Introduction

Knowing who really controls a company is no longer a “nice-to-have” — it’s a regulatory requirement. Financial institutions, fintechs, and corporates face increasing pressure to meet AML, FATF, and KYC/KYB obligations by verifying Ultimate Beneficial Owners (UBOs).

The challenge is that UBO data is messy. Complex ownership structures, offshore vehicles, and opaque jurisdictions make it difficult to uncover the individuals behind legal entities. Relying on outdated or estimated data can expose organizations to compliance risks, fines, and reputational damage.

This is where UBO data providers play a crucial role. They connect to official registries, corporate filings, and proprietary databases to map directors, shareholders, subsidiaries, and ultimate owners. But not all providers are equal — some emphasize registry-first accuracy, while others lean on scraping and secondary sources.

In this article, we evaluate the leading UBO data providers for 2025, comparing them across:

- Coverage (global vs regional)

- Depth of ownership hierarchies

- Data freshness

- Integration & API capabilities

- Compliance features (PEPs, sanctions, AML support)

- Pricing and licensing flexibility

Our goal is simple: help compliance teams, risk managers, and developers choose the right UBO data partner for their needs.

Evaluation Criteria

When comparing UBO data providers, it’s not just about who has the most records — it’s about accuracy, transparency, and usability. We used the following key criteria to evaluate each platform:

1. Data Sourcing

- Does the provider connect directly to official government registries?

- Or is the ownership information based on scraped, estimated, or third-party feeds?

- Registry-first sourcing ensures legal reliability, while scraped data often sacrifices accuracy.

2. Coverage

- How many countries and jurisdictions are supported?

- Are offshore and high-risk jurisdictions (often used to hide ownership) included?

- Depth of coverage matters as much as breadth — it’s not just about the number of companies, but also the detail of their ownership structures.

3. Data Freshness

- How frequently are records updated — real-time, daily, or quarterly?

- In fast-moving regulatory environments, stale data can undermine compliance efforts.

4. Ownership Hierarchy & UBO Depth

- Does the platform show only direct shareholders, or can it trace control to the ultimate beneficial owner across multiple layers?

- Are subsidiaries, parent companies, and cross-border structures clearly mapped?

5. Integration & API Capabilities

- Is there an API-first approach for embedding ownership checks into workflows?

- Are there out-of-the-box integrations with CRMs, compliance systems, and BI tools?

- Ease of integration often determines real-world adoption.

6. Compliance Features

- Does the provider link UBO data with sanctions lists, PEP screening, and AML watchlists?

- Are tools available for KYB automation, transaction monitoring, and audit trails?

7. Pricing & Licensing Flexibility

- Is pricing transparent and usage-based (pay-per-check, API call) or locked into expensive enterprise contracts?

- Are reseller rights, derivative use, and redistribution permitted?

- This often defines whether a solution fits startups, mid-market companies, or global banks.

