2. Zephira.ai — Best Developer-First API Alternative to Markaaz for KYB, UBO & Global Registry Data

Zephira.ai is one of the strongest developer-focused alternatives to Markaaz, offering a clean, fast, and highly structured API for global KYB, UBO mapping, company verification, and registry-based entity intelligence. Built for engineers, onboarding platforms, regtechs, and financial institutions, Zephira.ai delivers real-time registry-sourced data, transparent field-level sourcing, and modular endpoints designed for integration into any compliance, onboarding, or risk workflow.

For companies searching phrases like “Markaaz competitors,” “Markaaz alternatives,” or “Zephira vs. Markaaz”, Zephira.ai stands out as a powerful option when data depth, speed, UBO visibility, and developer experience matter most.

Strengths of Zephira.ai

Developer-first architecture

API built from the ground up for engineers: predictable schema, fast queries, clean JSON responses.

Registry-sourced global data

All core data points originate from official government registries across 100+ countries.

Full attribute-level sourcing

Every field includes its original registry source — ideal for AML, audited workflows, and regulatory compliance.

Modular endpoints for KYB & UBO

Including: legal entity verification, shareholders, officers, UBO mapping, group structure, tax IDs, financials, and more.

Real-time global coverage

Live access to registry data for KYB and due diligence across Europe, APAC, the Americas, and emerging markets.

Financial statements supported

Financial filings are digitized using OCR + AI, enabling deeper credit and risk analysis.

Easy integration into any workflow

Perfect for onboarding flows, payment-risk engines, supplier verification, and marketplace trust layers.

Weaknesses of Zephira.ai

(Balanced and neutral for SEO credibility)

No UI or dashboard

Zephira is API-only and may not suit teams without engineering resources.

Usage-based pricing

Can scale with large request volumes, depending on workload.

Financial data availability varies

Only countries with public filings can return financials.

Zephira.ai vs. Markaaz Comparison Table

Category | Zephira.ai | Markaaz |

|---|

Primary Focus | Developer-first KYB, UBO & global registry data API | Business verification & onboarding automation |

Data Coverage | Registry-sourced data from 100+ countries | 200+ jurisdictions (aggregated) |

Data Source Model | Direct official registry data | Aggregated data from multiple providers |

Source Transparency | Full attribute-level registry source references | Not available |

UBO Mapping | Deep UBO & ownership layers via registry filings | Limited |

Corporate Linkages | Group structures & ownership chain | Limited coverage |

Financial Statements | Yes — structured filings via OCR + AI | Not provided |

API Quality | High-performance, developer-friendly, clean JSON | APIs focused on verification |

Search & Filters | Advanced query filters & parameters | Basic business lookup |

Ideal Use Cases | Fintechs, regtechs, KYC/KYB tools, onboarding platforms, AML systems | SME onboarding & verification workflows |

Pricing Model | PAYG + enterprise API plans | Verification-focused subscription plans |

Conclusion — Zephira.ai as a Markaaz Alternative

Zephira.ai is a strong Markaaz alternative for organizations that need:

Real-time registry-sourced company data

Deep ownership, UBO, and shareholder intelligence

Reliable KYB, AML, and due-diligence workflows

A developer-focused API with fast integration

Financial statements and structured filings

While Markaaz is well suited for UI-driven onboarding and verification, Zephira.ai excels in data depth, sourcing transparency, and developer-centric use cases. Companies building automated verification flows, financial compliance tools, or global risk engines often choose Zephira.ai for its precision, structure, and scalability.

FAQ: Zephira.ai vs. Markaaz

1. Is Zephira.ai a good alternative to Markaaz?

Yes. Zephira.ai is one of the strongest Markaaz alternatives for engineering teams needing registry-sourced KYB, UBO data, corporate linkages, and financial statements via API.

2. Does Zephira.ai offer better data depth than Markaaz?

Zephira.ai provides deeper registry data, field-level sourcing, UBO mapping, and structured financials — areas where Markaaz offers more limited coverage.

3. Which platform is better for developers: Zephira.ai or Markaaz?

Zephira.ai. Its developer-first architecture, clean JSON schemas, and consistent endpoints make it more suitable for product teams and engineers.

4. Does Zephira.ai provide financial statements?

Yes. Zephira.ai offers digitized financial filings via OCR + AI, whereas Markaaz does not provide financial statements.

5. Is Zephira.ai better for KYB automation?

For API-based KYB, UBO mapping, and registry-level verification, Zephira.ai provides broader depth and transparency. Markaaz remains strong for UI-based onboarding.

3. Dun & Bradstreet (DNB) — Established Global Data & Credit Intelligence Provider

Dun & Bradstreet (DNB) is one of the most recognized names in global business information, known for its vast dataset, long-standing industry presence, and proprietary credit scoring models. DNB is frequently compared to Markaaz—especially for enterprise use cases requiring corporate hierarchies, credit intelligence, financial statements, and global compliance datasets.

Its reputation and scale make DNB a strong option for large financial institutions, procurement teams, insurers, and multinational organizations that require mature, enterprise-grade business data solutions.

Strengths of Dun & Bradstreet

Extensive global database

Coverage across hundreds of millions of company records globally.

Strong credit risk intelligence

Industry-leading credit scoring, the D-U-N-S Number system, and predictive risk indicators.

Mature corporate hierarchy data

Well-developed parent/subsidiary linkages and group structures.

Deep financial and compliance data

Business filings, credit information, legal events, and financials where available.

Enterprise-ready integrations

Strong native connectivity with major ERPs, CRMs, and procurement platforms.

Decades of trust in regulated industries

Widely used by banks, insurers, and large enterprises requiring long-term data continuity.

Weaknesses of Dun & Bradstreet

Strict reseller and redistribution rights

DNB has one of the most restrictive licensing frameworks in the industry, making resale, redistribution, or bundling challenging for partners and platforms.

Heavy reliance on data partners (with royalty obligations)

In many countries, DNB depends on third-party sources rather than direct registry integrations. This can increase costs due to licensing fees and may affect data transparency.

Limited attribute-level source visibility

Unlike registry-first providers, DNB does not typically supply original source references at the field level.

High pricing aligned with enterprise clients

Often cost-prohibitive for SMBs, startups, or mid-market platforms.

Complex contracts and onboarding

Implementation and licensing can be more complex compared to newer API-first providers.

Not developer-first

The API is functional but not optimized for modern engineering workflows or rapid product embedding.

