Introduction

In an increasingly regulated and risk-aware business landscape, understanding who truly owns or controls a company is no longer optional—it’s essential. Complex corporate structures, nominee arrangements, and cross-border entities are often used to obscure ownership and evade accountability. As a result, identifying the Ultimate Beneficial Owner (UBO) has become a critical step in compliance, risk management, and due diligence.

UBO discovery refers to the process of tracing and verifying the individuals who ultimately benefit from or control a legal entity—regardless of how many layers separate them from the surface. In 2025, this process is central to global anti-money laundering (AML) efforts, sanctions enforcement, and corporate transparency initiatives.

For financial institutions, fintechs, multinational corporations, and investigative teams alike, failing to identify UBOs can expose them to regulatory penalties, reputational damage, and operational risk.

2. Understanding UBO Discovery

What Is an Ultimate Beneficial Owner (UBO)?

A UBO (Ultimate Beneficial Owner) is the natural person who ultimately owns or controls a legal entity. This control may be exerted through direct or indirect shareholding, voting rights, or influence over management decisions—even when the person’s name doesn’t appear in public company records.

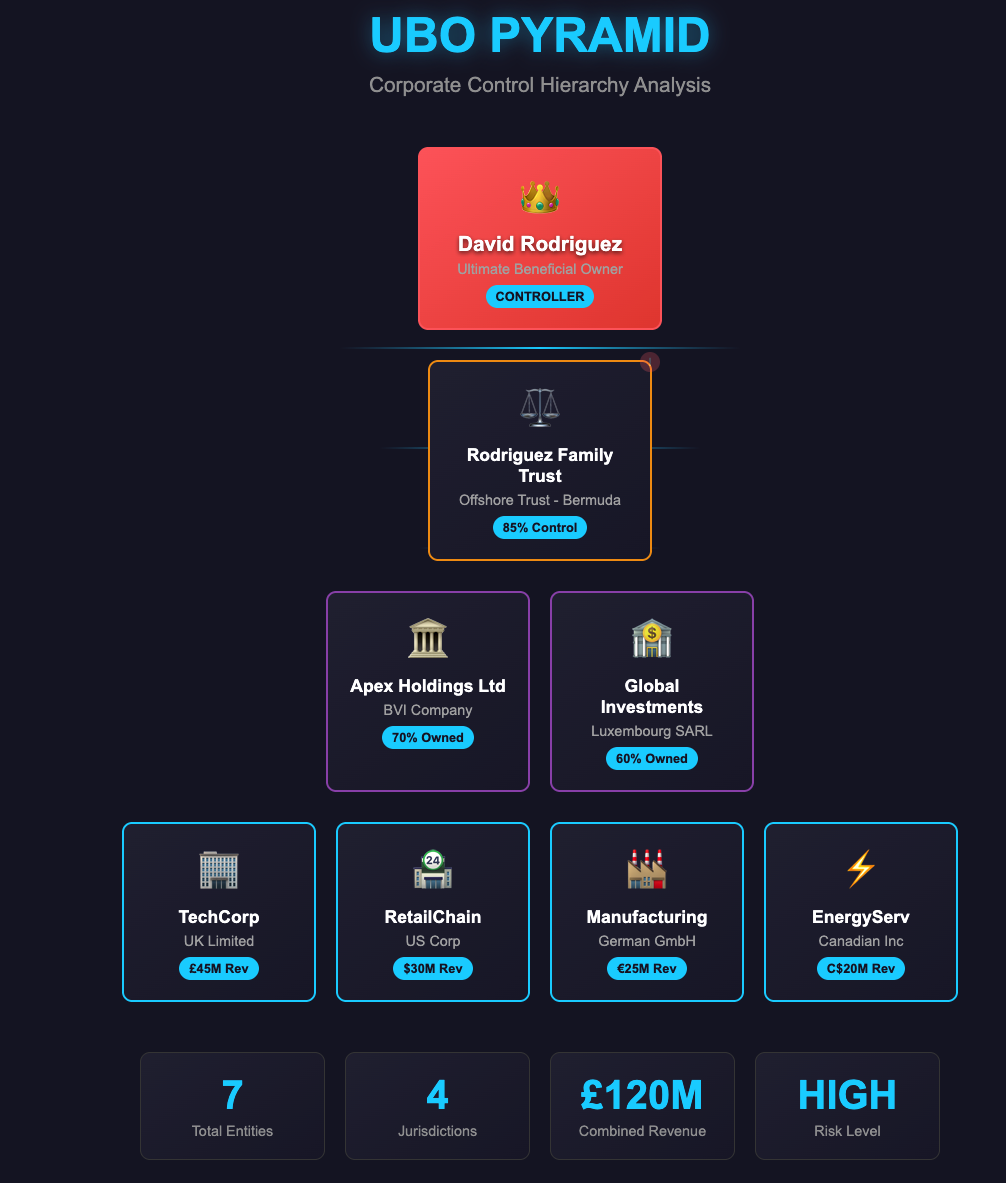

For example, if Company A is owned by Company B, and Company B is owned by an individual, that person is considered the UBO of Company A. In many jurisdictions, a UBO is defined as someone who owns 25% or more of a company or exercises control through other means.

Why Legal Ownership Isn’t Enough

Legal ownership only shows what's on paper—often a company name or a nominee shareholder. But that may not reflect the true person in control. Beneficial owners can hide behind layers of shell companies, trusts, or offshore vehicles to avoid detection. UBO discovery cuts through those layers to reveal the real person behind the entity.

Key Concepts in UBO Discovery

- Direct ownership: When an individual holds shares or control in a company directly.

- Indirect ownership: When control is exerted through one or more intermediary entities.