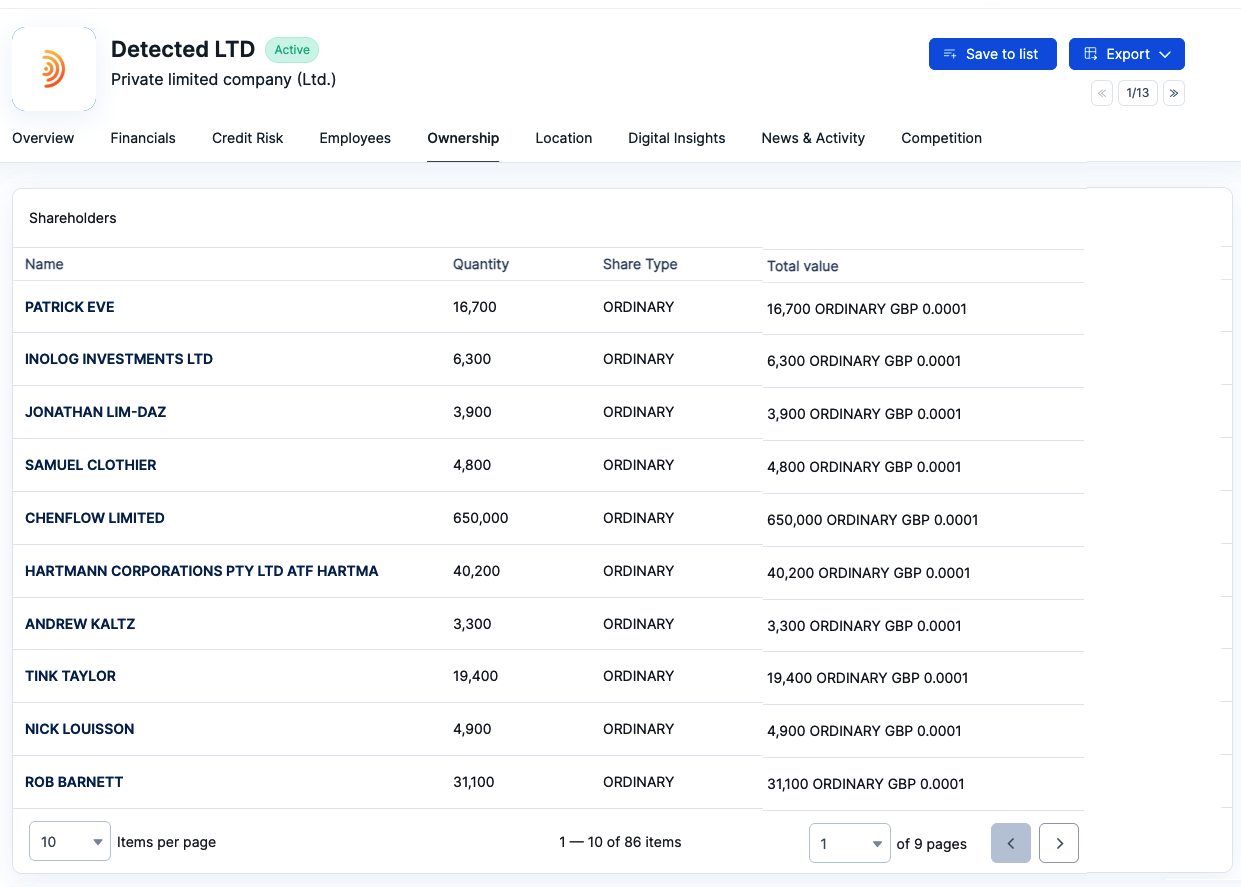

1. Global Database

Overview

Global Database is a first-party business data provider, sourcing UBO and shareholder records directly from 150+ official government registries. By avoiding third-party partners and intermediaries, it reduces costs while ensuring compliance-grade accuracy. Coverage extends across 300M+ companies in 195 countries, enriched with firmographics, VAT/tax IDs, and up to 20 years of digitized financials.

Strengths

- First-party sourcing: Direct registry connections deliver higher accuracy and independence from data resellers.

- Lower cost structure: No partner markups means more competitive pricing than legacy providers.

- Comprehensive enrichment: UBO data is enhanced with financials, firmographics, tax IDs, and contact data.

- Scalable delivery: Available through API, bulk data feeds, browser extension, and CRM integrations.

- Flexible usage rights: Includes reseller and derivative rights, unlike restrictive incumbents.

Limitations

- Lower brand recognition compared to global incumbents like Dun & Bradstreet or Bureau van Dijk.

- In some offshore jurisdictions, historical ownership depth may not match Orbis’ long-standing archives.

Pricing

- Basic KYB verification starts at $0.20 per check.

- UBO verification starts from $1 per check.

- Enterprise licenses include redistribution and derivative product rights, attractive for fintechs, CRMs, and data platforms.

2. Zavia.ai

Overview

Zavia.ai positions itself as an AI-powered UBO intelligence engine, designed to uncover complex ownership structures that often span multiple jurisdictions. Built on first-party registry connections and advanced AI algorithms, Zavia.ai maps corporate hierarchies, flags PEPs and sanctions, and supports AML/FATF compliance requirements. Its goal is to challenge the traditional reliance on scraped or estimated ownership data by offering transparency backed by verifiable registry sources.

Strengths

- Registry-first accuracy with AI: Combines official filings with AI models to trace hidden ownership structures.

- Cross-border discovery: Strong at revealing indirect UBOs and offshore ownership layers.

- Compliance-ready: Integrated with PEP and sanctions screening, aligning with FATF standards.