Dun & Bradstreet vs. Markaaz Comparison Table

Category | Dun & Bradstreet (DNB) | Markaaz |

|---|

Primary Focus | Global business data & credit intelligence | Business verification & onboarding automation |

Global Coverage | Hundreds of millions of companies | 500M+ companies across 200+ jurisdictions |

Data Sources | Mix of registry + external data partners | Aggregated datasets |

Source Transparency | Limited attribute-level sourcing | Not available |

Corporate Hierarchies | Strong corporate family trees | Available (varies) |

UBO Mapping | Available in certain markets | Available but limited |

Financial Statements | Yes, depending on country | Not provided |

Credit & Risk Scores | Industry-leading credit scoring | Basic validation indicators |

API & Integrations | Enterprise integrations, traditional API | Verification-focused API |

Reseller Rights | Highly restrictive | More standardized but restrictive |

Data Partner Dependencies | High — royalties often apply | Moderate |

Best Fit For | Large enterprises, banks, procurement | Onboarding & verification-first platforms |

Conclusion — DNB as a Markaaz Competitor

Dun & Bradstreet remains a strong Markaaz competitor for large enterprises needing high-quality credit intelligence, financial data, and global corporate hierarchies. Its established presence, risk models, and compliance datasets make it suitable for organizations that require deep, long-term business intelligence.

However, DNB’s strict reseller rights, dependence on external data partners (with associated royalties), and enterprise-level pricing make it less suitable for modern fintechs, regtechs, and growing digital platforms that need flexible licensing or developer-focused data access.

Markaaz remains a solid option for verification-first onboarding, while DNB serves organizations that require traditional, enterprise-grade credit and risk intelligence.

FAQ: Dun & Bradstreet vs. Markaaz

1. Is Dun & Bradstreet (DNB) a strong alternative to Markaaz?

Yes. Dun & Bradstreet is considered a strong Markaaz alternative for enterprises that need global credit intelligence, financial statements, and detailed corporate hierarchies. DNB is widely used by banks, insurers, and procurement teams looking for in-depth risk insights.

2. What is the main difference between Dun & Bradstreet and Markaaz?

DNB focuses on enterprise-grade credit data, financial reporting, and complex corporate structures, while Markaaz is optimized for business verification and onboarding workflows. DNB offers deeper risk modeling, whereas Markaaz offers fast verification tools.

3. Does Dun & Bradstreet provide UBO and ownership data?

Partially. DNB offers ownership and UBO information in select countries, but coverage depends on regional partners. Markaaz provides UBO visibility too, but with more limited depth.

4. Does Dun & Bradstreet rely on external data partners?

Yes. DNB relies heavily on external data partners in many countries—often with royalty obligations. This can affect cost, source transparency, and dataset consistency.

5. Are Dun & Bradstreet’s reseller rights restrictive?

Yes. Dun & Bradstreet is known for strict reseller and redistribution terms, making it harder for third-party platforms to resell or bundle DNB data compared to more flexible competitors.

4. Creditsafe — Global Business Credit & Risk Intelligence Provider

Creditsafe is a widely recognized business credit reporting and risk intelligence provider, best known for offering fast company checks, credit scores, and credit limits across many global markets. Compared to Markaaz, Creditsafe is often chosen by organizations looking for quick credit assessments, supplier checks, and basic KYB information.

Creditsafe has strong presence in Europe and North America, serving financial institutions, procurement teams, and SMBs that require accessible, easy-to-use business credit data.

Strengths of Creditsafe

Strong global credit data coverage

Creditsafe offers business credit reports across dozens of countries, with particular strength in Europe and the U.S.

Fast access to credit risk indicators

Including credit scores, credit limits, payment behavior, and financial distress signals.

Simple, user-friendly interface

Designed for quick company lookups and intuitive navigation, suitable for teams without technical expertise.

API access for automated checks

Creditsafe provides APIs for integrating credit reports into onboarding, risk, or underwriting workflows.

Popular with SMBs and mid-market companies

Because pricing is generally more accessible compared to enterprise-heavy providers like D&B.

Useful for supplier and vendor checks

Procurement teams often rely on Creditsafe for basic due-diligence and risk screening.

Weaknesses of Creditsafe

Limited UBO and ownership depth

Creditsafe does not specialize in ownership chains or multi-jurisdictional UBO mapping.

No attribute-level sourcing from registries

Creditsafe’s data sources are not always transparent at the field level.

Financial data availability varies

Financial statements and filings are only available in certain markets.

Global coverage is uneven

Strong in major markets, weaker in parts of APAC, Africa, and Latin America.

Not designed for deep KYB or AML workflows

Creditsafe is more suitable for credit checks than for regulated compliance processes.

Reseller rights are limited

Licensing and redistribution terms are stricter compared to flexible partner models.

Creditsafe vs. Markaaz Comparison Table

Category | Creditsafe | Markaaz |

|---|

Primary Focus | Business credit reports & risk indicators | Business verification & onboarding automation |

Data Coverage | Strong in EU & US, moderate globally | 500M+ companies across 200+ jurisdictions |

Data Source Model | Mixed sources, no field-level sourcing | Aggregated data from multiple providers |

Credit & Risk Data | Credit scores, credit limits, payment data | Basic validation & business status |

UBO & Ownership | Limited | Limited |

Financial Statements | Available in select countries | Not provided |

Corporate Hierarchies | Basic | Available (varies) |

API & Integrations | API for automated credit checks | APIs for verification workflows |

Reseller / Licensing | Restricted rights | Standard but restrictive |

Best Fit For | Credit checks, supplier risk, underwriting | Onboarding & business verification |

Conclusion — Creditsafe as a Markaaz Competitor

Creditsafe is a strong alternative to Markaaz for organizations focused on credit checks, supplier screening, and risk scoring, especially in Europe and North America. It offers reliable credit limits, payment data, and accessible pricing for SMBs and mid-market companies.

However, Creditsafe is less suited for deep KYB, ownership intelligence, or global registry-level verification, where more advanced platforms provide significantly broader coverage.

Markaaz excels in verification-first onboarding workflows, while Creditsafe excels in credit assessment and supplier risk analysis.

FAQ: Creditsafe vs. Markaaz

1. Is Creditsafe a good alternative to Markaaz?

Yes. Creditsafe is a strong Markaaz alternative for companies that specifically need business credit reports, credit scores, and supplier risk checks, especially in Europe and North America. It is well suited for procurement, underwriting, and SMB credit assessment.