- Control through other means: A person may qualify as a UBO even without meeting the ownership threshold, if they exert influence or control over decision-making.

What UBO Discovery Involves

UBO discovery is not just a one-time check—it’s a process that involves:

- Mapping ownership structures across jurisdictions

- Verifying legal entities and relationships

- Resolving complex hierarchies

- Monitoring changes in control or ownership over time

- Screening for politically exposed persons (PEPs), sanctions, and adverse media

3. Why UBO Discovery Is Now Essential

A Global Shift Toward Transparency

Governments, regulators, and international watchdogs have intensified efforts to combat financial crime, tax evasion, and hidden ownership. At the heart of these efforts is one core requirement: know who you’re doing business with. UBO discovery has become a legal and ethical necessity for organizations operating in any regulated industry—or across borders.

Key Drivers Behind UBO Enforcement

1. Anti-Money Laundering (AML) Compliance

Regulations now require financial institutions, fintechs, and other obligated entities to verify the UBOs of customers and business partners. Failure to do so can lead to serious consequences, including:

- Regulatory fines

- Account closures

- Revoked licenses

- Criminal liability

2. Sanctions and PEP Screening

Many sanctioned individuals use layered company structures to evade restrictions. UBO discovery helps identify if a business is ultimately controlled by a person on a sanctions list or flagged as a politically exposed person (PEP).

3. International Regulations

UBO transparency is now embedded in major global frameworks:

- FATF Recommendations: Set the global standard for ownership transparency

- EU AML Directives (AMLD5 & AMLR): Require UBO registers and verification mechanisms

- U.S. Corporate Transparency Act (CTA): Mandates disclosure of UBOs to FinCEN

- OECD & G7 Initiatives: Push for global registries and open ownership data

The Risk of Ignoring UBOs

Failing to identify UBOs isn’t just a compliance risk—it can expose your organization to reputational damage, fraud, litigation, and financial loss. In 2025, regulators are increasingly enforcing these rules with audits, investigations, and penalties. Companies that cannot demonstrate effective UBO discovery processes may be seen as high-risk actors in global business.