- Customizable thresholds: Allows compliance teams to adjust UBO ownership thresholds (e.g., 10%, 25%).

- Cost-efficient entry plans: Lower entry costs compared to legacy incumbents make it accessible to fintechs and smaller compliance teams.

Limitations

- Newer to the market, so less brand awareness than D&B or Moody’s.

- Focused heavily on UBO/AML, with fewer enrichment features like firmographics or contact data compared to broader platforms.

Pricing

- Subscription plans from $49–$199/month, covering 50–400 UBO checks.

- API access included across all tiers.

- Flexible pay-as-you-go options available for teams that don’t want long-term contracts.

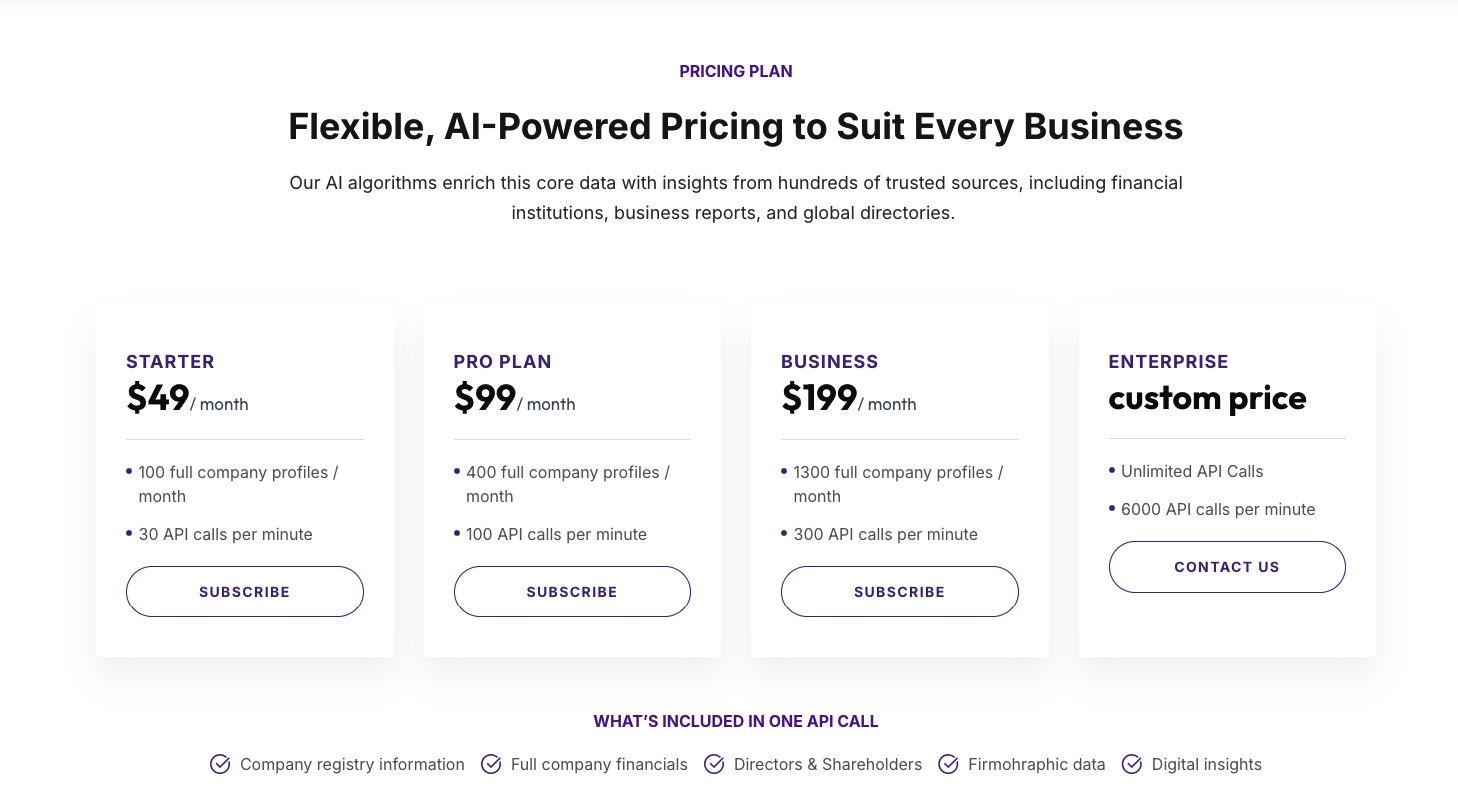

3. Zephira.ai

Overview

Zephira.ai is an API-first platform designed for developers and platforms that need registry-verified UBO and KYB data in real time. By focusing on modular APIs (UBO, KYB, tax IDs, financials, firmographics), it avoids bloated enterprise contracts and offers transparent, usage-based pricing.