2. What is the main difference between Creditsafe and Markaaz?

Creditsafe focuses on credit intelligence, payment performance, and risk scoring, while Markaaz is designed for business verification and onboarding. Creditsafe is better for credit checks, whereas Markaaz supports KYB and identity matching.

3. Does Creditsafe provide UBO or ownership data?

Only limited ownership visibility is available. Creditsafe does not specialize in deep UBO mapping or multi-layer ownership chains, while Markaaz also offers limited ownership depth. Platforms like Global Database offer far deeper ownership structures.

4. Does Creditsafe provide financial statements?

Yes, in select countries. Creditsafe offers financial statements where they are publicly available or sourced through partners. However, coverage varies by region, and financial data is not available in all markets. Markaaz does not provide financial statements.

5. Is Creditsafe suitable for global KYB and AML workflows?

Not typically. Creditsafe is primarily a credit risk provider, not a KYB or AML-focused platform. It is ideal for supplier checks and credit evaluations, while Markaaz is better suited for verification and onboarding workflows.

5. Moody’s Analytics (Orbis / Bureau van Dijk) — Deep Global Corporate Structures & Financial Intelligence

Moody’s Analytics (Bureau van Dijk – Orbis) is one of the world’s most comprehensive datasets for corporate ownership, global hierarchies, financial statements, and cross-border business intelligence. It is widely used by financial institutions, banks, researchers, and multinational corporations that require deep global insight into company structures and corporate families.

Compared to Markaaz, Orbis offers far deeper ownership data, broader financial coverage, and expansive corporate linkages, but generally comes with high pricing and restrictive licensing, making it less accessible for growing fintechs, SMBs, or developer-led organizations.

Strengths of Moody’s Analytics (Orbis)

One of the largest global corporate structure databases

Orbis provides unparalleled visibility into parent companies, subsidiaries, linkages, and cross-border families.

Extensive UBO & ownership mapping

Extremely deep ownership layers, including multi-step indirect ownership, ultimate beneficial owners, and integrated shareholder data.

Strong financial coverage

Detailed financial statements for millions of companies, historical data, ratios, and indicators.

Trusted by major financial institutions

Used by banks, governments, auditors, investment firms, and regulators for compliance and risk modeling.

Advanced research tools

Orbis is popular for macroeconomic analysis, competition analysis, and academic research due to dataset breadth.

Powerful matching & standardization

Uses advanced entity matching (including BvD ID Numbers) for consistent identification across jurisdictions.

Weaknesses of Moody’s Analytics (Orbis)

Very high pricing

Orbis is one of the most expensive platforms in the business intelligence industry, often prohibitive for SMBs and mid-market organizations.

Strict reseller & redistribution rights

Licensing is highly restrictive, limiting how platforms can use, display, or distribute Orbis data.

Heavy reliance on external data suppliers

Much of Orbis’ data is sourced from third-party partners, which also means royalty obligations, region-dependent availability, and variable source transparency.

Complex platform

Orbis is powerful but can be overwhelming, with a steep learning curve and complex workflows.

Not developer-first

API access exists but is designed for enterprise environments, not lightweight or modern developer workflows.

Coverage inconsistencies by region

Depth and availability of data vary across emerging markets.

Moody’s Analytics (Orbis) vs. Markaaz — Comparison Table

Category | Moody’s Analytics (Orbis) | Markaaz |

|---|

Primary Focus | Deep global corporate structures, ownership, financials | Business verification & onboarding automation |

Data Coverage | Millions of companies worldwide | 500M+ companies across 200+ jurisdictions |

Data Source Model | Heavy reliance on external data suppliers | Aggregated data from multiple providers |

Ownership & UBO Depth | Extremely deep multi-layer ownership & UBO mapping | Limited |

Corporate Linkages | One of the widest corporate hierarchy databases | Available (varies) |

Financial Statements | Extensive global financials | Not provided |

Risk & Credit Indicators | Available but varies by jurisdiction | Basic validation indicators |

Source Transparency | Limited at attribute level | Not available |

API & Integrations | Enterprise-focused, not dev-first | Verification API |

Reseller Rights | Highly restrictive | Standard but restrictive |

Data Partner Dependency | High — royalties apply | Moderate |

Best Fit For | Financial institutions, banks, regulators, research teams | Onboarding & verification workflows |

Conclusion — Moody’s Analytics (Orbis) as a Markaaz Competitor

Moody’s Analytics (Orbis) is one of the most advanced Markaaz competitors for organizations needing deep corporate linkages, multi-layer UBO mapping, and global financial intelligence. Its dataset is unmatched for corporate structure research, cross-border ownership tracing, and financial analysis.

However, Orbis is oriented toward large enterprises with the budget, technical resources, and licensing capacity to support its complex workflows and strict redistribution rules. For fast-growing fintechs, developer-led platforms, or SMBs, Orbis may be too costly and too restrictive.

Markaaz remains strong for verification and onboarding, while Orbis is designed for enterprise risk intelligence, corporate structure analysis, and regulatory compliance at scale.

FAQ: Moody’s Analytics (Orbis) vs. Markaaz

1. Is Moody’s Analytics (Orbis) a strong alternative to Markaaz?

Yes. Moody’s Analytics (Orbis) is one of the strongest Markaaz alternatives for organizations needing deep corporate ownership structures, UBO mapping, and global financial intelligence. It is widely used by banks, regulators, and multinational enterprises.

2. What is the main difference between Orbis and Markaaz?

Orbis provides extensive global ownership data, multi-layer UBO structures, and detailed financial statements, while Markaaz focuses on business verification and onboarding workflows. Orbis is stronger for complex corporate intelligence; Markaaz excels in verification-first use cases.

3. Does Moody’s Analytics rely on external data suppliers?

Yes. Orbis relies heavily on external regional data partners, which may require royalty payments and can impact source transparency and consistency. Markaaz also works with aggregated data sources.

4. Are reseller rights restrictive with Moody’s Analytics?

Very. Moody’s Analytics has some of the strictest licensing and redistribution rules in the industry. Third-party platforms usually cannot redistribute, display, or resell Orbis data freely.

5. Is Orbis suitable for KYB and AML workflows?

Yes, but primarily at the enterprise level. Orbis is ideal for institutions needing deep corporate linkage analysis and financial reporting, but may be too complex and expensive for SMBs or fast-scaling fintechs that need lightweight KYB automation.

