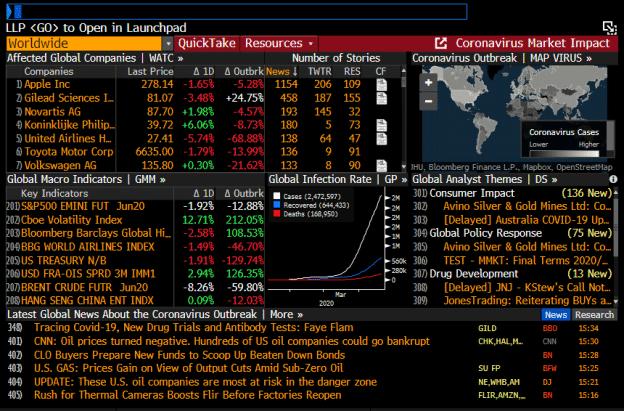

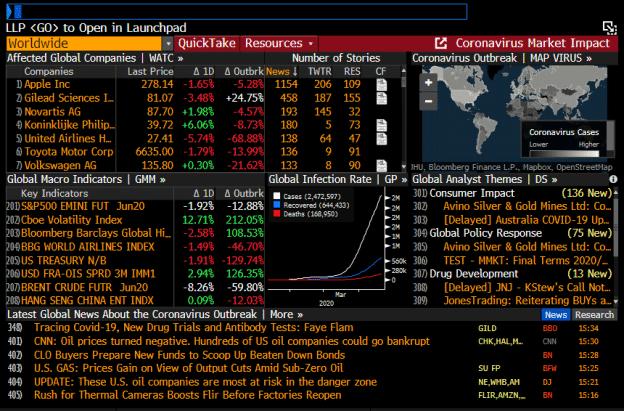

2. Bloomberg (Bloomberg Terminal)

Bloomberg is the global benchmark for financial market intelligence. Its Bloomberg Terminal is widely used by investment banks, hedge funds, and asset managers as the leading platform for public company financial data, market analytics, and real-time trading information.

Coverage

Public companies: Comprehensive coverage of listed firms worldwide, including financial statements, earnings reports, analyst forecasts, and ratios.

Private companies: Bloomberg does not cover private company financial data. Analysts and compliance teams looking for insights on private entities must rely on other financial data providers such as Global Database, Bureau van Dijk, or Dun & Bradstreet.

Markets: Deep coverage of equities, bonds, commodities, foreign exchange, and derivatives.

Data Types

Public company fundamentals and ratios

Real-time and historical market prices

Analyst research and consensus estimates

ESG metrics, industry benchmarks, and alternative datasets

Integrated news and financial reporting

Strengths

Unrivaled market coverage for public companies and securities

Real-time updates, making it indispensable for traders and portfolio managers

Powerful analytics, charting, and communication tools within the Terminal ecosystem

Limitations

No private company financial data — a major gap compared to registry-driven vendors

High cost — often priced at tens of thousands of dollars per seat annually

Closed system — data is largely restricted to the Bloomberg Terminal; APIs and exports are limited compared to API-first vendors

Ideal Use Cases

Equity and debt research on public companies

Real-time market intelligence for trading desks

Portfolio management and institutional investment analysis

Bottom line: Bloomberg is the undisputed leader in public company financial data and market intelligence. However, it offers no meaningful coverage of private company financial data, making it less useful for compliance, procurement, or credit risk teams that require insights into privately held firms.

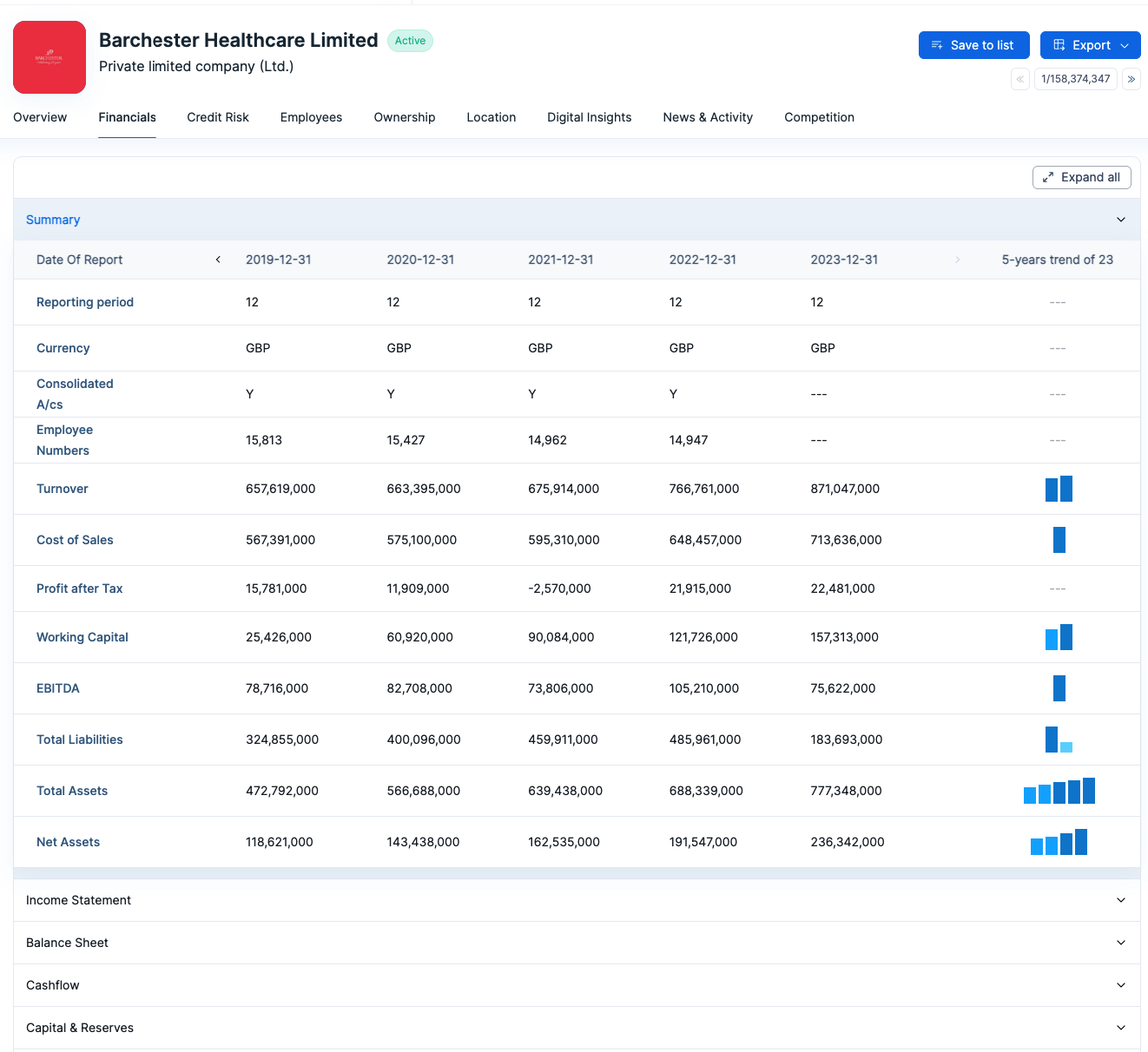

3 Monetaiq.com

Monetaiq.com is a modern financial data company focused on providing historical company financial data, credit risk metrics, and digital insights. Unlike traditional vendors that limit access to institutional clients, Monetaiq is built to serve both professional analysts and enterprises looking for more flexible access to verified financial information.

