2. Zephira

Overview:

Zephira is an API-first platform that delivers instant access to verified company data sourced directly from global registries. It’s designed for developers, fintechs, and regtechs who need real-time company verification and enrichment directly integrated into their products and workflows.

Key Strengths:

- API-first architecture optimized for speed and scalability.

- Verified company information from official registries across 100+ countries.

- Transparent data sourcing with timestamps for full traceability.

- Digitized company financials and ownership data available through a single API call.

- Supports KYB, AML, and onboarding automation with standardized, structured data.

- Developer-friendly documentation and sandbox environment for easy integration.

Limitations:

- Does not include contact or marketing data.

- Focused on data delivery and enrichment; lacks built-in analytics dashboards.

Pricing:

Zephira offers simple subscription-based pricing tiers with clear API limits:

- Starter: $49/month — 100 full company profiles per month; 30 API calls per minute.

- Pro: $99/month — 400 full company profiles per month; 100 API calls per minute.

- Business: $199/month — 1,300 full company profiles per month; 300 API calls per minute.

- Enterprise: Custom pricing — unlimited API calls and up to 6,000 API calls per minute.

Each plan includes full company registry data, financials, directors & shareholders, firmographic information, and digital insights within a single API call.

Best for:

Fintechs, regtechs, and data-driven platforms seeking real-time registry-verified company data via API with scalable pricing and flexible integration.

3. Statista

Overview:

Statista is one of the world’s most recognized business intelligence and market research platforms, aggregating data from over 22,000 sources across industries, countries, and topics. It provides statistical insights, reports, and company profiles designed to support strategic planning, market analysis, and investment research.

Key Strengths:

- Extensive global database covering more than 10 million company profiles .

- Combines firmographic data with industry statistics, financial indicators, and market trends.

- Offers premium access to company KPIs, revenue segmentation, and market share insights .

- Integrates research from official registries, financial filings, and verified third-party sources.

- Provides sector-specific reports and custom data visualizations for deeper analysis.

- User-friendly interface suited for analysts, consultants, and corporate strategy teams.

Limitations:

- Focused on statistical and aggregated data, not real-time registry information.

- Limited access to ownership structures, directors, or UBO details.

- Data enrichment and API integration capabilities are minimal compared to registry-sourced platforms.

Pricing:

Statista follows a subscription-based model, offering tiered access depending on data depth and user type:

- Basic Account: Free access to limited statistics and charts.

- Single Account: Approximately $59/month — full access to core statistics and selected reports.

- Corporate Account: From $490/month — includes advanced company profiles, financial KPIs, and export options for teams.

- Enterprise Solutions: Custom pricing for bulk data, API access, and multi-seat licenses.

Best for:

Market analysts, consultants, and corporate strategists seeking macro-level industry insights and financial benchmarks, rather than granular company-by-company registry data.

4. Monetaiq

Overview:

Monetaiq is a financial intelligence platform that provides access to detailed company financials, credit data, and digital insights, all powered by verified registry information. It focuses on transforming structured and unstructured financial data into standardized, comparable intelligence, helping users assess credit risk, analyze performance trends, and monitor markets globally.

Key Strengths:

- Built entirely on verified registry data enriched with financial KPIs, ratios, and multi-year balance sheets.

- Offers up to 20 years of historical financial data digitized through AI and OCR.

- Combines financial statements with firmographics, industry classification, and digital engagement insights.

- Designed for investors, analysts, and risk managers who require accurate, time-series data for due diligence and valuation.

- API-first architecture with real-time access for integration into analytical platforms and internal dashboards.

- Transparent data sourcing with clear linkage back to official filings and government registries.

Limitations:

- Focused primarily on financial intelligence; does not include contact or marketing datasets.

- Lacks advanced visualization tools compared to some full-scale analytics platforms.

Pricing:

Monetaiq offers tiered subscription plans designed to scale with business needs:

- Starter – $49/month: 50 full company profiles per month; 30 API calls per minute.

- Pro Plan – $99/month: 150 full company profiles per month; 100 API calls per minute.

- Business – $199/month: 400 full company profiles per month; 300 API calls per minute.

- Enterprise – Custom pricing: Unlimited API calls and up to 6,000 API calls per minute, with dedicated SLA and support.

Each API call includes company registry data, full financials, directors and shareholders, and firmographic data

Best for:

Financial institutions, investors, and data-driven platforms that need real-time access to verified company financials and credit intelligence at global scale.