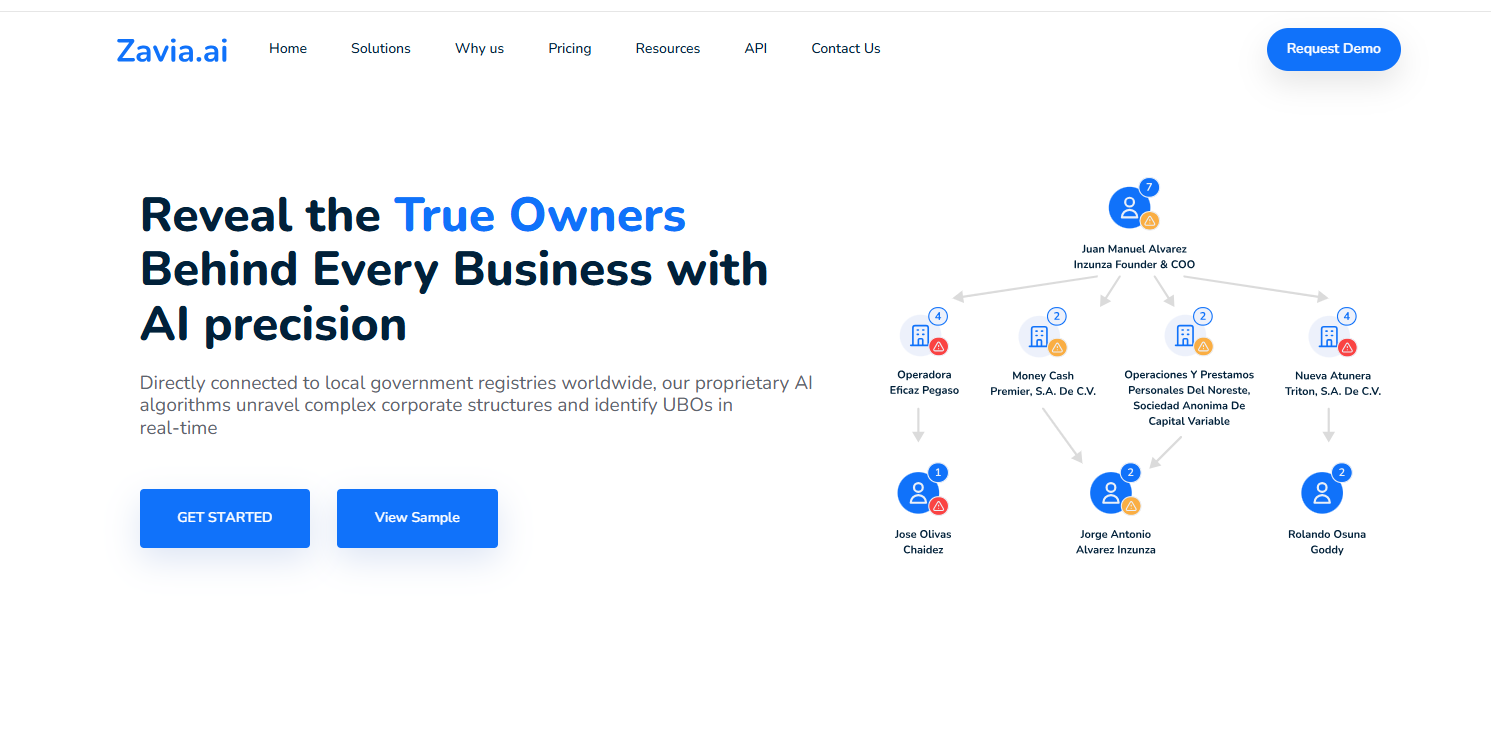

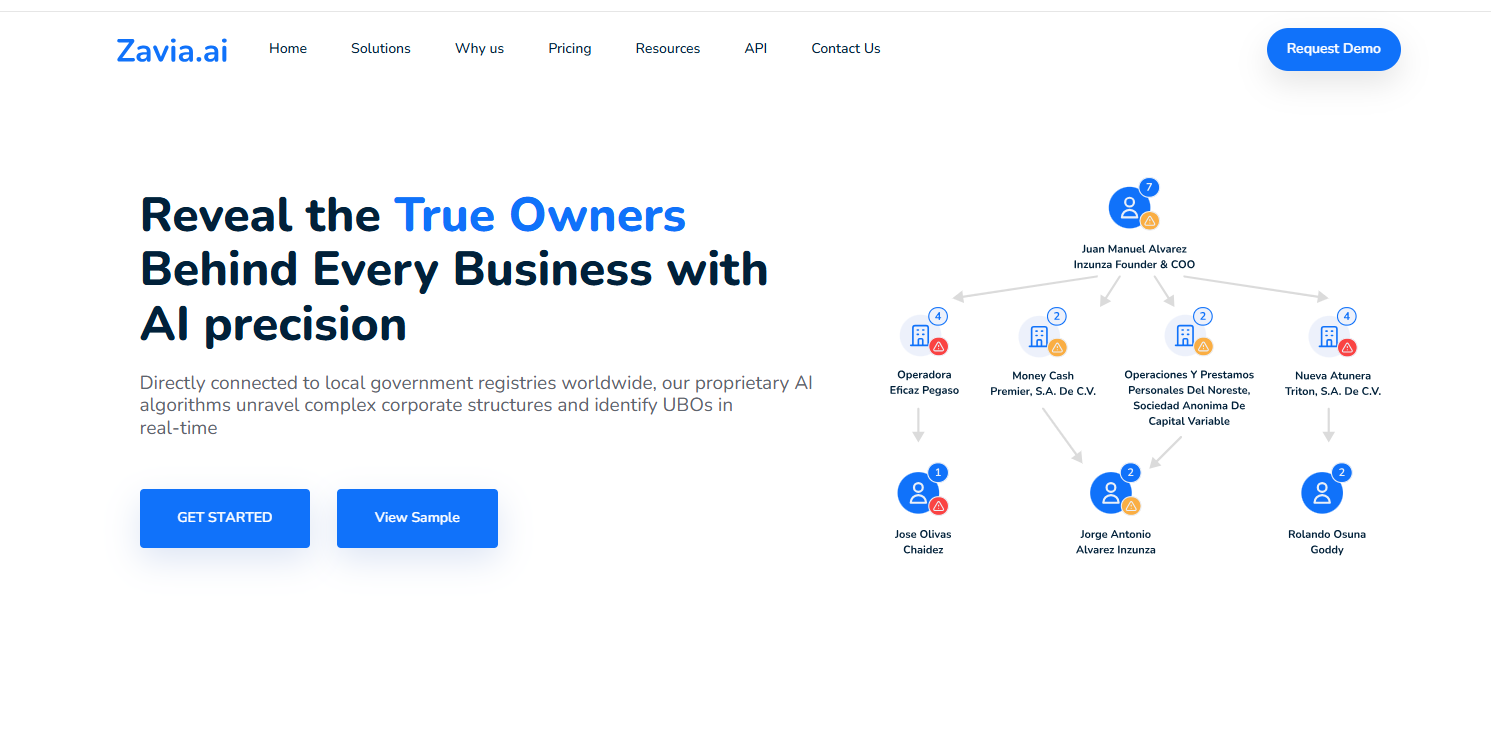

6. Zavia.ai — Top Markaaz Alternative for UBO Mapping & Global Ownership Intelligence

Zavia.ai is a next-generation platform focused on uncovering corporate ownership structures, identifying UBOs, and mapping global group relationships. It combines official registry filings with AI-driven inference to reveal multi-layer ownership paths, making it highly valuable for compliance teams, AML investigators, and due-diligence professionals who require clarity on who ultimately controls an entity.

Unlike Markaaz, which is centered around fast business verification and onboarding automation, Zavia.ai goes significantly deeper into ownership intelligence, global corporate linkages, and cross-border entity networks.

Strengths of Zavia.ai

AI-powered ownership discovery

Utilizes machine learning and graph intelligence to detect indirect shareholders, hidden ownership routes, and layered control chains across multiple jurisdictions.

Multi-layer UBO mapping

Provides detailed views into ultimate beneficial owners, even when ownership is distributed through numerous legal entities.

Advanced global corporate linkages

Visualizes parent–subsidiary relationships, related entities, cross-border networks, and corporate group structures.

Registry-first data model

Registry filings form the foundation of Zavia.ai’s dataset, with AI inference used to extend ownership visibility where needed.

Built for compliance and investigation workflows

Well-suited for AML teams, due-diligence analysts, onboarding risk units, and investigative functions that require clarity beyond basic business verification.

Weaknesses of Zavia.ai

Smaller total global company coverage than large-scale datasets.

Limited availability of company financial statements.

Some ownership layers rely on algorithmic inference where filings are incomplete.

Better suited for analysts than developer-led integrations.

Pricing typically fits mid-market and enterprise organizations.

Zavia.ai vs. Markaaz: Full Feature & Data Comparison

Category | Zavia.ai | Markaaz |

|---|

Primary Focus | AI-powered UBO mapping, ownership intelligence & corporate linkages | Business verification and onboarding automation |

Data Coverage | Multi-jurisdiction ownership & shareholder data with global linkages | 500M+ companies across 200+ jurisdictions for KYB checks |

Data Source Model | Registry filings + AI inference for complex ownership networks | Aggregated datasets from multiple third-party providers |

UBO Mapping | Deep, multi-layer ultimate beneficial owner (UBO) tracing | Limited UBO visibility |

Corporate Linkages | Extensive parent–subsidiary mapping, group structures & relationship graphs | Corporate data available, but less detailed |

Financial Data | Limited financial statement availability | No company financial statements |

Risk & Compliance Use Cases | Strong for AML, due diligence, ownership investigations | Optimized for business validation & onboarding workflows |

API Availability | API available for ownership intelligence; analyst-oriented | API focused on instant KYB & verification |

Best Fit For | AML teams, investigators, due-diligence analysts, UBO researchers | Companies needing quick verification and onboarding automation |

