Introduction

Validating VAT numbers is a critical part of cross-border business in the EU. Whether you're applying the correct VAT treatment, onboarding a new client, or ensuring compliance with local tax regulations, having a reliable method to confirm a company’s VAT status is essential.

The VAT Information Exchange System (VIES), operated by the European Commission, allows businesses to check the validity of VAT numbers issued by EU member states. It plays a central role in enabling VAT-exempt B2B transactions across borders within the EU.

However, as business needs evolve — from automated onboarding to global tax ID verification — many companies are exploring additional tools that offer broader coverage, enhanced data, and integration-ready APIs.

1. What Is VIES and How Does VAT Number Validation Work in the EU?

The VAT Information Exchange System (VIES) is an online service provided by the European Commission. Its main purpose is to allow businesses and tax authorities to verify whether a company registered in an EU member state has a valid VAT number and is eligible for VAT-exempt intra-community transactions.

When a company provides a VAT number, you can check it via VIES to confirm:

- That the number is valid,

- That it belongs to a business registered for VAT in an EU country,

- And in some cases, retrieve limited details such as the registered company name and address (if the local authority provides them).

VIES works by querying national VAT databases. It does not store data itself — it acts as a gateway to each member state's VAT registry. The result depends entirely on the national authority’s response, which means the quality and completeness of data can vary by country.

Common Use Cases:

- Cross-border B2B invoicing with 0% VAT rate

- Automating VAT checks during onboarding or procurement

- Ensuring compliance for tax reporting and audits

Countries Covered:

VIES supports VAT number validation for all 27 EU member states. It does not cover the UK (post-Brexit), nor does it support VAT or tax ID validation outside the EU.

2. How to Validate a VAT Number in Europe Using VIES (With Examples)

Validating a VAT number through VIES can be done either manually via the European Commission’s website or programmatically via its public API. Below, we’ll cover both approaches and what to expect from the results.

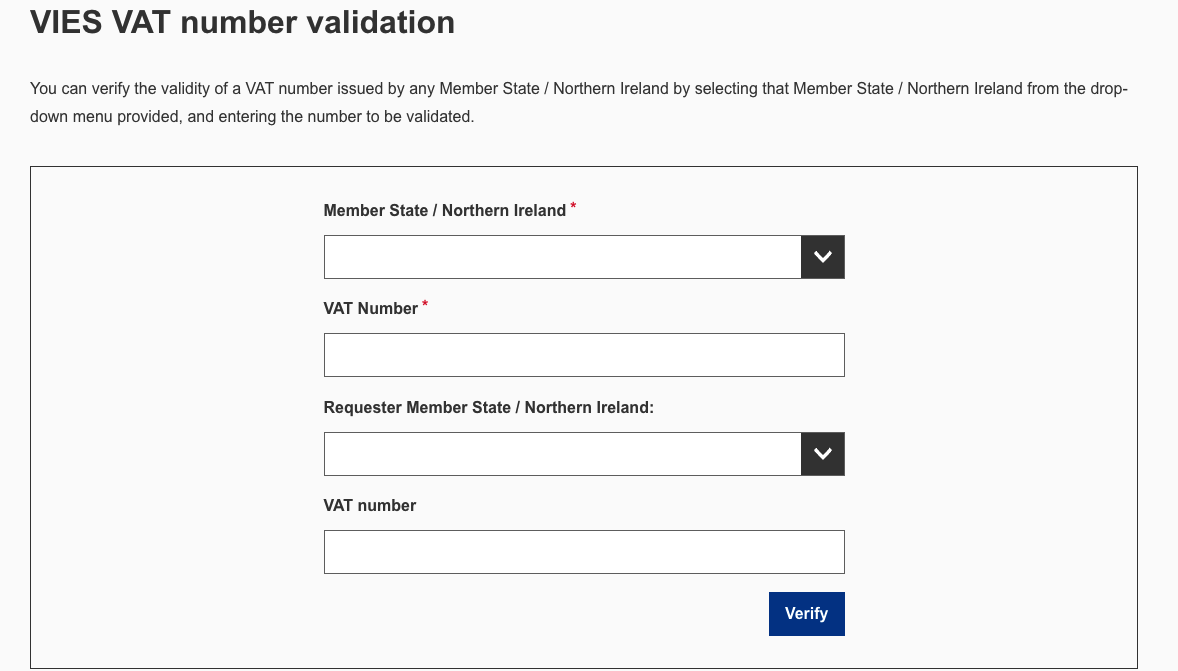

Manual Validation via the VIES Web Portal

To perform a manual check:

- Visit the official VIES VAT number validation site.