Coverage

Public companies: Provides digitized filings and long-term financial histories, allowing for performance benchmarking over multiple decades.

Private companies: Covers millions of private firms worldwide, including registry-sourced filings where available. This makes it valuable for analysts researching beyond listed companies.

Regional depth: Strong in Europe and North America, while expanding into Asia and Latin America.

Data Types

Historical company financial data with more than 20 years of coverage

Credit scores, credit limits, and risk indicators

Financial ratios (profitability, leverage, liquidity)

Ownership and shareholder information

Digital insights such as website traffic, geographic audience breakdown, engagement metrics, and technology stacks

Strengths

Combines financial data with digital analytics, offering a unique view of a company’s market footprint alongside its financial health

Easy access through APIs, bulk feeds, and Excel exports

Designed not just for investors, but also for procurement, compliance, and strategy teams that need a broader picture than financials alone

Limitations

Less brand recognition compared to Bloomberg or Refinitiv

Smaller ecosystem and fewer bundled services compared to legacy financial data vendors

Focused primarily on financial and digital insights, not real-time market data

Ideal Use Cases

Investment research where analysts need long-term financials and company fundamentals

Risk management teams requiring credit scores and registry-sourced filings

Procurement and supplier analysis, combining financial stability with digital presence

Market intelligence teams using website and traffic data alongside financial statements

Bottom line: Monetaiq.com stands out for blending historical company financial data with digital analytics, filling a gap between traditional financial data providers and newer big data platforms. It’s a strong option for businesses that need more than just financials when evaluating companies.