Conclusion — Zavia.ai as a Markaaz Competitor

Zavia.ai is a strong competitor to Markaaz for organizations that require deep ownership intelligence, global UBO mapping, and cross-border corporate linkage analysis. Its strengths lie in revealing complex ownership structures and providing clarity into who ultimately controls an entity — capabilities that go far beyond standard business verification.

While Markaaz excels at fast KYB checks and onboarding workflows, Zavia.ai is purpose-built for ownership discovery, risk analysis, and investigative due diligence, making it a powerful choice for compliance and AML-focused teams.

FAQs — Zavia.ai vs. Markaaz

1. Is Zavia.ai a strong alternative to Markaaz?

Yes. Zavia.ai offers far deeper ownership and UBO intelligence than Markaaz, making it ideal for compliance and investigative workflows.

2. Does Zavia.ai provide multi-layer UBO mapping?

Yes. Zavia.ai specializes in tracing multi-step UBO chains across multiple jurisdictions.

3. How does Zavia.ai compare to Markaaz in terms of data depth?

Zavia.ai provides stronger ownership visibility and corporate linkages, while Markaaz focuses primarily on verification and onboarding.

4. Does Zavia.ai offer company financial statements?

No. Zavia.ai is ownership-focused. Markaaz also does not provide financial reports.

5. Who typically uses Zavia.ai?

AML investigators, compliance teams, due-diligence analysts, and any organization requiring global UBO clarity.

7. Middesk — Leading U.S. Business Verification Platform for KYB & Onboarding

Middesk is a well-known U.S.-focused KYB and business verification platform used by fintechs, lenders, banking-as-a-service (BaaS) providers, and compliance teams. It specializes in helping companies instantly validate U.S. businesses, retrieve government filings, and automate onboarding workflows via API.

Compared to Markaaz, Middesk offers more authoritative U.S. business data, stronger compliance workflows, and more advanced KYB automation. However, its coverage is almost entirely limited to the United States, making it less suited for teams with international verification needs.

Strengths of Middesk

Strong U.S. business data coverage

Connects directly with U.S. federal and state-level registries, offering highly accurate domestic KYB data.

KYB automation tools

Offers automated checks for EIN verification, Secretary of State filings, registration status, entity type, and business history.

Excellent API-first infrastructure

Designed for developers and BaaS providers that need to integrate KYB checks into onboarding flows at scale.

Compliance-ready workflows

Supports risk reviews, onboarding decisions, and integration into fraud or compliance engines.

Trusted by major U.S. fintechs

A preferred choice for organizations operating in U.S.-specific financial services.

Weaknesses of Middesk

U.S.-only company coverage

No international KYB, UBO, or global entity intelligence.

No global ownership or multi-layer UBO mapping

Corporate structures are limited to domestic filings.

Limited financial data

Does not provide detailed financial statements or ratios.

Not suitable for companies with global supply chains or international partners

Coverage stops at U.S. borders.

Primarily API-driven

Less suitable for non-technical teams requiring UI-based workflows.