Strengths

- Developer-first: Built as an API-first solution for easy integration into apps, fintech tools, and onboarding flows.

- Registry-sourced accuracy: Direct access to government filings ensures compliance-grade data.

- Flexible pricing: Clear, scalable subscription tiers instead of opaque enterprise-only contracts.

- Modular approach: Separate endpoints for KYB, UBO, financials, and tax IDs so users only pay for what they need.

- High scalability: Handles small developer use cases through to enterprise-level throughput.

Limitations

- API-only, without a front-end dashboard for manual lookups.

- Newer brand, still building market awareness compared to established players.

Pricing

- Starter – $49/month → 100 company profiles, 30 API calls per minute

- Pro – $99/month → 400 company profiles, 100 API calls per minute

- Business – $199/month → 1,300 company profiles, 300 API calls per minute

- Enterprise – Custom pricing → Unlimited profiles, 6,000 API calls per minute

4. Sayari

Overview

Sayari is a corporate intelligence and investigative research platform widely used by government agencies, law enforcement, and large financial institutions. Its flagship product, Sayari Graph, excels at mapping cross-border corporate networks, offshore entities, and high-risk jurisdictions. The platform is designed for deep-dive investigations rather than lightweight KYB checks, making it a strong fit for high-stakes compliance, AML, and due diligence teams.

Strengths

- Investigative depth: Strong at revealing hidden ownership networks, shell companies, and offshore vehicles.

- Government trust: Widely adopted by U.S. and international regulators, giving it credibility in risk-heavy sectors.

- Graph visualization: Intuitive interface for mapping corporate structures and individual connections.

- AML/PEP focus: Enriched with sanctions lists, PEP screening, and watchlist data.

- Complex jurisdiction coverage: Especially strong in countries where ownership transparency is limited.

Limitations

- High cost: Starting price makes it inaccessible to smaller fintechs or mid-market companies.

- Not API-first: Designed for analysts and investigators, not automated KYB flows.

- Learning curve: Requires training to maximize investigative features.

Pricing

- Starts from $50,000/year for a single enterprise license.

- Larger deployments are custom priced based on user seats and access levels.

- No entry-level or pay-as-you-go options available.