5. OpenCorporates

Overview:

OpenCorporates positions itself as one of the largest open databases of company information, claiming coverage of over 220 million company records globally. The platform focuses on transparency by aggregating basic registry data such as legal names, registration numbers, incorporation dates, and jurisdictional identifiers, collected directly from government sources.

Key Strengths:

- Provides access to official registry data from more than 200 jurisdictions .

- Includes essential company attributes: legal name, registration number, incorporation date, and entity status.

- Strong commitment to data transparency and open access, widely used for compliance and public-sector research.

- Offers both API and bulk data delivery options for enterprise integrations.

- Each record is traceable to its original registry source, ensuring data provenance.

Limitations:

- Many listed jurisdictions remain offline or partially available , limiting actual usable coverage despite the 220 million record claim.

- Offers only basic registry data with minimal firmographic information and no ownership or financial enrichment.

- The API charges for search queries , even when no matching company result is returned.

- Strict reseller rights restrict redistribution or embedding into third-party products.

- Update frequency and data quality depend heavily on each local registry’s publication schedule.

Pricing:

OpenCorporates provides several API and enterprise options:

- Essentials – £2,250/year (≈ £225/month): Up to 500 API calls per month for internal use.

- Starter – £6,600/year (≈ £660/month): Up to 2,500 API calls per month; internal and external usage rights.

- Basic – £12,000/year (≈ £1,200/month): Up to 5,000 API calls per month and 1,000 calls per day.

- Enterprise – Custom pricing: Includes bulk-data delivery, bespoke API configurations, and jurisdictional customization.

Best for:

Organizations that prioritize open, registry-level company data for transparency, research, and compliance verification, but do not require enriched or financial datasets.

