Tax due diligence makes sure to review all kinds of taxes the company is susceptible to and ensure that the proper amount is reported. Additionally, it verifies the status of any tax-related case of the target company.

Human resources due diligence touches upon all exposure points between the employer and the employee. It is quite extensive and includes the company's relationships, obligations, employment contracts, salaries, all forms of leave, internal investigations, and so on. You can save a lot of trouble during post-acquisition if all the matters are resolved before then.

Foreign Corrupt Practices Act due diligence is tied to U.S. citizens and companies, nevertheless, it includes an overview of all active policies that combat foreign bribery. Usually, it is accompanied by an additional payment review so as to lessen the impact of missed violations in the post-acquisition phase.

Intellectual property due diligence refers to the analysis of property assets that contribute to the company’s business monetization. These types of belongings give a product or service a different feel to it compared to that of the competitors. It wouldn’t be a bold claim to make that this is the heart and soul of the company. The most notable items that appear on Intellectual property due diligence are patents, copyrights and trademarks, cases of intellectual property violation.

Reputational due diligence is as the name implies a background check on the quality of the target’s shareholder and the executive branch. Issues involving cases of financial irresponsibility as well as law violations are brought to the surface. As a thorough audit is in order, public records may hold information about hidden stones, bankruptcy-related risks or asset destroying concerns.

Environmental due diligence takes note of environmental regulations so as to avoid getting in trouble with the local authorities that can exercise the right to fine and in the worst-case scenario suspension of the company’s activity due to rule violations. Therefore, it is essential that every property asset undergoes an audit to convey underlying issues or avoid transferring them to your account. Mostly, it enables access to a list of permits and licenses as well as a verification that the company’s operations are in line with the local power guidelines.

Strategic fit due diligence is different from the others above in respect to that it changes the focus from the to-be-acquired firm back to the buyer. It is a self-evaluation that, chiefly, considers the synchronization of the acquisition with the company’s business plan. Such analysis is not a surface-grazing one and requires a number of questions to be answered regarding the worth, acquisition process, expected gain.

The term Due Diligence is indeed wide and covers a great deal of information that must be extracted. However, keep in mind that you might not need to perform all of it in one go only to be met with disappointing results. Time is money so you should make use of pre-meeting information that would endow with insight on whether proceeding down the deal path is reasonable.

Due Diligence for M&A Transactions

Despite the outstanding beneficial remarks, there have been numerous M&A practitioners in quite a few professions that got to hear questionable reasons as to why it shouldn’t be a necessity, most notably:

Contrary to people who skip a few steps and those who rely on survivor bias, transactions that make use of a proper due diligence process have a tendency to be more successful. Here are some key reasons why due diligence should have a respectable spot in your business M&A transactions:

-

Pre-existing bias/ uneven knowledge ground. Since buyers and sellers are not machine software acting on some metrics, they are subject to bias and logical errors. Moreover, in these types of trades, there is a discrepancy of knowledge, consequently, sellers will present a more optimistic view or withhold precious information that might alter forecasts. Buyers may also present some form of unrealistic expectations due to a lack of information or overconfidence in prior knowledge.

-

Incentives. Parties involved in a transaction - executives, key-persons, third-party staff and stockholders from both sides - may receive a sizable payout should a deal be closed. As such they are prone to using underhanded tactics considering there is little to no gain should a deal fail.

-

Inaccurate financial information. Financial information can at times be incomplete, or inaccurate and it’s not always the result of black hand tactics. There are countless difficulties in regards to identifying all the necessary matters, sometimes outdated technology can be a barrier. Nevertheless, do not exclude the possibility of being lied to with numbers and statistics.

-

Negotiation benefits. As the negotiation unfolds, due diligence opens all the books on the table. With a vast amount of information made available to both parties, a better deal term might occur pertaining to the price and future structure in order to achieve desired forecasts.

-

Risk analysis. Since due diligence stands for a thorough analysis, it might uncover potential burdens regarding product liability, environmental concerns, and foreign compliance, consequently, turning the tables.

-

Irreversibility. This type of transaction is irreversible and with its completion comes no refunds. Issues appearing after the deal are now your own as they have managed to pass the barrier of your diligent overwatch.

While due diligence helps pave the way to success, there are times when no significant concerns have been brought up to the surface. However, that is not a troublesome issue as it can still impact other areas of your business deal. New financial information can be a convenient tool to arrange for renegotiation on the initial purchase price or required holdback. But even if such arrangements might be considered a bluff, nevertheless, the buyer stands to win from such an occurrence due to being endowed with insight on whether it is worth proceeding forward with the prior price. A well-planned and executed due diligence will not make every acquisition a certain success but it minimises the number of unsuccessful trades that might have otherwise happened as a result of insufficient information on risk management and financial issues.

Due Diligence during COVID-19

The pandemic has had an impact on the overall development of M&A transactions around the world. Like any kind of field for deals, for some, it created opportunities, while for others it has become quite a painful subject. Buyers are more concerned about the risk of overpaying, while sellers are more focused on execution risk. The certainty of funds has become more important, as funding has been somewhat affected, yet there is no trend of financing commitment withdrawals. Some governments put a higher importance on protectionism to avoid opportunistic acquisitions. Stake sales are on the rise, including minority investments. M&A deals are taking longer to close, the average time increasing by one month from seven to eight months. Due diligence content would change consequently with a stronger emphasis on the security of supply chains and eventual pandemic-related special termination rights.

According to EY, private equity investors are now more prone to appeal to data-intensive due diligence, applying advanced analytics to process large amounts of data, regularly regarding domains that were a less important aspect for due diligence, examples here being analysis of computer code and historical transaction-level data, all being easy to verify remotely.