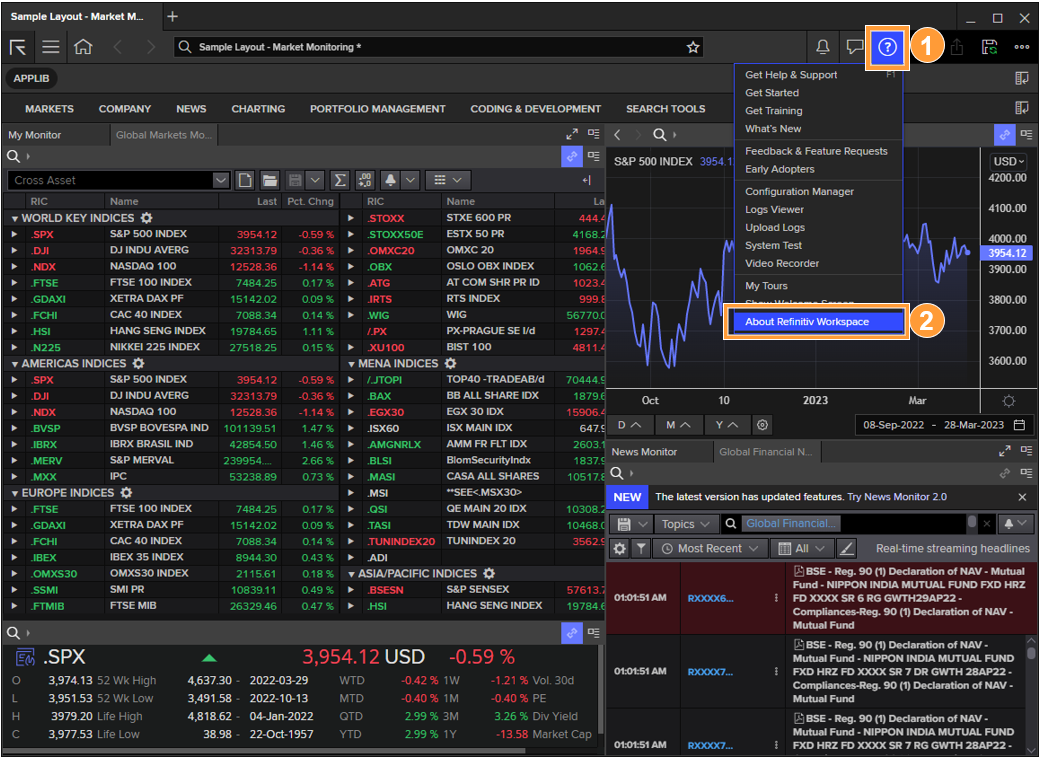

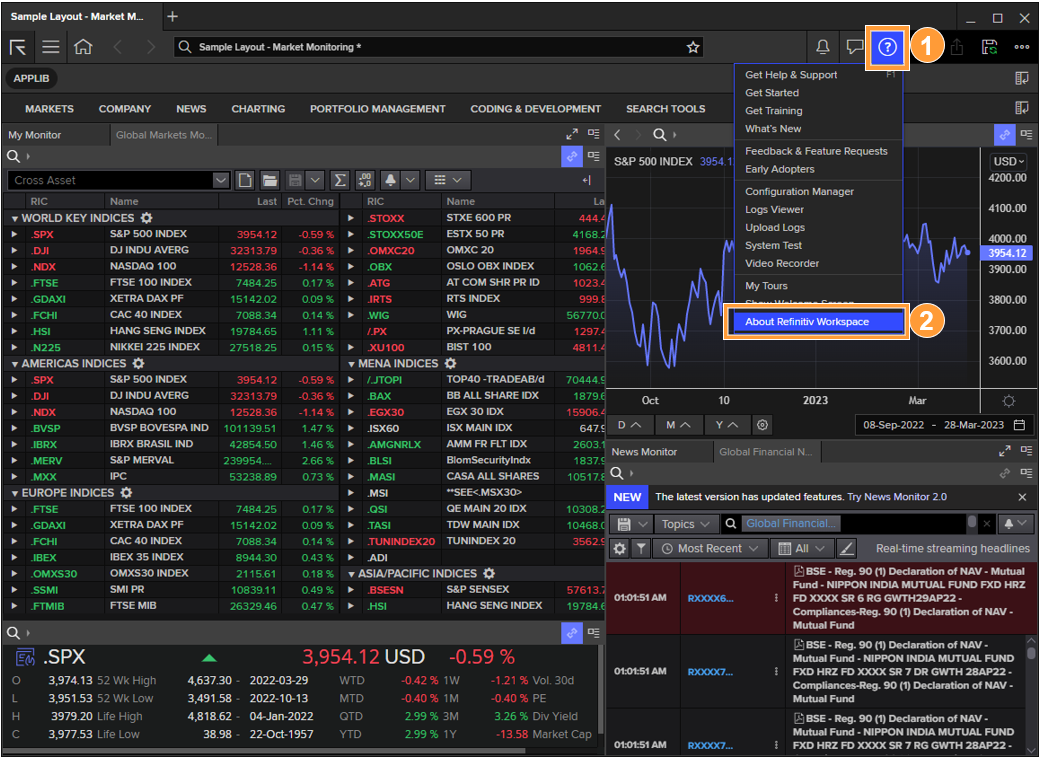

4. Refinitiv (part of LSEG)

Refinitiv, now part of the London Stock Exchange Group (LSEG), is one of the largest and most established financial data providers in the world. Its flagship platforms — such as Refinitiv Eikon — serve institutional investors, banks, and corporations needing extensive public company financial data and market coverage.

Coverage

Public companies: Comprehensive global coverage of listed companies, including financial statements, fundamentals, earnings, and analyst forecasts.

Private companies: Limited coverage compared to registry-driven providers like Global Database or Bureau van Dijk. Data is available for some private firms, but not with the same depth or consistency.

Markets: Strong focus on global equity, fixed income, FX, and commodity markets, making Refinitiv a go-to provider for trading desks and institutional finance.

Data Types

Public company financials, ratios, and valuation metrics

Historical company financial data and time-series datasets

Real-time market data (equities, FX, commodities, fixed income)

ESG and sustainability data

Risk and compliance datasets (KYC, sanctions, beneficial ownership — though often via partnerships)

Strengths

Scale: One of the most comprehensive financial data vendors, covering virtually every listed company worldwide

Integration: Eikon platform, APIs, and feeds integrate seamlessly with institutional workflows

Analytics: Extensive charting, screening, and financial modeling tools for analysts and traders

Limitations

Private company financial data is weak compared to registry-first providers

Licensing is restrictive; redistribution and derivative use cases are often prohibited

High cost, targeting large institutions rather than smaller businesses or startups

Ideal Use Cases

Institutional investors requiring global public company financial data

Trading desks needing real-time feeds and market analytics

Risk and compliance teams within banks using Refinitiv’s KYC and sanctions modules

Bottom line: Refinitiv is one of the most powerful financial data providers for public markets, making it a staple for banks, funds, and institutional finance. However, it remains less useful for those seeking deep coverage of private company financial data or flexible licensing models.

5. FactSet

FactSet is a global financial data services company that has built its reputation on delivering integrated data and analytics for investment professionals. It combines deep datasets with powerful software tools, making it one of the most popular choices among asset managers, investment banks, and research analysts.

Coverage

Public companies: FactSet provides comprehensive coverage of listed firms worldwide, including financial statements, analyst estimates, and valuation metrics.

Private companies: Offers some private company financial information, but coverage is limited compared to registry-first vendors like Global Database or Bureau van Dijk.

Global reach: Strong international presence, with clients across North America, Europe, and Asia-Pacific.

Data Types

Public company fundamentals, ratios, and performance metrics

Historical company financial data for benchmarking and trend analysis

Forecasts, consensus estimates, and analyst ratings

Market data including equities, fixed income, and derivatives

ESG and sustainability metrics increasingly integrated into its datasets

Strengths

Integration: FactSet is known for its tight integration with Excel, APIs, and proprietary tools, making workflows smooth for analysts and portfolio managers.

Analytics platform: Beyond raw financial data, FactSet provides screening tools, portfolio analytics, and risk modeling features.

Client base: Widely adopted by the buy-side and sell-side, with a strong reputation for institutional-grade reliability.

Limitations

Private company financial data coverage is weaker than registry-based competitors

High licensing costs, making it more suited for large institutions than SMEs

Redistribution of data is limited, restricting use cases outside of in-house analysis

Ideal Use Cases

Institutional investors conducting public company financial analysis

Asset managers and hedge funds needing integrated financial data and analytics

Research teams requiring historical company financial data and forecasts for modeling

Bottom line: FactSet is one of the top financial data vendors for institutional investors, combining strong global coverage of public company financial data with robust analytics. However, its limited private company coverage and high cost mean it is best suited for financial institutions rather than organizations focused on compliance or procurement.

6. Zephira.ai

Zephira.ai is an API-first financial data company built for developers, fintechs, and regtech platforms. Unlike traditional financial data vendors that focus on large enterprise platforms, Zephira is designed to provide real-time access to company registry data and financial fundamentals on-demand.

Coverage

Registry-based data: Sources information directly from 100+ official registries, ensuring accuracy and compliance.

Private companies: Strong focus on private company financial data, which is often hard to obtain from legacy providers like Bloomberg or FactSet.

Public companies: Also covers listed firms, but its main differentiator is private entity coverage.

Global reach: Provides data across North America, Europe, APAC, and emerging markets, making it well-suited for fintechs operating internationally.

Data Types

Company financial fundamentals: revenue, assets, liabilities, equity, and profitability

Historical company financial data (multi-year financial statements)

Tax IDs, incorporation details, and legal entity structures

Ownership information, including shareholders and group structures

Built for compliance and KYB/KYC use cases, but also applicable to enrichment and risk analysis

Strengths

API-first architecture: Designed for seamless integration into apps, onboarding flows, CRMs, and internal systems

Flexible pricing: Pay-per-call model makes it accessible for startups and scaling platforms, unlike subscription-heavy legacy providers

Real-time updates: Direct connections to registries ensure data is current and reliable

Developer-friendly: Detailed API documentation and sandbox environments speed up integration

Limitations

Smaller brand recognition compared to incumbents like S&P Global or Refinitiv

Primarily focused on company registry and financial data — does not provide broad market feeds, news, or analyst research

May require pairing with other datasets (e.g., market prices, ESG data) for institutional investment use cases

Ideal Use Cases

Fintechs and regtechs building KYB/KYC verification tools

Developers integrating financial data directly into apps and platforms

Enterprises enriching CRMs with registry-verified financials and ownership data

Compliance teams needing fast, scalable access to private company financial data

Bottom line: Zephira.ai represents a new generation of financial data providers, focusing on API-first delivery and registry accuracy. It is best suited for companies that want scalable, flexible, and real-time access to company financial data APIs, especially when dealing with private company data across multiple countries.

