Tool #2: Zephira.ai

Overview

Zephira.ai is an API-first verification platform built for developers who need instant, reliable company verification — including EIN, TIN, VAT, and registration numbers — across more than 150 countries .

It connects directly to official government registries , delivering standardized JSON responses that can be easily integrated into onboarding systems, payment workflows, or compliance platforms.

Every API call includes EIN validation, ownership details, company status, and financial summaries , simplifying the KYB process and ensuring compliance with 2026 regulatory requirements such as the Corporate Transparency Act (CTA) and AML directives .

Key Capabilities

EIN, TIN, and Global Registry Verification

Instantly validate company identifiers against official government registries.

Ownership & UBO Insights

Retrieve shareholder, director, and group structure information with transparent source references.

Sanctions & PEP Screening

Integrated modules for AML, PEP, and sanctions list monitoring.

Real-Time REST API

Optimized for developers — JSON-based responses, webhooks, and SDK support for popular languages.

Scalable Infrastructure

Capable of processing thousands of simultaneous verification requests with millisecond response times.

Pricing

Zephira.ai keeps pricing simple and predictable, with bundled data per API call — meaning every verification includes EIN, registry, ownership, and financial data together (no separate charges per data type).

Plan | Monthly Price | Profiles / API Calls | Rate Limit | Ideal For |

|---|

Starter | $49/month | 100 profiles | 30 API calls/minute | Startups testing or integrating basic EIN checks |

Pro | $99/month | 400 profiles | 100 API calls/minute | Fintechs or compliance tools scaling KYB |

Business | $199/month | 1,300 profiles | 300 API calls/minute | Platforms verifying entities at moderate scale |

Enterprise | Custom Pricing | Unlimited | 6,000 API calls/minute | Large-scale platforms and global data providers |

Note:

Each API call returns all data types bundled together , unlike competitors that charge separately for EIN, ownership, and financial datasets — making Zephira.ai one of the most cost-efficient and transparent solutions in the market.

Pros and Cons

✅ Pros

All-in-one API — EIN, ownership, and financial data included per call.

Transparent pricing — no hidden tiers or data-type markups.

Global coverage — registry access in over 150 countries.

High scalability — up to 6,000 API calls per minute for enterprise clients.

Developer-focused — lightweight, fast, and easy to integrate.

⚠️ Cons

No manual dashboard — fully API-based (best for technical teams).

Limited UI tools — lacks visualization for non-developers.

Lower suitability for small businesses needing occasional checks.

Coverage depth varies slightly by jurisdiction depending on registry openness.

Why It Stands Out

Unlike legacy KYB or EIN lookup tools, Zephira.ai is built for real-time automation .

It delivers every verification — EIN, registration, UBO, and risk checks — through a single endpoint, reducing complexity and cost.

By offering transparent pricing and global registry data, it empowers fintechs and compliance platforms to scale confidently without unpredictable API costs.

Ideal Use Cases

Fintechs & Payment Providers: Automate merchant or business onboarding globally.

RegTech & Compliance Solutions: Embed instant KYB verification directly into customer workflows.

APIs & SaaS Platforms: Add global business verification features with minimal setup.

Enterprise Integrations: High-volume identity validation for global partner ecosystems.

Summary

Zephira.ai is redefining EIN and KYB verification for developers — combining registry-sourced accuracy with an elegant, all-in-one pricing model.

Starting at $49/month , every API call includes comprehensive company data, eliminating the need for multiple providers or layered pricing.

For teams that value speed, scalability, and simplicity , Zephira.ai is one of the most developer-friendly verification APIs available in 2026.

