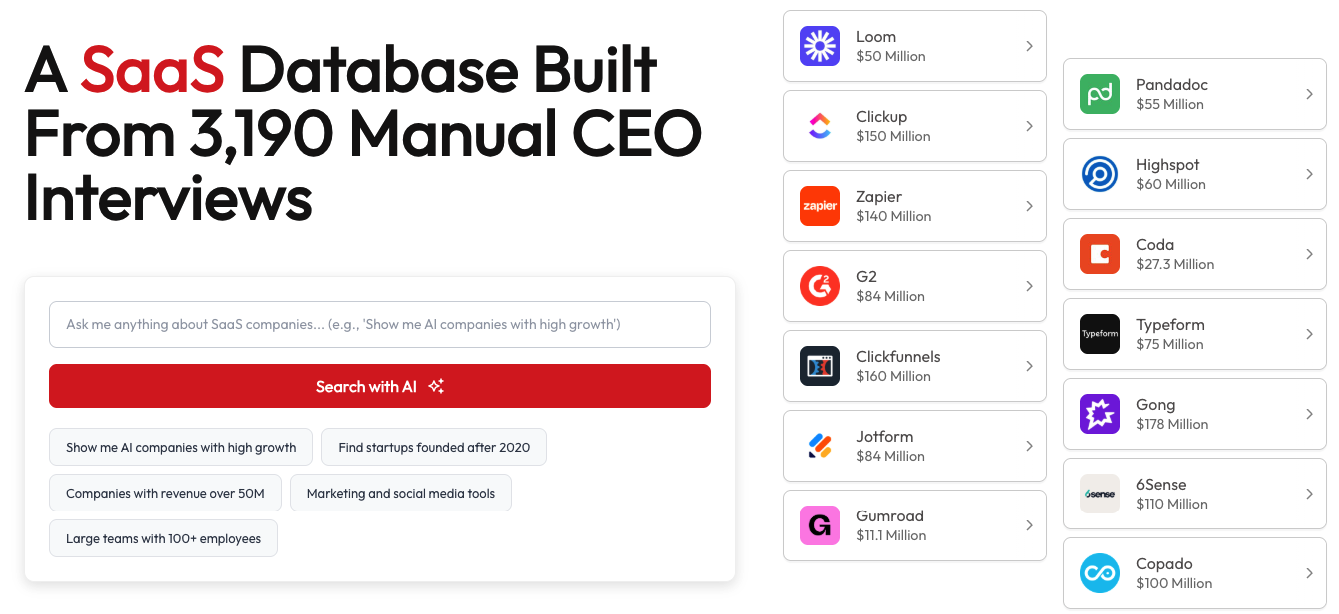

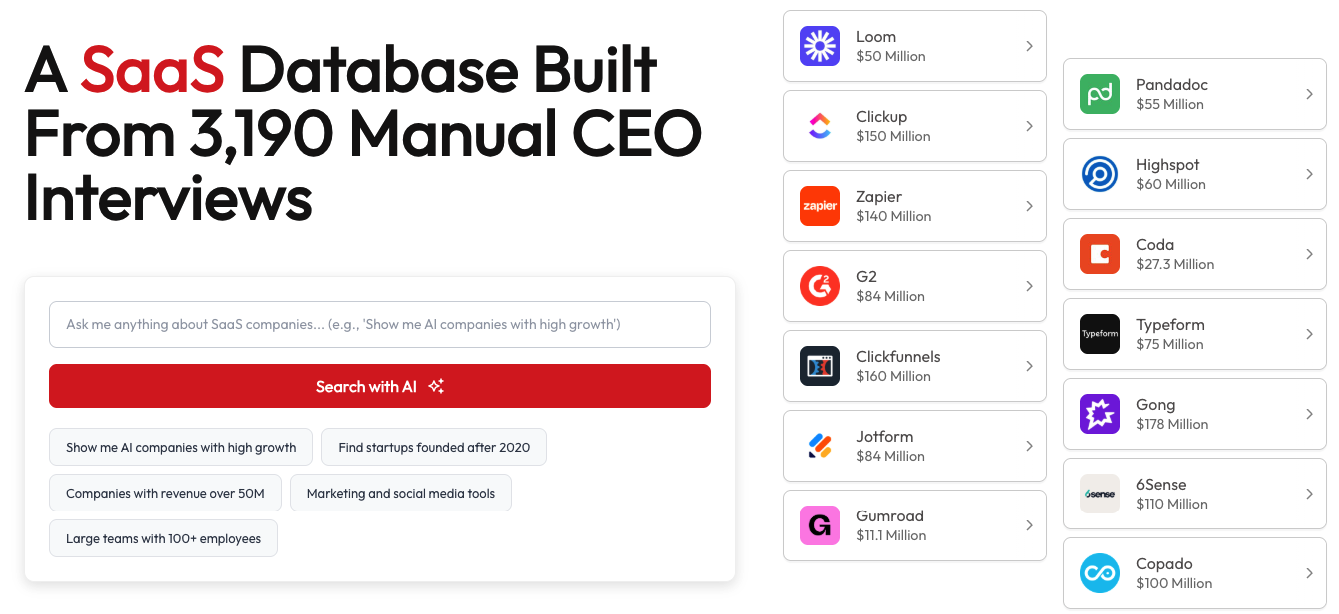

6. GetLatka.com

Best for: SaaS company benchmarks, founder insights, and recurring revenue data

GetLatka.com is a specialized database focused exclusively on SaaS (Software as a Service) companies, providing detailed insights into revenue, growth, and performance metrics. Created by entrepreneur and investor Nathan Latka, the platform gathers data directly from founder interviews, surveys, and verified public disclosures, making it a transparent and community-driven alternative to traditional data providers.