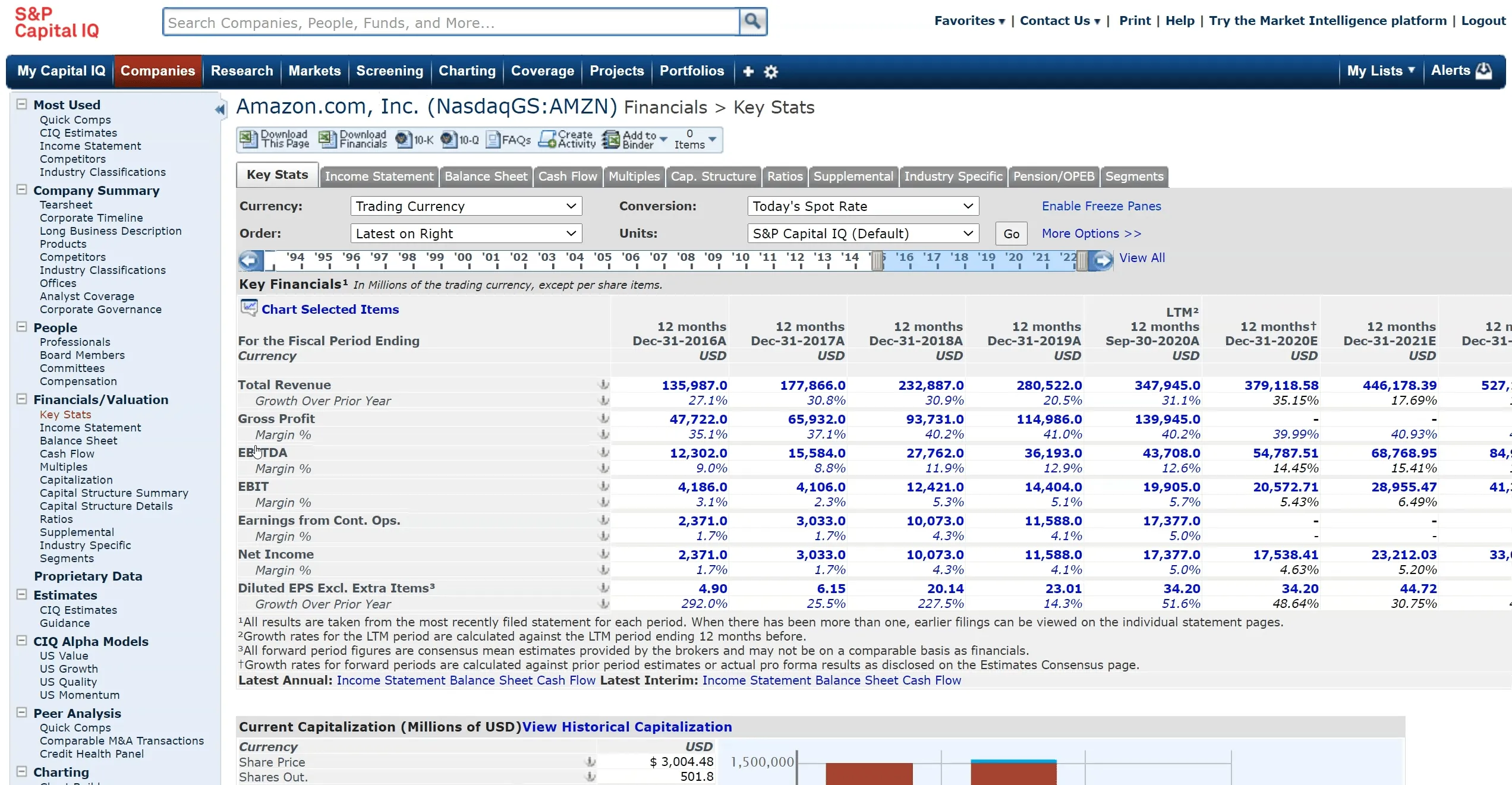

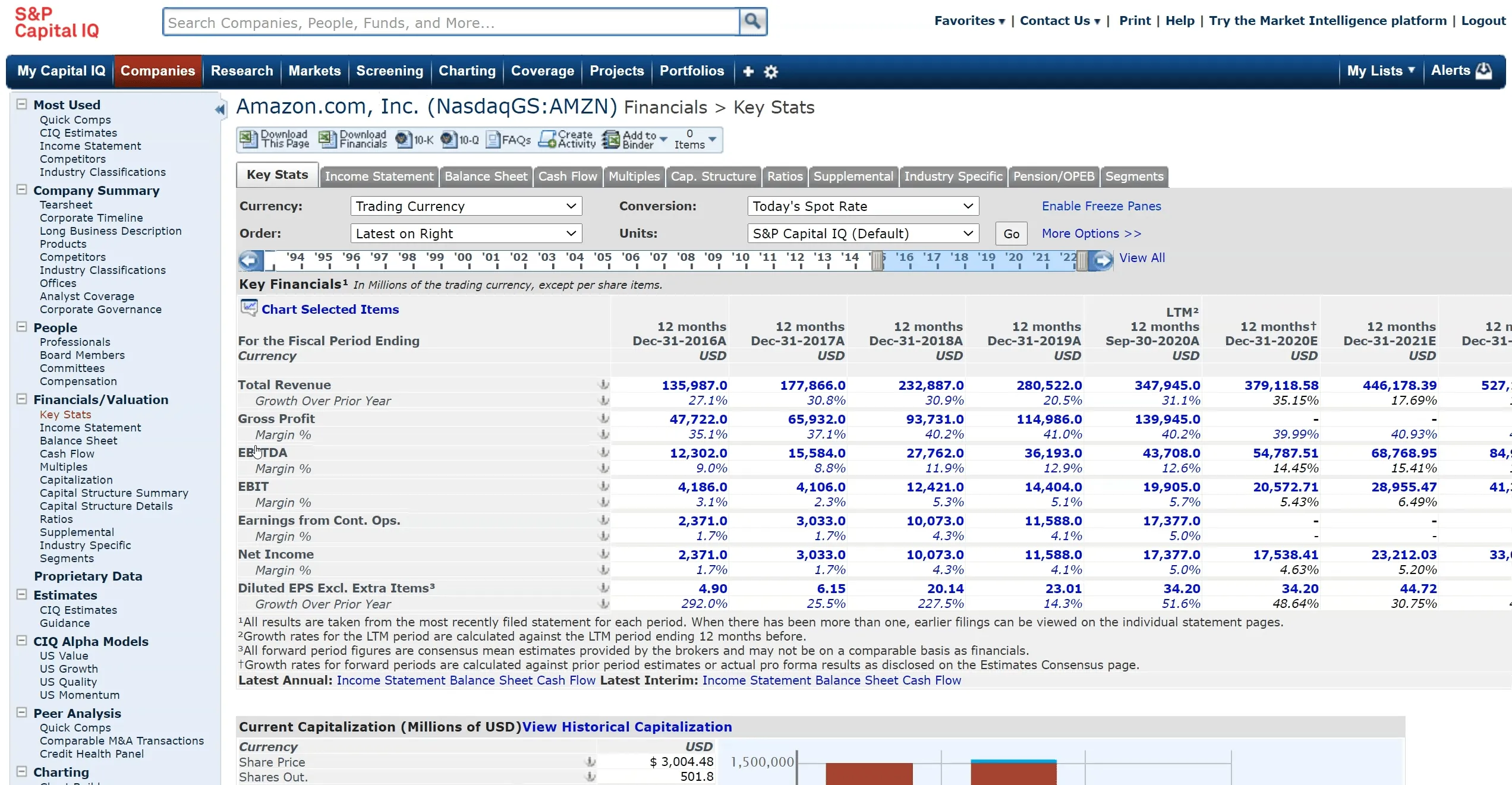

7. S&P Global (Compustat)

S&P Global is one of the most established financial data providers, with Compustat being its flagship dataset for decades. Compustat is widely used in academia, investment research, and corporate finance for its structured, standardized view of public company financial data.

Coverage

Public companies: Strong global coverage of listed firms, including full financial statements, ratios, and derived metrics.

Private companies: Minimal coverage — S&P Global focuses primarily on publicly traded entities.

Regional focus: Particularly strong in North America, with extensive time-series data on US companies, but also covers global markets.

Data Types

Standardized company financial fundamentals (balance sheet, income statement, cash flow)

Historical company financial data spanning decades, often used for back-testing and academic research

Market data, indexes, and macroeconomic indicators

Sector-specific datasets for banks, insurance, and energy firms

Ratios and derived performance metrics for comparability across firms and markets

Strengths

Data history: Unmatched depth of standardized historical financials, making it a trusted source for long-term research

Consistency: Data is normalized and comparable across industries and geographies

Institutional credibility: Used by leading universities, asset managers, and financial institutions

Limitations

Private company financial data is essentially absent

High licensing costs, making it more suited to large institutions rather than SMEs

Not built for flexibility or modern API-first integrations — often accessed through enterprise platforms or data feeds

Ideal Use Cases

Academic research and quantitative studies requiring long-term historical financial datasets

Institutional investors conducting back-testing, valuation, or risk modeling

Economists and strategists using Compustat’s breadth for macro-level analysis

Bottom line: S&P Global’s Compustat remains a gold standard for public company financial data and long-term historical analysis. However, it is less useful for organizations seeking private company financial data or API-driven integrations.

8. Bureau van Dijk (Moody’s Analytics)