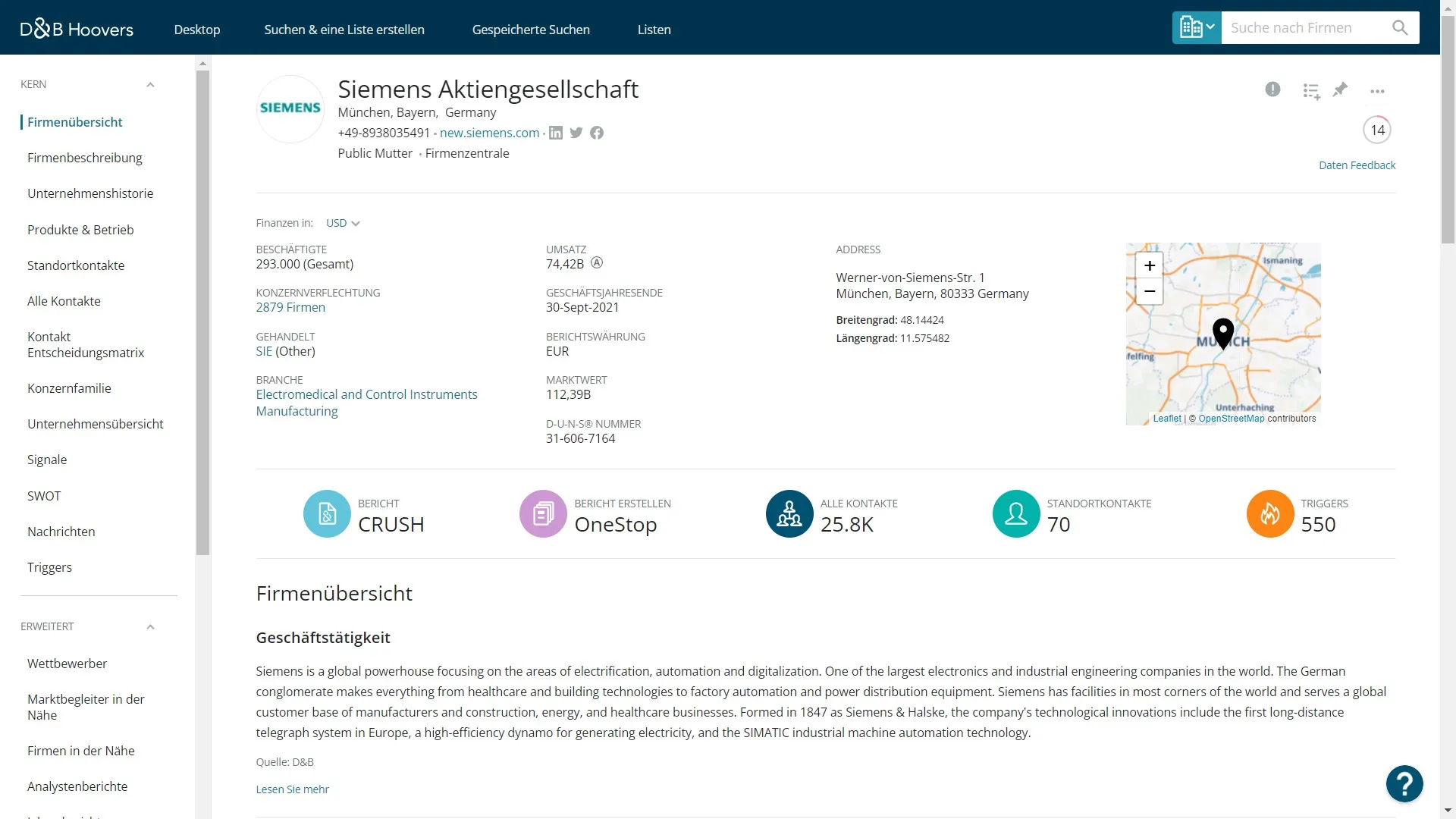

5. Dun & Bradstreet (DNB)

Overview

Dun & Bradstreet is one of the most established names in corporate data, with a strong reputation in credit, risk, and compliance intelligence. Its UBO and ownership information is bundled into broader offerings such as D&B Hoovers and D&B Direct. Coverage is global, though DNB often relies on partner networks to supplement registry information, which can lead to variation in data quality and licensing restrictions.

Strengths

- Global footprint: Broad company coverage across developed and emerging markets.

- Trusted brand: Longstanding relationships with banks, enterprises, and governments.

- Integrated solutions: Combines ownership structures with financials, supplier risk, and credit insights.

- Enterprise support: Strong account management and compliance modules.

- Data longevity: Decades of archived company information.

Limitations

- Partner dependency: Not all UBO data is sourced directly from registries.

- Restrictive licensing: Limits on redistribution and derivative product creation.

- High cost: Pricing and contract models favor large institutions, leaving little flexibility for smaller players.

Pricing

- Annual contracts start from $20,000/year.

- Individual reports range from $30–$200 per company, depending on jurisdiction and depth.

- Enterprise packages with full UBO/ownership data often exceed $50,000/year.

6. Bureau van Dijk (Moody’s Orbis)

Overview

Bureau van Dijk, a Moody’s company, is best known for Orbis, one of the largest corporate ownership and financial databases in the world. Orbis aggregates official filings, proprietary sources, and third-party feeds to build detailed corporate hierarchies and beneficial ownership records. It is widely used by banks, auditors, and regulators for AML, tax transparency, and risk management.

Strengths

- Extensive ownership hierarchies: Deep visibility into subsidiaries, parent companies, and cross-border networks.

- Massive global coverage: Tens of millions of companies across developed and emerging markets.

- Regulatory credibility: Used by governments and financial institutions for AML/FATF compliance.