Unlike Crunchbase, which highlights funding activity and general company overviews, GetLatka.com focuses on operational metrics — including ARR (Annual Recurring Revenue), customer churn, growth rate, and profitability. It’s particularly valuable for investors, analysts, and founders who want to benchmark SaaS businesses based on real financial performance rather than reported funding rounds.

Key Features

- SaaS-Focused Dataset — Covers over 30,000 subscription-based companies across B2B, fintech, and vertical SaaS categories.

- Verified Financial Metrics — Includes ARR, MRR, churn rate, CAC, LTV, funding raised, and headcount growth.

- Founder Interviews & Transparency — Many profiles include self-reported data verified through public appearances or investor filings.

- Benchmarking Tools — Compare SaaS performance by revenue range, sector, or geography.

- Public Leaderboards — Identify top-performing SaaS businesses by growth rate, valuation, or profitability.

Why It’s a Strong Alternative to Crunchbase

While Crunchbase provides high-level startup data across all industries, GetLatka.com dives deeper into one of the fastest-growing sectors — SaaS. Its focus on recurring revenue models makes it invaluable for investors and operators who care more about sustainable growth, retention, and margins than fundraising events.

However, because GetLatka.com relies primarily on founder-reported data and voluntary disclosure, its coverage is limited compared to larger datasets. It’s best seen as a specialized performance benchmarking tool rather than a full-scale business intelligence platform.