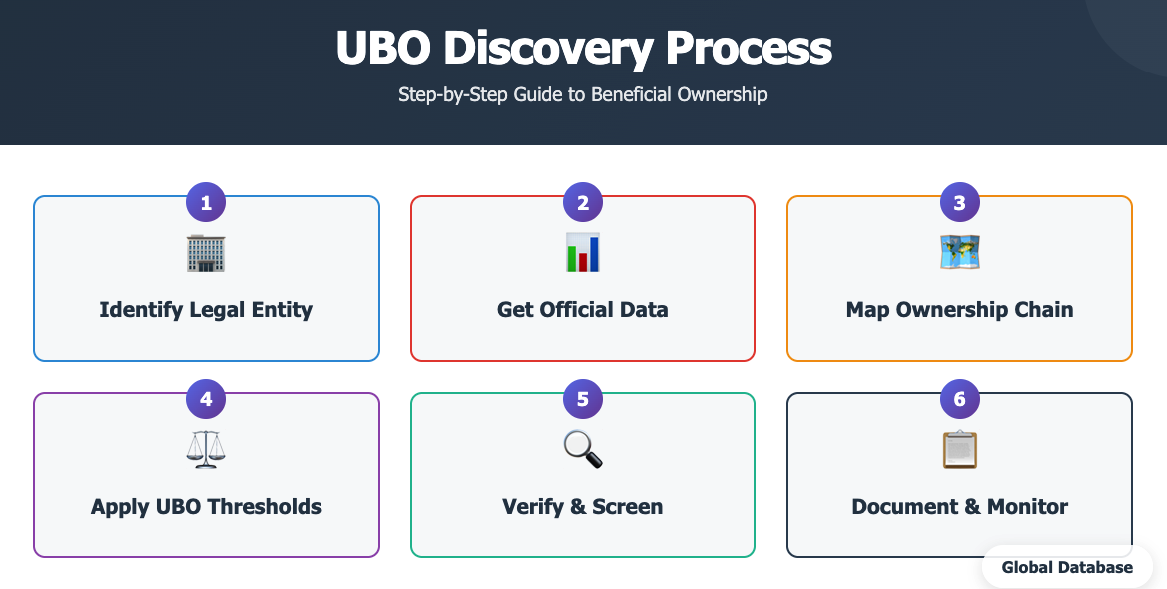

4. The UBO Discovery Process Step-by-Step

Uncovering a company’s UBO isn’t always straightforward. The process often involves tracing complex ownership structures across borders and resolving multiple layers of legal entities. Here’s a breakdown of how effective UBO discovery is typically conducted in 2025:

Step 1: Identify the Legal Entity

Start with the business you’re evaluating. Gather its legal name, registration number, jurisdiction, and any public filings. This is the anchor for mapping the ownership structure.

Step 2: Retrieve Official Ownership Information

Pull data from official sources such as national business registries, company filings, or government-mandated UBO databases. This includes:

- Shareholding data

- Director and officer lists

- Control via voting rights or contracts

- Historical filings and changes in ownership

Note: Registry-sourced data is critical for reliability. Scraped or user-submitted data often misses indirect ownership and legal nuance.

Step 3: Map the Ownership Chain

Track all entities and individuals with direct or indirect stakes in the company. This step may involve analyzing multiple layers of ownership, such as:

- Parent companies

- Subsidiaries

- Holding firms

- Trusts or nominee arrangements

Visualizing the structure (e.g. as a graph or tree) helps pinpoint key ownership concentrations.

Step 4: Apply UBO Thresholds and Criteria

Most regulations define a UBO as someone who:

- Owns or controls 25% or more of the company, directly or indirectly

- Exercises control through other means (e.g. voting rights, contractual influence)

- Holds senior management positions (in cases where no one meets the threshold)

Jurisdiction-specific rules may require lower thresholds or expanded definitions.

Step 5: Verify Identity and Screen the UBOs

Once identified, individuals should be verified against:

- Sanctions lists (e.g. OFAC, EU, UN)

- PEP databases

- Adverse media and watchlists

Verification may include name checks, passport validation, or biometric ID (in onboarding scenarios).

Step 6: Document and Monitor

Maintain records of the UBO discovery process, including evidence and timestamps. Ongoing monitoring is essential—UBO status can change due to:

- Ownership transfers

- Restructuring

- Regulatory actions

- Mergers or acquisitions

Automated systems can flag changes and trigger re-checks.

5. Real-World Use Cases Across Industries

UBO discovery is no longer a niche compliance requirement—it’s now a core function across a wide range of sectors. From finance to procurement, organizations are relying on accurate UBO data to reduce risk, meet regulatory demands, and make smarter business decisions

1. Financial Services & Fintech

Use Case: Onboarding new clients

Banks, neobanks, and payment processors are required to perform Know Your Business (KYB) and AML checks on every business account. UBO discovery helps:

- Prevent onboarding of sanctioned or high-risk entities

- Meet FATF, EU AMLD, and FinCEN reporting obligations

- Automate checks via API integrations with registry data

Example: A fintech integrating with an API like Global Database or Zavia.ai can verify UBOs of any company in real time during sign-up—reducing fraud and compliance costs.

2. Procurement & Vendor Risk Management

Use Case: Verifying third-party suppliers

Companies increasingly face reputational and operational risks from opaque supply chains. UBO discovery helps:

- Ensure suppliers aren't controlled by blacklisted or sanctioned entities

- Detect conflicts of interest

- Assess ESG and ethical compliance

Example: A procurement platform might screen new vendors in emerging markets and uncover that several are owned by the same politically exposed individual.