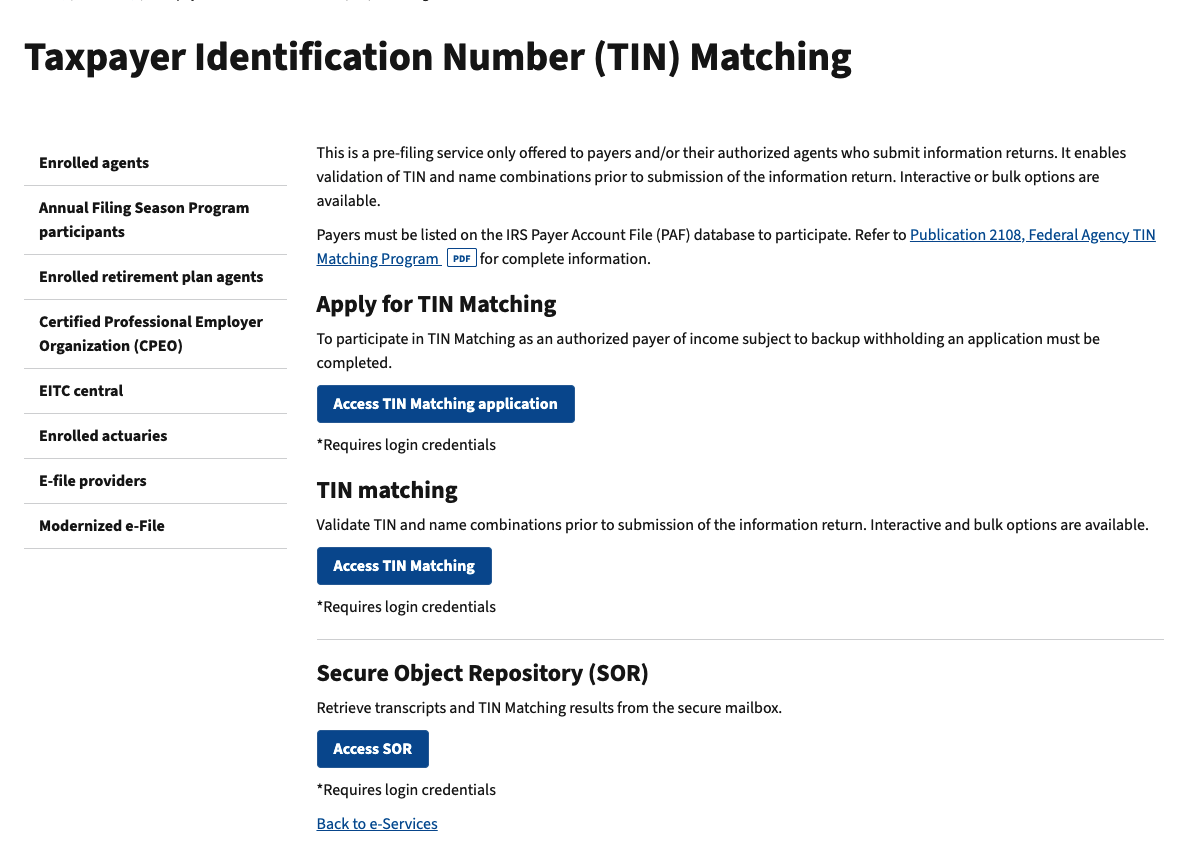

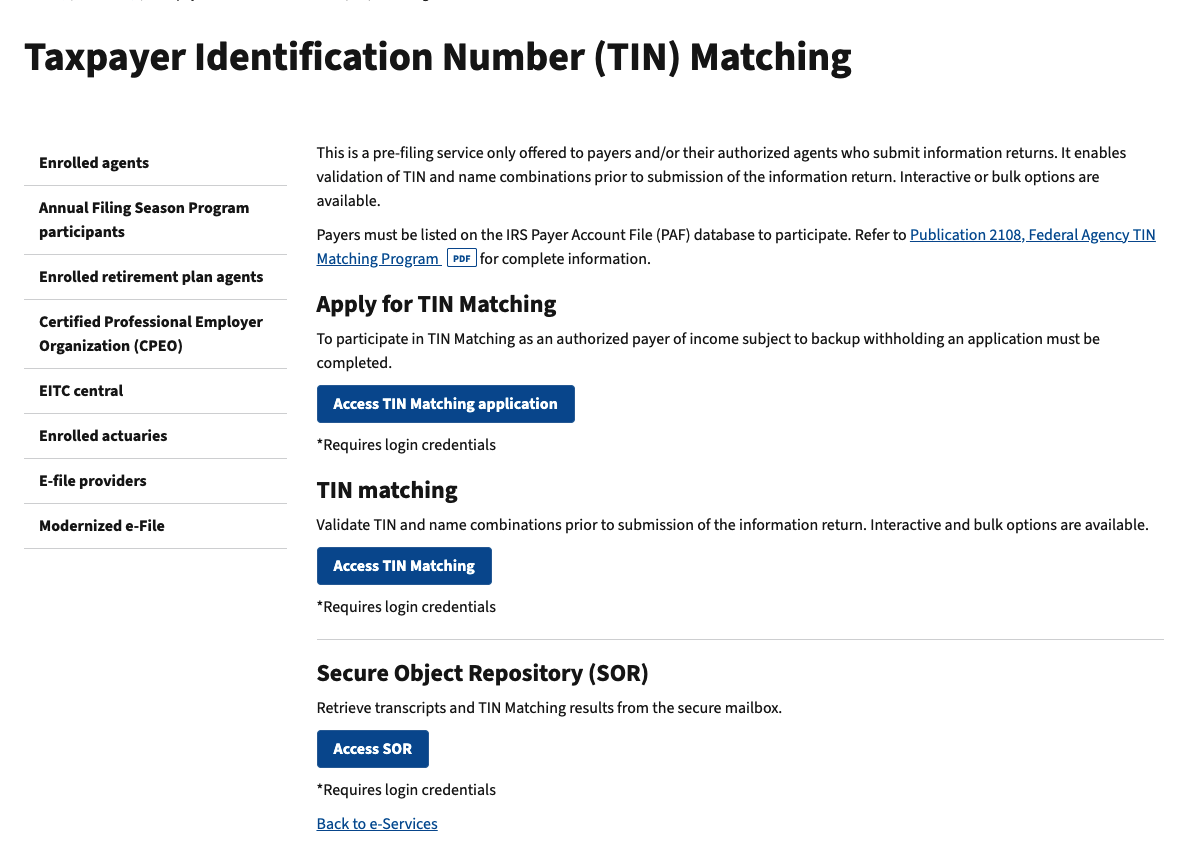

Tool #3: IRS TIN Matching Program

Overview

The IRS TIN Matching Program is the official government service for verifying Employer Identification Numbers (EINs) and Taxpayer Identification Numbers (TINs) in the United States.

Managed directly by the Internal Revenue Service (IRS) , it allows authorized users — such as businesses, tax professionals, and financial institutions — to confirm that the name and EIN/TIN combination provided by a client or vendor matches IRS records.

While originally designed for 1099 reporting and tax compliance , the TIN Matching Program has become a vital part of KYB (Know Your Business) and AML (Anti-Money Laundering) procedures across the U.S., particularly for companies that need to prevent fraud and ensure vendor authenticity.

Key Capabilities

Official EIN/TIN Verification

Confirms whether a name and EIN/TIN combination matches IRS records.

Real-Time and Bulk Matching

Offers both interactive (manual) and bulk upload options, supporting large-scale verifications.

Free and Direct Access

The service is completely free of charge for eligible users registered under an IRS e-Services account .

Designed for Compliance

Ideal for verifying taxpayer data prior to filing information returns (e.g., Form 1099).

Fraud Prevention

Detects invalid or mismatched EINs to reduce reporting errors and potential fraudulent submissions.

Pricing

The IRS TIN Matching Program is completely free to use.

To access it, users must have:

An active IRS e-Services account

Authorization to file information returns (Form 1099 series)

Approval from the IRS for TIN matching access

While there’s no direct cost, setup involves manual registration and approval , and the system does not offer API access — limiting automation for high-volume workflows.