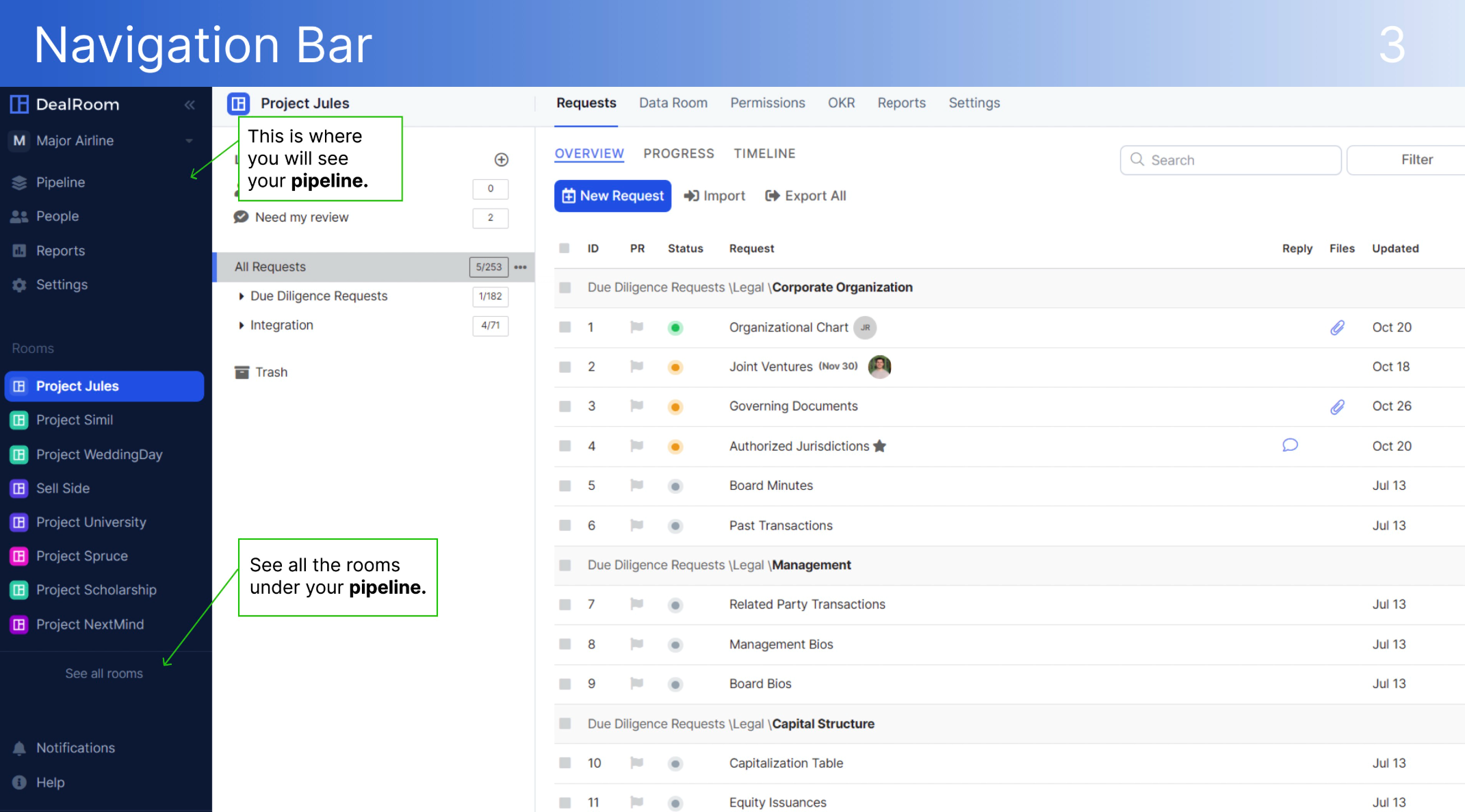

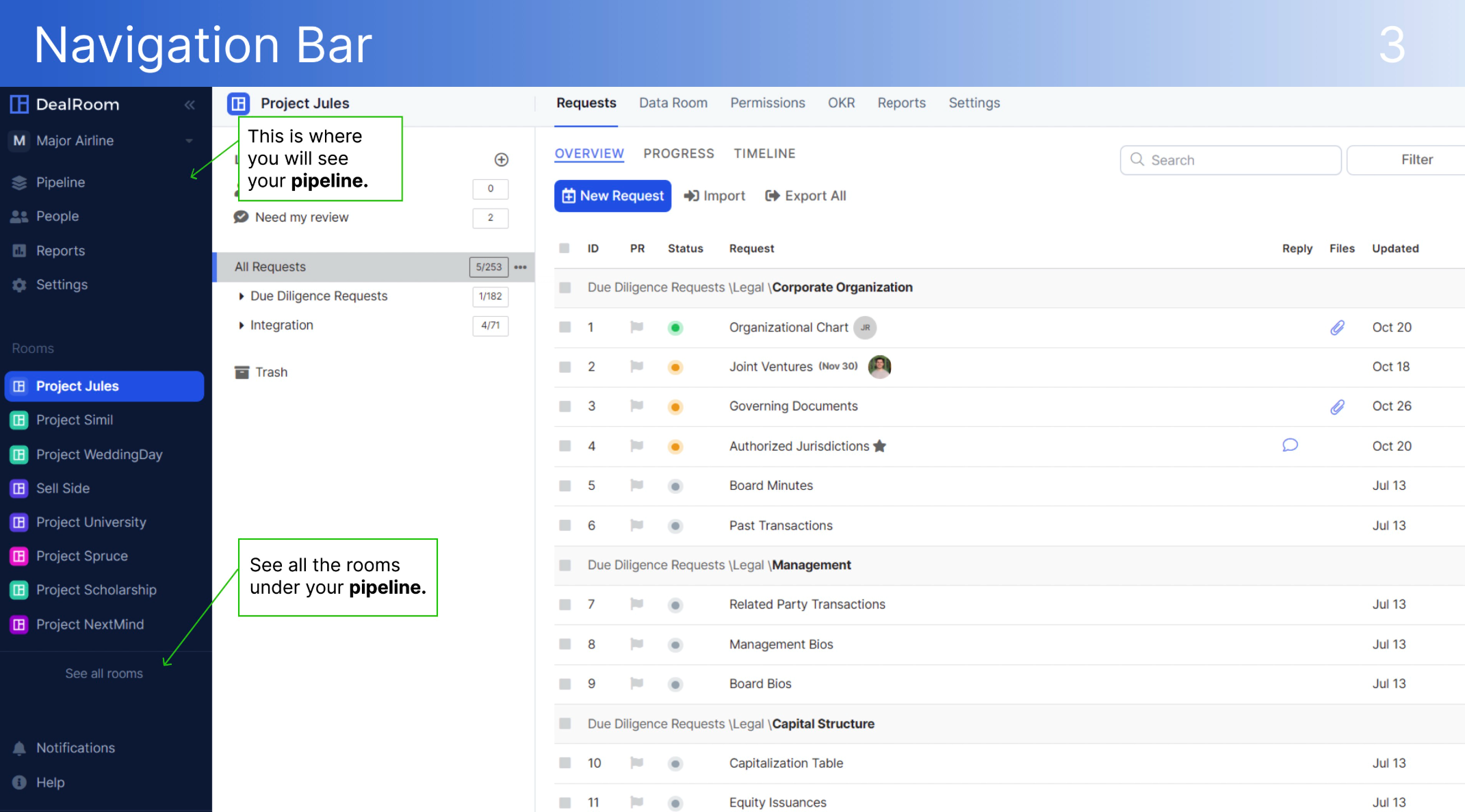

7. Dealroom

Best for: European startup ecosystems, innovation mapping, and government-backed data partnerships

Dealroom is one of Europe’s leading platforms for tracking startups, scaleups, and innovation ecosystems. Founded in Amsterdam, it has built a strong reputation for its verified and curated data model, developed in close collaboration with governments, investment agencies, and accelerators across Europe and beyond.