- Select the member state where the VAT number was issued.

- Enter the VAT number (without spaces or special characters).

- Click “Verify”.

If valid, you’ll receive a confirmation stating the number is registered for intra-community transactions. Depending on the country, you may also see:

- Company name

- Registered address

If invalid, the system will return a message stating that the number is not valid or cannot be found — which may also be due to temporary service unavailability from the member state's database.

Example: Validating a French VAT Number

- Country: France

- VAT Number: FR40303265045

Result:

✅ Valid

Company name and address are returned by the French tax authority.

Using the VIES API (SOAP Web Service)

For businesses that need to validate VAT numbers at scale or integrate checks into onboarding systems, VIES provides a public SOAP API. It allows for programmatic queries and includes an optional “requester” VAT field, which is important for obtaining proof of validation.

However:

- The API uses outdated SOAP protocol (not REST)

- Uptime is inconsistent

- No rate-limit documentation or official SLA

- No batch validation support

Because of this, many developers use third-party wrappers or switch to alternative APIs built on more modern standards.

3. Limitations of the EU VIES System

While VIES remains the official tool for validating EU VAT numbers, it was never designed to support modern business workflows, automation, or deep due diligence. Understanding its limitations is essential if you're building scalable systems or operating in compliance-sensitive environments.

1. Inconsistent Data Availability

VIES relies on each member state’s tax authority to respond to validation requests in real time. Some countries — like Spain, Italy, or Poland — do not consistently return company name or address, making it difficult to confirm the identity behind the VAT number.

2. No Company-Level Metadata

VIES only confirms whether a VAT number is valid — and in some cases, includes the company name and address. It does not provide:

- Company registration number

- Legal form or business status

- Ownership or group structure

- Industry classification or size

For KYB, risk checks, or CRM enrichment, VIES falls short.

3. Limited API Usability

The VIES API is SOAP-based, which is outdated and difficult to integrate into modern platforms. It also:

- Lacks support for batch queries

- Has no SLA or official uptime guarantee

- Is undocumented in terms of error handling and throttling

This makes it unsuitable for high-volume or production-grade use cases.

4. No Support for Non-EU VAT or Tax IDs

VIES only covers the 27 EU member states. It does not include the UK (post-Brexit), nor does it support tax ID validation for:

- US EINs

- Brazil CNPJs

- India GSTINs

- Australia ABNs

- or other global identifiers

Global companies need broader validation coverage.

5. Unreliable Availability

VIES experiences frequent downtime, often without warning. This can disrupt automated workflows and create gaps in onboarding or invoicing processes.

4. Best VIES Alternatives for VAT Number Validation

If your business needs more reliability, broader coverage, or deeper insights than what VIES can provide, several tools and platforms offer powerful alternatives. Some connect directly to national tax authorities or government registries. Others provide enriched metadata, API integration, and real-time validation with higher uptime and support.

Below are five trusted alternatives, each with different strengths depending on your use case:

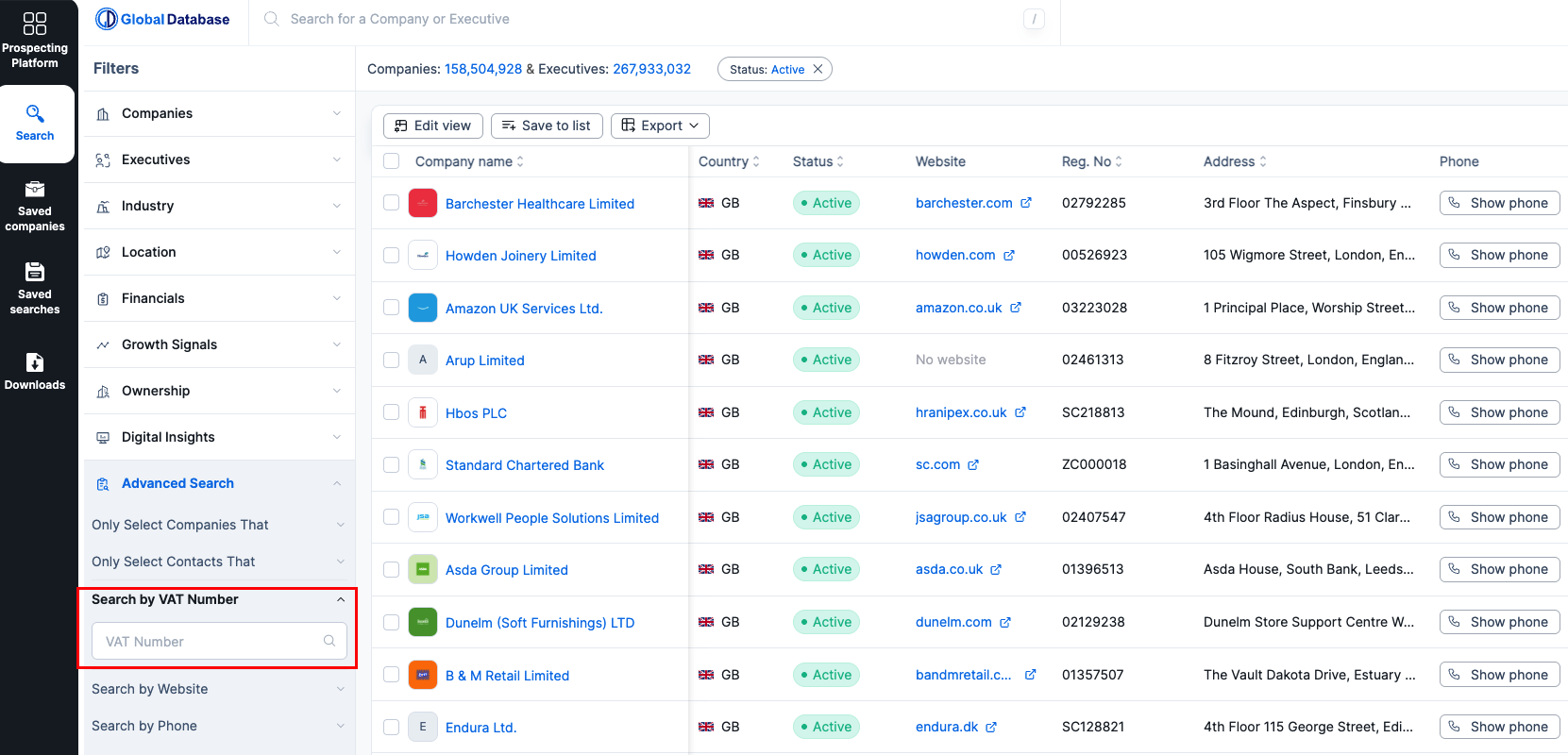

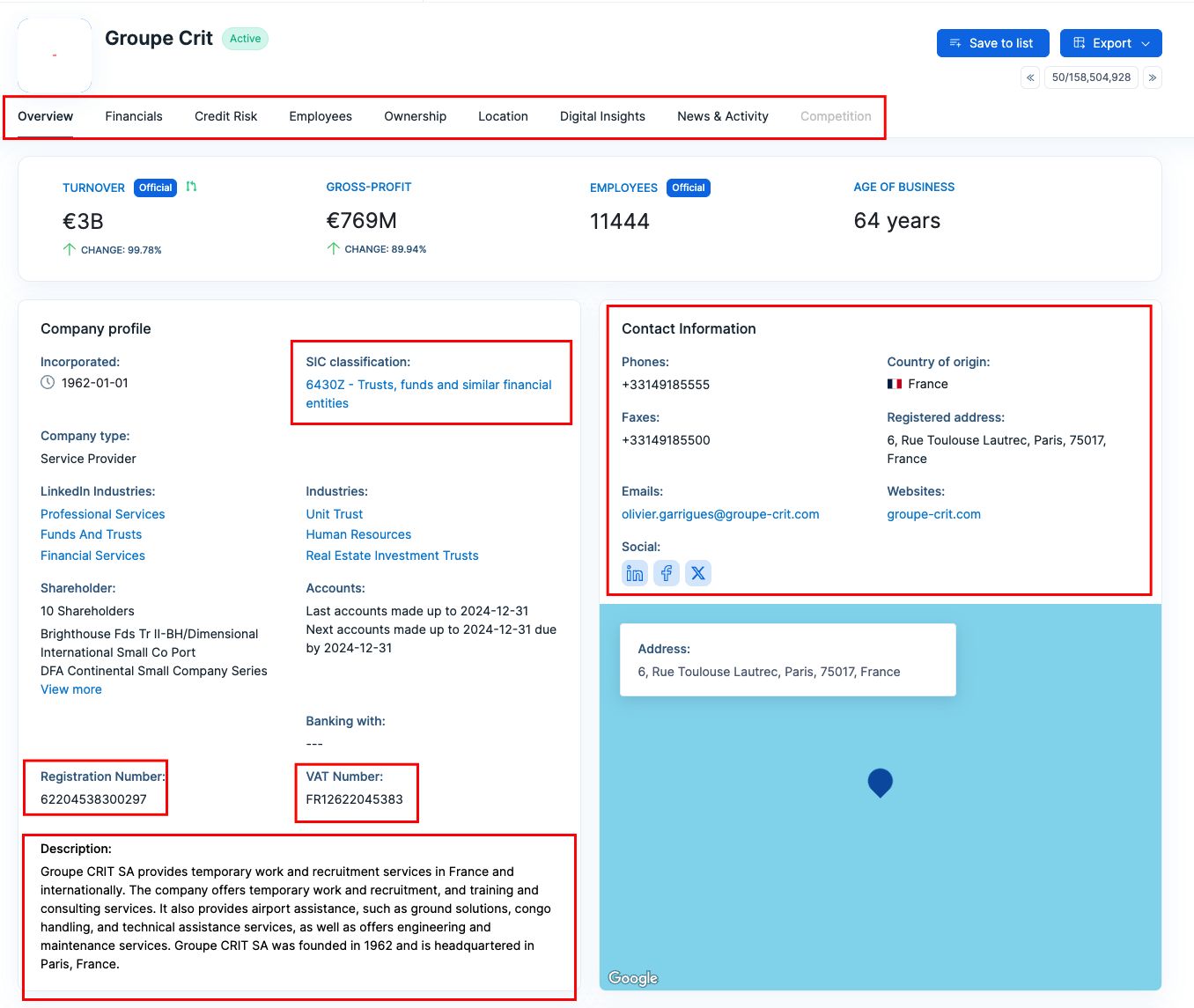

Global Database: A Registry-Backed Alternative to VIES

Global Database offers a powerful alternative to VIES by providing direct access to official government registry data and national tax authorities across more than 100 countries — not just within the EU. Unlike VIES, which only validates VAT numbers, Global Database delivers a complete picture of the legal entity behind the tax ID, making it ideal for compliance, onboarding, and B2B risk checks.

✅ What Makes Global Database Different

Unlike most VAT validation tools, Global Database goes beyond simple “valid/invalid” checks by enriching each result with verified firmographic data. This includes:

- Registered company name

- Legal status and incorporation date

- Registration number and VAT ID

- Registered office address

- Ultimate Beneficial Owners (UBOs) and shareholders

- Credit scores, financials, and risk indicators

- NAICS/SIC industry codes and business descriptions

All data is sourced directly from national registries and tax authorities, making it compliant, up to date, and defensible in regulated environments.

🔁 Real-Time Validation, Anywhere

While VIES is limited to EU VAT numbers, Global Database supports validation of tax identifiers globally, including:

- EU VAT numbers (via official sources, not cached or scraped)

- UK VAT (via HMRC)

- US EIN (via IRS)

- Brazil CNPJ (via Receita Federal)

- India GSTIN (via GSTN)

- Australia ABN, Canada BN, and more

This makes it ideal for platforms with global customer bases — fintechs, regtechs, compliance tools, or cross-border payment processors.

VIESAPI.eu: A More Reliable Way to Access the Official VIES System

VIESAPI.eu is not a data provider itself — it’s a service that offers improved access to the official EU VIES system through a more reliable and user-friendly API. It does not enrich VAT number data or provide information beyond what VIES returns, but it enhances how you interact with VIES by adding stability, structure, and automation features.