Bureau van Dijk (BvD), a subsidiary of Moody’s Analytics, is best known for its flagship platform Orbis. It is one of the largest global repositories of private company financial data, ownership structures, and corporate hierarchies, making it a critical resource for compliance and risk professionals.

Coverage

Private companies: BvD excels in aggregating financial statements and ownership data for private firms across the globe. Orbis covers over 400 million entities, with varying levels of detail depending on local disclosure laws.

Public companies: Also included, though the focus is not real-time markets but rather standardized financials and group structures.

Regional strengths: Particularly strong in Europe, where disclosure rules for private firms are stricter and registry access is richer.

Data Types

Private company financial data (balance sheets, income statements, cash flows)

Company financial ratios data for benchmarking and comparison

Beneficial ownership, shareholder structures, and ultimate parent companies

Historical company financial data, though availability differs by jurisdiction

Sanctions, PEPs, and compliance-related datasets integrated into the platform

Strengths

Depth in private company data, unmatched by most public market-focused providers

Powerful ownership mapping, including UBOs and global group structures

Strong reputation in compliance, AML, and KYC use cases

Standardized formats allow comparability across countries

Limitations

Licensing restrictions: Data redistribution is highly limited, which can be a challenge for platforms wanting to build on top of Orbis data

Cost: Among the more expensive options in the market, designed for large enterprises and institutions

Access model: Primarily through the Orbis platform; less flexible than modern API-first vendors like Zephira.ai

Ideal Use Cases

Compliance teams performing KYC, KYB, AML, and sanctions screening

Risk management and credit assessment for private companies

Researchers and consultants analyzing global corporate structures

Organizations needing to identify ultimate beneficial owners (UBOs) across borders

Bottom line: Bureau van Dijk (Moody’s Analytics) is one of the most powerful financial data providers for private company financial data and ownership structures. However, its restrictive licensing and high costs make it more suited to large financial institutions and compliance-driven organizations than to startups or developers.