While Crunchbase relies on global crowdsourced contributions, Dealroom focuses on data quality and verified local partnerships, giving it a unique edge in European markets. Its platform provides structured insights into funding rounds, valuations, investor activity, and industry innovation clusters, particularly within the EMEA region.

Key Features

- Verified European Data — Coverage of over 2 million companies across Europe, including startups, scaleups, and innovation hubs.

- Ecosystem Mapping — Visualizes local startup scenes, accelerators, and funding networks in collaboration with regional governments.

- Investor and Funding Insights — Tracks venture rounds, valuations, and exits across early to late stages.

- Industry and Trend Analysis — Monitors sectors like fintech, biotech, and sustainability to identify emerging leaders.

- API and Custom Dashboards — Provides enterprise clients with data integration and analytical tools for research and policy analysis.

Why It’s a Strong Alternative to Crunchbase

Dealroom offers a more curated and locally verified perspective compared to Crunchbase’s global, user-driven model. Its partnerships with European governments and institutions ensure higher data integrity and regional accuracy, particularly for innovation and startup monitoring within Europe.

However, Dealroom’s scope is geographically limited, with most of its depth concentrated in Europe and select global tech hubs. It does not provide full worldwide registry coverage or deep financial histories for non-funded companies, which makes it best suited for users focused on European ecosystems and early-stage venture activity.

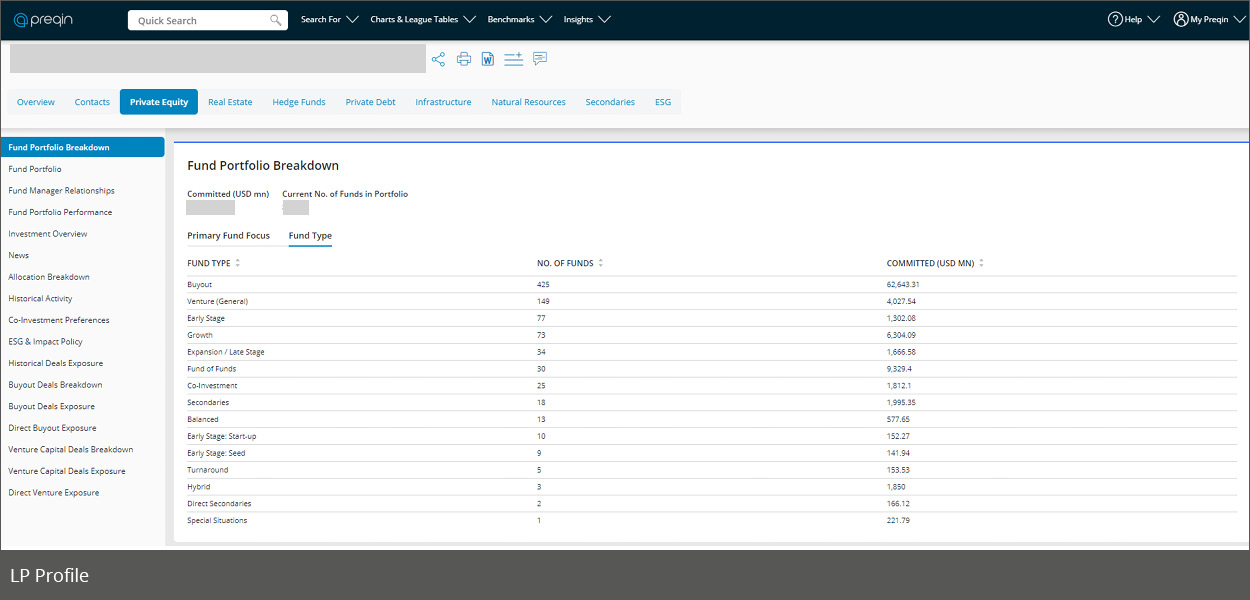

8. Preqin

Best for: Alternative assets, private markets, and institutional investment intelligence

Preqin is one of the world’s leading sources of data and insights on alternative assets, including private equity, venture capital, hedge funds, real estate, infrastructure, and private debt. Trusted by institutional investors and fund managers, it provides visibility into fund performance, investor mandates, and capital allocation trends across the global private markets ecosystem.

Unlike Crunchbase, which focuses primarily on startups and funding rounds, Preqin offers a top-down view of private capital flows, covering both fund-level and deal-level data. Its research-driven approach and in-depth analytics make it an essential tool for investors, fundraisers, and consultants operating in the institutional finance space.

Key Features

- Comprehensive Private Capital Coverage — Tracks over 60,000 funds and 40,000 fund managers across private equity, venture capital, and real assets.

- Investor Intelligence — Detailed information on LPs (Limited Partners), their investment preferences, and allocation strategies.

- Fund Performance Metrics — Includes IRR, DPI, TVPI, and other key indicators for benchmarking returns.

- Deal and Exit Data — Insights into private company transactions, valuations, and M&A exits.

- Market Research and Forecasts — In-depth reports and quarterly updates on trends in fundraising and alternative assets.