Pros and Cons

✅ Pros

Official source — verification directly from IRS databases.

Completely free — no subscription or API fees.

Reliable for U.S. entities — perfect for EIN verification and 1099 compliance.

Bulk verification support for large datasets.

⚠️ Cons

U.S.-only — does not cover non-U.S. Tax IDs or registry numbers.

No API or automation — requires manual uploads or web portal access.

Limited to authorized users — only available to approved e-Services participants.

No ownership or financial data — purely validates EIN/TIN identity match.

Why It Stands Out

The IRS TIN Matching Program remains the most authoritative source for EIN verification in the United States.

For accountants, HR departments, and compliance teams handling U.S.-based businesses, it’s the gold standard for validating federal tax identifiers.

However, it lacks the global scope, ownership transparency, and automation that modern platforms like Global Database or Zephira.ai provide.

Ideal Use Cases

Accountants & Tax Professionals: Verify EIN/TIN accuracy before filing 1099s.

Financial Institutions: Confirm vendor and client EINs for reporting compliance.

Corporate Compliance Teams: Validate domestic entities within internal KYB workflows.

Small Businesses: Check contractor EINs to avoid reporting errors or penalties.

Summary

The IRS TIN Matching Program is the official and most reliable source for verifying U.S. EINs.

It’s free, accurate, and directly tied to IRS systems — but limited in automation and scope.

For organizations operating globally or requiring integrated KYB workflows, it’s often used in combination with tools like Global Database or Zephira.ai to achieve full coverage across regions and data layers.