Middesk vs. Markaaz: Full Feature & Data Comparison

Category | Middesk | Markaaz |

|---|

Primary Focus | U.S.-focused KYB verification & onboarding automation | Global business verification across 200+ jurisdictions |

Geographic Coverage | United States only | 500M+ companies in 200+ regions |

Data Source Model | Direct access to U.S. state and federal registries | Aggregated datasets from multiple data providers |

UBO Mapping | No multi-layer UBO mapping | Limited UBO visibility |

Corporate Linkages | Domestic corporate connections | Global business relationships (varies) |

Financial Data | Limited U.S. filings only | No financial statements |

Risk & Compliance | Strong U.S.-centric KYB automation | Business validation and onboarding workflows |

API Availability | Robust API-first platform for verification | API for KYB + business validation |

Best Fit For | U.S. fintechs, lenders, neobanks, BaaS providers | Global onboarding and cross-border verification needs |

Conclusion — Middesk as a Markaaz Competitor

Middesk is a strong Markaaz competitor within the U.S. business verification and KYB automation space. It offers excellent domestic data accuracy, strong compliance tools, and a developer-friendly API that fits the needs of modern fintechs and financial platforms.

However, Middesk is limited to the U.S. market. Organizations with global KYB needs, international customers, cross-border suppliers, or worldwide onboarding will find Middesk unsuitable without additional data providers. In contrast, Markaaz covers international jurisdictions but offers shallower ownership and financial insights.

For teams focused exclusively on U.S. onboarding and verification, Middesk stands out as a top choice.

FAQs — Middesk vs. Markaaz

1. Is Middesk a good alternative to Markaaz for business verification?

Yes. Middesk is a strong Markaaz alternative for U.S.-only business verification. It offers highly accurate KYB checks using direct federal and state registry data. However, Markaaz is better for companies needing global business verification across 200+ jurisdictions.

2. Does Middesk offer global KYB or international company verification?

No. Middesk’s coverage is limited to the United States. It does not provide international business verification or global KYB checks. If you require global coverage, Markaaz offers significantly broader international reach.

3. Does Middesk provide UBO mapping or corporate ownership structures?

No. Middesk does not offer UBO mapping, ownership layers, or corporate hierarchy data. Middesk focuses on U.S. company verification. Markaaz also offers limited ownership capabilities compared to specialized ownership intelligence platforms.

4. Which platform is better for fintech onboarding and KYB automation?

For U.S.-only fintechs, Middesk is a top choice due to its precise domestic data and developer-first API.

For international fintechs or platforms onboarding companies across borders, Markaaz is more suitable because of its global entity coverage.

5. What is the key difference between Middesk and Markaaz?

The main difference is geographic scope:

Middesk specializes in U.S. registry-based KYB.

Markaaz offers broader global business verification.

Companies operating internationally typically choose Markaaz, while U.S.-focused fintechs often choose Middesk.

8. OpenCorporates — The World’s Largest Open Company Registry Database

OpenCorporates is one of the most widely recognized open-data platforms for global company information. Its mission is transparency: making company registries around the world freely accessible to the public. With data sourced from official government registries, OpenCorporates provides basic company records, officer information, and filing data from over 140 jurisdictions.

Compared to Markaaz, OpenCorporates offers broader global registry transparency, while Markaaz delivers a verification-first platform focused on onboarding automation. OpenCorporates is ideal for researchers, journalists, NGOs, and light due-diligence workflows — but not designed for real-time KYB, UBO mapping, or financial intelligence.

Strengths of OpenCorporates

Largest open database of company information

Tens of millions of companies from 140+ jurisdictions, sourced directly from government registries.

Strong transparency mission

Ideal for investigative journalism, compliance research, and corporate accountability initiatives.

Officer and director data available

Includes officer names, filings, and appointments when provided by local registries.

Free and paid access options

Data is partially free, with enterprise licensing available for bulk or API access.

Excellent for registry validation and cross-checking

Useful for confirming whether a company exists and identifying core registry attributes.

Weaknesses of OpenCorporates

No UBO mapping or ownership layers

Does not trace control structures or shareholder relationships.

Limited corporate linkages

No global group structures or parent–subsidiary mapping.

No company financial statements

Financial data is not provided, even in paid plans.

Coverage varies by jurisdiction

Some registries provide detailed data; others offer only minimal fields.

Not built for onboarding automation or real-time KYB

Lacks the enriched datasets and workflows needed for fintechs and enterprise compliance teams.

OpenCorporates vs. Markaaz: Full Feature & Data Comparison

Category | OpenCorporates | Markaaz |

|---|

Primary Focus | Global open-data registry transparency | Business verification & onboarding automation |

Data Coverage | Millions of companies across 140+ registries | 500M+ companies in 200+ jurisdictions |

Data Source Model | Direct data from official company registries | Aggregated data from multiple providers |

UBO Mapping | Not available | Limited |

Corporate Linkages | No parent–subsidiary mapping | Available, varies by region |

Financial Data | Not provided | Not provided |

Risk & Compliance | Good for basic validation & registry checks | KYB-driven business validation |

API Availability | API available for registry data access | API for verification & onboarding |

Best Fit For | Journalists, NGOs, researchers, light compliance checks | Businesses needing global verification workflows |

Conclusion — OpenCorporates as a Markaaz Competitor

OpenCorporates is a strong competitor to Markaaz for organizations that prioritize registry transparency, public records access, and verification through official filings. It is particularly valuable for investigative work, academic research, and light compliance checks.

However, OpenCorporates is not designed for onboarding, KYB automation, ownership mapping, financial intelligence, or risk-based workflows. For teams needing real-time verification, enriched global datasets, or integrated onboarding flows, Markaaz remains the more suitable solution.

FAQs — OpenCorporates vs. Markaaz

1. Is OpenCorporates a strong alternative to Markaaz for global company information?

OpenCorporates is a strong alternative if you need raw registry data, public filings, and official company records from more than 140 global registries.

If your goal is automated KYB checks, onboarding workflows, or verification across 200+ jurisdictions, Markaaz is better suited.

2. Does OpenCorporates provide UBO information or ownership structures?

No. OpenCorporates does not provide UBO mapping, shareholder hierarchies, or ownership chains. Its data is limited to what registries publish publicly.

Markaaz also offers limited ownership details, but neither platform specializes in UBO intelligence.

3. What is the main difference between OpenCorporates and Markaaz?

OpenCorporates focuses on open-access registry transparency, making official filings and basic company records easily searchable.