Why It’s a Strong Alternative to Crunchbase

Preqin caters to a completely different segment of the financial ecosystem. While Crunchbase is optimized for tracking startup-level fundraising, Preqin delivers institutional-grade data on private capital markets — connecting investors, fund managers, and advisors with actionable intelligence across all asset classes.

However, Preqin’s company-level data is typically tied to investment transactions and fund activity. It does not provide detailed coverage of every registered company or financials for smaller, non-funded businesses. For full corporate registry or operational data, users often complement Preqin with platforms like Global Database or Monetaiq.com.

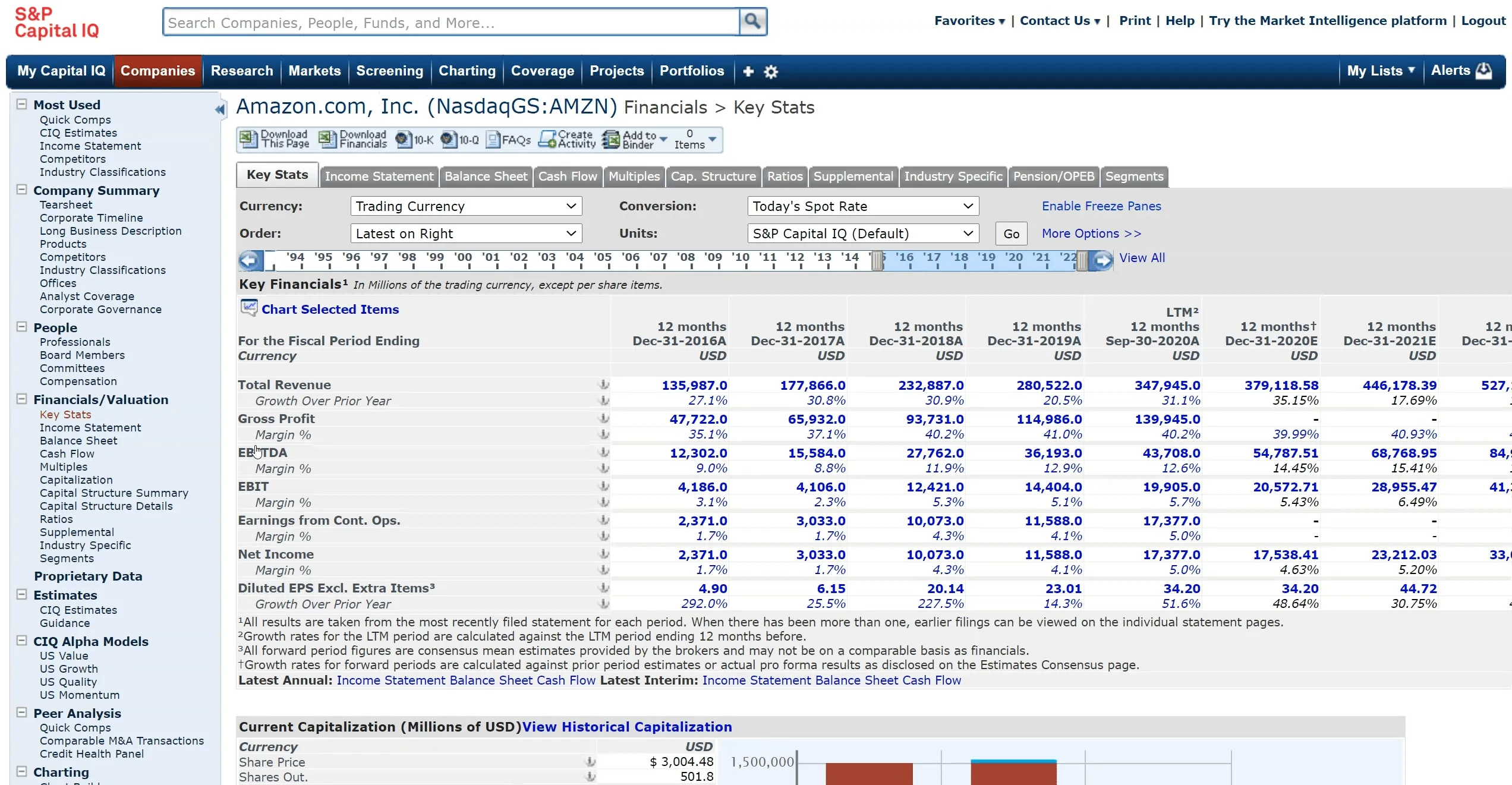

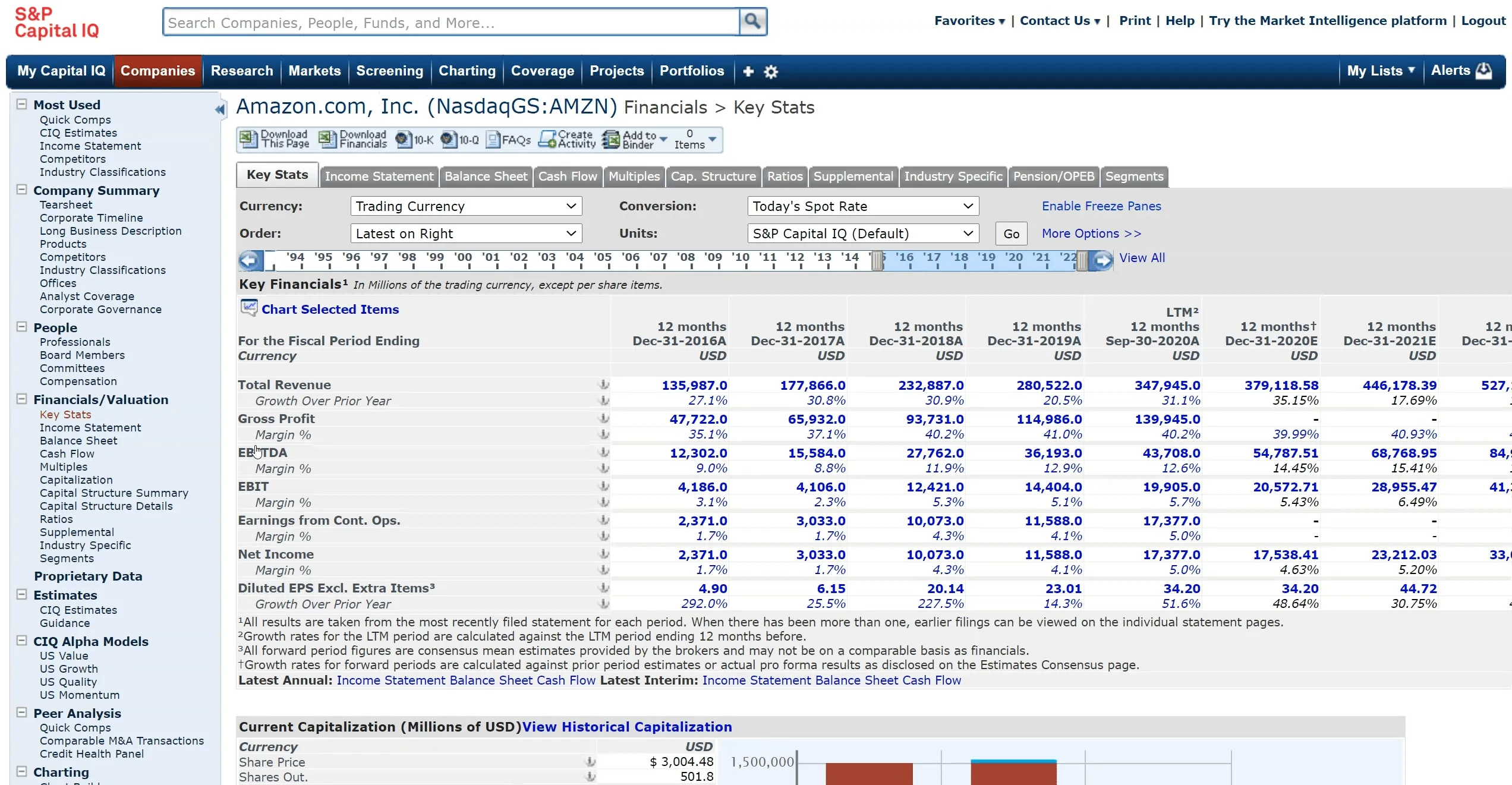

9. S&P Capital IQ

Best for: Public company analysis, financial modeling, and institutional research

S&P Capital IQ, part of S&P Global Market Intelligence, is a comprehensive financial data and analytics platform used by investment banks, asset managers, and research analysts worldwide. It provides in-depth coverage of publicly listed companies, offering detailed financial statements, valuation metrics, ownership data, and real-time market insights.

Capital IQ is recognized for its high data accuracy and modeling tools, making it an industry standard for financial professionals who need to analyze company fundamentals, build valuation models, or track corporate events. Its integration with Microsoft Excel and APIs allows seamless access to data for custom analysis and reporting.

Key Features

- Extensive Public Company Database — Financials, valuations, ratios, and forecasts for millions of listed entities globally.

- Advanced Analytics Tools — Built-in screeners, comparables analysis, and valuation modeling frameworks.

- Ownership and Insider Data — Visibility into institutional shareholders, executive changes, and corporate hierarchies.

- Market Intelligence — Access to M&A, IPO, and credit market data, with real-time updates and alerts.

- Integration and Automation — Deep Excel and API integration for automated financial workflows.

Why It’s a Strong Alternative to Crunchbase

S&P Capital IQ serves a very different purpose than Crunchbase.

While Crunchbase focuses on startups and funding events, Capital IQ delivers audited, institutional-grade financials for publicly traded companies. It’s ideal for analysts who require accuracy, completeness, and modeling flexibility — far beyond what startup databases can offer.

That said, its private company coverage is limited, often including only partial data such as ownership, revenue estimates, or basic identifiers. Financials for private firms are usually unavailable unless disclosed in filings or acquired through third-party sources. For users seeking registry-sourced private company data, Global Database or Monetaiq.com serve as stronger complements.