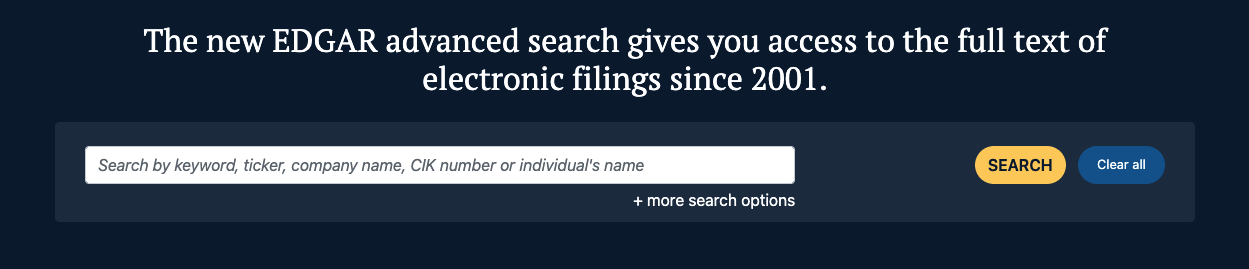

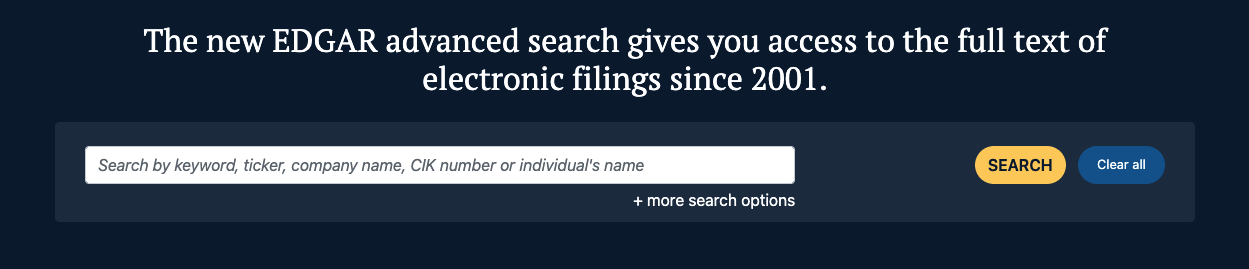

Tool #4: SEC EDGAR Database

Overview

The SEC EDGAR Database (Electronic Data Gathering, Analysis, and Retrieval System) is the official public filing system of the U.S. Securities and Exchange Commission (SEC) .

It provides free access to millions of corporate filings, including those that disclose EINs, company registration details, ownership structures, and financial statements .

While EDGAR wasn’t originally designed as an EIN verification tool, it remains one of the most trusted public sources for confirming a company’s legitimacy, tax identifier, and legal existence — especially for U.S.-listed or reporting entities.

Key Capabilities

EIN Discovery

Public filings such as Form 10-K , 8-K , and S-1 often include a company’s official EIN or federal tax identification number.

Corporate Transparency

Access executive names, shareholder information, and group structures for listed companies.

Financial Data Access

Retrieve official quarterly and annual financial statements directly from SEC submissions.

Free and Publicly Accessible

Available online without registration or subscription, making it ideal for independent research and compliance checks.

Historical and Real-Time Data

Search through decades of filings, ensuring visibility into a company’s evolution, mergers, and ownership changes.

Pricing

The SEC EDGAR Database is completely free and open to the public.

There are no subscription or licensing costs — anyone can search, download, and analyze filings.

However, EDGAR does not provide API-based EIN lookup or automation , which limits its usability for high-volume or KYB-integrated workflows.

For automated EIN verification, EDGAR data can be cross-referenced via platforms like Global Database or Zephira.ai .

Pros and Cons

✅ Pros

Official and reliable — sourced directly from SEC filings.

Completely free — no cost for access or usage.

Includes EINs in many corporate filings.

Rich financial and ownership data for public companies.

Excellent for due diligence and historical research.

⚠️ Cons

Limited to U.S. public companies — private and foreign entities are not included.

No API or automation tools for EIN lookup.

Manual search process — not ideal for batch verification.

EIN data inconsistently available (depends on filing type).

No monitoring or alerts — users must manually track updates.

Why It Stands Out

The SEC EDGAR Database stands out as the most transparent and authoritative source for public company data in the U.S.

It provides unmatched visibility into corporate ownership, financial performance, and official EIN disclosures — making it indispensable for investors, analysts, and compliance professionals conducting deep due diligence.

However, for businesses requiring real-time automation or international verification , it’s best used alongside integrated tools like Global Database and Zephira.ai .

Ideal Use Cases

Financial Analysts: Validate EINs, financials, and corporate structures for listed companies.

Compliance & Risk Teams: Cross-check U.S. entities during KYB or due diligence.

Researchers & Journalists: Access historical corporate data and filings.

Investors: Review SEC disclosures before investment decisions.

Summary

The SEC EDGAR Database is a free, official, and data-rich resource for verifying EINs, financial statements, and ownership information for U.S. public companies.

It’s ideal for manual due diligence and research but lacks the automation, global scope, and API capabilities found in platforms like Global Database and Zephira.ai .