Markaaz focuses on business verification, identity checks, and onboarding automation, offering broader global coverage and enrichment suited for compliance workflows.

4. Does OpenCorporates include company financial statements or credit data?

No. OpenCorporates does not offer financial statements, credit risk indicators, or financial analytics.

Markaaz also does not provide financial statements but supports broader verification-focused datasets for KYB workflows.

5. Who typically uses OpenCorporates?

OpenCorporates is widely used by:

Investigative journalists

NGOs and transparency organizations

Researchers

Compliance analysts needing registry confirmation

Public sector & academic groups

Teams requiring real-time KYB, global onboarding automation, or verification across 200+ markets typically use a platform like Markaaz instead.

9. Monetaiq — Global Financial Data Platform for Private & Public Companies

Monetaiq is a financial data intelligence platform providing real-time access to 400M+ private companies and 60,000 public companies across more than 100 countries. The platform specializes in delivering financial statements, historical performance data, company profiles, and ticker-level insights—making it a powerful resource for analysts, financial institutions, investment teams, and risk assessment workflows.

Compared to Markaaz, which focuses on business verification and onboarding automation, Monetaiq stands out for its financial data depth, historical records, and coverage of both private and public companies.

Strengths of Monetaiq

Extensive global financial data

Includes balance sheets, income statements, cash flow statements, financial ratios, and performance metrics for millions of companies.

Deep private company coverage

Financials and profiles for 400M+ private companies, which is significantly broader than most verification platforms.

Public company market data

Access to 60,000+ public companies, with up-to-date ticker information and historical performance.

Historical data availability

Supports multi-year analysis, trend identification, and financial modeling.

API and bulk delivery

Offers developer-friendly APIs and bulk data feeds for large-scale integration into platforms, CRMs, or financial tools.

Ideal for risk, underwriting, and investment workflows

Provides the depth needed for credit assessment, valuation, portfolio research, and due diligence.

Weaknesses of Monetaiq

Does not provide KYB verification or onboarding automation like Markaaz.

Limited ownership, UBO, or group structure visibility.

No company credit scores (unless calculated externally).

Less optimized for compliance teams compared to fintech-focused verification platforms.

Primarily data-focused; no low-code onboarding flows.

Monetaiq vs. Markaaz: Full Feature & Data Comparison

Category | Monetaiq | Markaaz |

|---|

Primary Focus | Global financial statements, private & public company data | Business verification & onboarding automation |

Data Coverage | 400M+ private companies + 60,000 public companies | 500M+ companies across 200+ jurisdictions |

Data Source Model | Financial statements, historical data, ticker data | Aggregated KYB-focused datasets |

Financial Data | Extensive financial statements (BS, IS, CF, ratios) | Not provided |

UBO Mapping | Not available | Limited |

Corporate Linkages | Not provided | Available (varies) |

Risk & Analytics | Strong for underwriting, portfolio analysis, research | KYB-driven validation only |

API Availability | API + bulk data feeds for financial data delivery | API for verification and onboarding |

Best Fit For | Financial analysts, investors, underwriters, research teams | Companies needing global KYB & onboarding automation |

Conclusion — Monetaiq as a Markaaz Competitor

Monetaiq is a strong competitor to Markaaz for organizations that need deep financial intelligence, multi-year company performance data, and broad coverage of both private and public companies. It excels in underwriting, financial modeling, investment research, and credit analysis.

While Markaaz focuses on identity resolution and onboarding automation, Monetaiq delivers structured financial statements and historical data on a global scale—making it a better fit for finance, banking, and analytics teams rather than KYB workflows.

Top 5 FAQs — Monetaiq vs. Markaaz

1. Is Monetaiq a strong alternative to Markaaz for global company data?

Yes. Monetaiq is a strong alternative for companies that require global financial statements, private company financials, and historical performance data, while Markaaz is better for KYB and onboarding automation.

2. Does Monetaiq provide financial statements for private companies?

Yes. Monetaiq offers financial data for 400M+ private companies, including income statements, balance sheets, cash flow data, and ratios—far deeper than typical verification platforms.

3. What is the biggest difference between Monetaiq and Markaaz?

Monetaiq focuses on financial intelligence and historical company data, whereas Markaaz focuses on business verification and onboarding automation.

4. Does Monetaiq include public company market and ticker data?

Yes. Monetaiq offers data for 60,000+ public companies, including ticker-level information and historical performance.

5. Who should choose Monetaiq over Markaaz?

Teams in investment research, credit risk, underwriting, portfolio management, and financial analytics will gain more from Monetaiq’s in-depth financial dataset than from Markaaz’s verification-driven approach.

10. Experian — Global Credit, Risk, and Business Information Provider

Experian is one of the world’s largest credit and business information providers, offering data on millions of companies across more than 200 countries. It is widely used by banks, financial institutions, lenders, insurers, and enterprises that require business credit scores, financial risk indicators, fraud prevention tools, and identity verification solutions.

Compared to Markaaz—which primarily focuses on business verification and onboarding automation—Experian delivers far deeper credit intelligence, risk scoring, and financial health insights, making it a strong competitor for organizations that need more than simple KYB checks.

Strengths of Experian

Global business credit data

Provides credit scores, credit limits, financial stability indicators, payment behavior, and risk grades for millions of companies.

Extensive financial and risk intelligence

Offers financial statements, payment histories, delinquency data, fraud risk factors, and industry-specific risk models.

Advanced identity and fraud solutions

Includes identity checks, fraud scoring, and compliance tools used by banks and regulated institutions.

Strong reputation and global reach

Decades of credibility in credit and risk analytics across 200+ countries and territories.

API, dashboards, and enterprise integrations

Supports automated decisioning, portfolio monitoring, credit assessments, and underwriting workflows.

Used by credit teams, underwriters, and financial institutions

Tailored for organizations requiring continuous risk monitoring and financial profiling.

Weaknesses of Experian

Higher pricing than lightweight verification platforms.

No open access data — all datasets are paid and license-controlled.

Limited transparency on raw registry sources compared to open-data models.

Not optimized for lightweight onboarding flows; built more for credit assessment.

Data refresh cycles vary significantly by country and dataset.