3. Legal, Audit & Advisory Firms

Use Case: Due diligence and investigations

Firms conducting M&A, litigation, or audit work use UBO discovery to:

- Identify red flags in target companies

- Support asset tracing, fraud investigations, or litigation strategies

- Build ownership trees to clarify control and influence

Example: A law firm investigating cross-border fraud maps out a network of offshore companies and uncovers the same UBO behind multiple shell entities.

4. Government & Regulatory Agencies

Use Case: Fighting corruption and financial crime

Tax authorities, customs agencies, and regulators use UBO intelligence to:

- Uncover hidden ownership and tax evasion

- Investigate illicit financial flows

- Enforce transparency in public procurement

Example: A government agency investigating tender fraud identifies that multiple bidders in a public contract are ultimately owned by the same individual.

6. Challenges in UBO Identification

1. Use of Shell Companies and Nominee Owners

Shell companies—legal entities without significant operations—are often used to mask ownership. In some jurisdictions, it’s legal for companies to appoint nominee shareholders or directors who serve as proxies, creating a smokescreen around the true controller.

Impact: You may see a name on paper, but it tells you nothing about who actually benefits or makes decisions

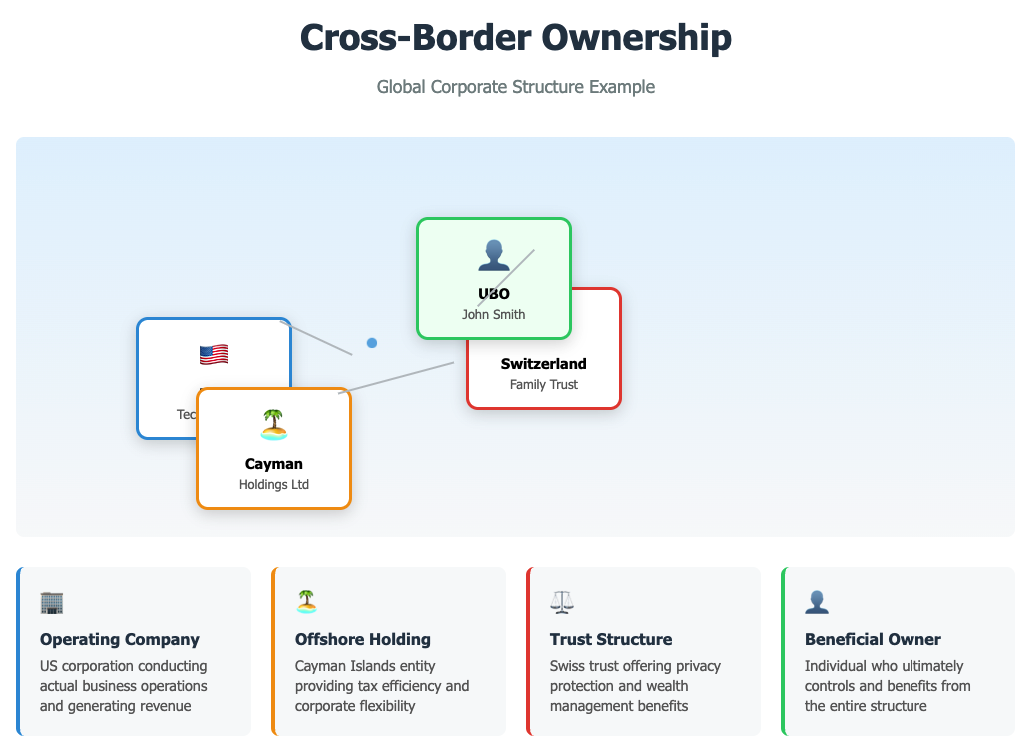

2. Cross-Border Ownership Structures

UBOs can be hidden behind multiple layers of companies registered in different countries. Each jurisdiction may have:

- Different disclosure requirements

- Inconsistent formats or data standards

- Language barriers

- Privacy protections that obscure beneficial ownership

Impact: Mapping ownership chains across borders is time-consuming without standardized, real-time data access.

3. Incomplete or Outdated Public Records

Many national registries lack the resources or infrastructure to enforce accurate, timely UBO reporting. Data can be:

- Self-reported and unaudited

- Months (or years) out of date

- Missing ownership thresholds or indirect control structures

Impact: Relying on static datasets or open directories may lead to missed risks or incorrect conclusions.

4. Varying Legal Definitions of UBO

Not every jurisdiction defines "UBO" the same way. Thresholds may differ (e.g., 10% in some countries vs. 25% in others), and the concept of "control through other means" may not be recognized or enforced equally.