✅ What VIESAPI.eu Offers

VIESAPI acts as a proxy layer over the VIES infrastructure and adds value in several ways:

- Improved uptime monitoring: It checks and logs availability of national systems daily

- Error handling and caching: Reduces failed validations and prevents redundant queries

- REST-based API: Offers a more modern interface than VIES’s native SOAP API

- Batch processing support: Enables validating multiple VAT numbers in one request

- Audit trail and logs: Stores historical validation attempts for compliance or reporting

🚫 What It Doesn’t Do

VIESAPI still relies entirely on the same underlying VIES data. That means:

- No company registry integration

- No legal entity details or ownership data

- No validation for non-EU tax IDs

- No firmographic enrichment (e.g., revenue, employees, industry codes)

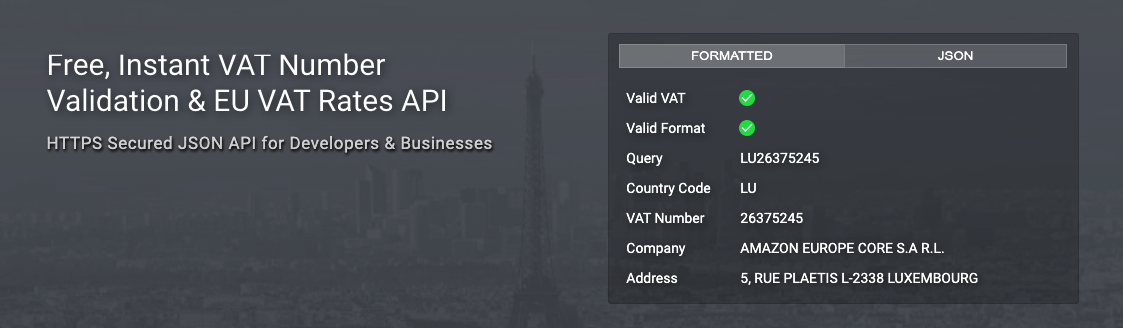

Vatlayer: Lightweight VAT Validation via API

Vatlayer is a commercial API that provides real-time VAT number validation for companies registered in the European Union. It’s designed to be simple, fast, and easy to integrate — making it ideal for lightweight applications such as online checkouts, invoicing platforms, or basic B2B signup forms.

Unlike solutions that pull from official registries, Vatlayer sources its data via the VIES system. This means it inherits some of VIES’s core limitations — but wraps them in a cleaner, more developer-friendly package.

✅ Key Features

- REST API: Quick, simple setup for validating EU VAT numbers

- Live VAT checks: Verifies whether a number is valid according to VIES

- Basic geolocation: Determines if the company is registered in another EU country (for VAT exemption purposes)

- JSON responses: Well-formatted, easy to parse in any backend system

- Free tier available: Suitable for small teams or startups testing basic functionality

🔍 Limitations

- Dependent on VIES: Returns the same data as VIES (no additional fields)

- No company enrichment: Doesn’t provide legal name, registration number, or company status

- No UBO, ownership, or financials

- EU-only: No support for UK VAT, EINs, CNPJs, GSTINs, etc.

- No direct link to national registries: Can be affected by VIES downtime or country-specific data gaps

Zephira.ai: Global Tax ID Validation Built for Developers

Zephira.ai is an API-first platform that validates tax IDs across more than 100 countries — covering far more than just EU VAT numbers. It’s designed for developers, product teams, and compliance platforms that need real-time, scalable access to verified company identity, whether for KYB, onboarding, payments, or B2B risk checks.

Unlike tools built on top of VIES, Zephira.ai connects directly to national tax authorities and official company registries. It verifies not only if a tax ID exists, but also who it belongs to — returning structured firmographic data that’s usable across onboarding workflows and compliance engines.

✅ Key Features

- Supports Global Tax Identifiers, including:

- ⚬ EU VAT Numbers

- ⚬ UK VAT (via HMRC)

- ⚬ US EIN (via IRS)

- ⚬ Brazil CNPJ

- ⚬ India GSTIN

- ⚬ Australia ABN

- ⚬ Canada BN, and more

- Verified Data: Matched directly against national registries

- RESTful API: Fast, well-documented endpoints for developers

- Firmographic Enrichment: Company name, legal status, registration number, address, and industry info

- Built for Scale: Designed for high-volume KYB/KYC pipelines and onboarding automation

🔍 Limitations

- No front-end UI: This is an API-first product — designed for integration, not manual search

- Focus on company-level validation: Does not offer personal KYC or ID validation (e.g., for individuals)