In 2026, it remains an essential part of the EIN verification ecosystem — especially for those prioritizing transparency, compliance, and public disclosure data .

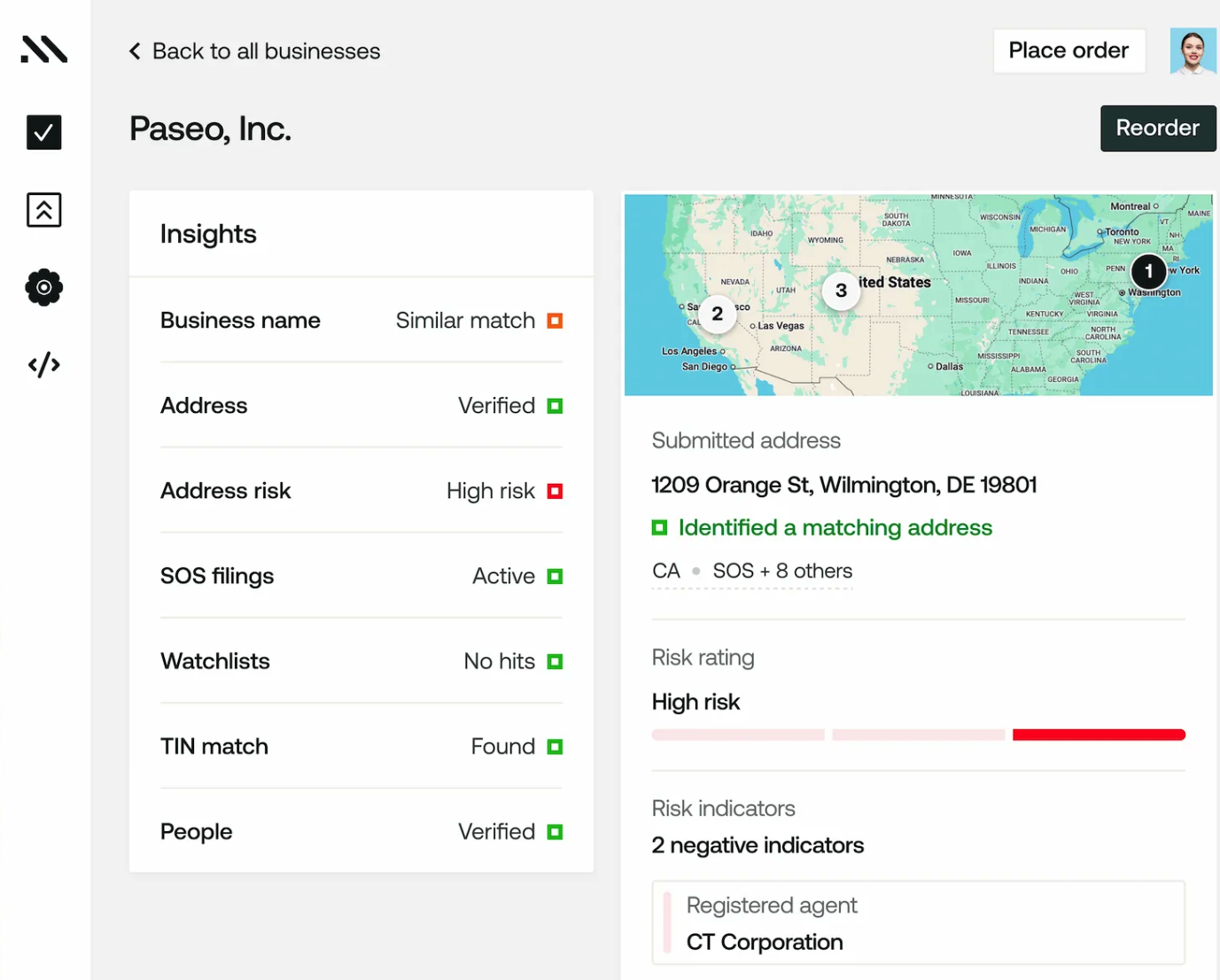

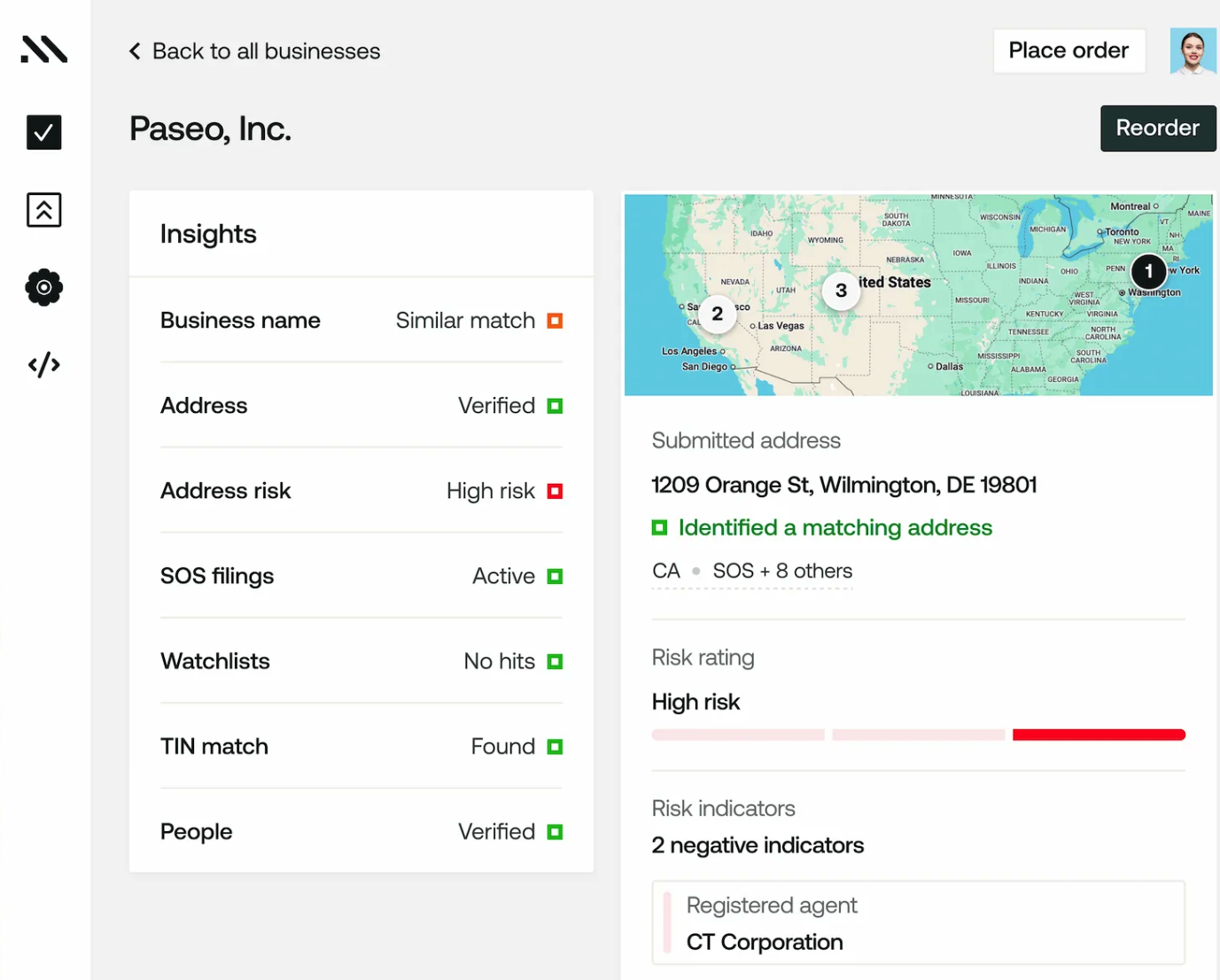

Tool #5: Middesk

Overview

Middesk is a U.S.-centric business verification platform that specializes in validating EINs and business registrations across state and federal databases.

It connects to IRS records, Secretary of State registries, and licensing authorities, allowing users to confirm whether a company is legally registered, active, and compliant.

The platform has become popular among fintechs, payroll providers, and lenders for automating onboarding and compliance checks.

However, its high annual cost, limited geographic coverage, and narrow focus on the U.S. market make it less suitable for global businesses or those needing richer data attributes such as ownership, UBOs, or financials.

Key Capabilities

EIN & Registration Validation

Confirms EIN and business registration data directly from U.S. state and federal sources.

Entity Classification

Identifies legal entity type, incorporation date, and business status.

Good Standing & Licensing Checks

Provides compliance and standing information for registered businesses.

Monitoring

Alerts users to status or registration changes across covered states.

API & Dashboard

Offers both API-based automation and a browser dashboard for manual searches.

Pricing

Middesk’s pricing is significantly higher than most EIN verification or KYB API platforms:

Plan | Coverage | Annual Price (Approx.) | Notes |

|---|

Regional Plan | 8 U.S. states | ~$8,000/year | Basic EIN and registration verification |

National Plan | All 50 states | ~$15,000/year | Includes broader registry coverage |

Enterprise | Custom | $15,000+ / year | For large-scale users or tailored integrations |

Additional costs may apply for premium features, monitoring, or higher-volume usage.