Impact: Multinational organizations face challenges creating unified global compliance policies

5. False Positives and Entity Confusion

When relying on name-based searches (instead of ID-matched data), companies risk false matches, especially with:

- Common names

- Transliteration issues

- Misspelled registry entries

- Duplicate or similarly named entities

Impact: Mistaken identity can lead to blocked transactions or rejected partnerships—hurting business.

Despite these challenges, companies that use reliable, structured, and registry-sourced data—combined with smart automation—can dramatically improve UBO visibility and reduce exposure to hidden risk.

7. The Role of Technology and Registry-Sourced Data

As UBO discovery grows in complexity, technology has become essential. Manual processes—such as checking registry PDFs one by one or building ownership trees in Excel—are no longer sustainable at scale. Modern platforms are now automating UBO identification by combining structured government data with AI-powered tools.

1. The Shift to Registry-Sourced Data

Many legacy providers rely on scraped web data, user-contributed profiles, or outdated public directories. While fast, these sources often lack credibility, legal backing, or coverage depth.

Registry-sourced data, on the other hand, is:

- Official: Pulled directly from national business registries, financial filings, and corporate disclosures

- Current: Reflects real-time or recently filed information

- Legally compliant: Meets audit and regulatory requirements for documentation and accuracy

Platforms like Zephira.ai and Zavia.ai connect directly to over 100 local registries, mapping complex ownership structures and returning UBO data in standardized formats—ideal for API integration or bulk analysis.

2. AI and Automation for Complex Ownership Mapping

Artificial Intelligence plays a key role in:

- Parsing and digitizing documents using Optical Character Recognition (OCR)

- Normalizing data across jurisdictions (e.g. legal forms, shareholder titles, entity types)

- Building ownership graphs and tracing control through multiple layers

- Detecting indirect control through voting agreements or related-party links

- Flagging anomalies such as circular ownership or high-risk jurisdictions

This reduces human error and allows teams to process thousands of entities in seconds—something previously impossible with spreadsheets or static databases.

3. Real-Time Monitoring and Alerts

Modern UBO solutions can continuously monitor changes in ownership, directorship, or legal status. If a sanctioned individual becomes the UBO of a supplier or client, you’ll know immediately.

Use cases include:

- AML teams automating re-screening for ongoing KYC

- Risk departments setting alerts on high-risk industries or PEP regions

- Procurement systems flagging vendor profile changes

4. Seamless Integration into Compliance Workflows

UBO discovery tools today integrate directly with:

- CRM systems like Salesforce, HubSpot, Microsoft Dynamics

- KYC/KYB platforms

- Onboarding flows via API

- Low-code tools and compliance dashboards

This ensures compliance is built into day-to-day operations—not just retroactive audits.

Technology is turning UBO discovery from a static compliance step into a real-time, scalable, and intelligence-driven function—empowering companies to act faster and with greater confidence.