- Comprehensive enrichment: UBO data is combined with financial statements, credit risk indicators, and industry classifications.

- Sophisticated tools: Orbis platform offers advanced search filters, visualization, and data export options.

Limitations

- High entry cost: Minimum contracts start at enterprise-level pricing, limiting accessibility to SMEs and fintechs.

- Data sourcing mix: Combines registry data with third-party and partner feeds, which can affect freshness and accuracy in some regions.

- Restrictive licensing: Limits on redistribution and derivative product creation.

- Complexity: The platform can be overwhelming for smaller teams without dedicated analysts.

Pricing

- Annual access starts from $20,000–$40,000/year for limited packages.

- Full global access with ownership and financial data often exceeds $100,000/year.

- Pricing depends on scope (countries, data types, users) and typically requires multi-year contracts.

7. Asiaverify

Overview

Asiaverify is a compliance-focused data provider specializing in real-time corporate registry connections across the Asia-Pacific region. The platform enables instant verification of company details, directors, shareholders, and UBOs, making it particularly useful for businesses expanding or operating in APAC markets. Asiaverify’s strength lies in direct registry integrations with countries where corporate transparency can be challenging, such as China, Singapore, Hong Kong, and other Southeast Asian jurisdictions.

Strengths

- APAC specialization: Strongest coverage in Asia-Pacific markets, where many global providers have limited reach.

- Registry integrations: Real-time data pulls directly from local registries.

- Compliance-first: Designed for KYC/KYB checks, onboarding, and AML compliance in regulated industries.

- Localized knowledge: Tailored to the unique regulatory frameworks and languages in APAC.

- Speed: Real-time access reduces manual delays in verifying companies and UBOs.

Limitations

- Regional scope: Primarily focused on APAC; limited coverage in Europe, Africa, or Latin America.

- Enterprise-first pricing: Not as flexible or transparent as API-first competitors.

- Less enrichment: Focused on verification rather than broader firmographic or digital insights.

Pricing

- Pricing is not publicly listed; typically structured as tiered enterprise contracts.

- Costs vary by country access and data volume.

- Customers generally need to contact sales for tailored quotes.

Which Provider Should You Choose?

Choosing the right UBO data provider depends on your use case, budget, and compliance requirements. Here’s a breakdown of which platforms stand out in different scenarios:

- Best for Cost-Effective, First-Party Accuracy → Global Database

- If you need registry-verified UBO and KYB data at scale, Global Database offers the best combination of accuracy, pricing, and flexible rights. With KYB checks from $0.20 and UBO verification from $1, it’s well-suited for fintechs, platforms, and enterprises that want full control over how they use and resell data.

- Best for AML-Focused Compliance Teams → Zavia.ai

- Zavia.ai combines first-party registry data with AI-driven ownership discovery, making it ideal for compliance officers who need to trace hidden UBOs across borders. With pricing starting at $49/month, it lowers the entry barrier compared to legacy incumbents.

- Best for Developers and API-First Platforms → Zephira.ai

- Zephira.ai is the clear choice for technical teams that want a plug-and-play API for KYB, UBO, and financial checks. Its transparent $49–$199/month pricing and modular endpoints make it attractive to startups building compliance or fintech applications.

- Best for Investigative Research → Sayari

- Sayari is built for deep-dive investigations into complex, offshore, and high-risk structures. With adoption by government agencies, it’s the go-to for analysts and law enforcement. But with pricing starting from $50,000/year, it’s targeted at enterprise and public-sector budgets.

- Best for Global Corporates and Banks → Dun & Bradstreet (DNB)

- DNB remains a strong option for enterprises that want UBO data as part of a broader credit, supplier risk, and compliance suite. Its strict licensing and $20k+ annual entry cost make it less flexible, but its brand recognition and enterprise support are unmatched.

- Best for Large-Scale, Multi-Jurisdiction Coverage → Bureau van Dijk (Moody’s Orbis)

- Orbis is one of the most comprehensive ownership databases worldwide, often exceeding $100k/year for global packages. It’s the standard for banks, auditors, and regulators, but restrictive licensing makes it harder to use in flexible or resale-driven models.

- Best for APAC Market Focus → Asiaverify

- Asiaverify shines for companies operating in Asia-Pacific, with direct registry connections in countries where transparency is limited. It’s a strong pick for onboarding, KYC, and AML checks in the region, though pricing is enterprise-only and requires custom contracts.