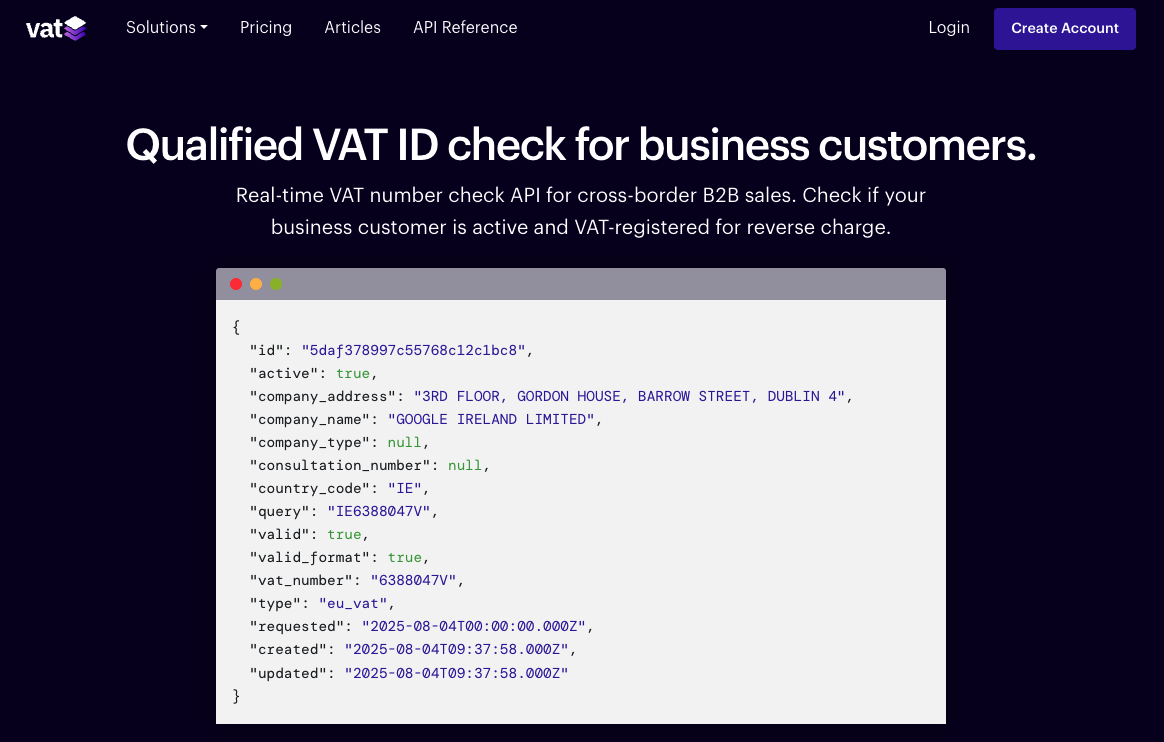

Vatstack: Simplified EU VAT Validation with Revenue-Ready Features

Vatstack is a VAT compliance platform designed for businesses selling digital goods and services across the EU. While it offers VAT number validation via the VIES system, it also includes features tailored for invoicing, tax calculation, and EU VAT reporting — making it especially useful for SaaS, marketplaces, and subscription businesses.

Unlike registry-based platforms, Vatstack does not provide company enrichment, but it simplifies VAT management with additional commercial tools.

✅ Key Features

- Real-time EU VAT number validation (via VIES)

- Tax rate calculation based on customer location

- VAT-exempt status detection for B2B transactions

- Transaction storage & reporting for audit readiness

- REST API and Stripe integration for automatic validation at checkout

🔍 Limitations

- Depends on VIES: Same data quality and coverage limits

- No company registry integration

- No UBO, credit, or financial data

Conclusion: Choosing the Right VAT Validation Solution for Your Business

While VIES remains the official EU system for validating VAT numbers, it's clear that modern businesses — especially those operating across borders or scaling their operations — often need more than what VIES can provide.

Depending on your use case, the right alternative will vary:

- If you need registry-sourced, verified company data across 100+ countries — including ownership, legal status, and financials — Global Database offers the most complete and reliable solution.

- If you want to keep using VIES but need better uptime, structure, and integration options, VIESAPI.eu is a strong technical enhancement.

- For developers needing lightweight REST access to EU VAT checks, Vatlayer is a quick and simple option — though still tied to VIES limitations.

- If your focus is on global coverage and scalable tax ID validation, Zephira.ai delivers an API-first solution with support for EINs, CNPJs, GSTINs, and more.

- And if you're just looking for basic format validation for web forms or internal tools, NumValidate does the job — but should not be relied on for compliance.

✅ Final Recommendation

If your goal is compliance-grade validation, KYB automation, and global reach, your best bet is a registry-backed platform like Global Database or Zephira.ai. These tools not only validate tax IDs, but also return structured business data, giving your team the visibility and accuracy needed to make confident decisions.