How Can Global Database Company Directory Help?

Company directories, such as Global Database, hold an immense amount of trustworthy insight on companies around the world. Our global database holds profiles of over 80 million businesses, and your acquisition prospect might be among them. In a manner of seconds, you could have a rather detailed page that would give you the upper-hand in the upcoming conference.

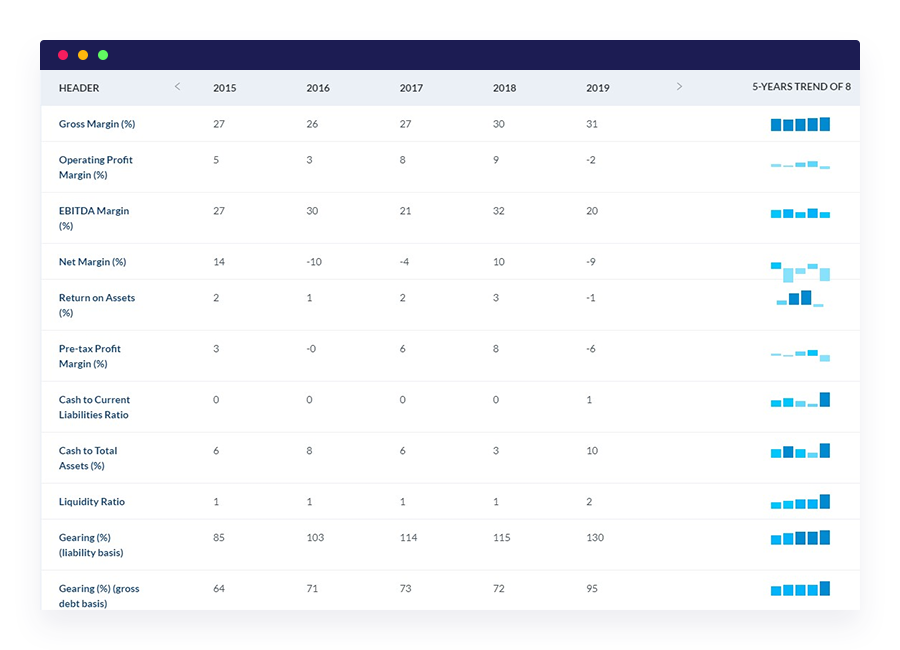

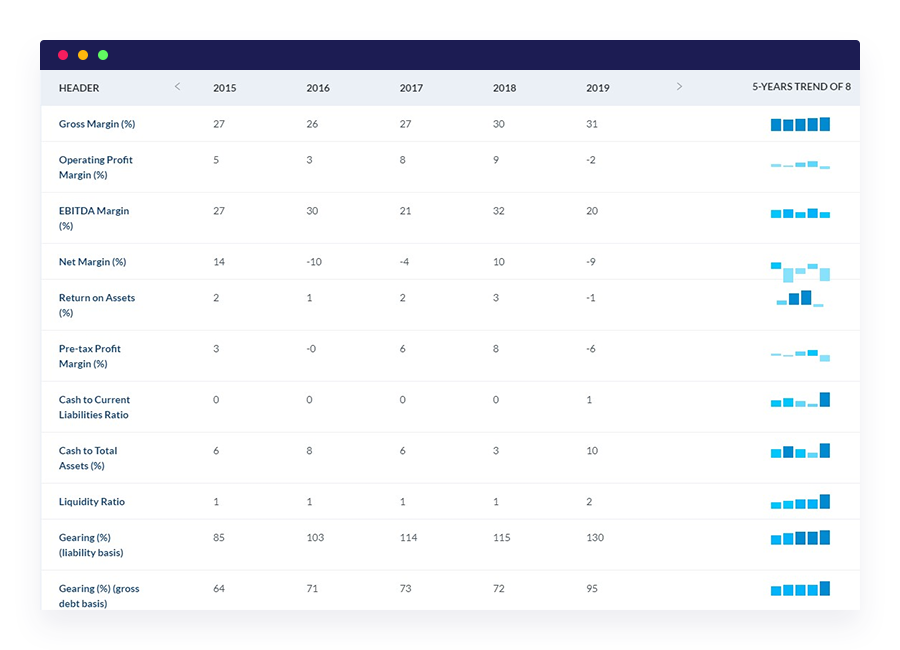

Yet there is a lot more to Global Database directories than credit reporting, financials, KPIs, corporate groups structures and web technology insights. While contact information on a company's employee will not yield any immediate results, social media checks and public records on a carefully exported employee list might net some interesting benefits. Every piece of information is crucial when striking a deal and Global Database works only in your favour. Past the highly-advanced filters and segmentation tools that would enable you to scoop any prospects out of their hiding pond, you get access to a most detailed report on financials, court calls and orders, shareholder hierarchy, and digital insight on the technologies used.

Global Database’s exclusive up to 95% data accuracy is not a replacement for orderly due diligence, but coupled with prior industry knowledge can be an important leverage for adventurous buyers.

To sum up...

M&A transactions bring about a great impact on the acquiring company due to the nature of the deal no matter how big or small the purchased firm is. Astute and timely feedback in a business transaction like this comes second to none, and the board relies on precise information as the basis of their good decision-making process. Due diligence is the crucial process that helps understand the targeted business and opens channels for discussion regarding the assimilation process. It can be performed by different people - internal specialized team, third-party advisors, senior player but is often the culmination of all parties involved to expose themselves to a deep transaction experience.