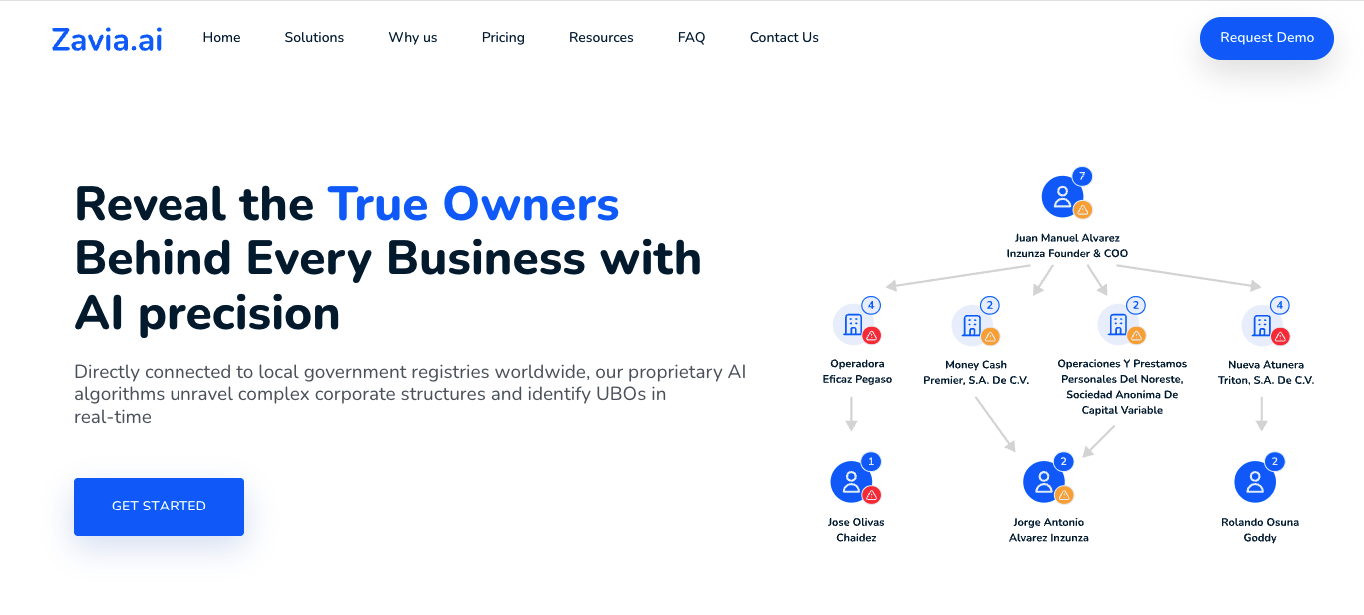

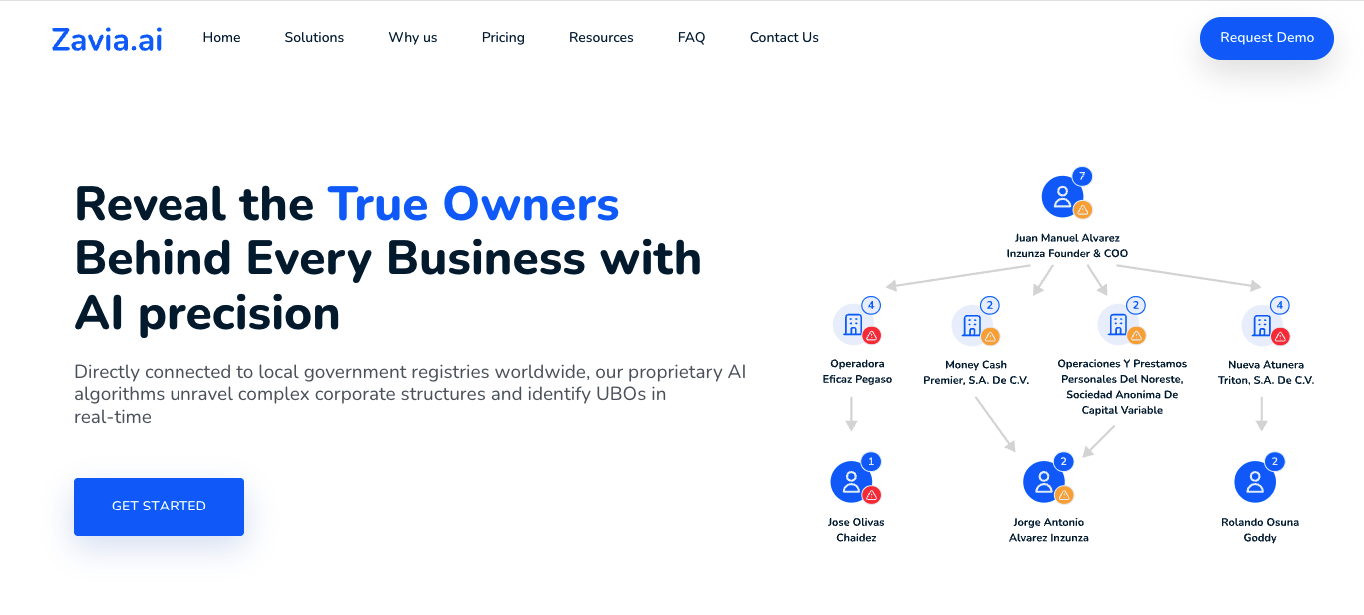

6. Zavia.ai

Overview:

Zavia.ai is an AI-powered UBO intelligence platform built to map ultimate beneficial ownership structures across global jurisdictions. It connects directly to government registries and leverages AI to analyze shareholding patterns, identify corporate hierarchies, and flag politically exposed persons (PEPs) and sanctioned entities. The platform is designed for compliance, risk, and investigative teams that need automated ownership verification with source-level transparency.

Key Strengths:

- Specializes in UBO discovery and ownership intelligence, covering millions of companies worldwide.

- Direct integration with official government registries ensures verified data and transparency.

- Uses AI algorithms to reconstruct complex ownership networks and reveal hidden relationships.

- Offers real-time monitoring, enabling continuous updates when company or shareholder structures change.

- Each data attribute is linked to its official source and timestamped for full auditability.

- API-first design, supporting seamless integration into AML, compliance, and onboarding systems.

- Coverage includes company registry information, directors, shareholders, and PEP/sanctions screening.

Limitations:

- Focused solely on ownership and compliance intelligence — does not include financial data or contact-level enrichment.

- While registry coverage is broad, some smaller jurisdictions may have limited data availability.

Pricing:

Zavia.ai provides straightforward subscription-based pricing tailored to different usage volumes:

- Starter – $49/month: 50 UBO checks per month, 30 API calls per minute, includes monitoring.

- Growth – $99/month: 150 UBO checks per month, 100 API calls per minute, includes monitoring.

- Corporate – $199/month: 400 UBO checks per month, 1,000 API calls per minute, includes monitoring.

- Enterprise – Custom pricing: Unlimited API usage with dedicated SLA, PEP/sanction add-ons, and high-frequency monitoring options.