Custom enterprise pricing is required for large organizations or fintechs processing high verification volumes.

While the data quality is strong, the cost-to-coverage ratio makes Middesk far less economical than global providers like Global Database or Zephira.ai, which offer international coverage and broader attributes at a fraction of the price.

Pros and Cons

✅ Pros

Verified directly from IRS and state registries.

Accurate EIN validation for domestic (U.S.) entities.

Simple user interface and accessible API.

Provides good standing and registration data.

⚠️ Cons

U.S.-only coverage — no international registry access.

High annual cost for limited geographic scope.

Lacks ownership, UBO, and financial data.

No transparent pricing for enterprise use — requires sales contact.

Limited scalability for global compliance workflows.

Why It Stands Out (and Why It Doesn’t)

While Middesk fills a niche in U.S. EIN verification, it falls short when compared with more flexible, registry-based solutions.

For companies operating globally or requiring advanced KYB data — such as ownership hierarchies, UBO discovery, or financial risk analysis — Middesk’s limited dataset and higher pricing can become restrictive.

Its strengths lie in reliability and automation for domestic operations, but its cost structure and lack of global coverage make it less competitive in 2026’s data landscape.

Ideal Use Cases

Fintechs and Lenders (U.S.-only): Automate EIN and registration verification within domestic workflows.

Payroll & HR Platforms: Validate employer EINs for compliance.

Tax & Accounting Firms: Confirm U.S. entities before issuing 1099 forms.

Not suitable for:

Global platforms requiring multi-country KYB.

Companies seeking ownership, financial, or cross-border data.

Summary

Middesk remains a solid choice for U.S.-focused EIN and business verification, but it’s a high-cost, narrow-scope solution in an increasingly globalized compliance environment.

With pricing typically between $8,000–$15,000+ per year, and limited data beyond basic registration checks, it’s best suited for organizations verifying domestic entities at scale — not for those needing multi-country coverage or deeper business intelligence.

4. Quick Comparison Table

Tool | Coverage | Source Type | Best For | API Access | Pricing |

|---|

Global Database | 150+ countries | Government registries | Global EIN & KYB automation | ✅ | Paid (Flexible) |

Zephira.ai | 150+ countries | Registry APIs | Developers, RegTechs | ✅ | Usage-based |

IRS TIN Matching Program | U.S. only | IRS database | Official EIN validation | ❌ | Free |

SEC EDGAR | U.S. public companies | SEC filings | Listed company verification | ❌ | Free |

Middesk | U.S. only | State registries + IRS | Fintechs, lenders | ✅ | Paid |

5. How to Choose the Right Tool

Key Decision Factors

Verification Volume: Organizations verifying 50 businesses annually have different needs than those verifying 50,000. High-volume operations need automated APIs; low-volume users may prefer manual dashboards and pay-as-you-go pricing.

Geographic Scope: Are you verifying primarily U.S. businesses or operating internationally? Global Database offers limited international coverage. Zephira.ai covers 150+ countries. Others are U.S.-only.

Compliance Requirements: What regulatory obligations drive your verification? 1099 filing? KYC/AML? Government contracting? Each has distinct requirements affecting tool selection.

Budget Constraints: Define your acceptable annual spend. IRS and SEC EDGAR are free but require manual work. Global Database offers low per-transaction costs. Zephira.ai requires monthly subscription. Middesk requires significant annual investment.

Technical Resources: Do you have internal development resources for API integration? Non-technical users should prioritize intuitive dashboards.

Data Enrichment Needs: Do you only need name/TIN matching, or do you need comprehensive business intelligence? If you need financials, credit scores, and risk assessment, you need more sophisticated tools.

Speed and Automation: Do you need real-time verification during onboarding, or can you process in batches? Real-time requirements favor commercial APIs.

Monitoring Needs: Do you verify once, or do you need ongoing monitoring for business changes?

6. Decision Matrix by Use Case

Startups and Small Businesses (0-500 annual verifications):

Recommended: Global Database ($0.10/tx, no commitment) or Zephira.ai Starter ($49/mo)

Rationale: Cost control and simplicity. Global Database's per-transaction pricing means minimal cost at low volumes.

Fintech and Online Lending (10,000+ annual verifications):

Recommended: Middesk (primary) + SEC EDGAR (public companies)

Rationale: Comprehensive KYB, real-time verification, risk scoring, and compliance capabilities justify the investment. Middesk delivers 2-3x automated approval lift.