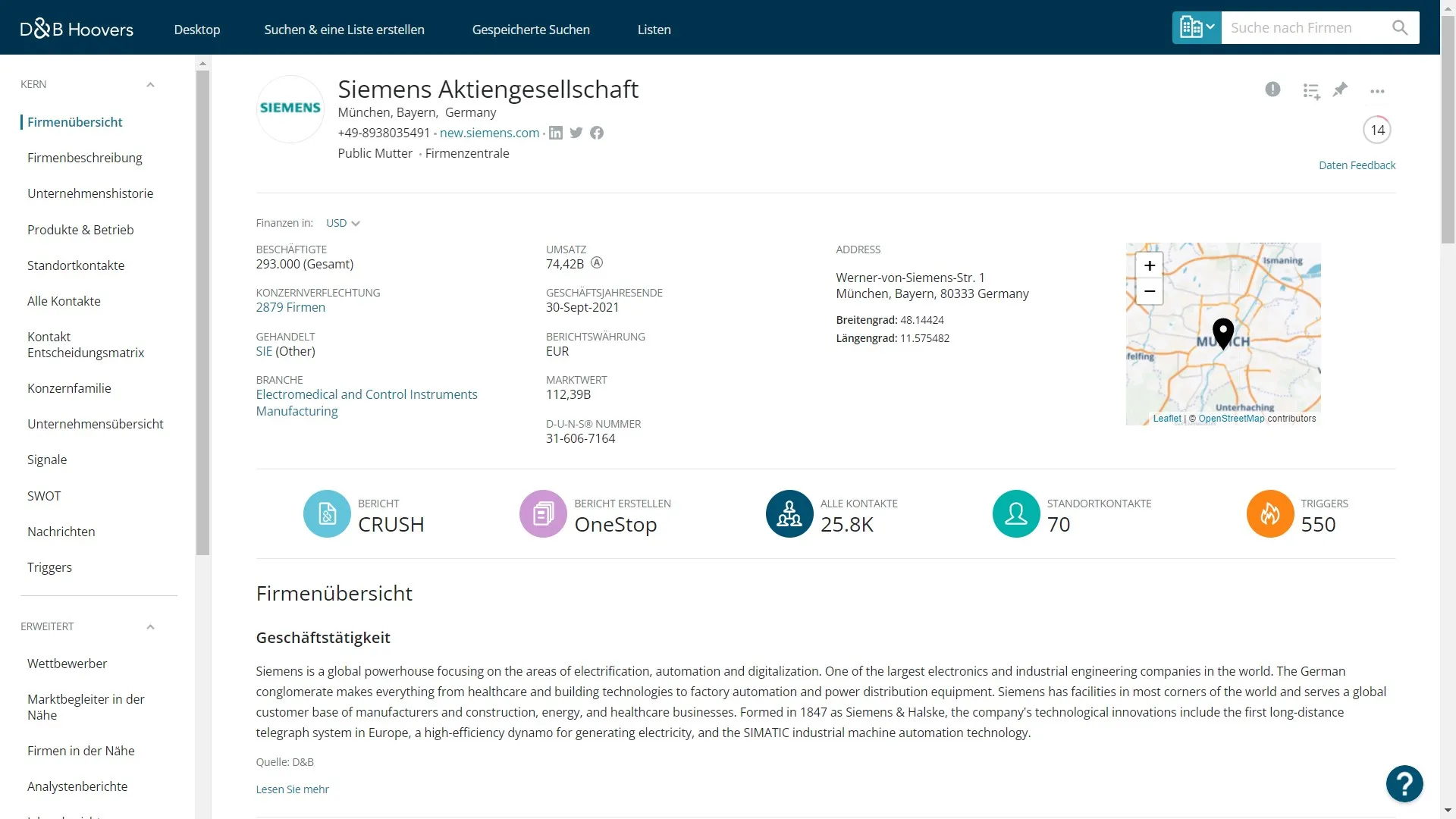

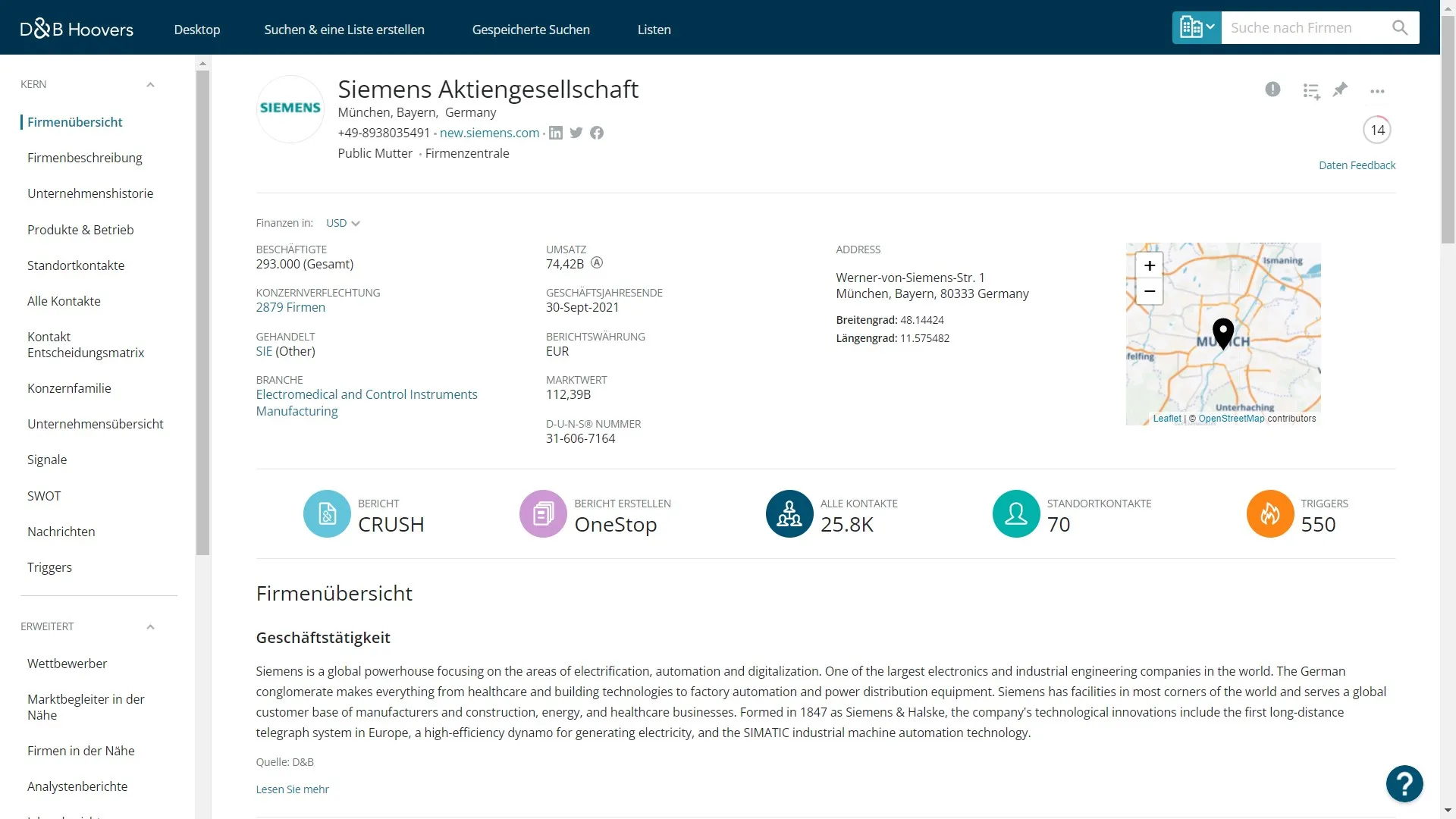

9. Dun & Bradstreet (D&B)

Dun & Bradstreet (D&B) is one of the oldest and most widely recognized financial data providers, best known for its D-U-N-S® Number system that uniquely identifies businesses across the globe. D&B is a staple in risk management, supplier due diligence, and credit assessment, offering a mix of company financial data and business intelligence.

Coverage

Private companies: Strong in North America and many international markets, though the depth of private company financial data can vary depending on local disclosure rules.

Public companies: Covered alongside private firms, with standardized datasets for easy comparison.

Global reach: Over 500 million businesses worldwide in the D&B database, supported by data partnerships and direct sourcing.

Data Types

Company credit scores and credit limits

Financial data of companies (balance sheets, P&L, ratios where available)

Ownership and group structures

Risk indicators such as bankruptcies, liens, and adverse filings

Trade payment history and supplier performance data

Strengths

Credit and risk focus: D&B is one of the most trusted sources for company creditworthiness and supplier risk monitoring.

D-U-N-S® Number: Widely adopted as a global company identifier, used in compliance, supply chain, and government contracting.

Breadth: Very large global company coverage, including both private and public firms.

Limitations

Private company financial data is not always sourced directly from registries and can be inconsistent in certain regions.

Licensing models can be restrictive, with limits on redistribution and derivative use.

Costs are high compared to API-first providers that focus on flexibility and transparency.