Best for:

Compliance officers, AML teams, and financial institutions requiring automated, registry-verified UBO identification and monitoring for risk and regulatory reporting.

7. Dun & Bradstreet (D&B)

Overview:

Dun & Bradstreet is one of the most established providers of business intelligence, specializing in credit risk, compliance, and supply chain data. Its proprietary D-U-N-S® Number serves as a globally recognized business identifier, widely adopted by governments, financial institutions, and multinational corporations.

Key Strengths:

- Deep expertise in credit and risk scoring, providing actionable intelligence for underwriting, compliance, and supplier assessment.

- Integrates multiple data sources — including registry filings, trade data, and payment history — into unified company profiles.

- Offers corporate hierarchy and ownership structures, supporting due diligence and global supply chain transparency.

- Enterprise-grade APIs and connectors available for platforms such as Salesforce, Oracle, and SAP.

- Longstanding credibility and global recognition as a trusted data provider in regulated industries.

Limitations:

- Licensing terms are strict, with limited flexibility for data redistribution or derivative product creation.

- High pricing and long contract commitments may not suit startups or smaller organizations.

- Source transparency is limited — end users cannot trace attributes directly to original registry filings.

- Update frequency and data depth can vary across regions and smaller jurisdictions.

Pricing:

Dun & Bradstreet follows a contract-based enterprise pricing model, typically structured around usage volume and access type:

- Basic Access: Starts around $10,000–$15,000 per year for smaller teams.

- Enterprise Packages: Range from $50,000 to $250,000+ annually, depending on the number of users, data domains, and integration depth.

- Optional add-ons include credit scoring, supplier risk monitoring, and global compliance data modules.

Best for:

Enterprises, financial institutions, and compliance teams requiring risk scoring, corporate hierarchies, and credit analytics supported by a long-established data infrastructure.

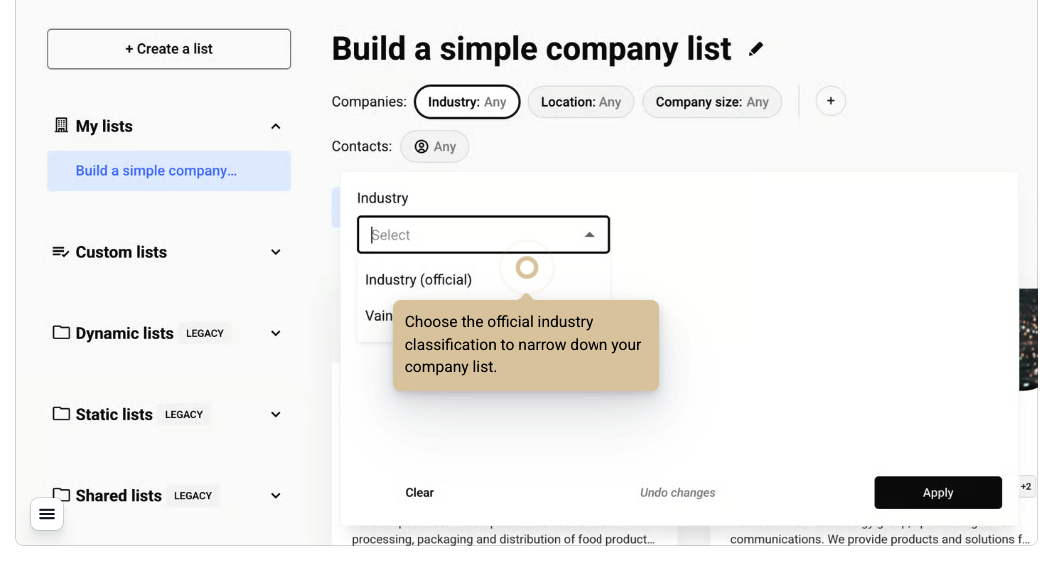

8. Vainu

Overview:

Vainu is a company data platform that provides firmographic and technographic insights for sales and marketing teams. The platform connects data from public registries and online sources, helping users identify, segment, and prioritize prospects based on real-time company signals.

Key Strengths:

- Provides verified company data across Nordic and global markets.

- Enriched with website, technology stack, location, and industry data.

- Strong CRM integrations with Salesforce, HubSpot, Dynamics 365, and Pipedrive.

- Real-time synchronization: automatically updates company records and flags new opportunities.