Tax Professionals (1,000-5,000 annual verifications):

Recommended: IRS TIN Matching Program (primary) + Global Database (supplementary)

Rationale: IRS program is authoritative and free for 1099 purposes. Global Database adds capabilities for general business verification.

Government Contractors:

Recommended: Middesk + SEC EDGAR

Rationale: Government contracting requires watchlist screening, sanctions checks, and comprehensive documentation that Middesk provides.

Marketplace Companies (5,000-100,000+ annual verifications):

Recommended: Middesk (full automation) or Zephira.ai (cost-conscious)

Rationale: Marketplaces need automation for high-volume seller onboarding. Choose based on automation requirements vs. budget.

Corporate Vendor Management:

Recommended: Global Database (enrichment focus) or Middesk (risk focus)

Rationale: Choose based on whether enrichment or risk scoring is priority. SEC EDGAR supplements for public company vendors.

7. Implementation Checklist

Define specific use cases and compliance requirements

Estimate annual verification volume

Identify geographic scope (U.S. only or international)

Clarify compliance obligations

Set budget constraints

Assess technical resources available

Determine data enrichment needs

Request demos and free trials

Test with real data before commitment

Review security certifications (SOC 2, ISO 27001)

Check customer support options and SLAs

Review integration documentation

Request customer references in your industry

8. Common EIN Verification Errors & How to Avoid Them

Top mistakes:

Relying on single data source (use multiple tools for critical decisions)

Not updating verification records (refresh periodically)

Ignoring business structure changes (re-verify after ownership transitions)

Confusing EIN with SSN (keep concepts distinct)

Skipping DBA name verification (DBAs are often legally registered)

Assuming one-time verification is permanent (business information changes)

Not documenting verification process (essential for compliance audits)

Best practices:

Verify at onboarding AND periodically for ongoing relationships

Document verification method, date, and results

Use multiple sources for high-risk transactions

Implement automated alerts for business changes when possible

Maintain audit trail documenting verification process

Cross-verify using multiple tools for critical decisions

Re-verify when business undergoes major changes (name change, ownership transfer, merger)

9. Frequently Asked Questions

Q: What's the difference between EIN and TIN? A: TIN (Taxpayer Identification Number) is the broader category including EINs, Social Security Numbers, and other identification numbers. EIN is specifically assigned to businesses.

Q: Can I verify an EIN for free? A: Yes. IRS TIN Matching Program (if eligible) and SEC EDGAR (public companies) are free but require manual work and have limitations.

Q: What if verification fails? A: Name/TIN mismatch in government records. Possible causes: typo, recent business name change, newly registered business, or fraudulent EIN. Contact the business directly to confirm correct information.

Q: How often should I re-verify? A: One-time transactions: verification at onboarding suffices. Ongoing relationships: annually or when business changes occur. Use monitoring tools for automatic alerts.

Q: Can I use multiple tools together? A: Yes. Primary tool + secondary tools for specific scenarios reduces fraud risk. Primary verification with cross-verification on high-risk transactions provides maximum confidence.

Q: What documentation should I maintain? A: Tool used, verification request, results, follow-up actions, date/time, and responsible party. Retain for minimum required period (typically 3-7 years per industry regulations).

Q: Are these tools sufficient for AML/KYC compliance? A: EIN verification alone is insufficient for comprehensive compliance. Add beneficial ownership identification, sanctions screening, and adverse media checks. Middesk includes these; others don't.

Q: Can I automate verification into my systems? A: Yes, if tools have robust APIs (Global Database, Zephira.ai, Middesk). IRS and SEC EDGAR require manual queries or third-party intermediaries.

Q: What if two tools give different results? A: Re-verify data entry, contact business directly, check SEC EDGAR if public, and use IRS TIN Matching as the authoritative tiebreaker.

Conclusion

Choosing the right EIN verification tool depends on your specific business needs, verification volume, compliance requirements, and budget. There's no universal best option—context determines the right choice.

Quick recommendations:

Best overall value: Global Database ($0.10/tx with comprehensive enrichment)

Best for global operations: Zephira.ai (150+ countries with AI enrichment)

Best for 1099 compliance: IRS TIN Matching Program (free and authoritative)

Best for public company research: SEC EDGAR (free official filings)

Best for fintech/lending: Middesk (comprehensive automation and compliance)

Next steps:

Define your specific use case

Estimate annual verification volume

Request demos and free trials

Test with real business data

Implement and monitor performance

Final recommendation: Most organizations benefit from a primary tool supplemented by one secondary tool for critical scenarios. This multi-layer approach provides maximum confidence and compliance protection while maintaining operational simplicity.

Start evaluating tools today. The cost of selecting the wrong solution is far higher than the effort of proper evaluation.