Ideal Use Cases

Credit risk analysis for banks, insurers, and lenders

Supplier and procurement checks, especially where the D-U-N-S® Number is required

Compliance workflows where a standardized global identifier is necessary

Corporate due diligence for partnerships, acquisitions, or onboarding

Bottom line: D&B remains a leading financial data vendor for credit and risk intelligence, with unparalleled global reach. However, organizations needing registry-sourced private company financial data or flexible licensing may prefer modern alternatives such as Global Database or Zephira.ai.

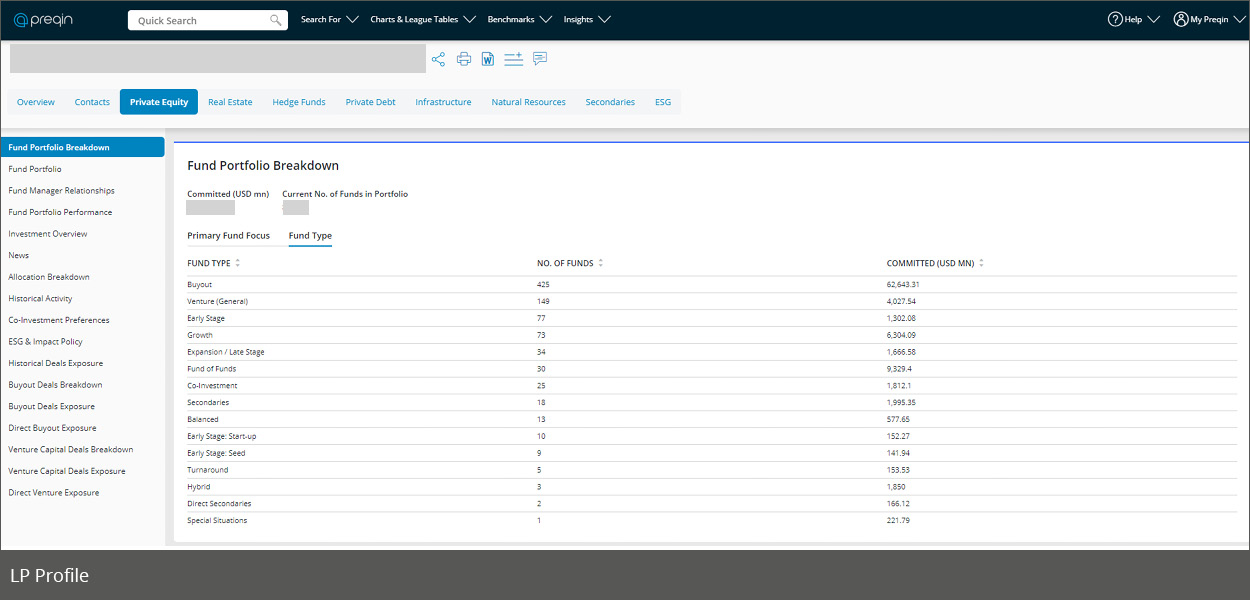

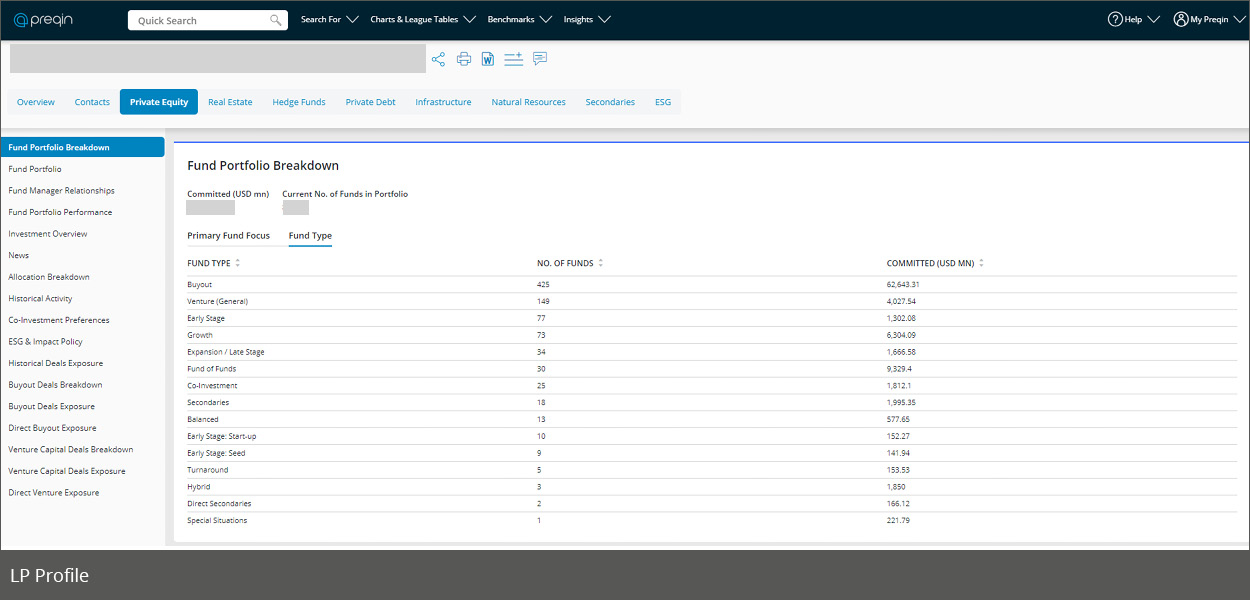

10. Preqin (part of BlackRock)

Preqin is a specialist financial data provider focused on the alternative assets industry, including private equity, venture capital, hedge funds, real estate, and infrastructure. In 2023, Preqin was acquired by BlackRock, which is expected to further strengthen its role as a key data partner for institutional investors.

Coverage

Private companies: Preqin’s strength lies in financial data on companies connected to private equity and venture capital deals, where disclosure is often limited elsewhere. It captures valuations, fundraising rounds, and performance metrics tied to investors and funds.

Public companies: Limited coverage — Preqin is not designed for broad public company fundamentals like Bloomberg or S&P Global.

Global focus: Strong worldwide coverage of private capital markets, particularly in North America, Europe, and Asia.

Data Types

Fundraising and deal data (VC, PE, M&A)

Private company financial data linked to investment events

Performance benchmarks for alternative funds

Investor and LP profiles, including allocations and strategies

Market trends and forecasts in alternative asset classes

Strengths

Alternative asset specialization: One of the most trusted sources for private markets data

Investor intelligence: Extensive coverage of LPs, GPs, and fundraising activity

BlackRock acquisition: Integration into one of the largest asset managers globally is expected to expand its influence and distribution

Limitations

Focused on alternative investments — not a comprehensive provider of public or private company financial statements

High costs, with pricing aimed at institutional investors and private equity firms

Limited API-driven access compared to more modern vendors like Zephira.ai

Ideal Use Cases

Private equity and VC firms tracking deals, valuations, and benchmarks

Institutional investors monitoring fund performance and allocation strategies

Advisors and consultants working with alternative assets and private markets

Researchers needing data on global fundraising and investment flows

Bottom line: Preqin is a top choice among financial data companies for private market intelligence, particularly in private equity and venture capital. With the backing of BlackRock, its influence is set to grow, though it remains highly specialized and less suitable for organizations needing broad company financial data across both public and private markets.