- Designed for sales teams, enabling segmentation, lead scoring, and prospect list creation.

- Transparent pricing with on-demand estimation tools for both Nordic and global coverage.

Limitations:

- Primarily focused on sales and marketing intelligence; lacks compliance and ownership datasets.

- No registry-level transparency or verified source traceability.

- Limited coverage outside Europe, especially for smaller jurisdictions.

- No reseller rights, as data is licensed only for internal use.

Pricing:

Vainu offers transparent annual pricing, based on regional and global datasets:

- Nordic Database: Starting at €4,200/year (+€750 one-time onboarding fee). Includes registry-based data from Finland, Sweden, Norway, and Denmark.

- Global Database: Starting at €12,000/year (+€750 onboarding). Includes global company data with website and technographic attributes.

- Both plans include one user license, CRM integrations, API access, and CSV/Excel export capabilities. Subscriptions renew automatically on a 12-month basis, with cancellation available 60 days before renewal.

Best for:

Sales and marketing organizations seeking European and global B2B prospecting data with CRM synchronization, technographics, and firmographic enrichment.

9. Orbis (Moody’s Analytics)

Overview:

Orbis , developed by Bureau van Dijk (a Moody’s Analytics company) , is one of the most comprehensive databases for company intelligence and financial benchmarking. It aggregates standardized company data from thousands of sources — including official registries, annual reports, and third-party filings — with a focus on providing in-depth financials, ownership structures, and corporate hierarchies.

Key Strengths:

- Deep coverage of public and private companies globally , standardized for cross-border comparison.

- Extensive financial information, including profit and loss, balance sheets, ratios, and credit indicators.

- Advanced mapping of corporate ownership, including UBOs, shareholders, and group structures.

- Rich set of search filters and modeling tools for credit analysis, valuation, and peer comparison.

- API and bulk data delivery available through the Moody’s Analytics DataHub for enterprise integration.

- Recognized as an industry standard among banks, investment firms, and academic researchers.

Limitations:

- High licensing costs, with pricing dependent on geography, company count, and data modules.

- Strict usage and reseller restrictions — clients cannot redistribute data or embed it into third-party products.

- Data lineage is not fully transparent, as registry sources are aggregated through multiple intermediaries.

- Complex interface for new users, requiring onboarding to access the full depth of the dataset.

Pricing:

Orbis uses a modular licensing model tailored to organization size and coverage requirements:

- Single-User License: Typically starts from $25,000 per year for access to selected regions or datasets.

- Full Access Packages: Range from $60,000–$200,000+ per year, depending on modules (ownership, financials, M&A, etc.).

- Enterprise Solutions: Include API access and data feeds for large-scale integrations, with bespoke pricing under multi-year agreements.

Best for:

Financial institutions, consultants, and analysts requiring detailed financial benchmarking, global ownership structures, and credit insights within a controlled, compliance-ready data environment.

10. Corporama

Overview:

Corporama, part of Ellisphere Group, is a French business intelligence platform focused on company monitoring, risk assessment, and sales prospecting. It aggregates firmographic, financial, and legal data on French and European companies, helping users identify opportunities and detect potential risks in real time.

Key Strengths:

- Strong coverage of French and EU companies, integrating data from local registries, BODACC, and financial filings.

- Provides detailed firmographics, financials, and legal events, including management changes, press mentions, and risk indicators.

- Offers monitoring tools that alert users to changes in a company’s status, ownership, or financial position.

- Integrated CRM and API connectivity for automated enrichment and prospect management.

- Combines registry data with financial and legal intelligence, positioning itself as both a sales and compliance tool.

Limitations:

- Coverage outside France and Western Europe is limited.

- The platform’s API is less open and flexible than those of global-first providers.

- Lacks ownership mapping at a global scale (no detailed UBO linkages).

- Reseller rights are restricted; data cannot be redistributed without specific agreements.

Pricing:

Corporama follows a subscription-based model with packages tailored to company size and feature access:

- Starter Plan: Around €250–€400/month, offering access to French company profiles and monitoring alerts.

- Professional Plan: €600–€900/month, including extended financial data, API integration, and additional seats.

- Enterprise Plans: Custom pricing, with full access to risk indicators, monitoring dashboards, and CRM integration.

Best for:

Businesses focused on the French and European markets, looking for a single platform that combines company verification, financial monitoring, and commercial prospecting capabilities.