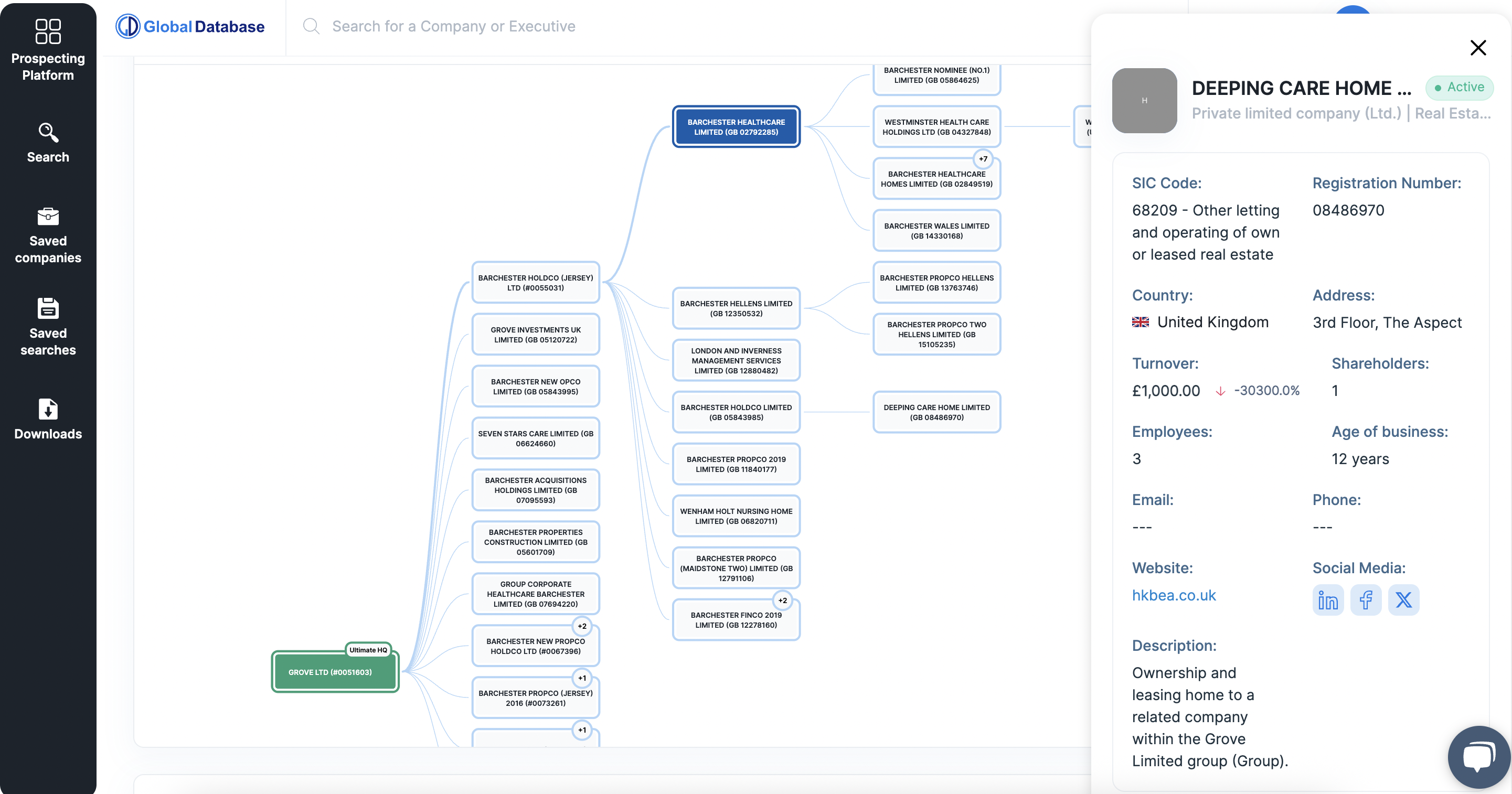

8. Choosing the Right UBO Discovery Partner

Selecting the right UBO discovery provider is critical. Inaccurate or outdated ownership data can lead to regulatory breaches, reputational damage, and exposure to sanctioned individuals. That’s why more companies in finance, compliance, and risk management turn to Global Database as their trusted partner.

Here’s what to look for—and how Global Database delivers.

Verified, Registry-Sourced Data

Global Database connects directly to official business registries, tax authorities, and corporate filings in over 100+ countries. Unlike providers that rely on scraped or self-reported data, Global Database delivers:

- Legally verified UBO disclosures

- Shareholder breakdowns with direct and indirect ownership

- Digitized documents, extracted using advanced OCR and AI

- Links to the original registry source for audit and regulatory use

✅ Accurate, defensible data—trusted by regulators.

Global Coverage, Local Detail

Whether you’re verifying entities in the UK, Luxembourg, Singapore, or offshore jurisdictions like the BVI, Global Database offers consistent access to ownership data across borders. Structures are normalized and standardized, allowing easy mapping of cross-jurisdictional relationships.

✅ Uncover complex ownership chains in seconds.

Built for Scale and Automation

Global Database offers:

- Real-time REST API access for KYB, onboarding, and transaction monitoring

- Daily bulk updates for large-scale enrichment and risk scoring

- Native integrations with Salesforce, HubSpot, Microsoft Dynamics, and Creatio

- A Chrome extension for on-the-spot UBO checks while browsing LinkedIn or company websites

✅ Seamless integration into existing workflows.

Flexible Licensing and Usage Rights

You own the data you license. With Global Database, you can:

- Store and reuse data indefinitely

- Enrich internal platforms or client applications

- Generate derived metrics (e.g. risk scores, onboarding scores)

- Distribute insights across teams and systems

✅ No hidden limitations—just full commercial flexibility.

Why Global Database?

Because you need more than a name on a paper. You need to know who really controls your customers, partners, and vendors—backed by real data, not assumptions. With Global Database, you gain full transparency, global reach, and the flexibility to make UBO discovery work within your business—not around it.