10. Zephira.ai

Best for: Developers, fintechs, and platforms needing real-time company data via API

Zephira.ai is an API-first platform that provides real-time access to registry-sourced company data from more than 100 government registries worldwide. Designed for developers, compliance teams, and fintech innovators, it delivers a flexible and scalable way to access verified business information directly within applications, workflows, and digital products.

Unlike Crunchbase, which aggregates and displays user-generated and public information, Zephira.ai focuses entirely on verified registry data — enabling users to query live company records, legal identifiers, and ownership details at the source. Its modular API infrastructure allows teams to integrate specific data endpoints — from company registration and tax IDs to UBOs and financials — based on their exact use case.

Key Features

- Registry-Sourced Data in Real Time — Pull live information directly from official government registries across 100+ countries.

- Modular Endpoints — Access targeted APIs for company registration data, financials, ownership structures, and tax information.

- Standardized Global Schema — Unified data structure across jurisdictions for easy integration and comparison.

- Developer-Friendly Architecture — Designed for seamless setup with RESTful APIs, robust documentation, and scalable usage.

- No Scraped or Third-Party Data — 100% first-party information sourced from registries and official filings.

Why It’s a Strong Alternative to Crunchbase

Zephira.ai addresses one of Crunchbase’s biggest limitations — the lack of verified, real-time, and machine-readable company data. While Crunchbase is valuable for discovering startups and funding activity, it cannot provide instant verification or compliance-grade accuracy.

Zephira.ai, on the other hand, delivers direct, live, and verifiable data that powers KYB checks, fintech onboarding, compliance automation, and enterprise enrichment. It is particularly suited for companies that want to embed trusted data into their own systems rather than rely on static or user-reported datasets.