Frequently Asked Questions (FAQ)

1. What is HitHorizons used for?

HitHorizons is a business intelligence platform that aggregates company data from European registries. It helps users explore firmographics, analyze industries, and identify business opportunities within the EU region. However, its limited geographic scope and integration capabilities have led many businesses to seek broader and more transparent alternatives.

2. Why look for HitHorizons alternatives in 2026?

While HitHorizons provides solid coverage in Europe, it lacks global reach, API flexibility, and financial data depth. Many organizations now require verified, registry-sourced company intelligence with real-time updates, transparent sourcing, and integration options for automation. Platforms like Global Database and Zephira offer these capabilities at scale.

3. Which is the best HitHorizons alternative overall?

Global Database is widely considered the top HitHorizons alternative in 2026. It provides registry-verified company data from over 100 countries , including digitized financials, corporate linkages, and enriched firmographics. Every data attribute is traceable to its official government source, ensuring unmatched transparency and accuracy.

4. Which HitHorizons alternative is best for developers and fintechs?

Zephira and Monetaiq are the best choices for developers, fintechs, and regtechs. They both offer API-first access to verified registry data, financials, and ownership structures, enabling seamless integration into onboarding, compliance, and credit workflows.

5. What alternative offers the most comprehensive global coverage?

Orbis (Moody’s Analytics) and Global Database both provide extensive international coverage. However, Global Database offers direct registry sourcing with daily updates, while Orbis aggregates data from intermediaries. For teams prioritizing data provenance and source transparency, Global Database is preferred.

6. Which platform is best for financial and credit analysis?

Monetaiq , Orbis , and Dun & Bradstreet are strong choices for users focused on financial intelligence and credit scoring . Monetaiq stands out for its AI-digitized historical financials and API-first architecture, making it ideal for investors and analysts needing real-time financial benchmarking.

7. What’s the best HitHorizons alternative for compliance and AML checks?

Zavia.ai is the leading alternative for compliance, AML, and UBO discovery. It uses AI to map ultimate beneficial ownership, monitor PEPs and sanctions , and link every ownership record back to its registry source, ensuring full auditability.

8. Which HitHorizons alternative suits sales and marketing teams?

Vainu and Corporama are excellent choices for sales, marketing, and prospecting. Vainu focuses on firmographics and technographics with CRM integrations, while Corporama combines French and EU company data with financial monitoring and alerts for opportunity tracking.

9. Are there free or open-source alternatives to HitHorizons?

Yes. OpenCorporates offers open access to basic registry-level company data from over 200 jurisdictions. While it’s ideal for transparency and research, it lacks enriched financials, ownership mapping, and API flexibility compared to premium platforms like Global Database or Zephira.

10. How do pricing models differ among HitHorizons competitors?

Pricing varies widely:

- Global Database – from £3,000/year (platform) or $0.10–$1.00 per API call.

- Zephira/Monetaiq – from $49/month (API-based plans).

- Statista – from $59/month for analytics access.

- Orbis/Dun & Bradstreet – enterprise-only contracts starting around $25,000/year.

- Vainu/Corporama – regional subscriptions from €4,200/year.

- The right option depends on whether you need global registry access, analytics depth, or API integration.

11. Which platform offers the most transparent data sourcing?

Global Database, Zephira, and Zavia.ai are the only platforms in this list offering full source transparency — every data point can be traced directly to its official government registry with timestamps, ensuring compliance-grade trust and accuracy.

Conclusion

The landscape for B2B company data platforms has evolved far beyond simple registry lookups. Businesses today demand real-time accuracy, global reach, and verifiable sourcing—capabilities that define the new generation of data providers. Platforms such as Orbis, Dun & Bradstreet, and Statista continue to serve established markets with extensive datasets, while emerging innovators like Zephira, Zavia.ai, and Monetaiq are reshaping how organizations access, enrich, and verify business information through APIs and AI automation.

For organizations focused on data transparency, registry accuracy, and integration flexibility , Global Database stands out as the most balanced solution among all HitHorizons alternatives. It combines direct access to over 100 official registries with digitized financials, enriched firmographics, corporate linkages, and full source traceability—delivered through scalable APIs and flexible licensing.

As data becomes the foundation of every growth, compliance, and risk-management strategy, choosing the right platform is no longer just about coverage—it’s about trust, transparency, and adaptability . In 2026, the platforms that prioritize verified, first-party registry data will define the next decade of business intelligence, and Global Database is well positioned at the center of that transformation.