Experian vs. Markaaz: Full Feature & Data Comparison

Category | Experian | Markaaz |

|---|

Primary Focus | Business credit data, financial risk scoring, identity & fraud solutions | Business verification & onboarding automation |

Data Coverage | Millions of companies across 200+ countries | 500M+ companies in 200+ jurisdictions |

Financial Data | Extensive financial statements & credit scores | Not provided |

Risk Analytics | Credit risk, fraud scoring, payment behavior, delinquency data | Basic business validation |

UBO Mapping | Limited | Limited |

Corporate Linkages | Available in business credit reports | Available (varies) |

Identity & Fraud Tools | Yes — strong fraud & identity verification suite | Basic verification workflows |

API Availability | Strong API for risk decisioning & monitoring | API for verification & onboarding |

Best Fit For | Banks, lenders, insurers, credit teams, risk analysts | Companies needing fast business verification across markets |

Conclusion — Experian as a Markaaz Competitor

Experian stands out as one of the most powerful competitors to Markaaz for companies requiring credit data, financial statements, risk scoring, and global financial intelligence. It is designed for regulated industries and financial institutions that need deep insight into a company’s financial stability and creditworthiness.

While Markaaz focuses on KYB verification and onboarding automation, Experian provides credit-grade financial analysis, fraud controls, and risk evaluation, making it the preferred choice for lending, underwriting, risk assessment, and identity decisioning.

Top 5 FAQs — Experian vs. Markaaz

1. Is Experian a strong alternative to Markaaz for business verification?

Yes. Experian is a strong competitor for companies needing business credit data, financial risk scoring, and creditworthiness insights, while Markaaz focuses more on basic verification and onboarding workflows.

2. Does Experian provide company credit reports and financial statements?

Yes. Experian offers detailed credit reports, financial statements, payment history, and credit risk indicators, which Markaaz does not provide.

3. What is the biggest difference between Experian and Markaaz?

Experian specializes in credit, risk, and financial intelligence, while Markaaz specializes in KYB verification and onboarding automation. Their use cases differ significantly.

4. Does Experian offer fraud prevention and identity verification tools?

Yes. Experian provides advanced fraud scoring, identity checks, and compliance tools widely used in banking and regulated industries.

5. Who should choose Experian instead of Markaaz?

Banks, lenders, insurers, financial institutions, and risk teams needing credit scoring, underwriting data, and fraud controls will benefit more from Experian’s capabilities than from Markaaz's verification-first approach.

Conclusion: The Future of Business Verification & KYB in 2025

The KYB sector in 2025 is defined by a shift from broad, aggregated datasets toward high-integrity, registry-based intelligence. As organizations operate across more jurisdictions and face stricter compliance requirements, the market is clearly favoring platforms capable of delivering verifiable data, ownership transparency, and automated decisioning.

Registry-First Data Is Becoming a Competitive Requirement

The competitive gap between providers using official registry filings and those relying on third-party aggregators is widening.

Registry-first datasets offer:

This shift is driven not by preference, but by necessity: KYB decisions increasingly require traceable data provenance, especially in regulated industries.

Automation Is Now a Differentiating Factor

Enterprises are optimizing onboarding and supplier review workflows to reduce operational cost.

As a result, platforms with:

are becoming more competitive than those limited to front-end verification tools.

Automation is no longer a “feature”—it is a determining factor in vendor selection.

The Market Is Splitting Into Two Tiers

A clear segmentation is emerging:

Tier 1: Registry-first, data-rich intelligence platforms

These platforms provide UBO mapping, corporate linkages, financial intelligence, and global coverage. They serve banks, fintechs, and enterprises with high compliance needs.

Tier 2: Workflow-first verification tools

These solutions focus on onboarding flows, form validation, and fraud prevention but offer limited depth in ownership or financial data.

This division will continue to shape how companies choose between Markaaz and its competitors.

Final Assessment

The future of KYB belongs to platforms that can combine:

Organizations evaluating Markaaz alternatives should prioritize solutions that meet these technical and regulatory demands.

As compliance expectations increase, data depth and transparency—not interface design—will determine long-term market leadership.

Top Questions About Markaaz & KYB Alternatives

1. What is Markaaz used for in business verification?

Markaaz is a business verification and onboarding platform designed to help companies validate suppliers, small businesses, and partners. It focuses on company existence checks, identity validation, and risk signals to streamline onboarding workflows.

2. What are the best alternatives to Markaaz for global business verification?

Top Markaaz alternatives include Global Database, Zephira.ai, Dun & Bradstreet, Creditsafe, Moody’s (Orbis), Zavia.ai, Middesk, OpenCorporates, Monetaiq, and Experian. These platforms offer varying strengths in registry data, UBO mapping, financial intelligence, and global coverage.

3. Does Markaaz provide UBO (Ultimate Beneficial Ownership) data?

Markaaz provides limited ownership information but does not offer deep multi-layer UBO mapping. Platforms like Global Database, Zephira.ai, Zavia.ai, and Dun & Bradstreet provide more advanced UBO and corporate group structure insights.

4. Which KYB platforms offer the most accurate registry-sourced data?

Platforms such as Global Database, Zephira.ai, Dun & Bradstreet, Moody’s (Orbis), and Zavia.ai maintain direct connections to global business registries, offering more authoritative and transparent data than aggregator-based solutions.

5. What is the difference between registry-first data and aggregated company data?

Registry-first data comes directly from official government sources and provides legally verified identifiers, ownership, filings, and financial information. Aggregated data is compiled from multiple third parties and may lack transparency, consistency, or auditability.

6. Which Markaaz competitor offers the best global coverage?

Global Database provides 600M+ company profiles across 200 countries, making it one of the largest registry-sourced datasets globally. Dun & Bradstreet, Experian, and Moody’s Orbis also offer extensive international coverage but often rely on multiple data partners.

7. Which platform is best for verifying suppliers and international partners?

Global Database, Zephira.ai, and Zavia.ai are strong for supplier risk verification because they offer registry filings, group structures, UBOs, financials, and risk indicators—ideal for procurement and vendor onboarding teams.

8. Which KYB solution is most suitable for onboarding automation?

Markaaz, Middesk, and Zephira.ai are commonly used for automated KYB workflows due to their API-first design. For deeper ownership or risk analysis, companies often combine onboarding automation tools with registry-first intelligence platforms.

9. Do any Markaaz competitors provide financial statements and credit data?

Yes. Global Database digitizes financial statements using OCR + AI and offers credit indicators. Creditsafe, Dun & Bradstreet, Experian, and Moody’s (Orbis) also provide financial data at scale.

10. What’s the best Markaaz alternative for banks and fintechs?

Banks and fintechs typically prefer registry-sourced platforms with ownership and financial transparency. Global Database, Zephira.ai, Moody’s (Orbis), and Dun & Bradstreet are the most common choices for regulated industries.