Comparing Financial Data Vendors

After reviewing each provider in detail, it’s helpful to see how they stack up across the most important dimensions: coverage, data depth, delivery, licensing, and ideal use cases.

How to Find the Best Website for Company Financial Data

With so many financial data providers in the market, the “best” option depends entirely on your specific needs. Some organizations care most about public company financial data, while others need deep access to private company financial data for compliance, procurement, or investment purposes. Delivery methods also matter — whether you prefer company financial data APIs, downloadable Excel files, or bulk datasets.

Below are the most common scenarios and the providers best suited for each:

Finding Financial Data on Private Companies

Challenge: Private companies rarely disclose detailed financials, making reliable sources difficult to find.

Best Providers:

Global Database – registry-sourced data on 300M+ companies, including ownership and UBOs.

Bureau van Dijk (Moody’s Orbis) – unmatched depth in private company reporting, though expensive.

Zephira.ai – API-first registry data, perfect for fintechs and regtechs.

Public Company Financial Data

Challenge: Access is easier, but speed, coverage, and history vary by provider.

Best Providers:

Bloomberg – real-time, best for traders and institutional investors.

Refinitiv (LSEG) – comprehensive global coverage with strong analytics.

S&P Global (Compustat) – gold standard for long-term historical company financial data.

FactSet – excellent for analyst workflows with Excel integration.

UK and Regional Company Financial Data

Challenge: Regional databases differ in transparency and accessibility.

Best Providers:

Global Database – direct link to Companies House (UK) and 150+ registries.

Dun & Bradstreet – widely used for credit checks and supplier risk monitoring.

Monetaiq.com – blends financials with digital insights for European companies.

APIs vs. Excel vs. Bulk Access

Specialized Use Cases

Credit Risk & Supplier Onboarding: D&B, Global Database

Alternative Investments (PE/VC): Preqin (BlackRock)

UBO & Compliance Checks: Bureau van Dijk, Global Database

Market Intelligence (Financial + Digital Footprint): Monetaiq.com

Bottom line: There’s no single “best website for company financial data.” Instead, the right choice depends on your goals:

Need real-time trading data? → Bloomberg, Refinitiv

Need private company data? → Global Database, BvD, Zephira.ai

Need historical datasets? → S&P Global (Compustat), Monetaiq.com

Need credit risk & supplier verification? → D&B, Global Database

Need specialist private markets data? → Preqin

Conclusion: The Future of Financial Data Providers

The landscape of financial data vendors is evolving quickly. Traditional players like Bloomberg, Refinitiv, and S&P Global continue to dominate when it comes to public company financial data and market intelligence, but their platforms remain costly and often restrictive. At the same time, new entrants are reshaping expectations by offering registry-sourced private company financial data, flexible licensing, and API-first delivery models.

Several key trends are shaping the future:

Registry-first sourcing: Companies like Global Database and Zephira.ai are proving that direct connections to government registries provide the most reliable and transparent company financial data sources.

API-first access: Organizations increasingly expect company financial data APIs that integrate directly into CRMs, onboarding platforms, and analytical tools — replacing closed systems with open, flexible access.

Private company visibility: Investors, compliance officers, and procurement teams are demanding deeper insights into private companies, pushing providers to expand coverage beyond public filings.

Specialization: Niche providers like Monetaiq.com (financial + digital insights) and Preqin (alternative assets) highlight a growing need for tailored datasets.

Bottom line: The “best” financial data provider depends on your goals:

For real-time market intelligence → Bloomberg, Refinitiv

For academic research & historical datasets → S&P Global (Compustat)

For private company financial data & compliance → Global Database, Bureau van Dijk, Zephira.ai

For credit & supplier risk → D&B

For alternative investments → Preqin

As financial services shift toward transparency, automation, and compliance, the winners will be those vendors that combine breadth of coverage with flexible, API-first delivery — empowering businesses to turn raw company financial data into actionable insights at scale.

Choosing the right financial data provider comes down to your use case: real-time trading, compliance, risk management, or market research. Legacy platforms still dominate public company data, but new registry-sourced providers like Global Database and Zephira.ai are setting new standards for transparency and flexibility.

If you’re ready to access financial data on 300M+ companies worldwide, sourced directly from official registries, explore Global Database today.

Want API-first access? Try Zephira.ai — built for developers, fintechs, and compliance teams.

Frequently Asked Questions (FAQ)

1. How to find financial data on private companies?

Private company data is harder to access because most are not required to publish detailed statements. The most reliable way is through registry-sourced providers like Global Database or Bureau van Dijk, which connect directly to local government filings. APIs such as Zephira.ai also provide real-time access.

2. How to get financial data on private companies?

You can get financial data on private companies by:

Using company registry data (e.g., Companies House in the UK, SEC filings for subsidiaries in the US)

Subscribing to a financial data vendor (Global Database, D&B, Bureau van Dijk)

Leveraging API platforms like Zephira.ai for scalable integration.

3. Where to find financial data of companies?

It depends on the company type:

Public companies → Bloomberg, Refinitiv, S&P Global, FactSet

Private companies → Global Database, Bureau van Dijk, Dun & Bradstreet

Regional focus → Companies House (UK), Bundesanzeiger (Germany), ASIC (Australia), etc.

4. How do I find financial data for German companies?

For German companies, financial data is published in the Bundesanzeiger (German Federal Gazette). For broader coverage, providers like Global Database, Bureau van Dijk (Orbis), and D&B aggregate and enrich these filings for easier access.

5. How to get company financial data?

Public companies → Stock exchange filings, Bloomberg, Refinitiv, FactSet

Private companies → Registry-based platforms (Global Database, Zephira.ai, Bureau van Dijk)

Excel or APIs → Many providers offer downloads and integrations for analysis.

6. How to get financial data for a German company?

You can obtain financial statements from the Bundesanzeiger, Germany’s official registry. For easier search and international comparison, use Global Database or Bureau van Dijk, which normalize German filings alongside other countries.

7. How to get financial data of companies via API?

Several vendors provide company financial data APIs:

Zephira.ai → Registry-sourced APIs for KYB, ownership, and financials

Global Database API → 300M+ companies with financials, UBOs, and credit scores

Refinitiv API → Real-time public company data for trading and analytics