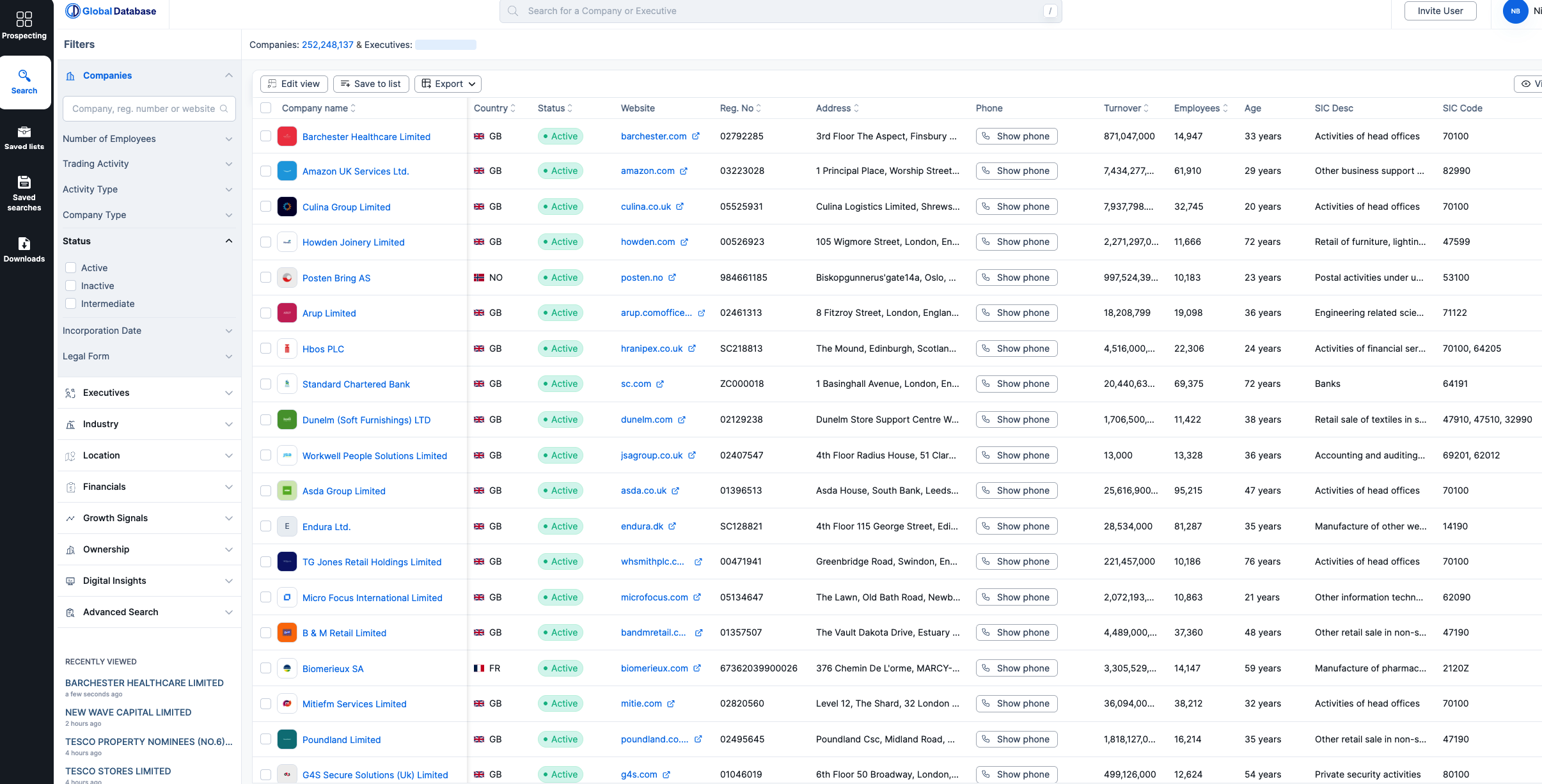

Comparison Table: Crunchbase vs Top 10 Alternatives

Conclusion

The landscape of company intelligence platforms has evolved far beyond the startup databases of a decade ago. While Crunchbase remains a valuable entry point for tracking funding rounds and identifying active investors, it represents only a small slice of the global business universe — primarily startups and companies that have gone public about their fundraising activity.

Professionals today require deeper visibility, verified data, and real-time access — whether for investment research, compliance, or go-to-market execution. The alternatives covered in this list illustrate just how diverse the modern data ecosystem has become:

- Global Database, Monetaiq.com, and Zephira.ai focus on registry-sourced, first-party data, offering complete visibility into all registered companies — not just funded ones — along with official filings, ownership structures, and digitized financials.

- PitchBook, Preqin, and S&P Capital IQ deliver institutional-grade financial intelligence, ideal for investors, analysts, and corporate finance professionals who require accurate valuations, deal data, and market benchmarks.

- FactSet caters to the public markets, providing real-time financial data and analytical tools trusted by asset managers and research analysts worldwide.

- CB Insights, Dealroom, and GetLatka.com excel in innovation, sector-specific, and startup ecosystem insights, offering unique views on market trends, SaaS metrics, and venture growth.

- Ultimately, the best alternative to Crunchbase depends on your objectives:

- Choose a registry-based platform (Global Database, Zephira.ai, Monetaiq.com) if you need verified legal data, official filings, and complete company coverage.

- Choose an investment analytics platform (PitchBook, Preqin, S&P Capital IQ, FactSet) if your focus is on valuations, fundraising activity, or portfolio tracking.

- Choose an innovation or market intelligence provider (CB Insights, Dealroom, GetLatka.com) if you want early insight into emerging technologies and growth trends.

In 2025 and beyond, businesses that rely on complete, accurate, and real-time company intelligence will gain a decisive edge. Whether for compliance, investment, or market expansion, the shift from scraped data to verified intelligence is already reshaping how professionals discover, evaluate, and trust the companies of tomorrow.

FAQ – Frequently Asked Questions About Crunchbase and Its Alternatives

1. What is Crunchbase most commonly used for?

Crunchbase is a crowdsourced platform used to track startups, funding rounds, and investor activity. It’s popular among entrepreneurs, analysts, and VCs who want to see who’s raising capital and in which sectors.

2. Why are professionals looking for Crunchbase alternatives in 2025?

Because Crunchbase covers mainly funded companies and relies on user submissions. It lacks verified financials, shareholder structure visibility, compliance-ready data, and full coverage of legally registered businesses worldwide.

3. What’s the best alternative for verified, registry-based company data?

Global Database, Monetaiq.com, and Zephira.ai stand out by sourcing data directly from official government registries. They provide real-time company records, ownership details, filings, financial statements, and global coverage beyond funded startups.

4. Which platform is better than Crunchbase for investment and transaction intelligence?

PitchBook and Preqin are superior for tracking private equity, venture capital, M&A deals, valuations, and investor portfolios — far beyond the deal-level visibility Crunchbase offers.

5. What’s the best choice for analyzing public companies and financial performance?

FactSet and S&P Capital IQ deliver audited financials, earnings data, ownership insights, valuation models, and market analytics — areas where Crunchbase has very limited coverage.

6. Does Crunchbase offer real-time company verification or compliance data?

No. Crunchbase relies on public sources, user submissions, and media coverage, so it cannot provide registry-sourced data, UBO verification, or legally validated company identifiers like platforms such as Zephira.ai or Global Database.

7. Are there better tools for tracking innovation and startup ecosystems by region or sector?

Yes. CB Insights and Dealroom provide deeper insights into emerging technologies, trend mapping, and innovation clusters — especially for corporate strategy and gov-tech initiatives.

8. What’s the best alternative for SaaS metrics and revenue-based benchmarking?

GetLatka.com is the strongest niche option for ARR, churn, growth rate, and founder insights across thousands of SaaS companies — areas Crunchbase does not cover in depth.

9. Which alternative covers companies that have not raised external funding?

Registry-based platforms like Global Database, Monetaiq.com, and Zephira.ai offer visibility into all legally registered companies, including private firms with no investment history.

10. What’s the main limitation of Crunchbase compared to modern data platforms?

Crunchbase shows who raised money — not who is financially stable, legally registered, profitable, compliant, or growing without external funding. It covers only a fraction of the global business landscape.