Conclusion

The demand for UBO transparency is only going to grow as regulators tighten rules and organizations face increasing pressure to prevent financial crime. What separates providers is no longer just the size of their databases — it’s the quality of sourcing, flexibility of use, and cost-efficiency.

Legacy incumbents like Dun & Bradstreet and Bureau van Dijk (Moody’s Orbis) continue to serve global banks and regulators with massive datasets, but their high entry costs and restrictive licensing make them less attractive for agile companies. Sayari remains a niche leader for investigative research and government contracts, but its $50k+ starting price positions it firmly in the enterprise and public sector space.

By contrast, first-party providers such as Global Database, Zavia.ai, and Zephira.ai are reshaping the market. With direct registry sourcing, transparent pricing, and flexible rights, they make UBO and KYB data accessible to fintechs, compliance platforms, and mid-market enterprises that need scalability without enterprise-level lock-in.

Looking ahead, the future of UBO transparency will be defined by providers that combine registry-first data with automation and integrations — enabling compliance teams and developers to verify ownership instantly, across borders, and at a fraction of the cost of legacy systems.

In short:

- For cost-effective compliance at scale, Global Database is a clear choice.

- For AML-focused UBO discovery, Zavia.ai adds AI-driven depth.

- For developer-led platforms, Zephira.ai delivers API-first simplicity.

- For governments and investigative teams, Sayari remains unmatched.

- For global banks, DNB and BvD continue to dominate with legacy strength.

- For APAC-focused firms, Asiaverify provides local registry expertise.

The competitive landscape is evolving, but one thing is certain: registry-sourced UBO data is becoming the new standard.

Frequently Asked Questions (FAQ)

1. What is UBO data and why is it important?

UBO (Ultimate Beneficial Ownership) data identifies the individuals who ultimately own or control a company. It’s critical for AML, KYC/KYB, and compliance to prevent fraud, money laundering, and financial crime.

2. How do UBO data providers source their information?

Some providers source data directly from government registries (first-party), while others rely on third-party partners or scraped data. First-party sourcing is generally more accurate and reliable for compliance use cases.

3. What’s the difference between Global Database, Zavia.ai, and Zephira.ai?

- Global Database: Broad coverage, first-party registry data, competitive pricing.

- Zavia.ai: AI-driven ownership discovery, AML-focused.

- Zephira.ai: API-first solution built for developers and platforms.

4. How much does UBO data cost?

Pricing varies widely:

- Entry-level API-first providers (Zephira.ai, Zavia.ai) start from $49–$199/month.

- Global Database offers KYB checks from $0.20 and UBO checks from $1.

- Incumbents like Dun & Bradstreet or Bureau van Dijk start from $20,000/year, with global packages exceeding $100,000/year.

5. Which UBO provider is best for startups or SMEs?

Zephira.ai and Zavia.ai offer affordable subscription plans with API access, making them ideal for startups and fintechs that need compliance-grade UBO checks without six-figure contracts.

6. Can I resell or redistribute UBO data?

It depends on the provider:

- Global Database, Zavia.ai, Zephira.ai → Generally flexible, allowing derivative use and resale.

- DNB, BvD, Sayari → Highly restrictive, with limited or no redistribution rights.

7. Which provider has the best coverage for APAC companies?

Asiaverify specializes in Asia-Pacific registries, offering real-time access to data from markets where transparency can be difficult.

8. How often is UBO data updated?

First-party registry providers update daily or in real time depending on the country. Some incumbents rely on periodic updates (weekly or quarterly), which may lead to stale records in fast-moving environments.

9. What industries rely most on UBO data?

- Banks and financial institutions → AML, FATF compliance.

- Fintechs and RegTechs → Automating KYB/KYC processes.

- Auditors and investigators → Due diligence and risk assessments.

- Enterprises → Supplier and partner verification.

10. Which provider offers the best value in 2025?

For enterprises, DNB and BvD Orbis remain strong but expensive. For cost-effective accuracy, Global Database is a standout with registry-first sourcing and flexible licensing. For AML-focused teams, Zavia.ai is highly effective, and

for developers, Zephira.ai is the most API-friendly option